- Details

- By Agora Policy

- Blog

- Hits: 356

By Mohammed Shuaibu | Globally, international trade and investment flows are regarded as strong enablers of sustained inclusive growth and development. Countries with more liberal trade and investment policies tend to grow faster, innovate more, produce more, have higher incomes, and create more opportunities. Although globalisation has ushered in an era of economic prosperity around the world, some developing economies like Nigeria have not taken full advantage of the opportunities created.

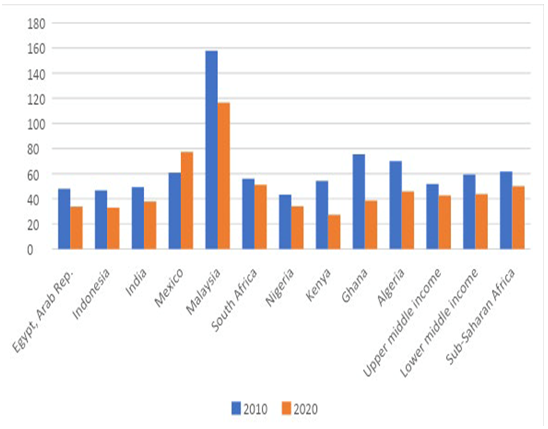

Higher trade openness could help stimulate industrialisation and economic diversity. However, Nigeria’s trade history is skewed towards a restrictive trade policy stance. This stance has been primarily motivated by the need to protect some sectors, increase domestic production, ensure security (preventing the smuggling of arms and ammunition), and attain self-sufficiency in food production. The government has deployed various tariff and non-tariff barriers such as import bans and other economic policies such as multiple exchange rate windows, foreign exchange restrictions, and border closure that have significantly disrupted trade flows. These policies are the result of the wariness of trade liberalisation by some critical stakeholders whose scepticism derives from concerns about unfair competition that could stifle domestic companies. Trade as a share of GDP in Nigeria declined from 43% in 2010 to 34% in 2019 making it one of the lowest among peer countries.

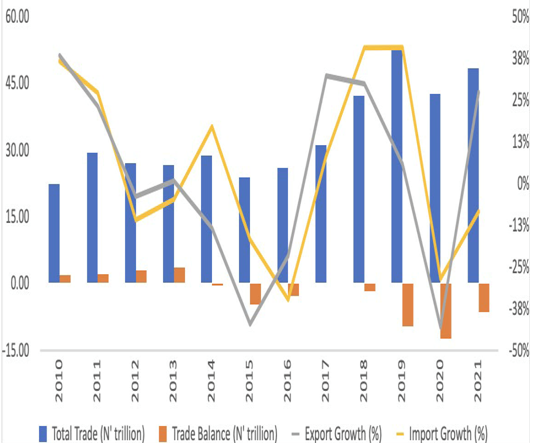

A major characteristic of Nigeria’s trade performance over the last decade is persistent deficits. Trade balance moved from a surplus of N2.14 trillion in 2011 to deficits of N4.51 trillion in 2015 and N2.61trillion in 2016, largely due to the oil shock and weak foreign exchange management that led to a recession (Figure1). Despite modest improvements in the trade deficit in 2017 and 2018, it increased to N12.25 trillion in 2020, and N6.31 trillion in 2021. While the performance of total trade was largely stagnant between 2011 (N29.38 trillion)and 2017 (N31.15 trillion), it increased to N52.4 trillion in 2019, and N42.6 trillion in 2020 followed by a rise to N48.36 trillion in 2021 (Figure 1). The growth of exports and imports has been quite volatile in the last decade, with exports largely driven by global oil market conditions and imports constrained by a poor exchange rate management strategy and a restrictive trade policy environment.

Fig 1: Trade volatility is driven by oil shocks

Source: CBN BOP Statistics

The last few years have witnessed a significant resurgence of protection with an escalation of trade barriers. These include higher tariffs, levies, and import bans on some commodities that can be produced domestically such as rice, sugar, and cassava. These trade policy distortions combined with recent global developments such as the slow recovery from the COVID-19 pandemic and the Russia-Ukraine crisis continue to amplify risks.

Furthermore, the non-oil sectors that are crucial for Nigeria’s diversification with potential for job creation have remained largely unexplored due to supply-side constraints that have been worsened by an unfavourable trade policy environment. The agriculture and manufacturing sectors, for example, have not been optimally harnessed especially with the dominance of the oil sector which has further dampened prospects and crowded out non-oil sectors (See Fig 3). The low value-added of these sectors has contributed to the country’s vulnerability to oil price shocks and consequently, foreign exchange shortages.

Fig2: Low trade openness in Nigeria relative to peer countries

Source: World Bank, World Development Indicators online

Note: Endpoint (2020) for Nigeria based on 2019 value

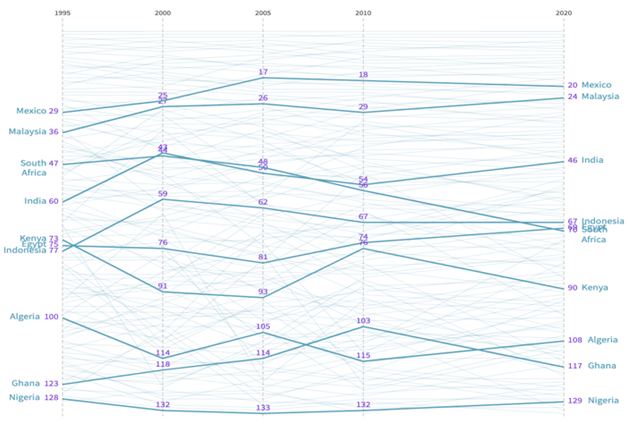

Oil sector dominance of Nigeria’s trade over the last five decades has translated to its very low economic complexity relative to peer countries (Figure 4). The economic complexity index gauges the state of an economy’s productive knowledge and is improved by increasing the number and complexity of the products they successfully export.1 Therefore, a robust trade policy and investment environment that promotes export diversity and sophistication could help address these gaps, create jobs, and inclusively transform the economy. Yet, the trade policy environment is dominated by restrictive policies which do not bode well for export diversification, capital inflows, and inclusive development. Trade supports economic growth through investment, competitiveness and technology transfer channels by creating jobs, improving domestic value-added and reducing domestic prices.

Fig 3: Oil Sector dominance in trade

Restrictive trade policies inhibit investment inflows and their positive effect on the economy.2 This is because trade barriers could encourage market power (monopoly) which is associated with inefficiency, higher prices, technology transfer and knowledge spill overs required to spur inclusive development. The investment climate in Nigeria is largely liberal, with 100% foreign ownership allowed in all sectors except the oil and gas sector. Investments in this sector are limited to joint ventures or production-sharing arrangements, with a minimum ownership structure of 55% for the government. Foreign investors must be registered as limited liability companies. Two recent important legislations are expected to improve the business and investment environment. The first is the Finance Act 2019 which provides tax incentives for businesses, and the second is the Companies and Allied Matters Act (CAMA) 2020 which simplifies and provides additional clarity for setting up businesses in the country especially micro, small, and medium small-scale enterprises. However, structural challenges, macroeconomic policy instability, and insecurity have, interalia, constrained investment inflows to Nigeria.

Fig 4: Economic complexity in Nigeria is very low relative to peer countries3

A comprehensive long-term trade policy agenda can help drive sustainable growth. This will require robust monitoring and evaluation systems to gauge the implementation of regional and multilateral trade initiatives such as the Africa Continental Free Trade Area Agreement (AfCFTA). Nigeria is currently participating in the AfCFTA negotiations and therefore, the trade policy discourse, especially around rules of origin, services trade, and intellectual property amongst other outstanding issues is critical. At the same time, reforming the tariff regime and service restrictions would help enhance competitiveness. This would entail simplification of import duties and gradual liberalisation of the service sector given its potential to create jobs and stimulate the transfer of knowledge which can drive non-oil sector growth.

Furthermore, distortionary non-tariff measures need to be urgently revisited and phased out completely. These include: (i) the foreign exchange restrictions on 42 products by the CBN; (ii) a review of the import prohibition and absolute import prohibition lists and perhaps replacing these trade policy tools with tariff duties or import quotas; (iii) change in government policy on border closure from partial reopening to the full reopening of closed land borders.

Modernisation of ports and custom infrastructure is critical for a successful trade and investment reform. Despite modest improvement in port and customs operations, there is still a lot more that can be done to enhance efficiency and optimal service delivery. Urgently addressing trade facilitation constraints ranging from cumbersome customs procedures to congested ports are crucial for the success of trade reforms. This would require standardisation of procedures, strengthening the e-governance portal towards paperless transactions, and establishing a functional grievance and redress mechanism for stakeholders. This means that bold reforms are required by the Nigeria Customs Service (NCS) such as the implementation of the e-Customs modernisation plan and the National Single Window (NSW) platform that can improve trade facilitation. Also, critical investments through public-private partnerships would be required to help address port congestions and delays.

Reducing oil sector dominance in the economy and building up the sector’s value chain would help drive economic diversity while counter-productive waivers and informal leakages that reduce public and private investment in export-oriented sectors need to be revised. This entails nipping supply-side constraints in the bud to shift from oil to high-value-added agriculture and manufactured products. This could be achieved by creating an enabling business environment devoid of contemporaneous discretionary measures that inhibit trade flows such as border closure, foreign exchange restrictions, and import bans.

Trade and investment flows could play an important role in revamping the Nigerian economy. However, their potency will depend on the right complementarity of macroeconomic policies and structural reforms that can support trade and investment. Realizing the need to develop a medium to a long-term trade policy plan that prioritizes diversification is critical. Recalibrating the trade policy thrust by shifting from distortionary non-tariff to tariff measures could also help while efforts to accelerate port and custom reforms are required. The institutional path used to implement the right mix of complementary reforms could help Nigeria maximize the gains from trade and investment. This should be predicated on good governance in terms of efficiency, sustainability and equity.

*Dr. Shuaibu is a Senior Lecturer in Economics at the University of Abuja. He is one of the authors of Agora Policy’s report on “Options for Revamping Nigeria’s Economy.”

Footnotes

[1]https://atlas.cid.harvard.edu/rankings

[2]https://atlas.cid.harvard.edu/rankings

[3]https://atlas.cid.harvard.edu/rankings

Read more: Leveraging Trade and Investment for Nigeria’s Economic Development

- Details

- By Agora Policy

- Blog

- Hits: 354

By Babajide Fowowe | Federal Government’s total debt stock at the end of the second quarter of 2022 was N35.672 trillion. This comprised N14.723 trillion in external debt and N20.948 trillion in domestic debt.

Read more: Three Critical Issues with Federal Government’s Mounting Debts

- Details

- By Agora Policy

- Blog

- Hits: 333

By Ifetayo Idowu | Poverty and unemployment are some of the most spoken about challenges in Nigeria. That’s why they are both recurring campaign topics.

Read more: Gender and Spatial Dimensions of Poverty and Unemployment in Nigeria