By Babajide Fowowe | Federal Government’s total debt stock at the end of the second quarter of 2022 was N35.672 trillion. This comprised N14.723 trillion in external debt and N20.948 trillion in domestic debt.

In December 2011, the total debt stock of FGN was N6.17 trillion. Thus, the total debt stock increased by 478% between January 2011 and June 2022.

However, the official figures of debt stock are understated, as the borrowing by the Federal Government (FG) the Central Bank of Nigeria (CBN)is not included. This is the first issue with FG’s debt. Called ‘Ways and Means’, FG’s borrowing from CBN reached N18.89 trillion in March 2022. Adding this figure to official statistics almost doubles domestic debt stock to N39.748 trillion.

This is in turn problematic on a number of fronts. First, higher debt means higher debt servicing, which is in danger of spiralling out of control. Second, not including Ways and Means borrowing in official statistics gives a misleading (lower) figure of debt. However, the FG stated last week that it will securitise the Ways and Means, now at N20 trillion, over a 40-year period at an interest rate of 9%. In addition, the Debt Management Office indicated it would subsequently add the Ways and Means to official debt stock.

Third, the CBN Act is being contravened. The guideline for ‘Ways and Means’ borrowing is contained in Section 38 of the CBN Act 2007. From the CBN Act, there are strict stipulations of the maximum amount that can be borrowed by the FG, including the repayment period. These stipulations have not been adhered to.

Section 38 of the CBN Act reads as follows:

38 – (1) Notwithstanding the provisions of section 34 (d) of this Act, the Bank may grant temporary advances to the Federal Government in respect of temporary deficiency of budget revenue at such rate of interest as the Bank may determine.

(2) The total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government.

(3) All Advances made pursuant to this section shall be repaid –

a. as soon as possible and shall in any event be repayable by the end of the Federal Government financial year in which they are granted and if such advances remain unpaid at the end of the year, the power of the Bank to grant such further advances in any subsequent year shall not be exercisable, unless the outstanding advances have been repaid; and

b. in such form as the Bank may determine provided that no repayment shall take the form of a promissory note or such other promise to pay at a future date or securitization by way of issuance of treasury bills, bonds, certificates or other forms of security which is required to be underwritten by the Bank.

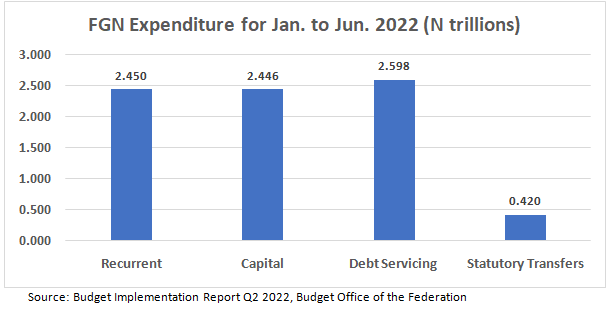

The second issue with FG’s debt is that debt servicing is crowding out other expenditure lines. In the first half of 2022, total expenditure by FG was N7.913 trillion. Debt servicing was the largest component of expenditure with N2.597 trillion. This was followed by recurrent expenditure (N2.45 trillion), capital expenditure (N2.445 trillion), and statutory transfers (N419.9 billion).Looked at another way, debt service alone gulped 32.82% or close to a third of FG’s expenditure for the first half of the year. The high expenditure on servicing debt significantly reduces much needed expenditure from critical sectors. This will ultimately have damaging consequences for human welfare and economic development.

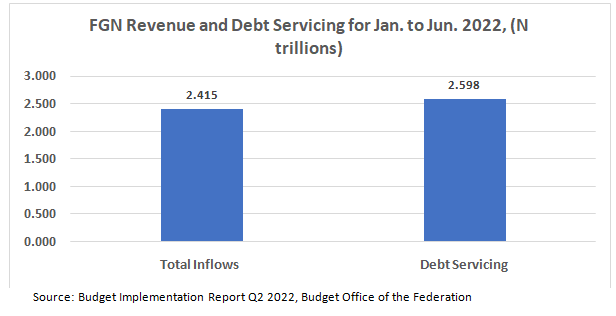

The third issue with FGN’s debt is the fact that debt servicing has surpassed revenue. For the first half of 2022, total revenue inflows were N2.415 trillion, while total debt servicing was N2.598 trillion. Debt service was 107.58% of revenue in the first half of this year or debt servicing surpassed revenue by N183 billion. The implication of this is that the FG is borrowing to pay back debt, which will further increase total debt burden and future debt service obligations. This is clearly a precarious situation.

There is the argument that FG’s debt has not reached alarming levels yet. Such arguments are largely based on using the ratio of debt to GDP. In 2021, the ratio of total debt to GDP was 23.97%. This would give the impression that the debt levels are not problematic. However, debt is not repaid with GDP but with government revenue, and the critical measure of debt sustainability is ability to pay back, that is, debt service payments. When we examine the ratio of total debt service (including interest on Ways and Means) as a ratio of revenue for 2021 in the report for Agora Policy, the figure we obtained is 90.92%, indicating very high risk of debt distress.

*Dr Fowowe, a Reader in Economics at the University of Ibadan, is the lead author of Agora Policy’s maiden report titled “Options for Revamping Nigeria’s Economy.”