By Celestine Okereke | A feature of revenue distribution in Nigeria in the past few decades is that some federal agencies receive a percentage of the revenues they collect on behalf of the Federation.

This is classified as the cost of collection. These costs are deducted at the monthly meetings of the Federation Accounts Allocation Committee (FAAC) before federally-collected revenues are shared to the three tiers of government and other statutory recipients. At the moment, the cost of collection applies to three agencies: the Federal Inland Revenue Service (FIRS), which receives 4% of non-oil revenues; the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), which gets 4% of royalties, rents and other revenues from the oil and gas sector; and the Nigeria Customs Service (NCS), which receives 7% of custom duties and levies.

The argument for centrally collecting taxes and revenues remains sound, as it allows for ease and efficiency of collection and administration. But the idea of turning federal agencies into commission agents of the Federation is riddled with all sorts of problems. The cost-of-collection approach to rewarding and funding such agencies might have served a useful purpose at some point. However, recent developments show that it is a flawed idea. It enables abuse, distortions, distractions and wasteful expenditures. The utility of the approach has been overtaken. It is thus no longer tenable.

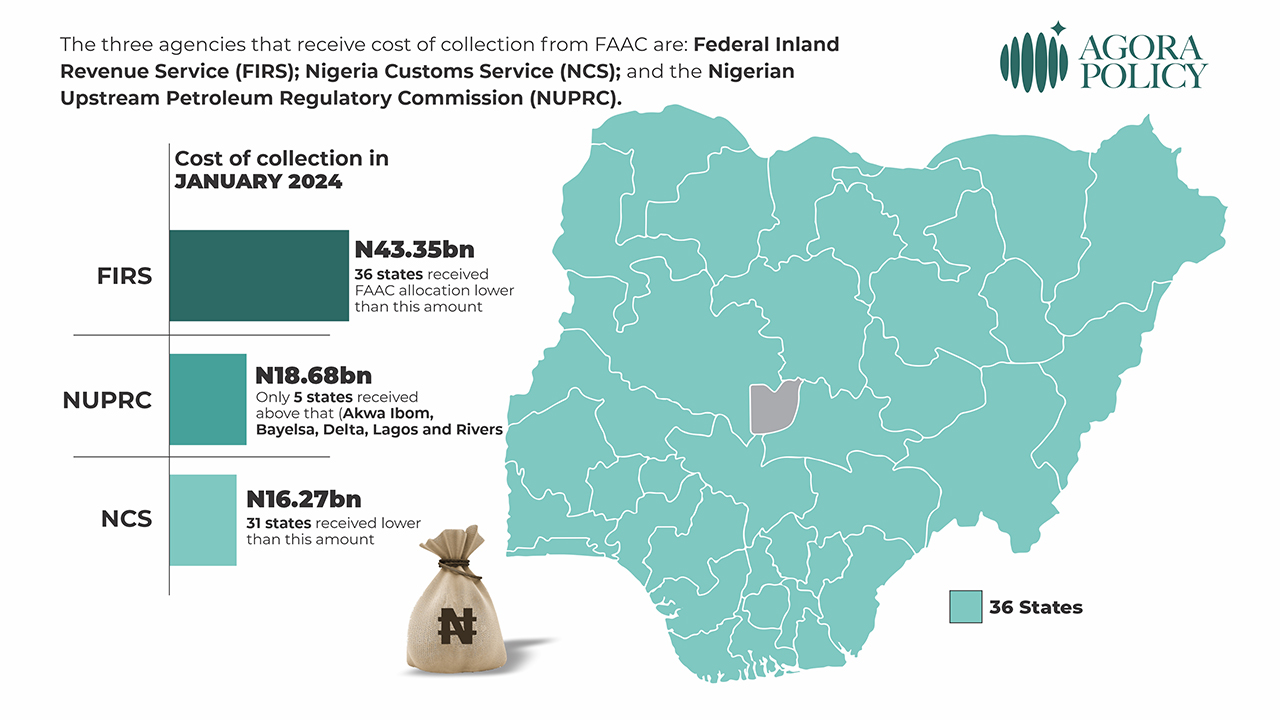

A review of the fully disaggregated data on FAAC disbursements, as published by the National Bureau of Statistics (NBS), highlights some of the incongruities that the arrangement has created. For example, in January 20241, FIRS received N43.35bn2 as cost of collection. None of the 36 states of the Federation received up to this amount as Federation allocation. The state with the highest gross allocation for the month, Delta State, got N39.59bn3, which means that FIRS not only received an amount more than what each of all the 36 states but also got 109.49%4 of the allocation of the state with the highest gross allocation. It is interesting to note that Customs Service received N16.27bn, the lowest cost of collection for the month. But what Customs got was higher than what each of the 31 states received as gross allocation for the month.

Sources: National Bureau of Statistics; FAAC Communique

Calculation by Agora Policy

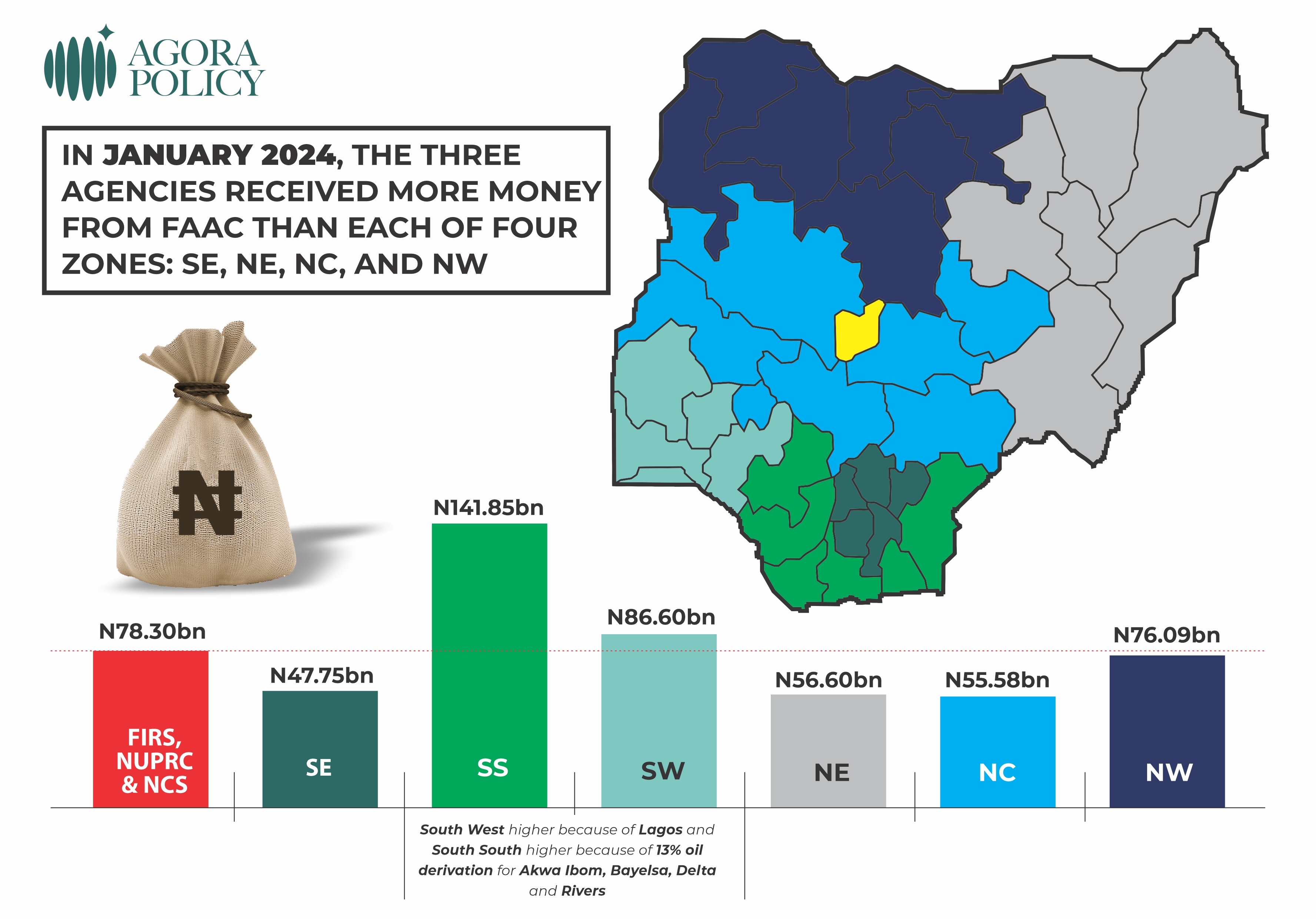

There is even a more incongruous dimension. The three agencies received a total of N78.30bn as the cost of collection for January 2024. But the gross allocations to the six geo-political zones for the same month were as follows: N56.60bn for the North-East; N55.58bn for the North-Central; N76.09bn for the North-West; N47.75bn for the South-East; N141.85bn for the South-South; and N86.60bn for the South-West. This shows that for the month, the cost of collection received by the three agencies (N78.30bn) was higher than the gross FAAC allocations to each of four geo-political zones in the country: North East (N56.60bn), North-Central (55.58bn), North-West (N76.09bn) and South-East (N47.75bn). The South-South and South-West got more than what the three agencies received only on account of 13% derivation for the oil producing states and the allocation of N21.28bn as the net allocation to Lagos State for Value Added Tax (VAT).

Cost of collection as a concept crept into revenue collection and management in Nigeria to address three issues: one, to create a mechanism for the revenue-collection agencies to get reimbursed for the cost they incur in carrying out tasks on behalf of the Federation; two, to ensure that agencies are incentivised and resourced enough to effectively discharge their mandates; and, three, to provide them with a predictable and adequate source of funding. In principle, these are valid arguments that are still being canvassed.

But it is unlikely that those who fashioned the cost-of-collection arrangement contemplated a situation where the agents will be receiving more money than most of the principals, including geo-political zones. It is doubtful that it was part of the plan for about 90% of the states to get gross allocations lower than the agency with the least commission in any month5. If the designers had thought about these possibilities and the unintended consequences, they probably would have installed circuit-breakers or sunset clauses.

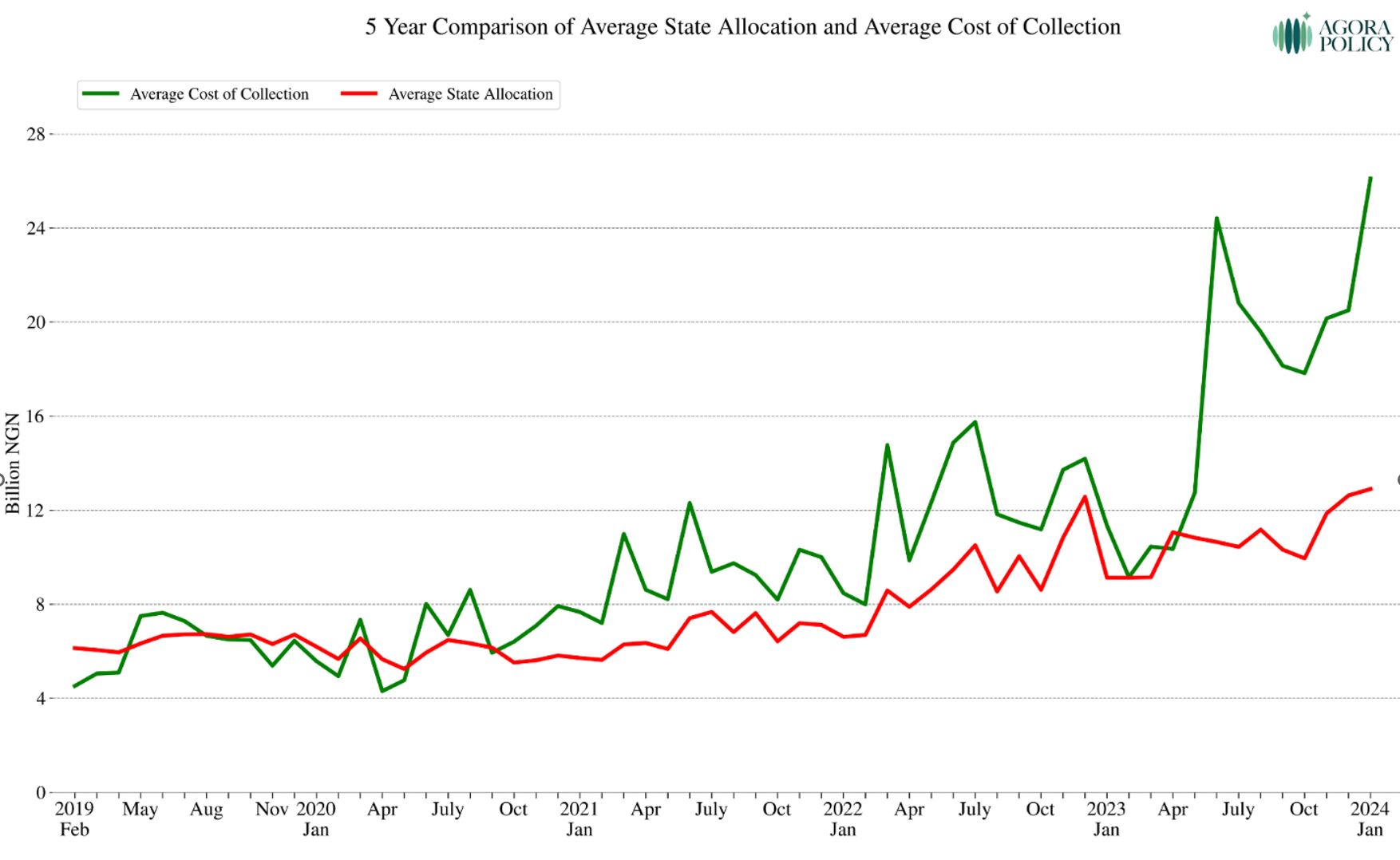

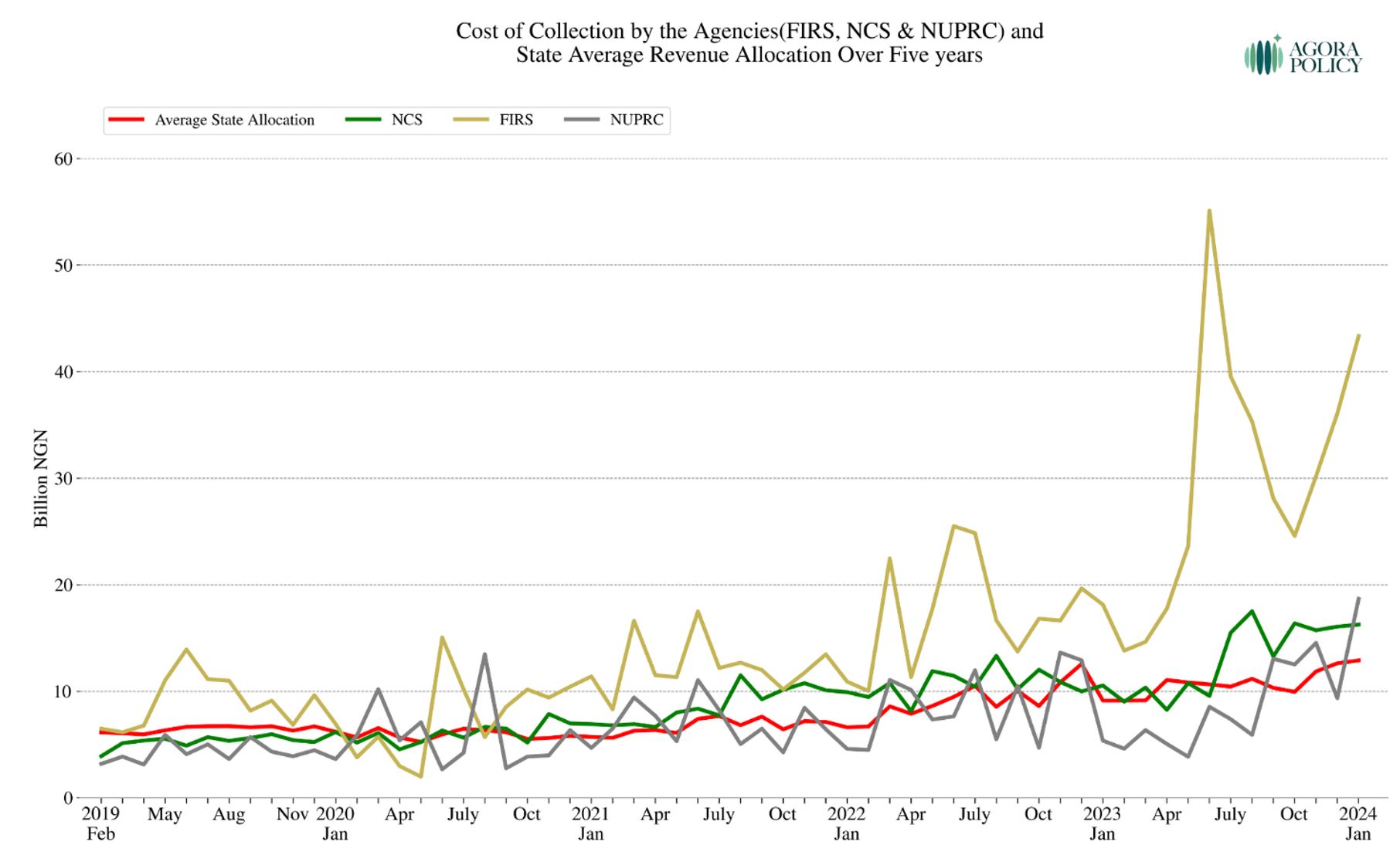

In their defence, the agencies can contend that they are receiving more money now simply because they are also bringing in more money to the Federation. To check this claim, we looked at the fully disaggregated data6 on FAAC disbursements for a five-year period, from February 2019 to January 2024. The data reveals how the revenue structure of the Federation has changed within five years and in a way that gives an edge to the agencies against the three tiers of government on behalf of whom they collect the revenues.

Sources: National Bureau of Statistics; FAAC Communique

Sources: National Bureau of Statistics; FAAC Communique

Calculation by Agora Policy

Sources: National Bureau of Statistics; FAAC Communique

Calculation by Agora Policy

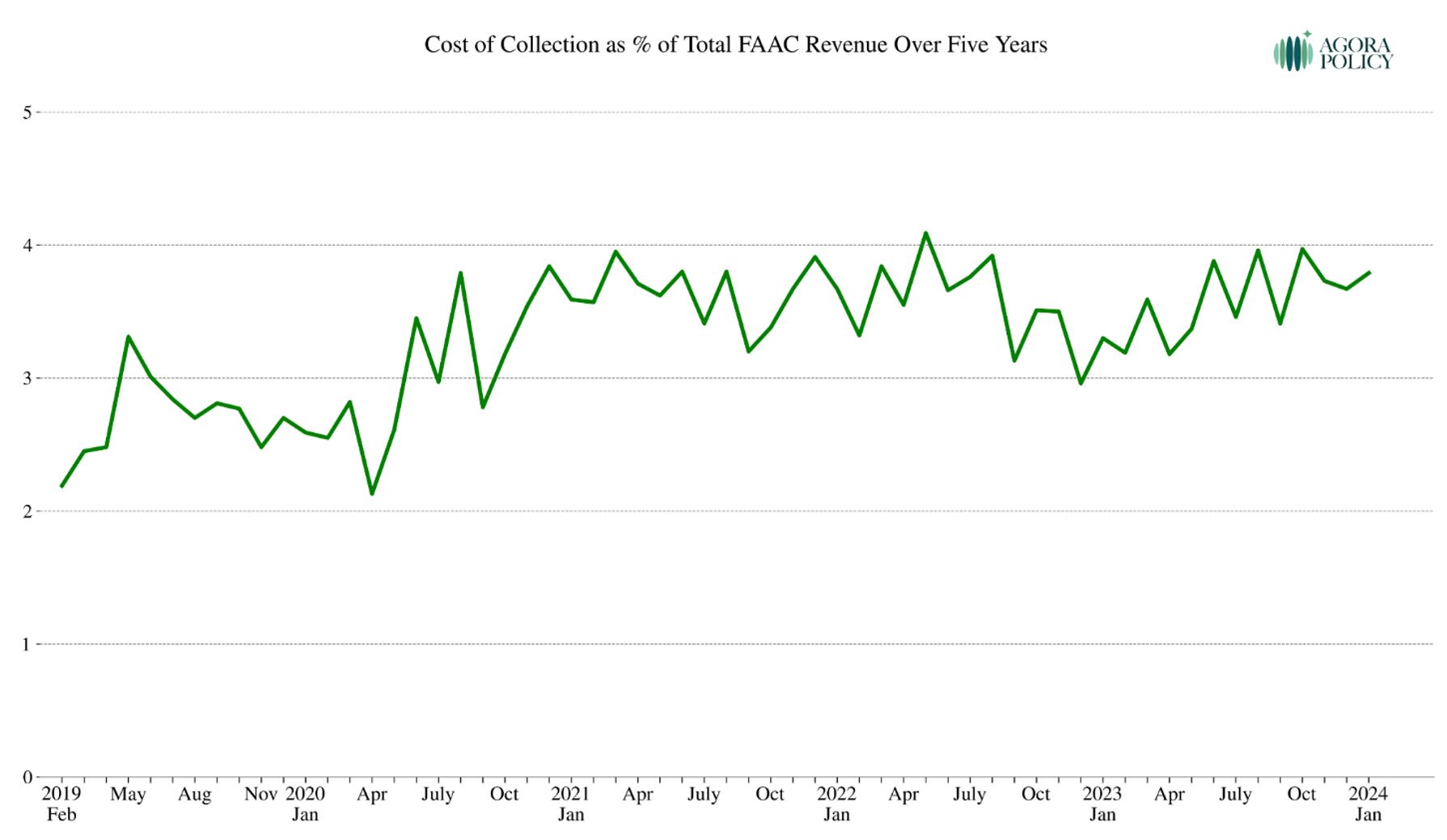

In February 2019, the gross FAAC revenue was N619.86bn and the total cost of collection was N13.58bn, or 2.19% of the gross allocation. In January 2024, the gross revenue was N2.07trillion while the three agencies received N78.30bn, or 3.79% of it. On the face of it, the absolute value of the cost of collection is merely rising gross revenue. But this is not exactly so: while the gross revenues between February 2019 and January 2024 increased by 234%, the cost of collection for the same period increased by 477%. So, the cost of collection has increased in more than corresponding proportion than the gross revenue has. If the cost of collection had remained at the 2.19% level of February 2019, the sum of N45.33bn (instead of N78.30bn) would have been due to the agencies as the cost of collection in January 2024. This means that the agencies would have received 42.11% less than they did this January.

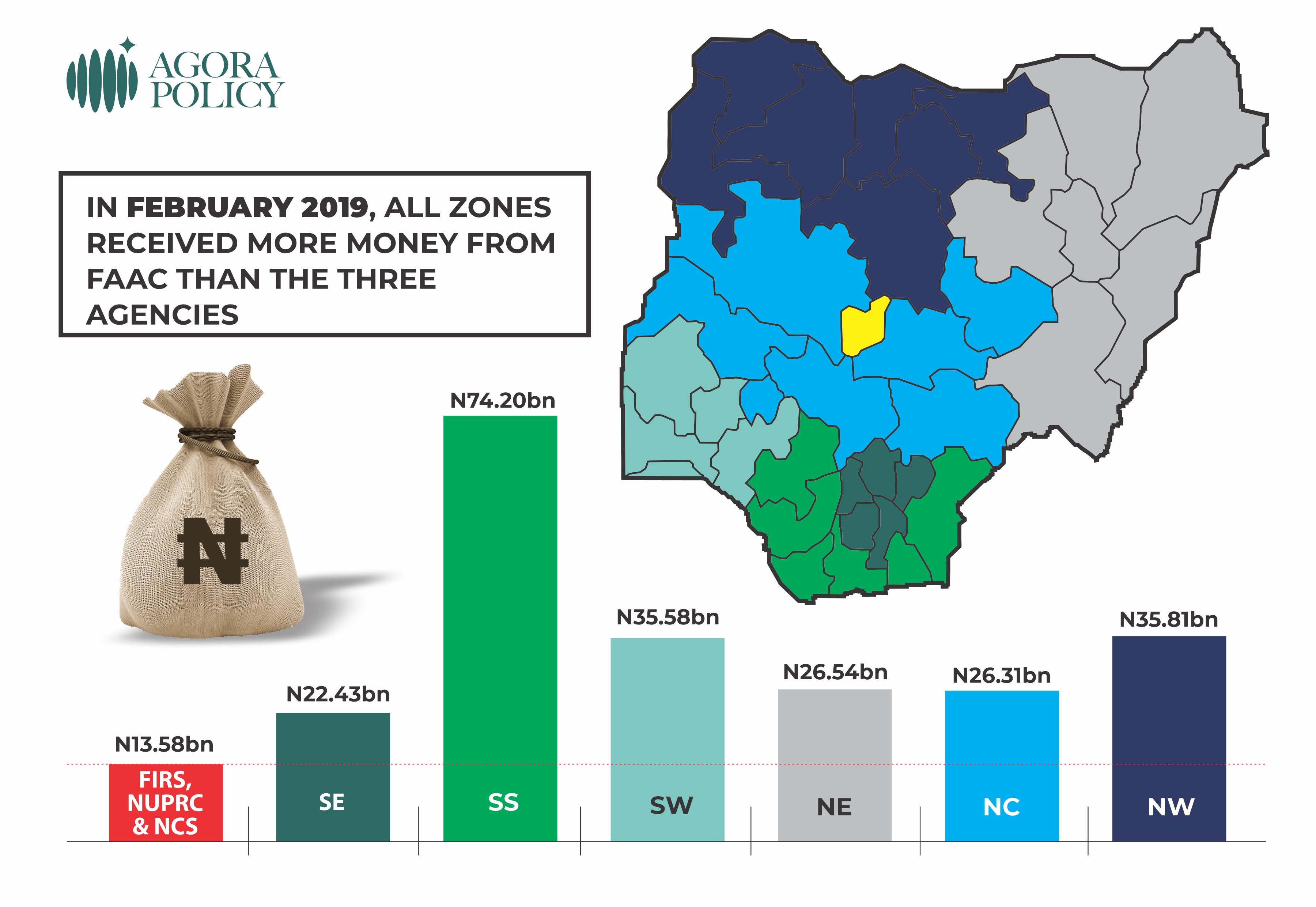

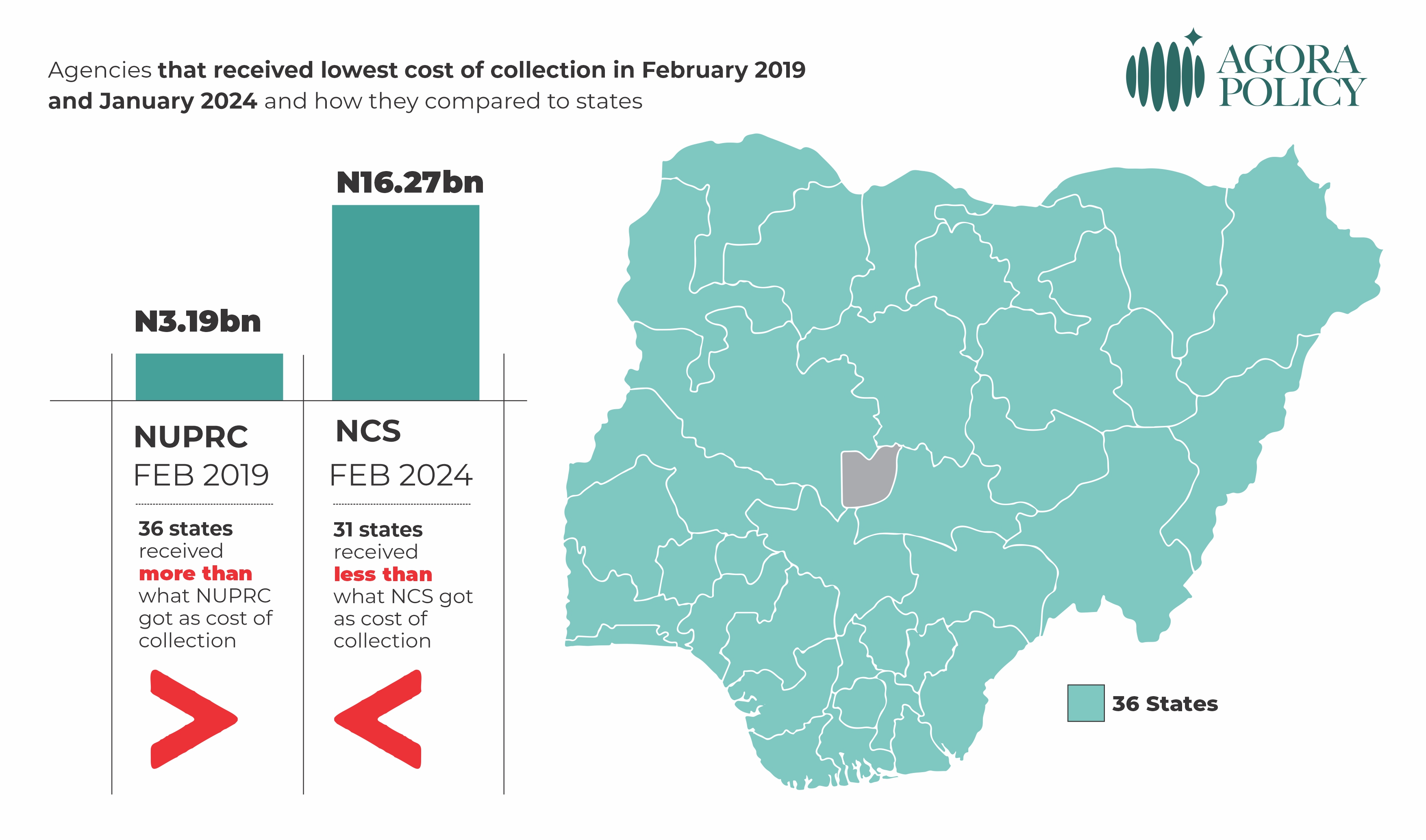

Also, the data shows that the agency that got the lowest amount in February 2019 was NUPRC, which got N3.19bn. None of the 36 states got lower than that. Also, all the zones got higher amounts than the three agencies combined in February 2019. This contrasts sharply with January 2024 when each of 31 states received amounts lower than the agency that got the lowest cost of collection (which in this case was NCS with N16.27bn) and when each of four geo-political zones received amounts lower than what the three agencies got as cost of collection.

Sources: National Bureau of Statistics; FAAC Communique

Sources: National Bureau of Statistics; FAAC Communique

Sources: National Bureau of Statistics; FAAC Communique

In the charts above, we mapped out the disbursements over five years to gain more insights from the FAAC data. Even when they have always received what some analysts consider disproportionate amounts, the agencies have not always overshadowed the states and others FAAC recipients. Two major developments changed the FAAC disbursement profile in the last five years. One, mineral revenue which used to be the bulk of FAAC revenue declined sharply, especially with the precipitous fall in oil production and the reclassification of Federation oil by the Petroleum Industry Act (PIA); and two, the depreciation of the Naira has significantly enhanced receipts from some revenue handles. The combined effect is that the shift in the structure of FAAC revenue has favoured the commission agents more than most of the principals.

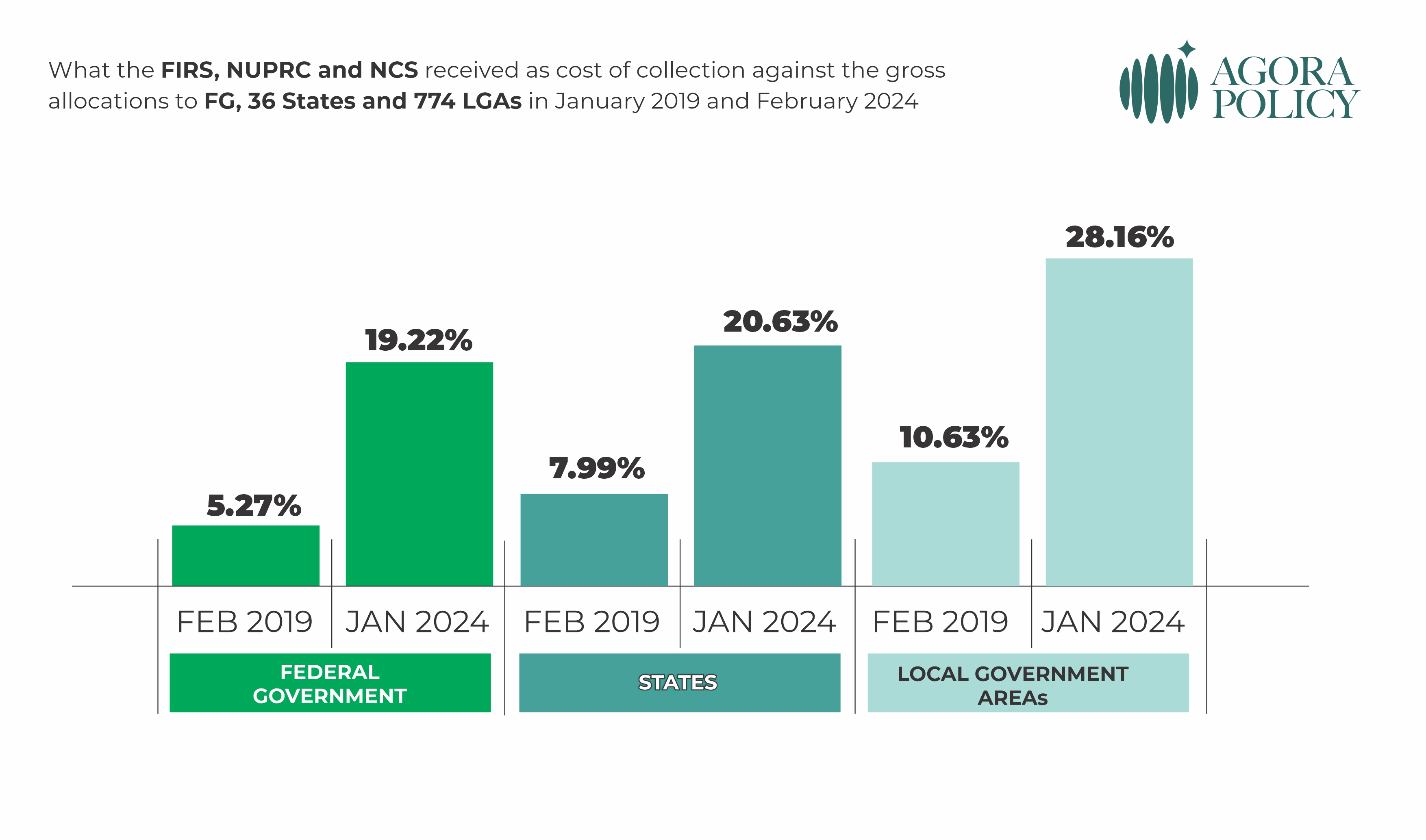

It is noteworthy that the shift has affected the statutory recipients across the board. In February 2019, the amount received by the three agencies was only 5.27% of the N257.68bn that the Federal Government got as gross revenue from FAAC. By contrast, what the agencies got as cost of collection in January 2024 was 19.22% of the N407.27bn that the FG received in that month. Also, what the three agencies received was 7.99% of what all the 36 states got in February 2019 but they received 20.63% of what the states got in January 2024; and while they received 10.63% of what the 774 LGAs received in February 2019, they got 28.16% of what the LGAs received in January 2024.

Sources: National Bureau of Statistics; FAAC Communique

Calculation by Agora Policy

Cost of collection is a recent feature of Nigeria’s revenue collection and sharing formula. One of the earliest places it appeared in law was in the Federal Inland Revenue Service (Establishment) Act 2007. Section 15 (a) of the Act states that: “The Service shall establish and maintain a fund which shall consist of and to which shall be credited a percentage as determined by the National Assembly of all non-oil and gas revenue collected by the Service which may be appropriated by the National Assembly for the capital and recurrent expenditures of the Service.” The law did not specify that it must be 4%, but somehow that number has stuck.

The Department of Petroleum Resources (DPR), the predecessor of NUPRC, was a struggling agency funded from the budget until 2014 when the then President Goodluck Jonathan gave an approval for DPR to earn 4% of royalties, rents and other revenue handles. Section 7(w) of the PIA defines the function of NUPRC as: “to compute, determine, assess and ensure payment of royalties, rents, fees and other charges for upstream petroleum operations as stipulated in this Act and any regulations.” Section 24 (2) (c)of the PIA identifies the sources of the Fund of NUPRC to include: “the cost of collection by the commission.” It didn’t stipulate 4% but it is possible that this number is a carryover from the 2014 presidential approval.

The NCS receives 7% as its cost of collection. The provenance of this number is unclear. But it is possible it also came from an executive fiat. However, the 2023 amendment to the enabling law of the organisation has a different funding arrangement. In Section 18 (1), the Nigeria Customs Service Act 2023 states that: “Subject to extant laws and regulations, the service shall keep and maintain bank accounts as may be approved by appropriate authority of the government into which shall be paid— (a) not less than 4% of the free-on-board value of imports according to international best practices.” While Section 18(1)(a) introduces 4% of free-on-board value which will be paid by importers, NCS is still receiving 7% as cost of collection from FAAC, despite that its law was signed in 2023.

The issue with the cost-of-collection arrangement is not just because the agencies are now collecting more money than most states or that they are getting higher proportion of gross revenues. There are other problems. One glaring issue is that the increase in revenue is not necessarily a product of increased efforts. The three agencies (NCS, FIRS and NUPRC) will rake in more money and collect higher commissions simply because of the depreciation of value of the Naira, which is the effect of monetary policy. This is basically rent transfer.

Two, these agencies are getting more allocations at the expense of others, including states and zones that have millions of citizens to cater for and a slew of challenges to tackle. Revenue allocation is a zero-sum. What is available to the agencies is what is denied the three tiers of government.

Three, giving agencies a portion of the revenue that pass through them has created a perverse incentive where they prioritise revenue collection and de-emphasise the other parts of their work even if at a cost to the larger economy. It is common for these agencies to be trumpeting how much money they have contributed to the Federation, even when they are not doing more than computing and assessing how much is due. The NCS regularly measures itself by the amount of money it is generating and rarely talks about its important mandates on border protection and trade facilitation. What is rewarded is what gets done.

The fourth issue is that most government agencies want to become commission agents or revenue-generating agencies. This distracts them from their core mandates and leads to imposition of heavy costs on individuals and businesses. The fifth problem is that this approach shifts scarce resources away from where they are needed the most at a time the country has enormous developmental challenges. It is not unusual for these agencies to vote huge sums for things like new office buildings, cars, trainings and travels, and staff welfare. NUPRC for example budgeted to spend N50bn on staff welfare in 2024, and this is apart from salaries and allowances of its staff. Money made available and deemed earned must be spent.

The last problem is that the quantum of money available to these agencies predisposes them to extravagance, opacity and graft. The 2024 proposed budget of Government Owned Enterprises is replete with examples of wasteful expenditure. In its 2024 proposed budget, NCS proposed to spend N451.65bn or 99.18% of its projected revenue of N455.39bn while FIRS planned to spend the entirety of its projected revenue of N356.95bn. (The final appropriation for FIRS for 2024 was N446.34bn, which must have included its internally generated revenue. Only 12 states of the Federation have budgets higher than this amount in 20247).

Ordinarily, ministerial and legislative oversight should put the agencies on the path of prudence. But the amount of money at play makes it easier for a camel to pass through the eye of a needle than for supervisors to enforce prudence and accountability in these agencies. Authorisers and those with oversight responsibilities are likely to treat such agencies are avenues for patronage and disguised expenditures.

The cost-of-collection approach is clearly defective. This defectiveness will not be fixed simply by reducing the percentage charged, contrary to a recent proposal by the presidential committee of fiscal policy and tax reforms8.

Our position is that the three agencies should be funded, and well-funded, via appropriation by the Federal Government. They are providing important services and adequate provisions should be made for them. But their budgets should be based on verifiable, justifiable and reasonable needs. Increase in budgetary provisions for them should be tied expected improvements and returns, as opposed to the current practice where expenditure routinely rises to meet available money.

It is also important to bear in mind that while the current approach may yield more money than the agencies need, and it may produce less than needed at some other time. What government should aim for is adequate and predictable funding for these important agencies. This can be a first-line charge in FG’s revenue. But this will be a better approach than having a few over-resourced and profligacy-prone agencies.

The Federal Government should receive an extra but minimal percentage as allocation for collecting revenues on behalf of the Federation. But this should go to the Federal Government and not directly to the agencies. FG can give performance bonus to these agencies to incentivise them but this should be when they surpass pre-agreed revenue targets. The cost-of-collection arrangement was probably designed based on good intentions and was clearly intended to solve some problems. But it has in turn spawned its own problems. It is time to jettison it for a more transparent, more prudent and more accountable approach.

*Uchechukwu Eze, Munir Salihu, Maryam Ibrahim, Samuel Ajayi and Saadatu Abari contributed to this report.

Link to download a copy of the policy note:

https://agorapolicy.org/files/Why_Nigeria’_Cost-of-Collection_Approach_is_no_Longer_Tenable.pdf

1 The most up-to-date and fully disaggregated data from NBS is for January 2024.

2 The figures used for the agencies do not include refunds. The refunds would have further increased the amounts recorded for the agencies as cost of collection in each month.

3 We used gross FAAC allocation for the revenues. Using net allocation will have produced lower figures for the states because of deductions.

4 There are months when FIRS recorded higher percentages. For example, FIRS got 138.73% and 142.66% of what the state with the highest allocation, Delta State, received in June 2023 and July 2023 respectively.

5 This is not an isolated occurrence. In September, October and November 2023, the number of states that got allocation lower than the agency with the lowest (NUPRC in these cases) was also 31.

6 The data was pulled from monthly reports of FAAC disbursement by NBS.

7 https://www.icirnigeria.org/nigerias-36-states-to-spend-n16-15-trillion-in-2024/#:~:text=A%20compilation%20of%20approved%20budgets,the%2036%20states%20in%202023.

8 https://www.thecable.ng/tax-reform-committee-proposes-slashing-cost-of-collection-to-1-to-improve-efficiency/#:~:text=The%20presidential%20fiscal%20policy%20and,held%20for%20journalists%20in%20Abuja.