By Babajide Fowowe and Mohammed Shuaibu | The fiscal policy reforms initiated by the President Bola Tinubu Administration have been geared towards addressing the legacy challenges of underperforming revenue inflows, inefficient spending, and high debt service payments.

In this policy note, we examine the scope and impact of the fiscal reforms by the administration in its first year in office.

Some of the key reform areas evaluated include measures aimed at boosting government revenue such as increasing oil production, removing petrol subsidy, deducting operating surplus upfront from revenue generating agencies, and enhancing tax collection efficiency. Assessment of the administration's actions in this domain reveals mixed progress.

While efforts at enhancing economic coordination and addressing insecurity in the Niger Delta are noted, more concrete initiatives for combatting oil theft and vandalism are lacking. In addition, there is the need to create a favourable climate for investment, and put a stop to NNPCL’s toxic practice of pledging crude oil for debt incurred. For non-oil revenue, clear operational guidelines are needed to improve efficiency, that is, eliminating multiple taxation, and broadening the tax base while keeping the tax burden low.

The hardship brought on Nigerians by petrol subsidy removal has not been matched by prudent spending from the government. There is a dissonance between the sacrifice that the government demands of Nigerians due to the immediate negative impacts of the reforms and government’s unadjusted expenditure on non-essential, luxurious items such as cars, yacht, and office renovations. Coupled with the slowness in promptly providing succour to the most affected and in increasing the minimum wage, this has led to the apparent implicit re-introduction of the petrol subsidies, which is a dent on the administration’s major fiscal policy.

On debt, the last administration succeeded in securitising a large chunk of the Ways and Means advances from the CBN and adding it to the official debt stock. However, the advances have started increasing. Also, the high debt service payments have continued to crowd-out other expenditure. Unfortunately, this trend will continue unless the government is able to substantially grow revenue to reduce borrowing.

Overall, there is the need for sustained fiscal discipline and conscious alignment of the goals of fiscal, monetary and trade policies to maximise the benefits of macroeconomic reforms. While the Tinubu Administration's fiscal reforms offer some promise, it is important to note that sustained commitment and comprehensive strategies that mitigate the impact of the reforms are essential to overcome Nigeria's fiscal challenges and to ensure long-term fiscal sustainability and economic prosperity.

The Fiscal Policy Imperative and Promises

When the Tinubu Administration assumed office a year ago, it was faced with numerous fiscal challenges such as weak domestic revenue mobilisation, a costly and distortionary petrol subsidy regime, rising external debt, high debt service payments, and low and inefficient capital expenditure. The precarious state of Federal Government’s finances can easily be seen from the fiscal figures.

As of 31st July 2023, FG’s retained revenue was N4.833 trillion which was 3.9% lower than N5.031 trillion , the pro-rated budget amount for January to July. Oil revenue largely accounted for this under-achievement. The projected oil revenue from the budget for January to July was N1.3 trillion1 but actual oil revenue was N813.58 billion. Oil revenue thus underperformed the budget by 37.45%. However, actual non-oil revenue was N1.836 trillion, which was 27.7% higher than the budgeted figure of N1.438 trillion. Other sources of FG’s revenue, such as FGN Independent Revenue also underperformed with an actual aggregate of N2.132 trillion, lower than the budgeted figure of N2.243 trillion 2. But FG’s pro-rated expenditure (January to July 2023) was N8.445 trillion, which was 21.6% below the budgeted figure of N10.766 trillion. Actual recurrent (N7.19 trillion) and capital (N857 billion) expenditures were lower than the budgeted figures of N8.684 trillion and N3.962 trillion, respectively.

Capital expenditure performed particularly poorly with an underperformance of 78.4%, possibly due to the under-performance of revenue. However, the actual debt service was N3.935 trillion, which was 2.9% higher than the pro-rated budgeted figure of N3.825 trillion. Thus, the fiscal position of the FG could be summed up as under-performing revenue, accentuated by high debt service payments. Actual debt service payments (N3.935 trillion) were 82% of actual revenue (N4.833 trillion)3 . This would essentially be a continuation of the experience from 2022 when debt service (N5.656 trillion) was 85.6% of FG retained revenues of N6.611 trillion. The fact that debt service was such a large percentage of revenue, and even had the possibility of exceeding it, posed serious risks for fiscal sustainability. It was the recognition of this risk that informed the fiscal reforms of the Tinubu Administration.

Tinubu’s fiscal reforms were kicked off on the very first day of the administration with the president announcing the removal of petrol subsidies during his inaugural speech. Other reforms have since been introduced. The president’s initial stance on fiscal policy reforms had been captured in the ‘Renewed Hope Agenda,’ his campaign manifesto for the presidential election. Six areas were identified: (i) review of federal budgetary methodology; (ii) national infrastructure campaign; (iii) import substitution; (iv) tax reform; (v) fight [against] corruption, inefficiency, and waste in government; and vi) optimisation of government revenue. The fiscal reforms were further crystalised in the Policy Advisory Council (PAC) report by the National Economy Sub-Committee. The fiscal policy thrust of the administration were further projected in the 2023 supplementary and 2024 budgets.

Thus, the fiscal reforms have broadly been premised around increasing revenue; improving expenditure efficiency; improving debt management; and engendering fiscal discipline to reduce budget deficits4,5 . Although the actions of the administration seemed to indicate it was following its fiscal policy agenda, emerging economic realities have also shaped fiscal policy priorities and decisions since its inception.

Fiscal Policy: Background, Thrusts and Targets

In this section, we will look at the historical and current trends and the policy thrusts and targets of the Tinubu Administration in three dimensions of fiscal policy: revenue, expenditure and debt management.

- Revenue

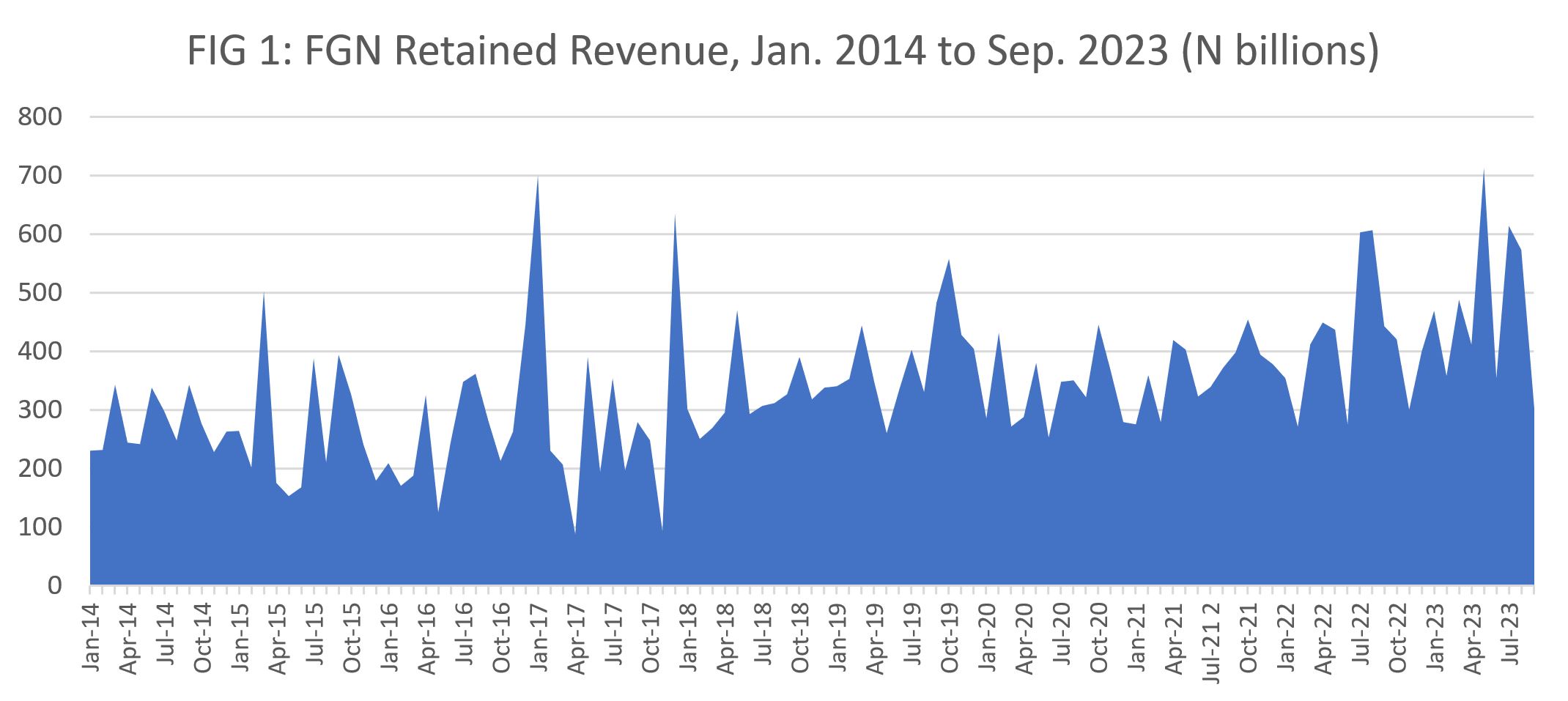

FGN revenue over the past decade has been volatile, as exhibited in monthly revenue having a minimum of N88.05 billion (April 2017) and a maximum of N714 billion (May 2023) (Figure 1). This volatility is expected, as the country is heavily reliant on oil revenue which is subject to boom-and-bust cycles typical of global commodity prices. For the early part of the period under consideration, there were wild swings but these have reduced over time. This can be explained by the changing composition of government revenue.

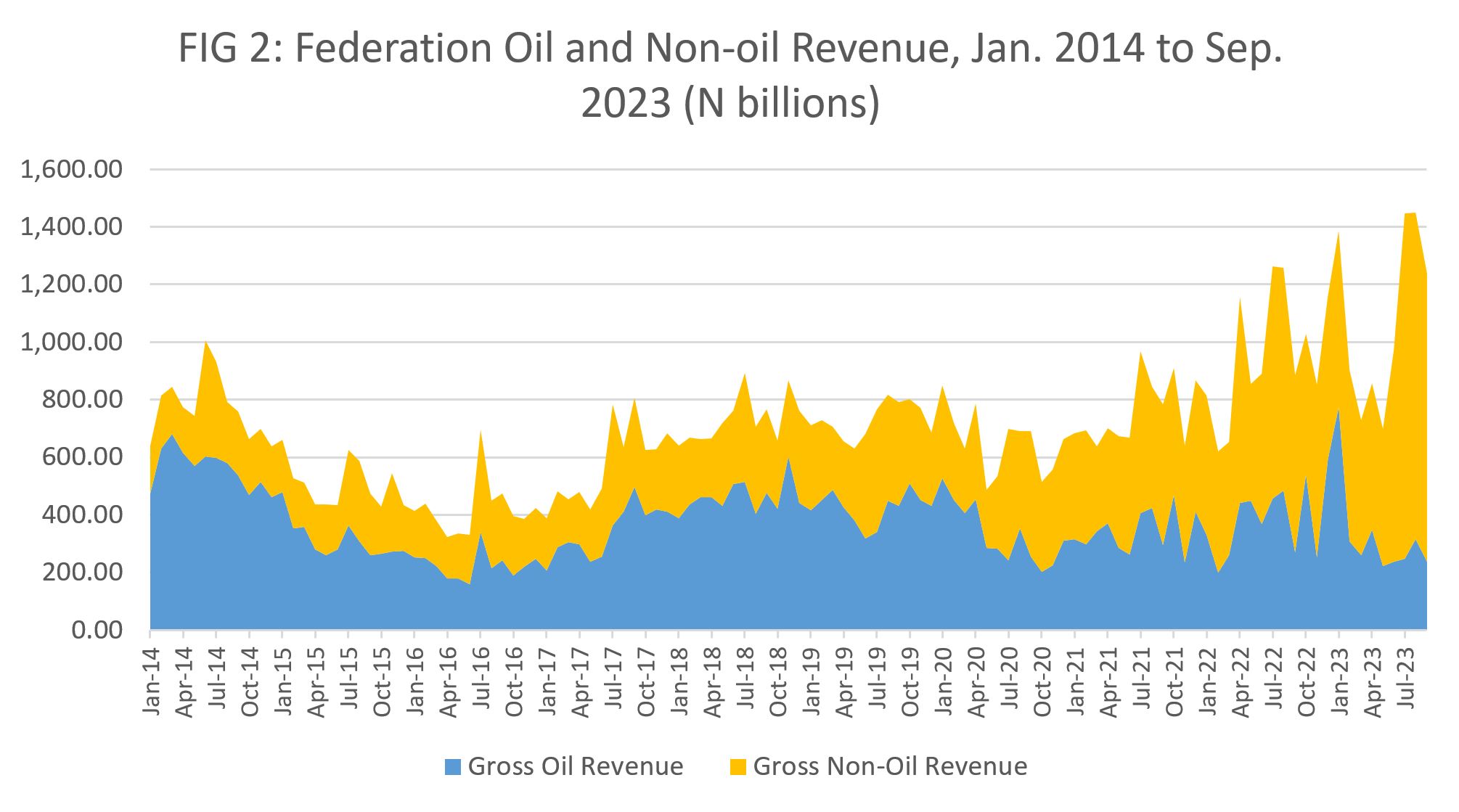

Between 2014 and the first half of 2020, oil revenue accounted for over 50% of gross Federation revenue (Figure 2). However, this has changed in recent times, with oil and non-oil revenue having similar percentages in some months, and non-oil revenue exceeding oil revenue in other months (Figure 2). Non-oil revenue accruing to the Federation exceeded oil revenue from February 2023 to September 2023 (Figure 2).

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

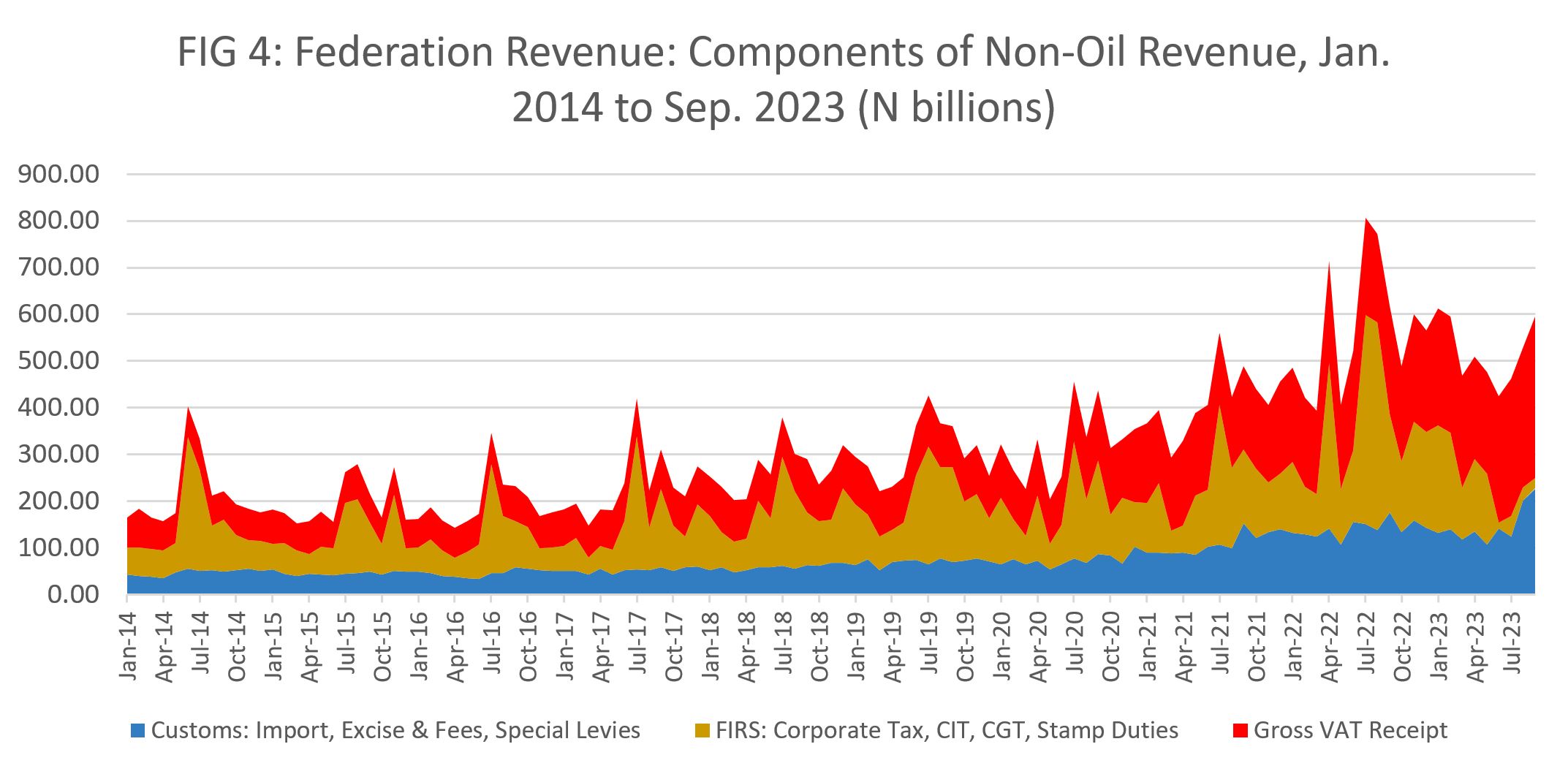

An examination of the components of Federation revenue shows changing dynamics of the sources of revenue. For oil revenue, crude oil sales were the largest component, followed by petroleum profits tax (PPT) and gas tax (Figure 3). Over time, crude oil sales have dwindled, owing largely to crude oil theft and lack of investment. This has resulted in PPT and royalties on oil and gas becoming the dominant contributors to oil revenue (Figure 3). For non-oil revenue, taxes collected by the Federal Inland Revenue Service (FIRS) were the dominant contributor (Figure 4). While these have increased over time, revenue from value added tax (VAT) and the Nigerian Customs Service (NCS) have also increased, and by the second and third quarters of 2023, these surpassed revenue from FIRS (Figure 4).

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

The drastic fall in oil production has resulted in significant revenue shortfalls for all tiers of government 6. Average daily crude oil production fell from 2.29 million barrels per day in January 2014 to 1.43 million barrels per day in December 2023. It was as low as 940,000 barrels per day in September 2022. Crude oil losses arising from theft, vandalism and pipeline breaks, in addition to lack of investment, an unclear policy stance, and difficult operating environments have led to the reduction in oil production, and resulted in significant decline in revenue from crude oil. Between 2009 and 2020, a total of 619.7 million barrels of crude oil was lost7 . The rampant crude oil theft has necessitated increasingly higher expenditure on pipeline repairs and management. Between January 2020 and July 2022, a total of N1.063 trillion8 was spent by the NNPC on pipeline repairs and management cost 9. Revenue from solid minerals is grossly insufficient. A mere N128 billion was the total revenue from solid minerals in 2020.

FG’s fiscal policy thrust sought to achieve a 78% year-on-year increase in budgeted revenue by strictly implementing the government’s revenue assurance model, leading to a targeted reduction of the budget deficit from 6.1% in 2023 to 3.9% in 202410 . A number of factors were identified as the causes of poor revenue performance. These are suboptimal oil and gas production and revenue; the existence of numerous waivers and exemptions impacting revenue performance and growth; and lack of a commercial orientation within the MDAs11 . Four key areas were identified for revenue reform12 :

- Safeguarding oil revenues;

- Increasing revenue contribution of MDAs and GOEs;

- Growing non-oil revenue;

- Optimisation of government assets.

These revenue reforms were skewed towards increased diversity of revenue inflows, indicating that the administration considers oil and non-oil domestic revenue mobilisation as critical.

The 2024 Budget of Renewed Hope is the first statutory fiscal policy instrument of the Tinubu Administration. Therefore, it was expected to reflect the administration’s fiscal policy objectives. The revised Medium Term Expenditure Framework (MTEF) and the Fiscal Strategy Paper (FSP) define the 2024 budget parameters. The oil price benchmark is US$77.96 per barrel and daily oil production is projected at 1.78 million barrels per day. With a Naira-US$ exchange rate of N750/$, the total projected aggregate revenue inflows of the government amount to N19.6 trillion. The projected revenue sources are: Federation Account with N11.24 trillion (57%), government-owned enterprises with N3.65 trillion (19%), independent revenue of N1.91 trillion (10%), others with N1.47 trillion (7%), aids and grants with N685.63 million (3%). Other dividends and special funds both had a 2% share of total revenue recording N357.92 million and N300 million, respectively.

- Expenditure

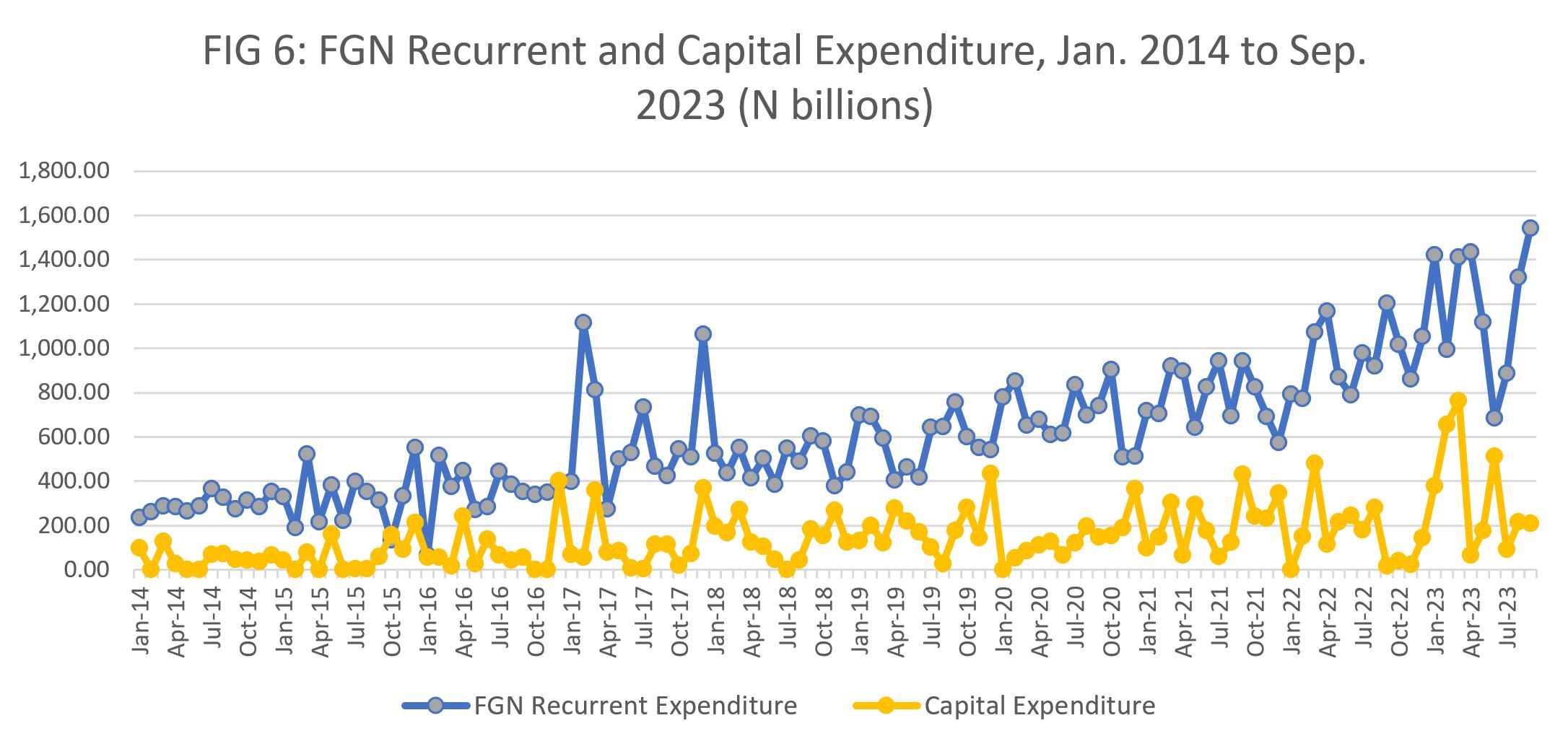

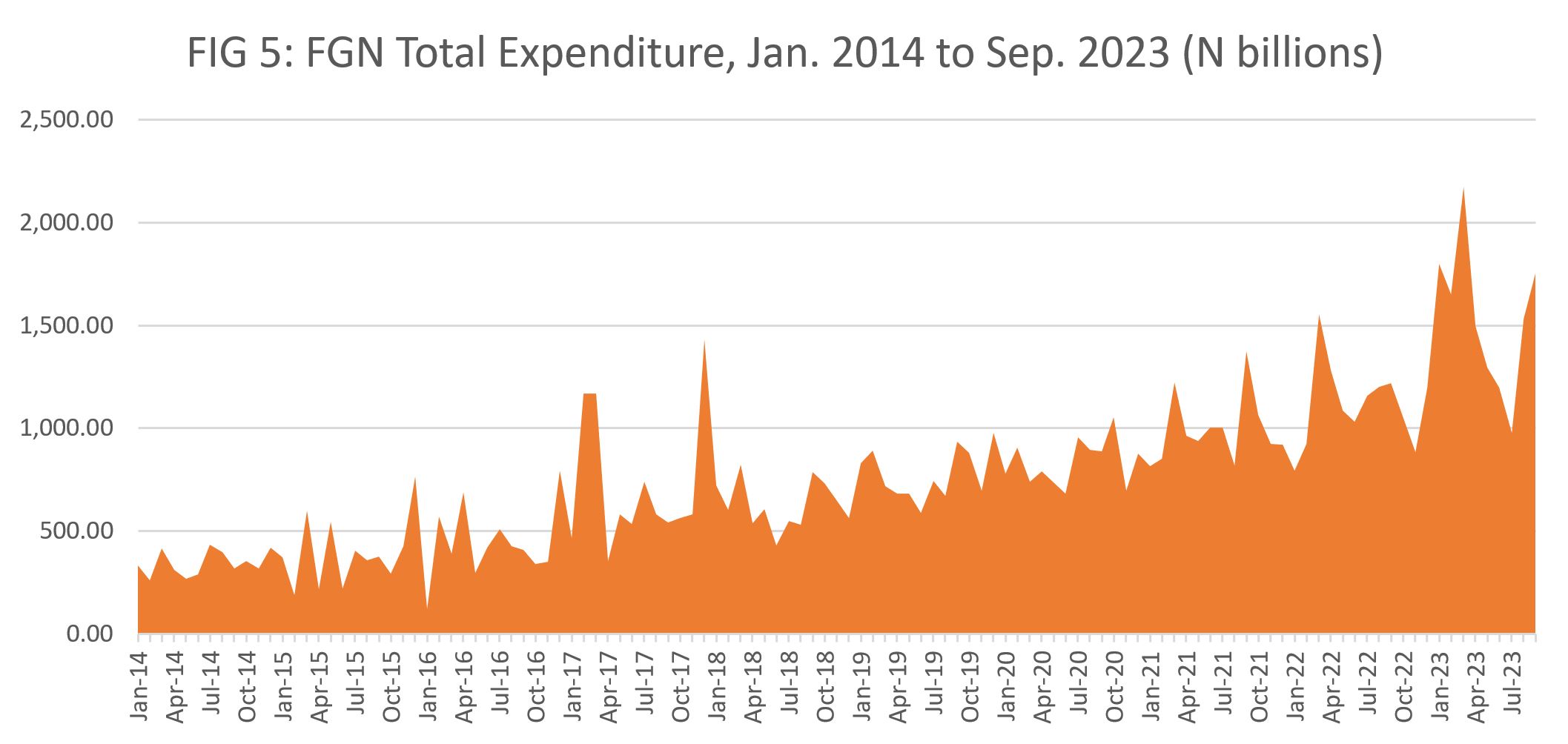

While FG revenue has largely fallen in the decade from 2014 to 2023, its expenditure has been increasing (Figure 5). Expenditure has also been volatile with the lowest monthly expenditure of N119.33 billion (January 2016) and highest monthly expenditure of N2.176 trillion (March 2023). Even as at 2014, FG’s expenditure was higher than revenue but the gap has been widening, as expenditure has increased by a greater proportion than revenue. Annual expenditure increased from N4.59 trillion in 2014 to N24.43 trillion in 2022, an increase of 432%. Between January 2014 and September 2023, with two exceptions (October 2015 and December 2016), recurrent expenditure has consistently outpaced capital expenditure (Figure 6). Also, except for 12 months, recurrent expenditure is more than twice capital expenditure.

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

Personnel cost and debt service have been the largest components of recurrent expenditure over the period under consideration (Figure 7). However, in recent times, debt service has taken the largest chunk of recurrent expenditure. In the 21 months from January 2022 to September 2023, debt service payments were higher than all other recurrent expenditures combined in 11 months. This further highlights the fiscal and debt sustainability risks mentioned previously. The third highest component of recurrent expenditure is overhead costs/service-wide votes, and this sheds light on the high cost of governance that successive governments have struggled to cut.

The Tinubu Administration set targets of prudent expenditure management. Some of the factors identified as responsible for difficulties with expenditure include high cost of governance; superfluous expenditure due to duplication of functions; and limited deployment of technology to drive service delivery13 . These factors are clear indicators of the critical areas of leakages of government expenditure that have been identified over time, but which successive governments have found difficult to address. In addition, petrol subsidies were prioritised for removal, and were removed right at the inauguration venue. Between January 2022 and October 2022 subsidy on petrol was more than N200 billion per month 14.

Three key areas were identified for expenditure reform :15

a) Minimising unnecessary redundancy, reducing leakages through digitisation and eliminating inefficiencies;

b) Revamped process for commencement of 2024 capital expenditure payments of MDAs and GOEs through direct payment to contractors; and

c) Promoting a government-wide cost curtailment culture across all MDAs and GOEs.

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023

In November 2023, the National Assembly approved a supplementary budget of N2.176 trillion to strengthen Nigeria’s security architecture and address the country’s critical infrastructure deficit, amongst others16. The Minister for Budget and Planning noted that 30% of the supplementary budget was for security and defence and 35% was for the provision of critical infrastructure by the Federal Ministries of Works, the FCT, and Housing and Urban Development. The outstanding 35% was committed to the new wage award for treasury-paid federal workers to cushion the effect of the removal of fuel subsidy, in addition to cash transfers to vulnerable persons, and support to the Independent National Electoral Commission (INEC), amongst other considerations17.

Total expenditure in the 2024 budget is N28.78 trillion. Capital expenditure accounts for 35% (N9.995 trillion) followed by non-debt recurrent spending 30% (N8.77 trillion). While statutory transfers at N1.74 trillion constitute 6% of total expenditure, the planned debt service for 2024 is N8.27 trillion (29% of total expenditure). At N5.299 trillion, domestic debt servicing (Ways and Means inclusive) nearly doubles the foreign debt service obligation of N2.75 trillion. The value of sinking funds to retire maturing promissory notes is N223.66 million.

The budget’s stated goals are to achieve job-driven growth, promote macroeconomic stability, improve the business and investment climate, boost human capital development as well as alleviate poverty and enhance access to social security18. The main priority of the government is defence and internal security followed by human capital development with particular attention to children. In addition, the budget sought to address long-standing issues in the education sector such as the development of a more sustainable funding model, and the recently launched students’ loans scheme19.

The combined implementation of the 2023 budget supplementation and the 2024 budget largely reflects the expansionary fiscal policy stance of the Tinubu Administration. This stance is seemingly unaware of the inflationary pressures the country is facing, thereby contradicting the price stability objective of monetary policy.

- Debt Management

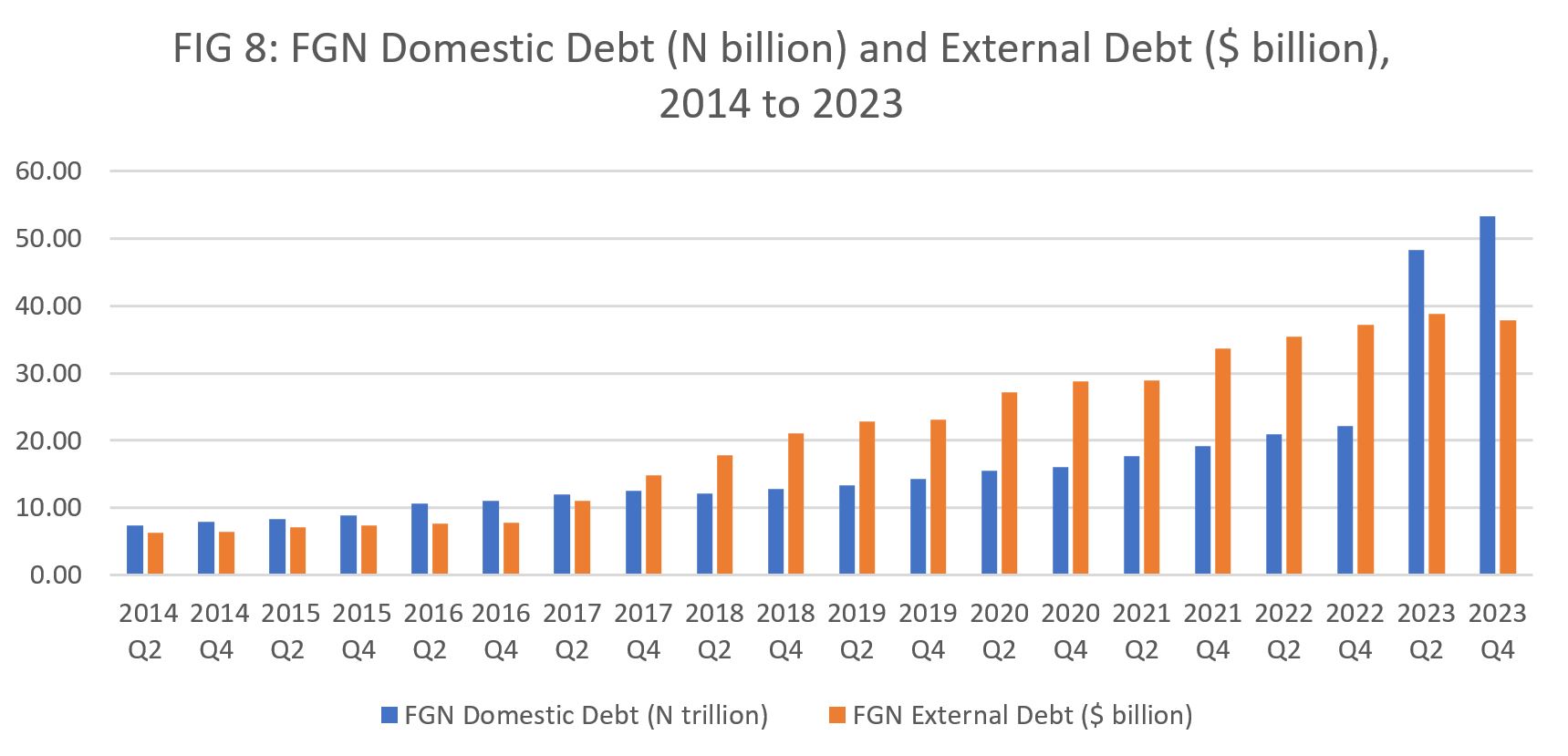

Between January 2014 and September 2023, the FG’s budgets were in surplus for only seven months. As previously discussed, revenue has not been able to keep up with expenditure. This has led to rapid increases in both domestic and external debt, and resulted in high debt service payments. In Q2 2014, FG’s domestic debt was N7.42 trillion and this had increased to N53.26 trillion by Q4 2023 (Figure 8). External debt also experienced similar increases, as it increased from $6.36 billion (Q2 2014) to $37.89 billion (Q4 2023) (Figure 8).

The administration identified two key areas as needing reform:

- High debt servicing cost

- Excessive reliance on Ways and Means financing

Proper management of these two issues is critical to fiscal sustainability. Debt service payments have become the largest component of recurrent expenditure, surpassing all other forms of recurrent expenditure combined for 11 out of 21 months between January 2022 to September 2023. Essentially, this implies that debt service payments are crowding-out other forms of expenditure. This has had particularly adverse effects on capital expenditure. Inability to incur capital expenditure is detrimental to investment and development of critical sectors of the economy, thus, hampering efforts at poverty reduction, human development and economic growth and development.

The huge size of the ways and means advances from the CBN has been well documented. In addition to being a violation of the CBN Act, having a blank cheque from the CBN via unregulated Ways and Means advances is not helpful when fiscal sustainability is the objective. Total CBN Ways and Means increased from N265.7 billion in January 2014 to N26.9 trillion in May 2023, an increase of over 10,000%.

Source: CBN Quarterly Statistical Bulletin Vol 12, No 3, December 2023, Debt Management Office

Assessment of Tinubu’s Fiscal Policy Actions and Impacts

In the past few years, the country has not taken full advantage of high oil prices as oil theft and infrastructure vandalization have remained a major challenge for the oil sector. The Tinubu Administration had promised to address these issues headlong. There have been on-the-spot visits and pronouncements by heads of relevant security and non-security agencies of government. It has been widely reported that the various security agencies continue to secure oil and gas infrastructure in the Niger Delta region, safeguarding all installations in Rivers, Bayelsa, Akwa Ibom, and Delta states, and protecting the country's territorial integrity and national assets20 . The Nigerian Navy launched Operation Delta Sanity to curb crude oil theft, leading to the dismantling of several illegal refineries in the Niger Delta region21 . Alongside improved welfare packages for Naval personnel, the Naval authority deployed ten warships, two attack helicopters, and 500 ballistic boats in a special amphibious exercise to curb crude oil theft and sea robbery in Nigeria's waters 22.

Some of these initiatives may have contributed to modest improvements in crude oil production, which increased from 1.08 million barrels per day in July 2023 to 1.427 million barrels per day in January 2024. However, production dropped to 1.322 million barrels per day and 1.230 million barrels per day in February and March 2024, respectively23 . This is below the OPEC production quota which was reduced to 1.5 million in 2024, down from the prior quota of 1.74 million barrels per day24 .

Despite high oil prices, FG’s efforts towards boosting oil revenue have not yet produced substantial results. Oil production has not increased to the desired levels, and oil revenue has fallen. Gross Federation oil revenue fell from N2.15 trillion in the first half of 2023 to N1.90 trillion in the second half. The bulk of the drop in Federation oil revenue was from taxes (Petroleum Profit Tax, PPT, and gas tax) which fell from N1.23 trillion in the first half of 2023 to N360 billion in the second half. Royalties fell from N870 billion to N780 billion.

As noted earlier, crude oil sales which used to be the dominant source of oil revenue had fallen to zero by the time the administration assumed office. Unfortunately, crude oil sales are still zero, meaning that a large component of oil revenue is still missing. If the Federal Government is to achieve its objectives for oil revenue, crude oil sales have to be revived.

In order to improve oil revenue, FG needs to do more to curb oil theft, encourage investment, and boost oil production. It is also important to note that some other factors, apart from crude oil theft are responsible for dwindling oil revenue. Such factors include lack of investment in the oil sector, crude oil bartered for debt obligations by NNPCL, crude oil assigned to domestic crude allocation, and divestment by oil majors. Comprehensive efforts need to be directed at strongly addressing all these factors before crude oil production, and oil revenue can improve.

The Federal Government established a Presidential Committee on Fiscal Policy and Tax Reforms in August 2023 to address critical challenges related to fiscal governance, revenue transformation, and economic growth. The committee presented a "quick wins" report covering foreign exchange management, multiplicity of taxes, efficiency of collection, quality of spending, and stimulation of local production. While this committee has consulted widely, there is not yet a concrete report or plan of action nine months after its establishment.

Thus, there is as yet, no discernible idea about FG’s direction for non-oil revenue. There is the need for the committee to quickly produce a final report with actionable recommendations. Broad consensus is also needed by all tiers of government to eliminate multiple and duplicated taxes. There is the need for close collaboration and cooperation between the FIRS and State Boards of Internal Revenues to agree on streamlining taxation to make it efficient. Tax revenue can be increased by broadening the tax base without introducing new or increasing taxes.

In addition, there is the need to examine the activities of federal agencies that generate revenue. Many agencies are abandoning their core mandates and focusing on revenue generation, with the attendant reluctance or refusal to remit appropriately to the Consolidated Revenue Fund (CRF).

While the previous administration tried to address this through its circular of 20 December 2021 on remittance of internally generated revenue (IGR) by MDAs25 , low compliance led to the new administration issuing a circular on 28 December 2023. This new circular is for the implementation of the presidential directive on 50% automatic deduction from internally generated revenue of FG-owned enterprises26. Essentially, the circular mandates all fully funded MDAs to remit 100% of their IGRs; while partially-funded and self-funded MDAs are to remit 50% of their IGRs. The Office of the Accountant General of the Federation (OAGF) was mandated to automatically deduct the money, so as to boost revenue, improve discipline, and enhance transparency and accountability. While this is potentially a good policy, with its expected positive effects on blocking leakages and addressing profligacy and exuberant expenditure, there is no data in the public domain yet on the revenue impact of its implementation.

The Federal Inland Revenue Service (FIRS) introduced a time-limited concession window, available until December 31st that allows complete waivers on accumulated penalties and interest related to unpaid tax obligations. This acknowledges the difficulties faced by numerous taxpayers in resolving their unpaid tax obligations27 .

The three major components of non-oil revenue increased between the first and second halves of 2023. Revenue from VAT increased from N1.45 trillion to N1.95 trillion, while receipts by FIRS increased by 131% from N1.18 trillion to N2.72 trillion. Also, revenue collected by the NCS (import, excise and fees, and special levies) increased by 47% from N770 billion to N1.14 trillion.

While a simplistic examination of these aggregate numbers could lead to the conclusion that the Tinubu Administration has been able to improve non-oil revenue in the short time it has been in power, a closer examination would suggest that these increases could be reflecting other factors. For example, the increased revenue by NCS is likely reflecting the pass-through of monetary policy (exchange rate unification) to fiscal outcomes (increased revenue), rather than explicit fiscal policy reforms.

The Customs exchange rate for import duties increased from N589.45/$1 in May 2023 to N770.88/$1 in July, before dropping to N757.023/$1 in September . By December 2023, it had increased to N951.941/$1 and further to N1,630.159/$1 in February 2024, before dropping to N1,303.842/$1 in March 2024. By the end of April, it was N1,373.646/$1 but increased to N1,480.619/$1 as of 27th May 2024. These massive increases in the exchange rates for import duties imply that revenue from NCS will necessarily increase, even in the absence of credible fiscal reform measures28.

However, there are negative aspects of these revenue increases due to exchange rate-fuelled hikes in the Naira value of import duties. First, regular changes of the rates lead to volatility in government revenue, which is detrimental for planning. Second, the regular increases and rapid changes in the exchange rates used for import duties have led to increase and volatility of prices for intermediate and final goods. For intermediate goods, output is constrained as firms seek to cut production costs by lowering the number of workers employed. However, firms might shift this higher production cost burden to consumers through higher final prices. For final goods, higher prices, combined with the removal of petrol subsidies, have contributed to inflationary pressures which has worsened household welfare.

Petrol subsidy removal was the first and consequential fiscal policy decision by President Tinubu. The decision was followed by mixed reactions from various stakeholders with some arguing that the removal should be more gradual while some others argued that the removal of the distortionary and inefficient petrol subsidy was long overdue. Removing the distortionary subsidy was critical due to its deleterious impact on the fiscal position of the government, costing about N400 billion monthly or 2% of GDP29. However, there are indications that the petrol subsidy is back in some guise: to ease the impact of rapidly rising inflation on living conditions, the government capped retail fuel and electricity prices—thus partially reversing the fuel subsidy removal 30.

Of even greater significance, the removal of petrol subsidy has had important implications for prices of goods and services and citizens’ welfare. Higher petrol prices have led to higher transportation costs. For workers, this has meant an increasingly higher proportion of salaries has been spent on wages, leaving very little left for essential expenditure. This situation has been particularly acute for low-income earners.

Higher prices of goods and services has resulted in reduced purchasing power across the board, adversely affecting welfare of consumers and sales of producers and vendors. The combined effect of these has been inflation, with headline inflation reaching 33.69% in April 2024. Food inflation was more acute at 40.53% in April 2024. The government missed the opportunity to quickly cushion the adverse effects of the removal of petrol subsidy. The most critical palliative would have been increasing the minimum wage, but this has not materialised, one year after petrol subsidy was removed. In addition, plans for buying buses for public transportation have taken so long to materialise. These failures have led to untold hardship for citizens, with many struggling Nigerians questioning the rationale for the subsidy removal.

The FG aims to minimise redundancy and leakages through digitisation, revamped payment processes, and promoting cost curtailment across MDAs and GOEs. The implementation of the Stephen Oronsaye report aims to streamline agencies and reduce governance costs, though concerns about its effectiveness persist. On 26th February 2024, the president reportedly ordered the implementation of the Oronsaye Report, with the goal of streamlining government operations and reducing the cost of governance31. However, the announcement focused on merging, subsuming, and scrapping agencies rather than comprehensively implementing the report. Some stakeholders raised concerns, suggesting that the report should be updated to reflect current realities. A federal lawmaker noted that the full implementation may not substantially reduce governance costs as it fails to address the current situation in the public service32. An implementation committee, constituted by the president, was given 12 weeks to submit its report. A recent Agora Policy report provides detailed recommendations for effective implementation33 . In addition to other recommendations, we highlight three critical recommendations of this report: (a) immediate independent staff and asset audits; (b) review of mandates, management arrangements and organisational structures; and (c) sequential rationalisation of staff 34.

The combined implementation of the 2023 budget supplementation and the 2024 budget largely reflects the expansionary fiscal policy stance of the Tinubu Administration. Faced with dwindling revenue and fiscal sustainability risks, expansionary fiscal policy could be understandable if such increased expenditure is for critical development-inducing investment and human development. However, available evidence casts doubt on this.

First, the share of capital expenditure in the 2023 supplementary budget was 51%, which is just marginally higher than the share of recurrent expenditure of 48%. Given the enormous development challenges it inherited, the government was expected to devote more to capital spending to complement and spur the government’s infrastructure initiatives such as the Renewed Hope Infrastructure Fund, ramping up to 6GW of generated and delivered electricity in the second half of 2024, and the large-scale housing development programme.

Second, in light of omissions of important capital expenditure, the inclusion of some expenditure is surprising. For example, some expenditure which do not contribute significantly to human development nor infrastructure were included. These include: renovation of presidential and vice-presidential residences and quarters (N15 billion), procurement of official vehicles for the office of the first lady (N1.5 billion), procurement of SUV vehicles (N2.9 billion), replacement of operational pool vehicles (N2.9 billion), and acquisition of a presidential yacht by the Nigerian Navy (N5.1 billion) 35. Even if the amounts budgeted for these items might not be significant in the grand scheme of things, including them in a supplementary budget sent a wrong message about the administration’s priorities. Prioritising such types of expenditure raises doubts about the seriousness of the government in achieving fiscal sustainability and sincerity with the pain-inducing reforms that the government is implementing.

Third, capital expenditure as a share of total government spending dropped from 26% in the first half of 2023 to 18% in the second half of 2023. Conversely, total recurrent spending as a share of total expenditure rose by 800 basis points from 74% in the first half of 2023 to 82% in the second half of the year. Reducing capital expenditure while increasing recurrent expenditure is hardly a positive indicator of commitment to robust growth and development.

Fourth, the 2024 budget seeks to achieve job-driven growth, promote macroeconomic stability, improve the business and investment climate, boost human capital development, alleviate poverty, and enhance access to social security36 . However, some of the expenditure items cast serious doubts as to how these goals can be achieved. An agency such as FIRS plans to spend the entire N356.95 billion that it expects to receive as collection cost in 2024, while NCS plans to spend N451.55 billion out of its expected revenue of N459.38 billion 37. For context, in 2021, total expenditure by FIRS was N171.22 billion, and the agency will spend N171.29 billion on personnel alone in 2024. These types of expenditure which can be observed for many MDAs, severely casts doubts on the stated objectives of the budget and suggests a lack of serious efforts to achieve poverty reduction and development of critical infrastructure for sustainable development.

Debt service as a share of recurrent expenditure remained high and rose slightly from 53% in the first half of 2023 to 54% in the second half of the year. FG has committed to reducing and eliminating Ways and Means as a deficit financing strategy38. The Governor of the Central Bank was reported to have said “The CBN will no longer give Ways and Means to the Federal Government until the previous loans are repaid39”. Ways and Means had contributed to inflationary pressures and excess liquidity in the system. While FG external debt dropped from US$38.81billion in the first half of 2023 to US$37.89 billion in the second half of the year, the FGN domestic debt stock rose from N36.52 trillion in 2023H1 to N51.73 trillion in 2023H2.

This followed the massive drop in Ways and Means claims on the FG from about N26.95 trillion in May 2023 to N4.36 trillion in June 2023 due to securitisation of about N22.7 trillion advances at the CBN40,41. The securitised Ways and Means financing were added to the official domestic debt figures. This resulted in the net claims on FG through CBN Ways and Means financing falling sharply from N26.95 trillion in the first half of 2023 to N8.22 trillion in the second half of the year. Despite this remarkable progress and commitment towards reducing CBN deficit monetisation, net claims on the FG through Ways and Means are steadily rising again. It increased gradually from N4.45 trillion in July 2023 to N5.13 trillion in August 2023, increasing further to N6.44 trillion and N7.24 trillion in September and October, respectively. By December 2023, it stood at N8.22 trillion, up from N7.59 trillion recorded in November.

Conclusion and Recommendations

FG's current fiscal policy space presents a complex landscape with both challenges and opportunities. Although recent efforts by the administration have aimed to improve the fiscal position, there remain significant areas for improvement. Upon assumption of office, the Tinubu Administration identified broad fiscal policy objectives of increasing revenue mobilisation, improving the quantum and quality of spending, and implementing innovative debt management strategies with less recourse to the CBN's Ways and Means of financing. Largely, these objectives have not yet been achieved.

Expenditure remains weak and inefficient across different MDAs, reflecting a relatively weak prioritisation of development activities with higher multiplier effects and tangible benefits for Nigerians. Government actions have consequences for both the demand and supply sides of the economy. While the former is linked to the welfare of citizens, which is at its lowest in recent times, the latter is connected to the productivity of domestic firms that already struggle with a difficult business environment.

Urgent measures are needed to improve both oil and non-oil revenue. For oil revenue, though there is a popular tendency to link declines in oil production solely to theft, the declining trend in offshore oil production and the absence of any major final investment decision by the international oil companies (IOCs) in Nigeria in over a decade suggests that declining field productivity and lack of re-investment is the key underpin. Despite the presence of still ample reserves onshore, the continuing disengagement by the IOCs has not been met by proactive measures by the various state regulators to stem the tide.

To stimulate oil production, there is need for a direct engagement with the various groups (IOCs, NOCs, domestic independents) with credible assurances provided on the stability and fairness of the prevailing fiscal and regulatory regimes. The government should work with these groups to unlock financial and technical resources towards a target of raising oil production to 2.5mbpd (production values achieved in the early 2010s). A similar effort should be made on gas where Nigeria must deliberately target ramping up on gas export by working with partners to build out more LNG export trains.

Efforts aimed at securing oil-related infrastructure need to be intensified, as oil theft and vandalism are major contributors to revenue volatility. Increased coordination between security agencies is imperative. Beyond securing oil output, efforts should focus on significantly boosting Nigeria’s oil export revenues. The NNPCL should end the practice of pledging crude oil for debt and discontinue the domestic crude allocation.

For non-oil revenue, there is the need for broad consensus amongst different stakeholders on a basis for taxation and fiscal equalisation at subnational level. There is a tendency towards revenue ear-marked taxes at the federal level and multiple taxation at state and local government levels. This requires direct political engagement between the federal government and state governors to harmonize tax basis, tax rates and tax collection.

Furthermore, federal, state and local tax boards need to agree to eliminate multiple and duplicated taxes and agree on streamlined and efficient taxation. On the other hand, federal agencies need to agree on the best and most efficient agency for revenue collection, while focusing on other core mandates. The recent efforts towards broadening the tax net and improving revenue collection should be complemented with proactive measures to improve compliance.

FG should continue to prioritise fiscal discipline and efficiency. Rationalising expenditures, particularly in recurrent and directing resources toward critical sectors such as infrastructure, education, and healthcare is imperative. Beyond the quest to increase spending, the quality of spending needs to improve which will require a framework for improving the efficacy of expenditure on some social sectors like tertiary education, healthcare and housing.

In addition, the government needs to find a way to attract development finance and private finance into infrastructure delivery by a more efficient use of guarantees and commitments. Climate change has provided a new vista for governments to access financing for certain types of climate resilient infrastructure in power, transportation, agriculture and housing. Nigeria needs to deliberately look to tap these sources to fund infrastructure delivery on concessional terms. In addition, government must look to implement robust monitoring and evaluation mechanisms to ensure that public funds are utilised effectively and transparently. This will be essential for fostering accountability and trust.

Debt management requires careful attention to prevent a debt crisis. While borrowing can be a useful tool for financing development projects, it must be done judiciously. The government should focus on improving debt sustainability by diversifying funding sources, negotiating favourable terms, and investing in projects with high economic returns. Strengthening institutional capacity for debt management and adhering to prudent borrowing limits would be crucial for safeguarding the country's long-term fiscal stability.

There is also an urgent need to ensure utmost clarity on and proper alignment of the goals of fiscal, monetary and trade policies. The fiscal authorities cannot be pursing expansionary policies while the monetary authorities are walking the contractionary path. For a country battling with a high debt burden, expanding budget deficit, and strangulating inflation, the different actors in the economic policy arena should be singing from the same hymn sheet of inflation control and fiscal consolidation.

In conclusion, we submit that sustained fiscal discipline is crucial to ensure that the potential gains from fiscal reforms are maximised for the benefit of citizens. This would require improved transparency and accountability in public financial management to foster investor confidence and attract much-needed foreign investments. In addition, there is need for sustained and strategic investments in social welfare programmes, infrastructure, and human capital development which will make growth more inclusive and close socioeconomic disparities. The different policy arms need to work in concert, not at cross-purposes. Finally, reducing the cost of governance needs to be treated with desired seriousness and urgency to build more confidence in the Federal Government and its fiscal institutions. This is particularly crucial because trust as a social capital is now near zero in Nigeria.

* Professor Fowowe and Dr. Shuaibu are senior fellows at Agora Policy.

1. Abubakar Atiku Bagudu (2023) Public Consultation on the Draft 2024 - 2026 Medium Term Expenditure Framework & Fiscal Strategy Paper [MTEF & FSP], Budget Office of the Federation, Federal Ministry of Budget and Economic Planning

2. Ibid.

3. Ibid.

4. National Economy Sub-Committee (2023) Policy Advisory Council Report

5. Abubakar Atiku Bagudu (2023) Public Consultation on the Draft 2024 - 2026 Medium Term Expenditure Framework & Fiscal Strategy Paper [MTEF & FSP], Budget Office of the Federation, Federal Ministry of Budget and Economic Planning

6. In recent times, these shortfalls have been reversed due to exchange rate gain, as the falling value of the naira to the dollar has increased naira payments

7. NEITI (2023): The Way Forward in the Reform of Nigeria Oil, Gas & Mining Sector

8. Excludes data for October 2020, January 2021 and February 2021 due to unavailability

9. Total Pipeline repairs and management cost = Security and Maintenance cost + Pipeline and other Facilities Repairs cost + Marine Distribution + Pipeline Management cost + Strategic Holding cost

10. Wale Edun (2024) Reconstructing the economy for growth, investment, and climate resilience development. Paper delivered by the Honorable Minister of Finance and Coordinating Minister of the Economy at the Lagos Business School Breakfast Club.

11. National Economy Sub-Committee (2023) Policy Advisory Council Report

12. Wale Edun (2024) Reconstructing the economy for growth, investment, and climate resilience development. Paper delivered by the Honorable Minister of Finance and Coordinating Minister of the Economy at the Lagos Business School Breakfast Club.

13. Wale Edun (2024) Reconstructing the economy for growth, investment, and climate resilience development. Paper delivered by the Honorable Minister of Finance and Coordinating Minister of the Economy at the Lagos Business School Breakfast Club.

14. Excludes data for October 2020, January 2021 and February 2021 due to unavailability of data

15. Ibid.

16. https://statehouse.gov.ng/news/president-tinubu-signs-n2-1-trillion-supplementary-2023-budget/#:~:text=1%20Trillion%20Supplementary%202023%s,-November%208%2C%202023&text=President%20Bola%20Tinubu%20signed%20the,infrastructure%20deficit%2C%20amongst%20other%20considerations

17. Ibid.

18. https://www.budgetoffice.gov.ng/index.php/2024-budget-speech/2024-budget-speech/viewdocument/956

19. https://statehouse.gov.ng/news/in-detail-the-student-loan-access-to-higher-education-act-2024/#:~:text=President%20Bola%20Tinubu%2C%20on%20Wednesday,all%20Nigerian%20students%20and%20youths.

20. https://www.nddc.gov.ng/newsdetails.aspx?nid=1350

21. https://nannews.ng/2024/02/24/akpabio-hails-navys-stride-in-combating-crude-oil-theft/

22. https://www.vanguardngr.com/2024/03/assessing-nigerian-navys-impactful-war-against-oil-theft/

23. https://www.nuprc.gov.ng/oil-production-status-report/

24. https://www.reuters.com/markets/commodities/nigeria-lifts-production-targets-ahead-opec-meeting-2023-11-23/

25. https://oagf.gov.ng/wp-content/uploads/2023/03/12.-Re-Revenue-Expenditure-IGR-Remittances-to-CRF.pdf

26. https://oagf.gov.ng/updates/re-implementation-of-presidential-directives-on-50-automatic-deduction-from-internally-generated-revenue-of-federal-government-owned-enterprises-fgoes/

27. https://www.agusto.com/publications/driving-nigerias-fiscal-future-the-imperative-of-tax-reform/

28. https://trade.gov.ng/en/exchange/customs-exchange-rate

29. Wale Edun (2024) Reconstructing the economy for growth, investment, and climate resilience development. Paper delivered by the Honorable Minister of Finance and Coordinating Minister of the Economy at the Lagos Business School Breakfast Club.

30. https://www.imf.org/en/News/Articles/2024/02/09/pr2443-nigeria-imf-exec-board-concludes-pfa

31. https://agorapolicy.org/practical-steps-for-effective-implementation-of-the-oronsaye-report/

32. https://www.thecable.ng/update-oronsaye-report-before-implementation-reps-tell-tinubu/

33. https://agorapolicy.org/practical-steps-for-effective-implementation-of-the-oronsaye-report/

34. Ibid.

35. https://budgit.org/wp-content/uploads/2023/11/2023-Supplimentary-Budget.pdf

36. https://www.budgetoffice.gov.ng/index.php/2024-budget-speech/2024-budget-speech/viewdocument/956

37. https://www.thisdaylive.com/index.php/2024/01/07/still-on-the-funding-of-our-super-agencies/

38. https://www.vanguardngr.com/2024/04/tinubus-govt-has-not-borrowed-from-cbn-edun/

39. https://punchng.com/cbnll-no-longer-give-ways-and-means-to-fg-cardoso/

40. https://www.dmo.gov.ng/news-and-events/dmo-in-the-news/securitization-of-the-n22-7-trillion-naira-ways-and-means-advances-at-the-central-bank-of-nigeria-2

41. Debt securitization is expected to improve debt transparency as the ways and means advances would now be included in the public debt statistics. In addition, savings from the relatively lower interest rate (9% per annum) would help reduce the deficit and new borrowing requirements (ibid.)