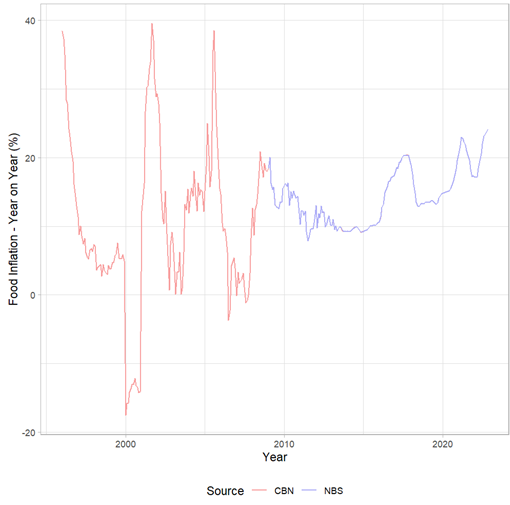

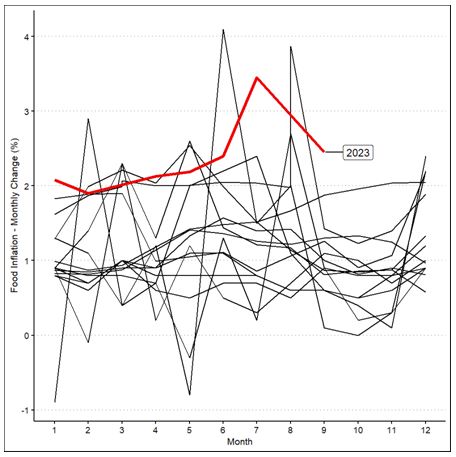

By Adebayo Ahmed | There is hunger in the land and you don’t need to go too far to see it. On almost every lip in the country today is a statement on how food prices are rising so fast that it is becoming increasingly difficult to survive. The data backs up this claim. According to the National Bureau of Statistics (NBS), food inflation, at 30.64% in September 2023, is higher than is has ever been since the NBS started reporting more formally on it in 2009. According data from the Central Bank of Nigeria (CBN), food inflation was never persistently so high in the last few decades as it is currently. This situation has worsened in 2023 where monthly changes have never been so consistently high, at least since 2009. As is clear in Figure 2, this trend was present even before the removal of fuel subsidies which added to the pressure.

Fig 1: Food inflation chart. Source: National Bureau of Statistics. Central Bank of Nigeria.

The consequences for Nigerians and Nigeria are dire. Substantial segments of the population are struggling to feed themselves and their families, a situation which poses a threat to social and political stability in the country and worsens the country’s food insecurity profile. Though official figures are hard to come by, food insecurity has been on a steady increase in Nigeria for most of the last decade.

Fig 2: Monthly Change in Food Prices since 2009. Source: National Bureau of Statistics.

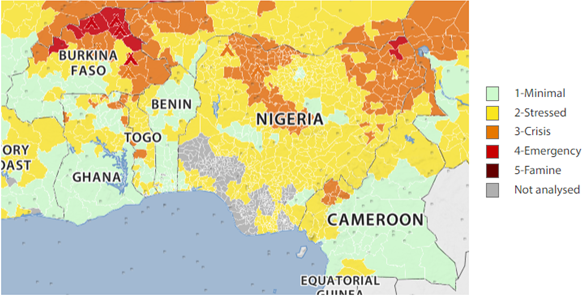

According to a recent publication by the IMF, more than 40% of Nigerians as at 2019 could be described as food insecure based on the average income and the amount of money required to consume the recommended number of calories1. This was before the COVID-19 pandemic and the following years of high food inflation. The Food and Agriculture Organization (FAO) estimates that 69.7% of the people in Nigeria were moderately or severely food insecure as at 20192. The Cadre Harmonisie, a unified and consensual tool that measures acute food and nutrition insecurity in the Sahel and West African region, estimated that at least 25 million people in 27 states of Nigeria were at risk of facing hunger in 2023. The other nine states were not analysed so the overall number is likely higher.

Whichever way you slice it, there is hunger in Nigeria. It appears to be getting worse, and people are struggling to cope. Layering consistent spike in food prices with lingering and widespread food insecurity does not bode well for Nigeria. This combination should keep policy and development experts and officials awake at night, as there is something smoldering beneath the surface that could, with a mere spark, compound Nigeria’s unflattering development challenges.

Fig 3 Graph of index of nominal GDP per capita versus food inflation. Source: National Bureau of Statistics.

Importantly, this struggle is not just for people employed in agriculture. According to the 2023 Cadre Harmonise, the state with the largest number of people at risk of food insecurity is actually Lagos, where very few people are engaged in agriculture. Yes, there are apparently more people at risk of food insecurity in 2023 in Lagos that in Borno or Katsina or any of the agriculture-heavy states plagued by violence which disrupts food production and distribution. The reality is that food prices have likely been rising faster than incomes, squeezing households in the process. Although data on this is few and far between, a comparison of average growth in nominal per capita GDP and food inflation, as shown in Figure 3, makes this very clear. This does not mean that even those engaged in agriculture are also not feeling the pressure. As is clear in Figure 4, the hunger is spread almost across the entire country. Ironically, our neighbours, especially those who are not mired in some conflict are mostly fine, even if they are not significantly richer than Nigeria.

Figure 4: Food insecurity across West Africa. Source: Cadre Harmonisie.

Drivers of Food Inflation

What has caused this consistent spike in food inflation? We can think of this from a standard supply and demand framework. Things that disrupt supply tend to push prices up while factors that boost demand also tend to push prices up, and vice versa. Importantly, these factors in principle need to be “new” factors for them to matter, especially on the supply side. For example, if we have always had logistical challenges that hinder food distribution resulting in a mark-up on food prices then that does not really impact food inflation because it has always been there. However, if it gets better or worse, then it impacts food inflation for the better or worse.

The same can be said for our low levels of productivity, which are recognized as low even compared to our peers. For example, maize yields in Nigeria, at about 21,000 grams per hectare are lower than Ghana’s and even the African average, half as much as South Africa’s and Brazil’s and only a tenth of the United States’3. Low yields are bad especially for those employed in agriculture whose low yields imply they remain in poverty. But Nigeria has always had low yields and previously did not have such high food inflation.

What then, on the domestic supply-side could have worsened significantly enough to really impact food inflation? The escalation in violence, especially in key agriculture-intensive states in the North West and North Central is likely one culprit. The floods in 2022 which occurred during the peak harvest season also likely resulted in harvest losses and affected food supply. The COVID-19 pandemic and the disruptions to the fertilizer market as well as the markets for other inputs also likely negatively impacted food supply, at least for 2023.

However, in many countries the direct impacts of domestic supply shocks on food prices are actually pretty limited. This is because domestic shocks are mostly localised and don’t affect all food production everywhere. A drought might reduce production of maize in Zimbabwe but as long as the drought is not global, maize will be produced somewhere else and be traded in other places. International supply is vulnerable to shocks of course, such as is the case with the Russia and Ukraine crisis. Regardless, in the presence of international trade, the ability for domestic shocks to severely impact food prices should be limited.

Fig 5: Food inflation in select African countries. Source: Food and Agriculture Organisation – FAOStat.

In the last few years, global food prices have increased due to a variety of factors. That increase has however not been enough to explain most of Nigeria’s food inflation. As is clear in Figure 5, except those who are involved in some conflict, and whose livelihoods would be directly affected, food inflation is significantly lower in other African countries, and there is little food insecurity even in the face of similar global food shocks.

Indeed, it is more likely that Nigeria’s increasing restrictions to international food trade have contributed more to domestic food inflation. The anti-trade policies such as the border closure and the banning of foreign exchange for some food products have restricted international supply of food and put upward pressure on food prices. The exchange rate problem has probably also contributed to food inflation although it is likely not the major driver. A look at food inflation in Figure 1 shows two distinct patterns. The long-term trend which keeps inching upwards, and the more temporary bumps which can be attributed to the episodes of foreign exchange crises. The bumps are important of course but they are usually temporary. The longer-term upward should be of more concern.

The Role of Demand Pressures

What explains the more longer-term trend? On the other side of the price equation is demand. As basic economics suggests, prices can go up because of supply or demand. On the demand side we have a population that is growing by about 2.6% a year on average. This means actual food supply has to be growing by at least 2.6% in real terms just to keep up with population growth. In the presence of international food trade this will likely not be a challenge. But given that we have moved to limit food trade, then it becomes important. Unfortunately, in the past half a decade agriculture growth has slowed. In the 2nd quarter of 2023 agriculture GDP had slowed to 1.5% in real terms. It was negative in the first quarter. This means the agricultural sector wasn’t even growing fast enough to meet the demand pressures from a larger population.

Fig 6 Select Food price inflation with Maize, Rice, and Yams highlighted. Source: National Bureau of Statistics

But perhaps a larger source of demand has been the growth in money supply. More money chasing fewer goods, including food, typically means higher inflation. Money supply has been growing at over 20% a year in the past few years4. This has likely contributed to the growth of inflation. In general, if you observe an increase in prices of a few goods then you can typically pin it down to supply side shocks. However, if you observe an increase in the price of all goods then it is likely a demand problem. As is clear from Figure 6, all food prices have been on the increase, including those produced locally and imported and those eaten by a few and those eating by many. In such a situation, the likely driver is too much demand driven by money supply that is growing too fast.

The Path Forward for Reducing Food Inflation

Given the likely causes of high food inflation identified above, the path to reducing it is clear. Simply, it involves tackling the challenges on both the demand and supply sides. Some things will be easier to implement and will result in quicker impacts while others will be more long term.

On the quick demand side, the obvious policy measure is to slow the growth of money supply. Regardless of what happens to the supply side, if money supply growth continues to be too fast then inflation, and food inflation, will continue trending upwards as well. If people’s incomes cannot keep up, then that additional means more affordability problems and even worse food insecurity.

On the quick supply side, the obvious policy measure is to ease the restrictions on international food supply. The borders may now be open and the restrictions on foreign exchange access for food and fertilizer may have been removed but there are still other significant restrictions, chief of which is the relatively high tariffs on food imports. The argument may be that reducing tariffs on food will negatively affect local producers of the food items. But there is a case to be made for the consumers as well. Consumer surplus matters and in principle more people eat food than grow food hence the consumer should matter at least as much as the producers. The best practice is not necessarily to have high tariffs on food but to re-channel some of the revenue from the lower tariffs to directly support food producers.

The more longer-term supply-side actions will include fixing some of the more structural issues that affect food supply: resolving the violence and issues in rural areas; resolving logistical challenges in food transportation; improving the productivity of farmers; building resilience to climate change; and so on. These are prescriptions that will be beneficial for food prices and food security in the long-term.

Right now though, quick wins are needed to halt the consistent price spikes that put food out of the reach of many citizens and potentially put the country at larger risks.

Footnotes

[1] Food Insecurity in Nigeria: Food Supply Matters. Thomas and Turk. IMF Selected Issues Paper No. 2023/018

[2] Food and Agriculture Organization - FAOStat

[3] Food and Agriculture Organization - FAOStat

[4] According to data from the Central Bank of Nigeria.

PHOTO CREDIT: Mansur Ibrahim