By Wale Thompson | In a surprise move on 14 June 2023, the Central Bank of Nigeria (CBN) announced the removal of all restrictions on foreign exchange rates and signalled a willingness to tolerate greater flexibility in exchange rate determination as against the previous practice of a hard peg. In simple terms, the CBN ‘floated’ the Naira. This announcement was accompanied by directives which unified the multiple FX tiers invented by Mr. Godwin Emefiele, the suspended CBN governor, and specified the re-introduction of a “willing buyer, willing seller” arrangement for Nigerian foreign exchange markets.

This policy shift was consistent with the expressed desire of President Bola Tinubu for a unified exchange rate in his inauguration address of 29th May 2023, as well as the yearnings of private businesses, analysts and financial market investors, who had been frustrated at the arcane rules and lack of liquidity associated with the previous era. In its aftermath, the Naira has lost around 40% of its value within the official window to close at NGN770/$ on the first day of trading, a development that has elicited a mix of cautious optimism and pessimism. While praises have poured in from international financial organisations, business elites and financial market investors and western countries, the fledging reform has also attracted an avalanche of knocks from segments of the media, labour unions and a growing number of citizens struggling with continued depreciation of the Naira and its adverse inflationary effects.

After the initial optimism surrounding the unification of the Naira, with the disappearance of the gap between the official and parallel market exchange rates, sentiments have turned pessimistic as trading activity in the Investors & Exporters (IE) window has remained stagnant, and parallel market premiums have widened to 20% with the value gap at N170/$. Alongside a steady decline in gross external reserves to $33.9 billion, concerns have heightened about the outlook for the currency and its knock-on effect on domestic prices and citizen welfare. Granted that FX unification was not an end to itself, but rather a means towards restoring improved forex liquidity flows and restoring capital flows, the initial signs have not inspired confidence that a resolution to the lingering FX crisis is at hand.

Given the speed within which the Naira floatation was executed without any concrete arrangements on bolstering dollar supply, focus has shifted to this unresolved item given thin dollar liquidity within the official segment (daily trading has averaged $106 million versus $110 million prior to unification) amid signs of fresh weakness at the parallel market. Without direct attempts to stem the tide, the temptation to return to the old ways of managing things might look attractive which might blow away the current opportunity.

What further steps are required to stabilise the emerging situation over the near term and what concrete policy adjustments should follow for Nigeria to have a more sustainable approach to exchange rate management? In what follows, we briefly review the Naira float policy, provide some historical context to exchange rate regimes—highlighting the expected benefits and potential pitfalls of fixed and floating systems—and provide some recommendations on how Nigerian policymakers should look to approach FX management in the near and medium term.

Naira Floatation: Shock Therapy in the Face of Fundamental Deterioration

For the fifth time in Nigeria’s post-independence history (after similar moves 1986, 1995, 1999-2000, 2017), Nigeria’s policymakers have elected to abandon a hard nominal exchange rate peg (with the most recent one set at N461/$) in the face of depleting external reserves. Interestingly, the CBN announcement on the seismic shift in policy did not provide any justification for the decision nor an admission that the old peg arrangement had failed.

This would suggest it was not an innate desire or willingness to change but rather a loss of ability amid growing political pressure following the suspension of the CBN governor. Indeed, only as recent as May 2023, the CBN organised a conference where many participants (including the present top brass at the apex bank) ‘celebrated’ one of the many confusing policies (RT200) of the old FX regime which has now been scrapped. Thus, it is more likely that a shift in political leadership catalysed an opportunity for the CBN insiders to save face by quickly returning to fundamentals as the basis for FX rate management.

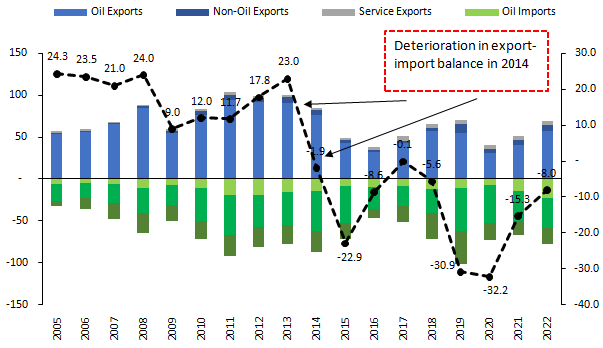

A look at the fundamental data reveals the existence of large imbalances in Nigeria’s external accounts occasioned by a mix of structural shifts and policy missteps by the CBN as the bane of the present FX woes. Between 2005-2013, Nigeria enjoyed a ‘structural surplus’ in the export and imports of goods and services (see Figure 1) primarily on account of higher oil export revenues due to stronger oil prices as oil production remained roughly static around2-2.2mbpd. This surplus exceeded $20 billion annually in the early part of the period (2004-2008) which allowed substantial external reserve accretion (peak $62 billion in September 2008) before moderating to $10-15 billion in 2010-2013 period.

Figure 1: Nigeria’s export import balance 2005-2022 (USD’billion)

Source: CBN

By design, the CBN has a fiat ownership of export petrodollars (a flaw at the heart of Nigeria’s FX architecture which we shall see later), which allows the apex bank to situate itself at the heart of FX management during boom times with the ability to determine to a large extent the price (exchange rate that most people get dollars) and quantities (USD allocation or who can get dollars). The latter being a derivative of the former as the readily available ‘stronger’ CBN rate ensured that its price set the tone for other FX segments. As a result, the official USD market was large enough relative to the non-official USD market so much so that the CBN began supplying dollars to retail end-users via Bureau-De-Change operators.

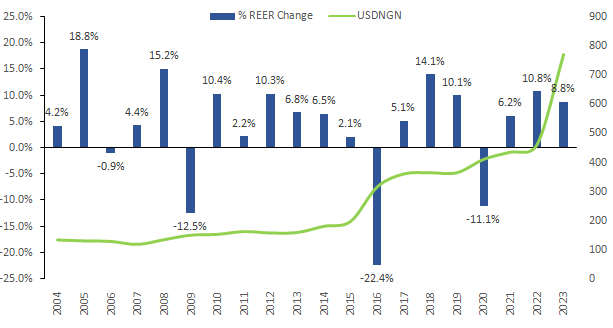

The large crude oil flows resulted in the adoption of a ‘defacto’ policy of exchange rate stability as the basis for monetary policy even though several CBN governors would publicly declare inflation targeting as the ‘dejure’ basis for monetary policy1. This commitment to nominal exchange rate stability also underpinned real exchange rate appreciation over the period. For context, while the nominal exchange rate weakened 16% (-1.8% per annum) over the 2005-2013 period, the Naira appreciated 55% (+6% per annum) in real terms which as we shall see had profound implications for non-oil exports and service imports.

Figure 2: Nominal USDNGN and annual change in the real effective exchange rate

Source: CBN, Bruegel *May 2023

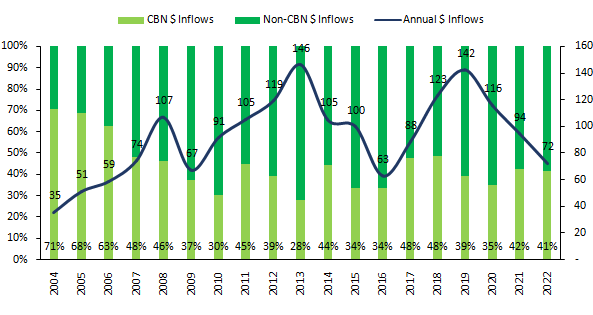

But first we turn our attention to dollar supply trends within the Nigerian economy. As noted earlier, at the height of the oil boom in the mid-2000s, the scale of the oil inflows and Nigeria’s shallow and less integrated financial markets (Nigeria had no bond market until 2007) implied that the CBN dominated the FX market accounting for between 60-70% of the total market. However, this dominance in terms of USD inflows declined to under the 50% in 2007 when CBN flows totalled $36 billion relative to non-CBN inflows of $38 billion implying that there was more USD coming into the Nigerian economy via autonomous sources than through the CBN channel.

This gap would widen in the coming years and at one point was more than double CBN inflows in 2010 ($63 billion vs $27 billion) before peaking at over $103 billion in 2013 (when CBN flows came to $41 billion). Essentially, the CBN dominance of the official market was an illusion helped by the commitment to exchange rate stability via a combination of tight Naira interest rates and relaxed FX controls. This allowed the CBN maintain the illusion of control that it determined prices within the official segments and could control the market.

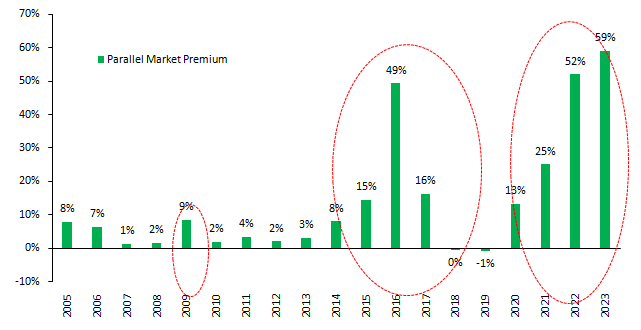

However, in 2009, despite fairly robust firepower with record reserves, the onset of the global financial crisis and the Nigerian banking crisis triggered a crisis of confidence in the Naira. This manifested in the form of widened spreads between the official and parallel market exchange rate which averaged 18% between March 2009 and June 2009 despite heavy CBN intervention so much that the apex bank briefly suspended the interbank FX market and eventually surrendered by devaluing the official peg to the level obtainable in the parallel market.

Though most literature have linked this divergence to the 2008-09 global financial crisis, in hindsight this was the first show of force by autonomous flows that CBN control of Naira determination was tenuous. It is within this context that we should interpret latter episodes of wider parallel market premiums (2014-17) and (2020-2023). In essence, given their size, autonomous flows would only equilibrate on CBN’s perception of Naira pricing when it was perceived to be ‘fair’ and not on CBN’s dictated terms.

Figure 3: USD Inflows to the Nigerian Economy

Source: CBN

Figure 4: Parallel Market Premiums

Source: CBN, Author’s Calculation *H1 2023

Nevertheless, CBN’s illusion of control allowed it to remain in charge of the official segment by offering a stronger exchange rate than the weaker rate available within the non-official segment, alongside the threat of sanctions, the CBN was able to finance over 60% of USD import demand between 2005-2013. Thus, to a large extent the CBN could dictate the FX rate that mattered for importers of goods and services and could supply liquidity within this segment.

However, the tectonic plates were shifting in Nigeria’s external accounts, a function of an artificially strong exchange rate. In particular, the share of non-tradables or services within the import basket had expanded greatly as Nigeria increasingly integrated into the global economy. Services share of imports rose to 30-40% levels from 20% driven by increased Nigerian consumption of foreign transportation (given the absence of a Nigerian flag carrier on international routes), education, health and financial assets.

The other big shift in dollar demand composition was in oil imports which rose from 10-15% in 2005 to 20-22% of total imports at end of 2022. In all, non-tradable service imports and oil imports, by-products of real exchange rate appreciation and an unrealistic fuel price subsidy regime would become the fatal flaws in Nigeria’s FX market architecture that would provide to be its Achilles heel.

But rather than directly address the unrealistic petrol subsidy regime or look to curb the growth in non-tradable service imports, Nigerian policymakers chose to periodically embark on import suppression on good imports which disproportionately target the poor. While the CBN would routinely institute FX bans on good imports, it would strive to provide FX for Nigerians looking to school abroad.

The More Things Change, the More They Stay the Same…

Following the collapse of oil prices from an average of $100/barrel to under $50/barrel in the 2014-2017 era exacerbated by a drop in oil production in 2016, the fundamental situation changed. As in 2009, when the CBN held the line on the FX rate and suspended the interbank, the policy response was broadly similar in 2015: the apex bank froze the FX rate at N200/$, ended the Dutch auction system of weekly auctions and terminated the trading in the currency alongside liquidity restrictions within the official market.

As in 2009, the non-CBN flow market would respond by refusing to unite with the CBN dictated rate leading to an expansion in the gap between the official and parallel market exchange rates. Unlike the 2009 episode, the CBN however no longer had the fundamental picture of excess USD liquidity. But the CBN refused to recognise or accept the change in reality. In another replay of 2009, the apex bank resorted to tolerating excess Naira liquidity while imposing multiple restrictions, creating several FX layers and fighting an imaginary war on currency speculation.

It is important to highlight that the CBN actions was consistent with the expressed desires of former President Muhammadu Buhari even though the apex bank knew the truth of the underlying reality: that within the grand picture of FX flows, it no longer had the ability to underwrite a level of Naira exchange rate, especially after it had lost the faith of autonomous flows. While the CBN still held the line of regulating official transactions, this was an empty title: Naira’s rate determination would now take place away from official windows.

The difficult 2015-17 episode did have one major implication: unlike in the past when a desire for a stronger exchange rate overran the desire for USD liquidity, long taken for granted, the CBN response forced Nigerian corporates and citizens to realise that USD liquidity was of prime importance with pricing less so. Thus, began a game of chicken wherein the parallel market rate assumed prime importance while the CBN owned the title of master of no nation with its totemic official window.

It is against this backdrop that we should understand the present policy response: the adjustment to reality enforced by another cycle of deficits in the current account which authorities could not finance via reserve drawdowns or foreign portfolio inflows. The former is largely because the petrol subsidies financed via refined petrol for crude oil swaps curtailed inflows to external reserves while the latter is brought about by the pursuit of negative real interest rates and restrictions on FX access.

The second point bears some examination. As led by its now suspended governor, the CBN embarked on an experiment with unorthodox monetary policy which included large monetisation of fiscal deficits by ways and means, financial repression brought about by negative real rates, the imposition of a hard peg on the Naira exchange rate and direct balance sheet lending by the CBN to the real sector.

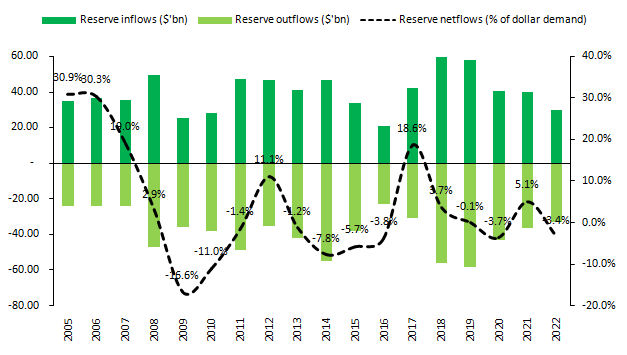

These unorthodox arrangements were initially sustained by a brief period of high oil prices in the external sector following Russia’s invasion of Ukraine, which helped mask weak oil production and the burdensome costs associated with a petrol subsidy regime. However, over the second half of 2022, the deterioration in oil production and out-of-control subsidy bill financed via crude-for-refined petrol swaps shrank inflows into the CBN’s reserves. As in Figure 5, declines in these flows tend to correspond with periods when Nigerian policymakers adjust their currency pegs to reality.

Figure 5: Reserve Inflows and Dollar Demand

Source: CBN, Author’s computation

A Brief History of Exchange Rate Systems

Flexible exchange rate regimes and their variants are now considered ideal for most economies, but this has not always been the case. Historically, the gold standard was the dominant exchange rate system, wherein currencies were equivalent to pre-defined weights of gold. This regime was in force till the end of World War II in 1945. Thereafter, countries shifted to pegging their currency values against the US Dollar as the dominant power while only the US Dollar maintained a fixed convertibility to gold.

However, as economies recovered from World War II and global trade expanded, along with significant growth in cross-border financial flows, pressure mounted on the US Dollar, leading the US Government to abandon the gold-USD convertibility in 1971. The inherent problem with fixed arrangements is that it required that countries with trade surpluses needed to strengthen their currencies, while those with trade deficits needed to weaken theirs, in order to achieve a balance in global trade which, in itself, is essentially a zero-sum game of winners and losers.

However, the pegged arrangement hindered this balance and countries with trade surpluses were reluctant to tolerate stronger currencies due to the effect on their export competitiveness. A similar explanation worked for losers in the global trade game as countries with trade deficits, often import-dependent economies were unwilling to tolerate widespread depreciation due to welfare implications. Thrown into the dynamic was the rise of financial assets which allowed investors to speculate on interest rates and currency adjustments, further intensifying pressure on the US Dollar and prompting the need for changes.

Numerous attempts to reform fixed exchange rate systems worldwide proved unsuccessful, prompting most countries to transition to some form of floating exchange rate system during the late 1980s and 1990s. With the collapse of the Soviet Union in the 1990s, more economies with pegged exchange rate regimes in the global south had to face this reality and experienced disorderly transitions from fixed to flexible exchange rate regimes. The dominance of the US Dollar in global trade between non-US countries, owing to its large liquidity and the non-convertibility of other major currencies, played a central role in this shift.

After the 1990s, countries adopted either fully flexible exchange rate regimes or some variant of flexibility, such as managed float. In the latter scenario, the level of central bank commitment to a peg determines the degree of flexibility in the exchange rate regime. The harder the commitment, the less flexible the regime, while a softer commitment results in a more flexible regime.

In Nigeria, from 1960 to 1985, the exchange rate was fixed at a 1-1 peg against the US Dollar in nominal terms, similar to much of the global economy. However, in real terms, the Naira became overvalued relative to the dollar following the collapse of oil prices in the early 1980s. Nigeria's over-reliance on a single commodity proved to be a major vulnerability for the wider economy during subsequent foreign exchange crises. Unfortunately, resistance from political and economic leaders to face reality created the perfect conditions for spectacular collapses once the ability (external reserves) to pretend about the exchange rate dissipated.

Flexible exchange rate regimes are preferable to fixed peg arrangements for several reasons. Firstly, flexible exchange rates provide an automatic framework for adjusting to external shocks and changes in economic conditions such as fluctuations in commodity prices or global economic downturns. A flexible system allows for countries to adjust their currencies in a manner that enables limited disruptions to trade and capital flows.

Secondly, flexible exchange rates grant more autonomy to monetary policy, enabling central banks to respond effectively to domestic economic challenges. In contrast, fixed peg arrangements can greatly constrain a country's ability to implement independent monetary policies, potentially exacerbating inflation as seen in Nigeria over the last eight years. Additionally, flexible exchange rates can foster competitiveness in export industries and prevent the build-up of unsustainable imbalances on the import side, supporting economic diversification and reducing reliance on a single commodity.

However, there are several variants of flexible exchange rate arrangements and there is no off-the-shelf variant for emerging markets like Nigeria. Rather, each country develops a commitment to ensuring that its exchange rate trends broadly mirror developments in the external accounts. To avoid the political golf ball that comes with currency adjustments wherein opposition politicians and others deploy exchange rate trends as part of political campaigns, there is need for transparency and clear communication around central bank’s actions and FX markets in general and commitment to a credible basis, usually inflation-targeting, for monetary policy.

Getting Nigeria’s Forex Reform on Track

Following several failed attempts at transitioning to a flexible exchange, Nigeria has embraced another attempt which needs to be situated within the context of wider discussions about macroeconomic strategy with the appropriate time frames. Mere FX adjustments to adapt to reality may lead to short-lived gains, followed by a return to previous practices. To avoid this cycle, forex and monetary policies should be part of a comprehensive economic plan where the exchange rate serves as a tool for export diversification and for attracting capital flows to foster overall development. Successful fixed to floating transitions are characterized by certain key features. Outlined below, these features should be taken on board by Nigeria’s policy makers in the medium to long terms:

- A clear role for exchange rates within the context of broader economic strategy: The exchange rate is a key input variable within the context of an economy: as it serves as a measure of relative prices between a country and its trading partners. The long-stated objective of Nigeria’s policymakers is to diversify its export base which given Nigeria’s labour abundance distils to ensuring that industrial activity is geared towards the production of exportable goods that use a lot of low-skilled labour that is abundant in Nigeria. To ensure export competitiveness of these non-oil exports, exchange rates policies must look to deliver an extra layer of competitiveness to export prices in a form that favours domestic industries. To this end, the goal of policymakers on FX is not nominal exchange rate stability but real exchange rate stability with an undervaluation bias. To this end, Nigeria’s FX policy must look to ensure a balance between real exchange rate stability that ensures non-oil export competitiveness and keeps inflation at a level supportive of domestic welfare. Nigeria’s economic managers must explicitly seek to achieve this balance and must demonstrate annually how their policy measures or adjustments deliver on these goals. The best example here is Singapore, where the central bank is required to publish annually how it goes about delivering balancing FX policy within the twin objectives of trade competitiveness and low inflation. Nigerian authorities must change the CBN Act with explicit references for the CBN to demonstrate how via its policy actions it ensures real exchange rate competitiveness and stable prices via reports published bi-annually.

- A deep and liquid FX markets: By definition, a laissez-faire market is one with many buyers and many sellers such that no one party is large enough to influence the actions of others. In creating a workable FX market architecture, Nigerian policymakers must envision a distinct set of supply forces i.e. multiple FX sources which can be attained by removing all forced sale rights on oil exports presently held by the CBN. Rather, the CBN should purchase its USD like every market participant to manage Naira liquidity at a level consistent with its own money supply objectives. Essentially, a credible FX reform will end the forced petro-dollar to Naira conversions financed via the printing of new money. The goal is to create an FX market with diverse players especially on the supply side: CBN, oil exporters, non-oil exporters, remittances, foreign portfolio investors etc.

- Consistent focus on price stability: In lieu of nominal exchange rate targeting, Nigeria’s central bank must have an explicit inflation targeting framework with clear annual and inter-mediate inflation target that are publicly known and must annually demonstrate how its policies achieve this objective. The CBN can have several inflation measures (consumer price index, producer price index, wage inflation etc) to prevent undue reliance on one metric and importantly it should demonstrate how its adjustment of policy instruments (interest rates and money supply) are enabling it move inflation within targets. Nigeria’s fiscal and legislative arms should be on hand to deploy censure to CBN governors unable to deliver within target inflation. To avoid the egregious abuses over the last five years, Nigeria should look to divorce CBN control over development finance banks and capitalise these entities to fund underserved sectors of the credit market.

- Curtailing information asymmetry through increased transparency and clear communication: To help proper FX pricing, Nigeria’s central bank must work to deliver increased information about demand and supply trends and end the dark ages on critical data on trends across FX markets. As in some markets like Singapore, the CBN legislation must include requirements for publication of period data and analysis of trends in FX markets to the public. This requirement must impose penalties for non-compliance. Under the suspended CBN governor, the CBN commenced data censorship with the withdrawal of more in-depth data which created no transparency on FX markets.

- Institutional mechanisms for hedging volatility: Beyond developing deep and liquid spot markets, concerted efforts must be on including avenues for hedging without any arcane restrictions that look to curb speculation. The CBN should work with exporters and financial institutions to develop the means for importers to hedge against FX volatility risk to prevent demand front-loading. Nigeria should work actively to ensure that the large USD flows (including remittance flows) equilibrate within the official segments.

- A clear framework for FX interventions: Market failure is a feature of still forming markets and Nigerian policymakers must be clear-eyed to have a system for dealing with periods when markets become volatile. Thus, there must be a clear operational framework for dealing with periods of external shocks which should include providing temporary US liquidity, interest rate adjustments, communication and FX adjustments.

Beyond these broad medium to long term objectives, policymakers must not ignore the near term. To stabilise the present spiral, Nigeria needs a big stash of dollars and fast! Policymakers must look to strike the iron while it is hot to avoid reform fatigue by seeking out sources of large USD liquidity on concessional terms by exploring the option of a standby arrangement from multilateral agencies of significant scale ($5-10billion) with the objective of acquiring credibility.

Having front-loaded fiscal consolidation and external sector adjustments, Nigeria has the credibility to embark on key partnerships to catalyse increased capital flows. While this is politically tricky, desperate times call for bold and desperate measures. The global geopolitical environment means Nigeria has a window to obtain this funding if it is ready to push the envelope. These dollar flows are necessary to give the market ‘time to breathe’ as left unsolved, the Naira could come under fresh speculative pressures which might drive a return in policymakers towards the very pegged arrangement they recently jettisoned.

The CBN must look to be flexible in thinking: there are several variants of flexible FX regimes and we should be pragmatic to not rule out any options. The goal is to ensure that FX adjustments reflect the trends in balance of payments in a credible manner over the near and medium term.

Footnote

[1] In its 2021 Article IV, the IMF noted that Nigeria’s monetary policy was inflation blind (see IMF Article IV 2021)

Photo Credit: Mansur Ibrahim/TheCable