Policy Memo

- Details

- Policy Memo

By Bolaji Abdullahi | Nigeria’s return to democratic rule in 1999 coincided with the end of the first decade of a global commitment to the goal of Education for All (EFA) and the adoption of the Millennium Development Goals (MDGs), focused on achieving universal basic education, especially in the developing countries, as one of its core objectives.

However, while many countries still struggle to achieve the goal of universal education, a strong consensus has emerged over the years that although basic education is important, no country has achieved growth on the back of mass literacy alone.

The compelling argument for greater investment in university education, relative to other levels of education, flows from the strong evidence that better graduates have greater positive impacts on economic growth as well as the realisation that the 21st Century global knowledge economy requires more than literacy.1 The transformation of our public university system, where 94% of the undergraduates within Nigeria are enrolled, should therefore be integral to our vision of economic growth and competitiveness.

The promise of national development must reflect in our commitment to transforming the public university system to make it more efficient and able to meet the skills, knowledge and research needs of our country now and in the future. In seeking to realign our public university system with our national development objectives, we must ask four critical questions:

- What are our development goals over the next 15 years?2

- What human resources would we need to achieve these goals?

- How many of our citizens of university-going age would we require to have degree-level qualifications in the identified areas of need within the same period?

- What research priorities do we need to pursue and promote in order to meet these goals?

Attempts to answer these questions will highlight major problems in our current attitude to public university education which in turn has conditioned how we structure, operate and fund the system. The endemic corruption, inefficiency, ineffectiveness, inequity and lack of accountability that characterise the system merely thrive on a fundamental failure that cannot be addressed by interventions that merely target any of the symptoms in isolation. What we require is a system-wide reform that addresses the three critical elements of governance, funding, and quality assurance based on a rethinking of the entire public university education itself as a driver of national development objectives.

-

Rethinking the Governance of Public Universities

The central issue in governance is that of efficiency and service delivery. What kind of governance regime is best suited for the kind of services that the public universities are expected to provide? At the heart of this question in Nigeria is the issue of autonomy: the degree to which each university has the freedom to operate independent of the government authorities that set them up and fund them.

In Nigeria, universities are governed by the National Universities Commission (NUC), whose establishment Act of 1974 gives it controlling power over the university education system, including what departments or academic units they run and what they teach; what funding they receive and how; what personnel they hire and the conditions of service attached to such personnel; what their research needs are; and “carry[ing] out such other activities as are conducive to the discharge of its functions under this Act3.” Many university administrators and lecturers regard the NUC as a major impediment to innovation and creativity in the universities.

Global trends also suggest that less government is better for universities and that universities function best when they are self-governing. Lant Pritchett, a professor at Harvard University, used the spider and the starfish to illustrate two kinds of systems. The spider system is that in which all organs and parts of the body are centrally controlled, while the starfish allows for a level of control but grants freedom to each of the limbs to operate with significant autonomy. A pure spider system, Pritchett says, pulls responsibility for all functions to itself, especially through financing; whereas a starfish system creates local operation which,

“Pulls apart all of the many functions and activities and allocate those across the system such that the local component of the system provides a constant stream of innovation and new ideas and can use the local nature of the operation of the system for thick accountability…while the national level provides a framework for standards and monitoring and evaluation performance4”.

The starfish approach will fit squarely within a system of embedded autonomy which allows the university the flexibility to explore and establish local and international relationships and partnerships while government involvement is scaled back to quality assurance and monitoring compliance with national regulations. Another major advantage of the starfish system is that by granting autonomy to the local components, it also ensures that a problem with one of the components does not cripple the entire system.

By granting autonomy to each of the universities to negotiate contract terms with its staff based on its unique capabilities and local conditions, the government would have addressed the problem posed by the principle of collective bargaining which has turned the Academic Staff Union of Universities (ASUU) into a disruptive force over the years. Of the eight identified issues that have formed the basis for ASUU’s perennial strikes, five are directly related to issues of conditions of service and remunerations5.

Granting autonomy to the universities along this line will not necessarily save the government money, but it will achieve three things. One, it will bring stability to the university system; two, it will ensure that the lecturers are competitively and equitably remunerated; and three, it will enable the government to focus on her quality assurance functions as an objective arbiter.

The argument for more equitable remuneration of lecturers is central to attracting and retaining the right calibre of lecturers and professors. The current system that pays lecturers in different contexts and with different quality of outputs the same salary just because they are on the same “salary scale” is wrongheaded and suboptimal. However, this can only be corrected if each university is at liberty to negotiate salaries and other benefits with its lecturers.

University lecturers should be employees of their universities not those of the Federal Government or the state go vernments. Essentially, what we require is a system that fosters high-level competition for resources and even for students. Under the current governance system, the universities lack the incentive to do anything differently. Neither the funding they get nor the students that come to them depends on the quality of what they offer to students either in terms of learning or living experience or the quality of their research outputs.

Autonomy will create the condition for each university to develop at its own pace, based on real accomplishments in research, in teaching and in their contributions to national development goals. It is interesting to note that “university autonomy and academic freedom” has been one of ASUU’s key demands. Their desire is to free the universities from what they consider as the stranglehold of the NUC. The obvious implication of this, however, is that the NUC must undergo its own reform to enable it repurpose itself for its coordinating and monitoring role in a new governance system.

2. Changing How Public Universities are Funded

In respect of funding, two factors need to be considered. Effectiveness: are they being adequately funded? Efficiency: are the funds being spent on factors that are directly relevant to delivering the best results, especially in the core task of teaching, learning and research? The current funding system does not meet either of the criteria. The chief source of funding for public universities in Nigeria is the government, whose intervention however accounts for only about 44% to 60% of what is required to run a university effectively6. This means that at any given time, the funding deficit is between 40% to 56%.

Table 1: Allocations to Federal Universities in the 2023 Budget

Source: Budget Office of the Federation

Table 2: 2023 Allocations to Federal Universities: Percentage of allocation to personnel and overheads

Source: Budget Office of the Federation

Table 2 indicates that between 86% and 96% of the federal allocations of these four universities goes to personnel cost alone. This leaves a range of 0.7% to 1.4% and 2.2% to 7.2% for overhead and capital respectively. What this means in essence is that our federal universities are existing mainly to pay salaries, with hardly much left for the other operational costs and for provision and maintenance of infrastructure for teaching, learning and research. Funding effectively and efficiently would require a major paradigm shift in how we view public university education generally and how we fund it.

If we take the budgetary allocations to the universities as standing in lieu of tuition, this should be regarded as subsidy. However, as Table 2 has shown, what the government has done over the years is to subsidise personnel cost of the universities, rather than the students who should enjoy the subsidy.

A major step-change that is required here is to target the subsidy payments around students’ enrolments rather than the administration of the university. What this does is to place the students at the center of the university planning, with all other expenditures, including personnel, overheads and physical development, now revolving around the students and their needs. This also ensures an objective parameter for allocation of funding, one that is focused on output rather than the current input-based approach. Running a university costs a lot of money.

Costs are incurred almost on a daily basis. One Vice Chancellor reported spending about N40million monthly on diesel alone to keep the generators running, this is in addition to the cost of the main electricity supply. The university therefore spend up to N100million on power supply alone in a given month. Infrastructure and vehicles maintenance, fueling of vehicles, re-agents and other consumables for the laboratories, sporting activities, all these are covered under the overhead costs, which are released to the universities on a month-by-month basis.

However, interaction with several university heads reveals that while the budget for personnel is released 100%, they hardly get more than 50%of overheads allocation in a given year7. However, even if all the overhead allocation is released, it is hard to imagine how it could meet the monthly cost of running the university. For example, the University of Nigeria Nsukka (UNN) with an overhead allocation of about N203 million in its 2023 budget has a population of 36,000 students. To start with, it means that UNN has an allocation of N16.9 million per month for overhead. But more interestingly, it means that, minus personnel cost, the university has only N5,638available in a year as running cost for per student.

Even if this amount is added to the fees charged by the university in a year, the total available per students will be about N67,000 or $145. This applies to all federal universities in Nigeria. The Fallacy of Tuition-Free Education The two organised ‘vital constituencies’ for government in producing education are the students and the lecturers. The two constituencies appear to want the same thing: university education that is accessible to all who can meet the entry requirement, that is of high quality and that is free of charge.

Although this is more like a pie in the sky, government has continued to give the impression that it is possible to achieve. This has resulted in a lose-lose situation for everyone involved. Government’s best funding efforts continue to run short, the vital constituencies are permanently disgruntled, and the system continues its steady decline because government has been funding the administration of the institutions rather than education itself.

Table 3: Fees charged by some public universities in Nigeria8

In contrast, Table 4 shows the fees charged by some private universities in the current year.

Table 4: 2023 First Year fees for some private universities in Nigeria9

It is possible to argue that private universities run on a business model and will not operate at a loss. Nevertheless, the fees they charge may provide useful insights for determining what might be a realistic cost of providing university education in Nigeria. It is interesting to note that American University of Nigeria in Yola actually calculates its fees per credit units offered by the student10.

Even if we account for profitability, it is difficult to understand how University of Ibadan can reasonably charge a maximum fee of N36,800 in a session for a course that AUN, Yola charges more than twice the same amount to teach a single credit. Best practice is to fund university based on the needs of students. Money must be made to follow the students.

We need to determine what is required to deliver university education to each student, do a realistic costing and pay the universities accordingly or arrive at a cost-sharing arrangement, with government bearing most of the costs. It is understandable why government may want to persist on the outmoded policy of zero tuition, but no one is helped by it, not least the students who are mostly being rolled through the university with no prospect of real employment because they have not had the opportunity to acquire real skills.

Government needs to allow introduction of cost-reflective tuition or should pay the university full equivalent of what they would ordinarily charge as tuition or provide alternatives that guarantee realistic funding for the universities. Like Kosack argued “in the absence of a well-functioning private education market, where most consumers are unable to afford education without subsidy, there are only two options: government continues to pay subsidy or lower the fee to make it available to everyone11.”Kosack’s assumption is that there are fees to lower.

But what happens where there are no fees at all, and government cannot pay enough? In the current fiscal climate, it is unlikely that government can afford to give the universities all the money they need to function effectively. Government therefore needs to invite parents to shoulder more of the financial responsibility. If it is clearly defined as a means of improving quality, which will enhance the employability of the students upon graduation, it would not be a totally strange proposition.

Afterall, as parents lose confidence in the public primary and secondary schools, they voted for fee-paying private schools. It is indeed curious that parents who were able to pay fees running into hundreds of thousands for private basic education would expect to pay next to nothing for university education. Below are some options that can be explored to improve the pool of funding for our public universities and ensure that students from poor homes are not denied access to university education.

- Guaranteed Loan through the Education Bank

The issue of a federally-backed Education Bank has been in the works for about three decades. Now is the time to give it real traction in the context of the funding reform. It is a great opportunity that the National Assembly as well as some civil society actors have backed the idea over the years12. Once again, the only voice of dissent is ASUU, whose president declared in 2022 that “ASUU will never support the issue of Education Bank because the poor will not benefit from it.”13

It is not clear from this statement whether ASUU is opposed to the idea of students’ loan because it thinks the scheme would constitute a debt burden to the students or because the union fears that the loans might not be awarded to intended beneficiaries. Whatever the case, concerns should be addressed and the idea of an Education Bank must be framed as part of the efforts to improve quality of education generally (including to ensure that the public universities are well funded and the lecturers can be well paid) and as a means to support indigent but talented students who need university education for career progression.

Affordable loans, with repayment tied to salaries earned upon graduation will ensure that children from poor homes are not excluded from university education because their parents are too poor to pay. One major reason the idea of a students’ loan scheme may not be attractive, especially to a government seeking to shift costs, is that the risk of people defaulting is high. Education is a bad collateral.

A bank can recover a house from a defaulting customer, but education cannot be recovered from a customer who fails to pay for the obvious reason that she is not able to get a job after graduation or because she has simply relocated to another country, leaving no contact address. There is thus the risk that government might still end up paying for defaulters, except adequate risk-mitigating strategies are put in place. In the context of a full subsidy, the alternative is for the government to give out scholarship vouchers to students which would stand as guaranteed promissory notes that the universities could redeem with the government.

If the government is able to redeem the vouchers in full and on time, it would have ensured that the universities get paid the agreed amount for each student. But this is unlikely to happen. It is important to emphasise that the conversation around an Education Bank is in the context of the need to introduce tuition payment in the university, which has become inevitable as the only realistic and sustainable pathway to effective funding of the universities.

Even in the face of high risk of default, there are other benefits to the system in the idea of a student incurring a debt to fund her education. It turns the parents and the students into active financial stakeholders and gives them a skin in the game. Perhaps, the most important effect is that it is likely to engender a new attitude towards learning and even teaching.

As the indebted students begin to demand value for money, horizontal accountability will be strengthened and quality is likely to improve generally. As quality of graduates improve, employability is likely to improve and same with earning capacity. In addition to all these, government may also use the instrumentality of the loan to push students towards some courses that are relevant to the nation’s manpower requirement by giving priority to students who go in for those courses.

- Strengthening Scholarship Schemes

Scholarship awards, whether need-based or merit-based, represent another opportunity for talented students to pay for university education. It is interesting to note that while the Federal Government and some state governments award scholarships every year, they are mostly for candidates to study abroad. Under the Bilateral Education Agreement, the Federal Ministry of Education awards scholarships to Nigerian students to study in countries such as Russia, Morocco, Hungary, Egypt, Cuba, Macedonia and Japan. Sending students to study abroad has also become a pet policy of some state governments in recent years. Government agencies like the Petroleum Trust Development Fund (PTDF) also award annual study-abroad scholarships, up to $30,000 for a student. A 2022 report says PTDF has awarded 9,659 such scholarships since 200214.

It is possible to argue that governments and government agencies prefer to award foreign scholarships because Nigerian universities do not charge fees. The rise in the number of fee-paying private universities in recent years would however put a question mark on that argument. Most scholarships available to study in public universities in Nigeria are awarded by private companies in the country. These limited scholarships are mostly for the upkeep of the students. Introducing tuition payment is likely to direct some of these scholarships into Nigerian universities and help students to pay.

- Expanding Funding through Endowments & Alumni Donations

Endowment is another great opportunity for universities to expand their pool of funds. Just as government alone cannot provide all the money that universities need to be truly competitive in a global sense, tuition payment would also not be the silver bullet. The universities must constantly seek means to expand their funding based. This is why the modern university administrator is more of a fund raiser than anything else. But the current system does not encourage the goal-getting attitude that is required to attract the right support outside government.

Some of our public universities have endowments already, but they are too paltry for the scale of the challenge. Alumni represent a great source of endowments to universities. Each university needs to bring their alumni closer and give them real incentives to contribute to the funding of their alma maters.

Many universities have alumni who have gone on to become successful businessmen and women, and even state governors and ministers. Many are even setting up their own universities. The universities need to be more deliberate in tapping into this opportunity.

- Instituting Work-Study Programmes

Looking at the unemployment statistics, it would be tempting to dismiss this as an option. But work-study provides additional option for indigent students. And they don’t have to seek employment outside the universities. Some reports indicate that many of the universities have up to four times the number of their academic staff as non-academic staff, mostly doing the work that students can do and get paid for.

The employment office can keep a register of students who need such jobs and give them priority as vacancies are available. Also, some of the students can serve as research and teaching assistants to lecturers or serve as library assistants. As done in many countries abroad, the number of hours that students can work per week should be limited so that work will not interfere with their study.

- Develop a New Framework for TETFUND’s Allocations

The Tertiary Education Trust Fund was established in 1993 to manage the 2% education tax payable by companies registered in Nigeria and to disburse same to tertiary institutions in the country for the purpose of providing or maintaining physical infrastructure for teaching and learning, for instructional material and equipment, research and publications as well as academic staff training and development15.

Although the TETFUND was intended to provide intervention funds to support the universities in the areas listed above, it has more or less become the only source of funding available to the universities to carry out those activities. Apart from the grants uniformly awarded to universities annually, some universities may still get additional grants depending on the vice-chancellor’s political connections or capacity to lobby.

There is no evidence that allocations from TETFUND follow any objective parameters other than the Fund’s own discretion or proposals submitted by the universities themselves based on their respective needs. Moreover, giving the same amount to all universities regardless of their performance in the core business of teaching and research does not encourage productivity or accountability. Therefore, a new National Framework for Tertiary Education Funding needs to be developed that will set objective parameters for allocation of funds.

This new framework should ensure that institutions are funded based on verified outputs in teaching, research and community service. While the details of this funding framework will still need to be worked out, the main objective is to ensure that funding is made based on output, rather than input requirements. Because the parameters for allocation of funds under the new framework will also be objective and pre-defined, it would bring about greater equity and transparency, while providing real incentives for each institution to respond to the national development needs in manpower development, research, and community service.

A framework that funds the entire higher education system as a single system will also improve accountability and limit the chance for duplication. Perhaps more importantly, because institutions would be required under the new framework to show evidence of change in governance, operations and productivity, funding will then serve as an important lever in driving the desired reform. The idea of financial autonomy to the universities would also be better served because once a university is able to win the grant under the new framework, it would also be at liberty to decide how to spend it to better position itself for even more grants in the future.

- Re-prioritising Quality Assurance

Conversations about improving the quality of university education or education generally usually focus strongly on the issue of funding. As has been noted however, a university is like a factory. If the factory is not producing the goods, simply throwing in more money or recruiting more staff will not change its fortune. To proceed with the same analogy, a factory that is designed to produce sheets of paper cannot be used to produce roofing sheets without undergoing a major redesign.

Generally, people go to university to increase their earning power and for social mobility. But like Kosack noted, the investment value of education is a function of three conditions: the education’s quality; scarcity; and the level of the country’s economic development.”16. Nigeria has doubled admission spaces in the last two decades or so, yet a significant majority of those who apply for university admission each year are unable to get in. Rapid expansion of private universities in recent years has not helped much, as most students are unable afford the fees they charge. While there are 79 private universities in the country, they account for only 6% of the undergraduate students enrolled in Nigerian universities.

Of the remaining undergraduates, 29%are in the 48 state universities while the remaining 65% percent are in 43 federal universities. Available reports indicate that only one in four applicants (or 25% of applicants)is able to secure admission. This has pressured the government to continue to expand access by granting licenses to private universities and setting up new ones of her own.

In 2011 alone, the government set up nine new federal universities. It is axiomatic that wherever enrolment expands too quickly, the first casualty is quality. Expanding access without paying corresponding attention to factors that actually determine quality of teaching and learning will ultimately devalue education. It is no surprise therefore that one of ASUU’s demands is that government should stop the proliferation of universities. Related to the issue of quality is also the issue of relevance both in terms of curriculum content and in terms of course preferred by students relative to the needs of the employment market and the nation’s manpower needs.

The Association of African Universities has identified weakness in curricula and how they are delivered as major factors in explaining the declining quality of graduates in Africa: “The orientation of curricula needs to shift away from producing theoretical elites and administrators to produce doers and entrepreneurs who are transformational wherever they find themselves.

Due to poor remuneration and poor facilities, African HEIs are not competitive in attracting and retaining top instructors.”17 In addition to this is the question of what the students are applying to study and how these courses will help their prospect of getting a job or contributing in areas that the country needs their expertise. In 2019, while 1,874 graduated in Medicine and 923 in Computer Engineering, 10,261 graduated in Accounting, and 6,239 in Political Science in the same year.

Other reports also show that Education and Agriculture are the only two courses for which universities are not receiving enough applications, yet these are areas of critical manpower needs for the country.18 The issue of curriculum is also related to that of governance. Over-centralisation of the university system has created a sense of uniformity that has robbed every university the chance to develop a unique character of its own. Almost every university offers the same menu of courses without regards to the needs of its local environment or its own capabilities.

As stated earlier, higher education system in Nigeria must be situated within a national human resource development strategy, which in turn must derive from a broader national development plan. Therefore, transforming the public universities in Nigeria will not be a job for the minister or the Ministry of Education alone. The Ministry of National Planning, the Ministry of Labour and Productivity and the Organised Private Sector (OPS) must work closely together. But the process has to be led by the President of the country or someone who has his convening authority to drive the process.

The 2023 webometrics ranking of African universities includes less than 10 Nigerian universities in the top 100. While these rankings may be taken as fair indicators of our universities’ standing within the parameters being measured either in a global or regional context, they are not sufficient in measuring our higher education institutions’ responsiveness to the national development needs. We need a new system of evaluation and quality assurance that is semi-autonomous and has a strong private sector orientation.

It is important for the private sector to play a leading role in quality assurance because they are the major off takers of what the universities produce as students or as research. Acting Director of the Innovation and Technology Management Office of the University of Lagos, Abiodun Gbenga-Ilorin, recently stated that 13,282 research papers were published in Nigeria in 2020, which ranks the country 50th in the world in the number of research papers published that year. However, of all these, only 300, about 2.2 percent has led to successful innovations. Working closely with the industries will ensure that research focus becomes more demand- and solution-driven, plus the added benefit of attracting good funding19.

Summary of Recommendations

- Federal Government needs to step back. Less government is best for universities. Government should grant full autonomy to its public universities, and allow each university to develop its own identity and grow at its own pace.

- National Universities Commission Act (1974) should be amended to release its stranglehold of NUC on the universities and assign it a coordinating and monitoring role rather than a directive or prescriptive role.

- In keeping with the principle of autonomy, government should cede its role as employers of university lecturers to each university. This will empower the universities to negotiate terms and conditions of service with their respective employees in line with their local reality and the value expected of each lecturer.

- A realistic annual cost for each student should be determined and the universities should be funded by government based on the number of students rather than personnel or administrative needs of the university.

- Universities should be allowed to charge tuition fees within the parameters set by government, but the Education Bank needs to be established to offer federal government-backed loans to students who may require them.

- Government and institutional scholarship awards are another opportunity for talented but indigent students to pay tuition. Most government scholarships now are targeted at students studying abroad. This should be reversed.

- Work-study also presents another option for indigent students. Most of the work currently being done by non-academic staff and even contract staff in the universities can be done by students.

- Endowment funds are a major way for universities to expand their pool of funds. Currently, the universities are not tapping into it as much as they should do. They need to bring their alumni closer and give them incentives to contribute to their university endowment programmes and to establish scholarship schemes and give back in other ways.

- A new framework for tertiary education funding needs to be developed that will set objective parameters for allocation of funds from the TETFUND based on verified outputs in teaching, research and community service.

- A semi-autonomous National Higher Education Quality Assurance Agency (NHEQAA) needs to be established to monitor the quality of teaching and research in the universities, and evaluate them in terms of their responsiveness to the nation’s manpower requirement and economic development plan.

*Abudullahi, an education enthusiast, was Commissioner for Education in Kwara State and Minister for Youth Development and Sports.

Footnotes

[1]IBRD/WB. (2003), Directions in Development - Lifelong Learning in the Global Knowledge Economy: Challenges for Developing Countries, World Bank, Washington DC; and Kosack S. (2020). The Education of Nations: How Political Organisation of the Poor, Not Democracy, Led Governments to Invest in Mass Education; Oxford University Press, New York.

[2] In projecting for 15 years, I adopt the cycle for the United Nations Millenium/Sustainable Development Goals.

[3] National Universities Commission Act, 1974.

[4] Pritchett L., (2013). The Rebirth of Education; Centre for Global Development, Washington DC.

[5]https://businessday.ng/news/article/explainer-asuus-demands-and-what-government-has-met/

[6]This is according to a 2013 paper delivered by Prof. Rahmon Bello, former Vice-Chancellor, University of Lagos.

[7] Some reported going months without receiving any overhead allocation.

[8] These are sundry fees charged at the discretion of each university. Tuition remains free of charge.

[9]The table captures the minimum payable. Fees normally varies, with significant upper bound in the same university, depending on the courses.

[10]The N2,220,000 is arrived at by charging N74,000 per credit for a 30-credit academic session.

[11] Kosack S.(2012), Ibid.

[12] https://guardian.ng/features/stakeholders-canvass-implementation-of-education-bank-act/

[13] https://dailytrust.com/asuu-opposes-students-loan-bill/

[14] See Punch Newspaper, April 18,2022. [15]https://tetfund.gov.ng/index.php/mandate-objectives/

[16] Kosack S. (2012). Ibid. Pg 25.

[17] Strategic Plan 2020-2025 (Accra, 2020). Pg. 18.

[18]https://punchng.com/367499-applied-for-43717-medicine-slots-jamb-report/

[19] TETFUND allocation to each university for research in 2023 is only N40 million or $86,000.

- Details

- Policy Memo

By Fola Aina | The Nigerian state is currently confronted with multiple security threats, most of which emanate from, and are perpetuated by violent non-state actors (VNSAs). In the troubled Northeast region, the predominant threats include the activities of violent extremist organisations such as the Boko Haram driven by a political ideology of establishing an Islamic Caliphate, and its first breakaway faction Ansaru, as well as its second breakaway faction, the Islamic State in West Africa Province (ISWAP). The most affected states include Adamawa, Borno, and Yobe states, popularly referred to as ‘BAY’ states. As of 2021, Boko Haram has been responsible for the deaths of 350,000 people,1 and the internal displacement of 2.5million people as of January 2023.2

In the country’s Northwest and Northcentral regions, the activities of armed bandits have devasted local communities. Armed bandits numbering over 30,000 were responsible for the deaths of over 2,600 people3, and the displacement of about 1million others.4 Driven by economic opportunism rather than political ideology, the activities of armed bandits have been mostly manifested through brigandage, theft, kidnappings for ransom, cattle rustling, and sexual violence mostly perpetuated against women and girls. Armed banditry which remains a very significant threat to Nigeria’s national security has its roots in the country’s persistent farmer-herder crisis.

In the Southeast region, secessionist agitations by the Independent People of Biafra (IPOB) and its paramilitary wing, the Eastern Security Network (ESN), have disrupted peace and continues to threaten the freedoms of citizens through the imposition of sit-at-home orders. Added to these are also issues of piracy and terrorism that have plagued the Niger Delta, thereby resulting in the region’s insecurity. In the Southwest region, the activities of cultists, kidnappers and other organised criminal gangs continue to threaten the peace and security of the region as well. These threats have since evolved overtime and adapted making the quest to addressing them even more challenging. This is particularly pertinent as their existence reflects an afront on the state’s monopoly of the use of force.

The degree of severity across these multiple threats varies, given that they have the potential to continually derail social, political, and economic development across the Nigerian state. Collectively, these threats pose significant challenges to human security in Nigeria. These

challenges are mostly manifested in the effects of these threats to human lives and livelihoods. Furthermore, they constitute a grave threat not only to Nigeria’s national security, but also to those of its immediate neighbours such as Cameroun, Chad, and Niger in the Lake Chad Basin region as well as the Sahel region.

Nigeria’s current security architecture is ill-positioned to address these threats. From issues associated with the lack of adequate equipment to those of manpower shortages and non-professionalism, the challenges confronting the security sector abound. This has also contributed towards the proliferation of private security companies (PSCs) in complementing the security provisioning across the country.

Tackling growing insecurity efficiently and effectively will demand reviewing and changing how the security sector is governed in Nigeria. This is in addition to recalibrating the state’s coercive apparatus and repurposing its preparedness and responsiveness to these threats. The Nigerian state has mostly responded to threats to its national security in a reactionary way, rather than proactively.

Repositioning National Security Through Improved Governance

Currently, Nigeria’s national security architecture can be broadly categorised under two sub-headings. These include internal security and external security. Under internal security the state’s institutions mostly saddled with the responsibility of protecting the state from internal threats include the Office of the National Security Adviser (ONSA), the Nigerian Police Force (NPF), the Nigerian Police Intelligence Response Team (IRT), the Department of State Security (DSS), the Federal Ministry of Interior, the Nigerian Customs Service, the Nigerian Immigration Service, the Nigerian Correctional Services, the Nigerian Drug and Law Enforcement Agency (NDLEA), the Defence Intelligence Agency (DIA), the Economic and Financial Crimes Commission (EFCC), and the Independent Corrupt Practices and Other Related Offences Commission (ICPC), and the Nigerian Counter-Terrorism Centre (NCTC), and the Nigerian Financial Intelligence Unit (NFIU), to mention a few. Others at regional levels include Amotekun in the Southwest region, and Ebube Agu in the Southeast region, in addition to local vigilante groups.

With respect to external security, it is pertinent to note that the Office of the National Security Advisor (ONSA) also plays a fundamental role in this regard. Others also include the Nigerian Customs Service and the Nigerian Immigration Service, the Nigerian Intelligence Agency (NIA), the Nigerian Counter-Terrorism Centre (NCTC), the Nigerian Armed Forces (The Nigerian Army, the Nigerian Navy, and the Nigerian Air Force), the Directorate of Military Intelligence, Army Intelligence, Naval Intelligence, Air Force Intelligence, the Defence Intelligence Agency (DIA), and the Regional Intelligence Fusion Unit (RIFU) amongst others. It is equally significant to note that the military is fundamentally the state’s coercive apparatus deployed with the goal of averting external aggression against the Nigerian state, given the NPF’s incapacity to address the country’s multiple threats, the military has since assumed an active role in internal security management as well. As of November 2018, Nigeria has had only 334,000 police officers.5 In addition to being overstretched, as of 2019, Nigeria’s total military forces stood at 223,000 personnel.6

The threats to Nigeria’s national security can be broadly categorised into five dimensions. These include the political dimensions, given that some of these threats are triggered by political issues such as actual or perceived political marginalisation. There is also the socio-economic dimension, which stems from issues such as poverty, inequality, unemployment, and illiteracy amongst others. There is also the environmental dimension which bothers on issues such as climate change resulting in desertification and deforestation, water supply shortages, resulting in conflicts over increasingly scarce natural resources. The fourth dimension is the ethno-religious dimension which reflects tensions resulting in communal clashes. Another very significant dimension is the cyber security related dimension. This dimension is mostly manifested through propaganda, the spread of misinformation, and hacking through malware.

Nigeria’s response to national security threats appears to be overly militaristic. The issue with this is that it has the unintended effect of neglecting “human security” which is required in gaining the support of those affected. This is critical to the exchange of influence between the state and society in the pursuit of mutually-linked security goals and objectives. A viable option towards repositioning Nigeria’s national security architecture would be the adoption of an integrated approach towards national security, one which has “human security” at the centre of it all. This implies a prioritisation of the wellbeing of humans, as members of society, to whom the state is obligated to protect by provisions of the constitution and in accordance with the social contract. The components of this integrated approach to national security entails economic security, social security, food security, housing security, health security, and cultural security. To effectively address national security threats, these components are expected to considered not in isolation, but collectively as a whole.

Recommendations:

To better position Nigeria’s national security architecture to respond more efficiently and effectively to the multiple threats confronting the country, the following are some recommendations:

- The need for a review of the National Security Strategy (NSS) every five years. Nigeria’s approach to national security is essentially derived from the NSS. Given the nature of the new and emerging threats to the country’s territorial integrity, which has resulted in irregular warfare within its shores, the NSS should reviewed every five years to ascertain what works and what does not.

- Establishment of the Office of the Director of National Intelligence (ODNI), not as a separate government agency, but under the Presidency. This is to be patterned after a similar institution in the U.S., which was created in 2005 as part of the responses to the 9/11 terrorist attacks, and designed to ensure integration of national intelligence. In the U.S., both the Director of National Intelligence and the National Security Adviser (NSA) report to the president. As it currently stands in Nigeria, the Office of the National Security Adviser (ONSA) plays the role of a coordinating agency on all matters related to national intelligence. This creates room for underperformance on its fundamental role, which is to advise the President on national security matters. The creation of an ODNI would therefore go a long way in ensuring the harmonisation and coordination of all national intelligence thereby fostering the availability of actionable intelligence in a timely manner. This is in line with what exists in the United States of America (USA), which has both the NSA and the ODNI

- Establishment of two designated portfolios, not as separate agencies, but under the Office of the National Security Adviser (ONSA). The recommended portfolios are: the Deputy National Security Advisor (DNSA) on Africa and Economic Affairs and a Deputy National Security Advisor (DNSA) on Grand Strategy, Counterterrorism, and Intelligence. Both portfolios are needed to deepen and broaden the operations of ONSA.

- There is a need for manpower increase across the Nigerian Police Force and the Nigerian Military to provide much needed surge against criminal activities across the country. The current deficiencies that exist with manpower, amongst Nigeria’s security forces leaves them mostly stretched to the limit thereby impeding their abilities to effectively tackle insecurity.

- There is an urgent need to provide state of the art equipment, advanced weaponry, and technology including combat gears, night vision googles, armed drones, surveillance drones and advanced weapon systems across the security forces. The use of state-of-the-art equipment, advanced weaponry and technology offers an edge to Nigeria’s security forces in the increasingly complex and dynamic sphere of asymmetric warfare.

- Regular trainings for members of the security forces are required to sustain their professionalism, and preparedness to address the issues of insecurity currently confronting the country. This should also be strengthened through foreign security forces assistance with partner countries. Doing so regularly would also help to ensure that Nigeria’s security forces are attuned with the latest doctrines, tactics and operational strategies required to persecute the ongoing multiple internal security operations.

- Nigeria’s structure of intelligence should be repositioned to provide actionable intelligence that informs counterterrorism (CT) and counterinsurgency (COIN) operations across the country. This can be better optimised by prioritising a locally driven strategy towards winning the hearts and minds of local communities.

- There is need to prioritise a human security and people-centred approach over the current militarised approach. This should focus on addressing the underlying root causes and triggers of insecurity such as socio-economic grievances, political marginalisation, ethno-religious tensions and environmental degradation.

*Dr. Aina is an international security expert and an associate fellow of the Royal United Services Institute for Defence and Security Studies (RUSI), London, United Kingdom.

Footnotes

[1] United Nations Development Programme, “Assessing the Impact of the Conflict on Development in North East Nigeria”. Available at https://www.ng.undp.org/content/nigeria/en/home/library/human_development/assessing-the-impact-of-conflict-on-development-in-north-east-ni.html (Accessed June 25, 2021).

[2] International Crisis Group, “Rethinking Resettlement and Return in Nigeria’s North East”, Available at https://www.crisisgroup.org/africa/west-africa/nigeria/b184-rethinking-resettlement-and-return-nigerias-north-east, (January 25, 2023)

[3] Ayandele. Olajumoke., and Goos, Curtis., 2021. Mapping Nigeria’s Security Crisis: Players, Targets and Trends”, Available at: https://acleddata.com/2021/05/20/mapping-nigerias-kidnapping-crisis-players-targets-and-trends/ (Accessed 2nd October 2022)

[4] Hassan, Idayat. and Barnett, James, 2022. ‘Northwest Nigeria’s Bandit Problem: Explaining the Conflict Drivers’. In Centre for Democracy and Development. Available at: https://cddwestafrica.org/wp-content/uploads/2022/04/Conflict-Dynamics-and-Actors-in-Nigerias-Northwest.pdf (Accessed 13 July 2022).

[5] Godwin Comrade Ameh, 2018. “IGP Idris Reveals Number of Police in Nigeria”, Daily Post. Available at: https://dailypost.ng/2018/11/14/igp-idris-reveals-number-police-nigeria/ ( Accessed March 27, 2023).

[6] World Bank, 2023. “Armed Forces personnel, Total”, Available at https://data.worldbank.org/indicator/MS.MIL.TOTL.P1?end=2019&start=2019 (Accessed March 27, 2023).

- Details

- Policy Memo

By Babajide Fowowe and Muhammed Shuaibu | As Nigeria prepares to usher in a new administration, the state of the economy remains a key point of interest. This owes largely to the myriad of economic challenges the country faces, as highlighted in the Agora Policy Report on the economy1. A critical issue that the incoming administration has to grapple with is how to revamp the economy, and quickly.

The key macroeconomic statistics do not paint a rosy picture. The inflation rate rose to 22.04% in March2023. Real GDP growth rate fell from 3.40% in 2021 to 3.1% in 2022. The latest statistics show that 40.1% of Nigerians are poor, while unemployment is 33.28%.Despite favourable global oil market conditions, domestic oil production shocks have dampened oil revenue inflows and have drastically increased the cost of the petrol subsidy, thereby widening Federal Government’s fiscal deficit. This has led to crowding-out of critical spending on social services and infrastructure.

While there are numerous development challenges and actions required at all levels of government, this memo focuses on three key policy actions at the Federal level: fiscal, monetary and trade policies. It is our considered opinion that the incoming administration needs to undertake fast, coordinated macroeconomic policy reforms on these three fronts. These policy actions or economic reforms must be predicated on inclusion, transparency and accountability.

2 Fiscal Policy

2.1 State of Affairs

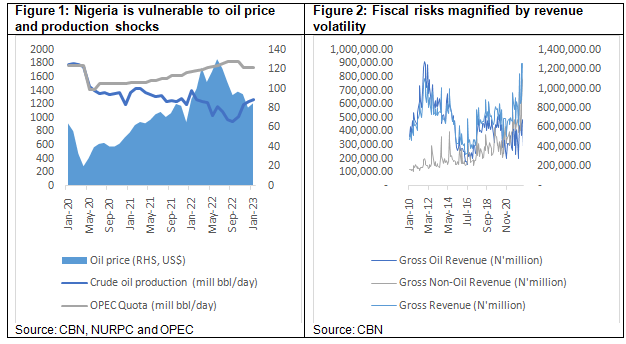

Since the 1970s, Nigeria’s fiscal profile has been tied to the oil sector. Despite the high oil prices in the aftermath of the COVID-19 pandemic, Nigeria’s oil production has been very low. Oil production started falling from 1.799 million barrels per day (bpd) in January 2020 and reached a trough of 937,766 bpd in September 2022 (Figure 1). Since April 2020, the country’s oil production has consistently been below its OPEC quota, and the production shortfall reached a peak of 892,234 bpd in September 2022 (Figure 1). These drastic falls in oil production have come amid a surge in oil prices, with oil prices reaching an all-time high of $130 per barrel in June 2022 (Figure 1). The overall performance of federally-collected revenue has been quite poor, exhibiting heightened volatility in line with global crude oil price movements. FG’s gross oil revenue inflows were N329.984 million in January 2022 but fell to N199.082 million in February 2022. It then started rising and reached a peak of N485.068 million in August 2022 (Figure 2).

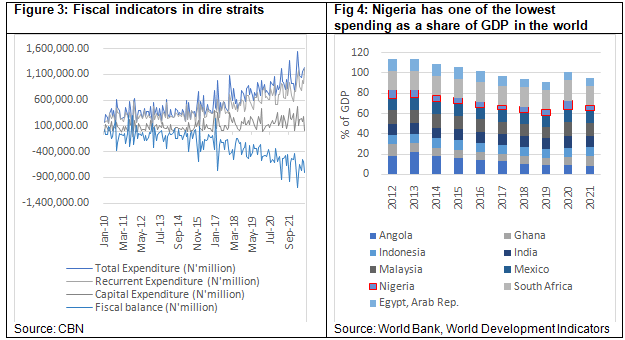

The performance of federally-collected gross non-oil revenue exhibited relatively larger swings in 2022. It dropped from N485.645 million in January to N393.012million in March but rose to N805.854 million in July before declining to N616.420 million in September 2022. While the modest improvement could be a reflection of improvements in tax collection, the non-oil revenue generating capacity remains far below its potential especially given the country’s significant spending needs. As pointed out in the Agora Policy report on the economy, many revenue-generating agencies either fail to remit any revenue, or remit a very small fraction to the government. This is a serious problem that needs to be addressed because it deprives the FG of the much-needed revenue. Moreover, the action of such agencies is in violation of the Fiscal Responsibility Act which mandates revenue-generating agencies to remit 80% of their operating surpluses to the Consolidated Revenue Fund and retain 20% in their reserve fund.

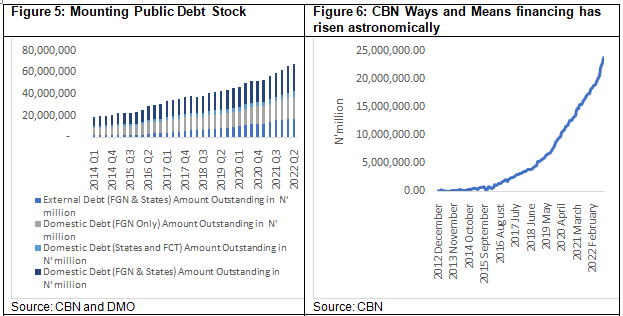

Nigeria’s spending needs have maintained an upward trend since 2010 (Figure 3). However, when compared to other countries, the quantity and quality of spending is low (Figure 4). Figure 3 shows that total FGN spending is largely dominated by recurrent spending with a limited share going to capital expenditure. The average share of monthly recurrent spending in 2021 was about 79% compared with 21% for capital expenditure. Between January and September 2022, average recurrent expenditure was about 84% while capital expenditure was 16%.

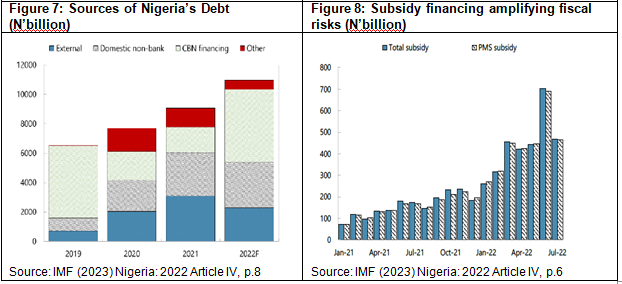

The FG has consistently run a fiscal deficit over the last decade but this has worsened in recent times due to a combination of lower revenue inflows and high fuel subsidy payments (Figure 8). The high fiscal deficit financing need has led to a steady increase in FG’s total public debt stock. FG's domestic debt doubled from N7.18 trillion in Q1 2014 to N14.534 trillion in Q1 2020. Domestic debt further increased to N20.14 trillion in Q1 2022. It is important to note that the official domestic debt statistics does not include ways and means borrowing from the CBN. The Agora policy report on the economy2 highlighted the fact that the FGN’s ways and means borrowing from the CBN had reached N18.8 trillion in March 2022. If this is added to the official domestic debt figures, then total domestic debt would be N38.94 trillion in Q1 2022. The Central Bank of Nigeria’s (CBN) ways and means financing has overshot the statutory limit. Since 2005, FG has increased borrowing through the ways and means financing from CBN (Figure 6). This has been further increased in recent times due to external elevated borrowing costs in the Eurobond market (Figure 7).3

On the external side, the combined outstanding debts of the FG and state governments increased from N8.3 trillion in Q2 2019 to N11.3 trillion in Q2 2020. By Q2 2021, the outstanding external debt stock increased further to N13.7 trillion and rose further to an all-time high of N16.6 trillion in Q2 2022 (Figure 5).

2.2 Immediate Fiscal Reforms

2.2.1 Boosting oil revenue: The drastic fall in oil revenue has been as a result of the double whammy of lower oil production and petrol subsidy. The government needs to take decisive action to address these two critical issues.

Ending oil theft: Addressing the drastic fall in oil production requires urgent action to end oil theft in the oil producing areas. This would require strong determination from the government and crucially, cooperation from host communities and the security agencies. The government needs to review the security architecture in the oil producing areas and give clear instructions about ending oil theft. In addition, both the Nigeria Upstream Petroleum Regulatory Commission (NUPRC) and Nigeria National Petroleum Corporation (NNPC)Limited should be given clear oil production and exporting targets, and be held accountable when these are not met.

Removal of the petrol subsidy: The use of a strategic communication team to engage the public and other critical stakeholders on the benefits and costs of removing the subsidy would be required for the public to buy into this policy measure. At the same time, detailed plans of how funds are saved from subsidy removal need to be extensively discussed and disseminated to the general public to increase trust as a social capital. The savings from the fuel subsidy could be used to scale up short-term direct cash transfers to the poorest and most vulnerable groups in the country. Prices of petroleum products should be market-determined rather that regulated by the government.

2.2.2 Boosting non-oil revenue: There is a need to address the nation’s dismal tax revenue to GDP ratio. The FIRS has done well in recent times by increasing revenue generated from N6.4 trillion in 2021 to N10.1 trillion in 2022, thereby crossing N10 trillion in revenue for the first time. However, for the size of the economy, government revenue and expenditure are grossly inadequate to effectively drive policy, enhance economic growth, lower poverty, and achieve the Sustainable Development Goals (SDGs). This would require two critical actions on boosting non-oil revenue:

Tax reforms and domestic revenue mobilisation: There is an urgent need to broaden the tax net to capture the formal and informal sectors not in the existing tax net. For the formal sector, a first step would be to properly capture and tax high net worth individuals and large corporations. Also, FIRS needs to work closely with the NBS to identify small and medium scale enterprises (SMEs) and ensure they pay taxes appropriately. Some simple incentives and an amnesty period, following which appropriate sanctions will be meted out, can be given to ensure quick compliance. It would be crucial to continuously communicate the issue of tax reforms to the citizens to gain public confidence in the system. In addition, leakages from taxes collected by non-state actors need to be eliminated.

Full compliance with the Fiscal Responsibility Act: The Fiscal Responsibility Act mandates revenue generating agencies to remit 80% of their operating surpluses to the Consolidated Revenue Fund and retain 20% in their reserve fund. There are many revenue-generating agencies that either fail to remit any revenue or remit a very small fraction to the government. The Fiscal Responsibility Act should be amended to set strict penalties for agencies that fail to remit their stipulated operating surpluses. Also, there is the need to stop funding revenue-generating agencies from the federal budget.

2.2.3 Improving the budget implementation framework. This entails strengthening the zero-based budgeting framework by ensuring that budget preparation starts on time. There is an urgent need to end “drip-feeding” which has inhibited the completion of critical capital projects and perpetuated the “ongoing project” syndrome. This comes at zero cost to the key agencies such as the Federal Ministry of Finance, Budget and National Planning and the Budget Office of the Federation. Increased budgetary provisions should be given to capital expenditure. There is also the need to increase the percentage of the budget that goes to capital expenditure and the necessity of trimming recurrent expenditure.

3 Monetary Policy

3.1 Monetary Policy Developments

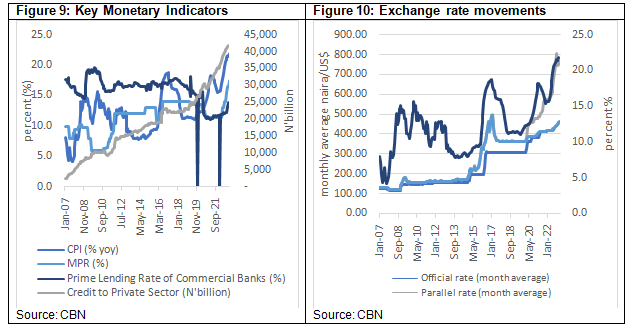

Similar to other central banks around the world, the Central Bank of Nigeria (CBN) has tightened its monetary policy stance to tame rising inflation. The CBN raised the monetary policy rate by a cumulative 5% in 2022 and also increased the cash reserve ratio from 27.5% to 32.5%. Despite these tightening measures, the monetisation of the fiscal deficit and other quasi-fiscal activities such as the intervention programmes have expanded the growth of credit and thus contributed to inflationary pressures. The year-on-year composite price index (CPI) increased from 15.6% in January to 18.6% in June and to 20.8% in September 2022. It moderated marginally to 21.3% in December 2022 before rising again to 21.91% in February 2023. The obvious disconnect between fiscal and monetary policy has heightened macroeconomic risks and vulnerabilities. The weak transmission mechanism of monetary policy is a combination of poor policy coordination and focus of the CBN on economic growth rather than on inflation(Figure 9).

Exchange rate management has remained at the front burner of policy discussions. This is due to the complete exchange rate pass-through to domestic prices in Nigeria. Nigeria currently operates several exchange rate windows, often at varying rates (Figure 10). This has created arbitrage opportunities for speculators in the foreign exchange market. The official exchange rate was N416/$ in March 2022 and had increased to N461/$ in February 2023 (Figure 10). The parallel market exchange rate has continued to diverge from the official rate. In January 2022, the parallel market exchange rate was about N570/$ and had increased to about N761/$ in February 2023. The CBN also created an Investors and Exporters Foreign Exchange (IEFX) window to give genuine importers and exporters access to foreign exchange. This IEFX rate closely mirrors the official exchange rate but is still below the market-based parallel exchange rate. The average IEFX rate in 2022 was about N428/$ and it had increased to N461/$ in January 2023.

- Immediate Monetary Reforms

- Enhance the coordination of fiscal and monetary policy to reduce frictions and counteractive policy goals. The government should strengthen the Fiscal-Monetary Coordination Committee to ensure that the monetary authority (CBN) and the fiscal authority (Federal Ministry of Finance, Budget and National Planning) optimally coordinate policies to ensure the gains from fiscal and monetary reforms are maximized.

- Restore monetary policy focus back to its price stability mandate, taming inflationary pressure and strengthening the monetary transmission. The CBN should focus on its core mandate of maintaining price stability. The CBN should set clear and realistic targets for inflation, and a timeline for achieving these targets. Addressing supply-side bottlenecks such as trade restrictions on critical intermediates that increase the cost of doing business. The CBN will have to restore the credibility of the MPR such that bond yields and lending rates are reflective of the monetary policy rate (MPR).

3.2.3 The removal of the current multiple exchange rate windows being operated by the CBN. This would make the exchange rate market-determined and mitigate speculative pressures that fuel arbitrage conditions in the market. This would further inspire confidence from domestic and foreign investors.

3.2.4 Putting an end to ways and means financing of FGN expenditure. This would curtail the growth of the money supply and thus curtail inflationary pressure. Part of this will involve the CBN helping the FG to properly forecast its revenue as well as helping the FG, on a technical level, identify potential sources of revenue. A strategy will also need to be developed to manage the current stock of FG’s debt at the CBN.

4 Trade and Investment

4.1 State of Trade and Investment

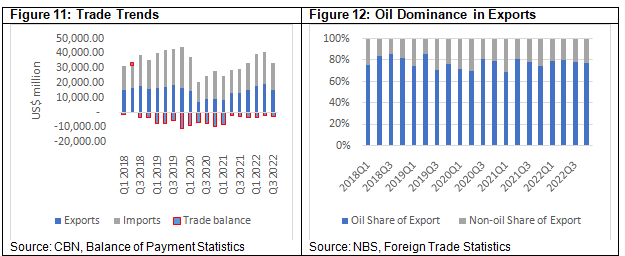

Nigeria has one of the largest economies in Africa, with a significant trade volume. However, the country’s trade profile has historically been dominated by oil exports, which account for a large share of the country’s foreign exchange earnings (Figure 12). The low level of trade diversity and the need to reduce over-reliance on oil exports in Nigeria has remained a major concern for governments over time. Figure 11 indicates that since Q1 2020, with the exception of Q2 2021, Q2 2022 and Q4 2022, imports have exceeded exports, resulting in trade deficits for most of the period.

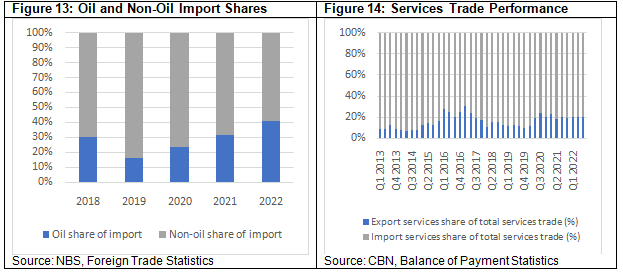

While Nigeria’s export shave largely been dominated by oil exports, the trend of imports depicts a different picture. Non-oil commodities dominate Nigeria’s total imports as they increased from 70% in 2018 to 84% in 2019 and 77% in 2020, before falling to 69% in 2021 to 59% in 2022 (Figure 13).In terms of trade in services, Nigeria’s performance is quite limited as services import dwarfs services export (Figure 14). The average services import in 2018 was about 87% and increased to 89% in 2019 then dropped to 81% in 2020. By 2021, it dropped marginally to 80% and remained at the same average level in the first three quarters of 2022.

The volatility of capital inflows has persisted over the last decade. FPI inflows in the fourth quarter of 2018 was US$3,935 million but dropped significantly, translating to an outflow of US$3,788 million in the fourth quarter of 2019. By the fourth quarter of 2020, FPI outflow slowed down to US$477 million and even recorded significant improvements with inflows of US$1,926 million recorded in Q1 2021, before dropping to outflows of US$3,012 million in 2021Q4. FPI remained positive in the first three quarters of 2022 recording a drop from US1,542 million in 2022Q1 to US$1,001 million in 2022Q3. In terms of FDI inflows, the fluctuations have been relatively lower than FPI as it rose from US$59 million in 2018Q4 to US$248 million in 2019Q4and US$439 million in 2020Q4. This positive trend reversed by the fourth quarter of 2021 as FDI inflows dropped significantly to US$42 million and for the first time in over a decade recorded an outflow in 2022Q1 (US$323 million) and 2022Q2 (US$1,537 million) before a positive rebound of US$726 in the third quarter of 2022.

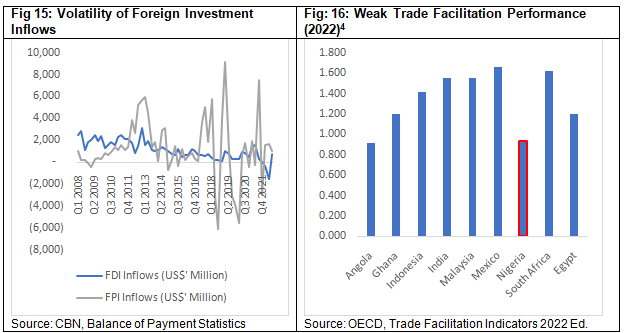

One of the major issues that have impeded trade performance and thus diversification in Nigeria is the weak trade-related infrastructure. Having in efficient or inadequate systems of transportation, logistics, and trade-related infrastructure can severely impede a country’s ability to compete on a global scale.5 Based on the 2022 OECD trade facilitation performance indicator, Nigeria performs poorly (0.930) relative to regional peers such as Ghana (1.200), South Africa (1.625), and Egypt (1.200). The trade facilitation performance indicator is composed of a set of variables measuring the extent to which countries have introduced and implemented trade facilitation measures in absolute terms, but also their performance relative to others. The indicator takes values from 0 to 2, where 2 indicates the best performance that can be achieved.6

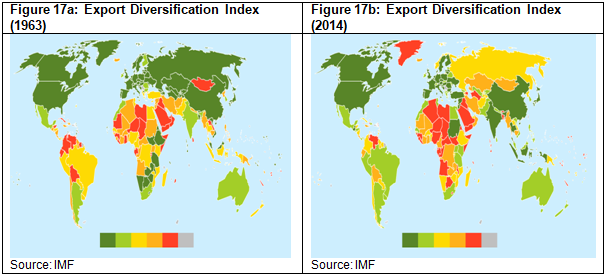

The lopsided structure of Nigeria’s trade performance over time is linked to low trade diversity. Although this has remained at the forefront of various development policy plans, weak implementation and poorly coordinated macroeconomic policy and structural reforms have constrained trade diversification. For example, Nigeria has used several trade restrictions mainly to protect domestic industries and spur domestic productivity. However, this has not achieved the planned objectives as domestic firms remain largely uncompetitive due to structural rigidities tied to the inadequate soft and hard infrastructure. Comparatively, as shown in Figures 17a and 17b, Nigeria’s export diversification has worsened over the last five decades. At 3.74 in 1963, it increased to 4.65 in 1970 and 6.15 in 1980. By 1990 it had reduced marginally to 5.99 before rising to 6.04 in 2000 and then dropping again to 5.54 in 2010. In 2014 Nigeria’s export diversification index was 5.62 which was far below the performance of other countries like South Africa (2.59), Egypt (2.65), India (2.16), Indonesia (2.21) and Mexico (2.43).7It is important to note that higher values correspond to lower export diversification while lower values correspond to high export diversity.

4.2 Immediate Trade and Investment Reforms

4.2.1 Replacement of import bans with import duties. The use of tariffs rather than the existing import bans would spur the domestic productivity of firms, especially those that rely on the import of intermediates that are affected by the import prohibition. This has to be done in a coordinated manner between the Ministry of Industry, Trade and Investment, Ministry of Finance, Budget and National Planning, and the Nigeria Customs Service.

4.2.2 Development of regional industrial hubs and transport infrastructure through PPP arrangements. FGN should prioritise the development of industrial hubs and export processing zones as well as the delivery on critical infrastructure which support international trade, such as ports, roads, and telecommunications networks. In view of obvious budgetary constraints and current revenue shortfalls, the government should seek partnership with the private sector. This could help enhance efficient service delivery and reduce trade costs, thereby making it easy for domestic firms to integrate in domestic and regional value chains.

4.2.3 Reopening all closed borders and removing all food trade restrictions. These have hurt prices and have not led to the expected increase in domestic productivity. The government needs to prioritise the development of a goods and services export strategy in collaboration with the subnational governments. Such a strategy should focus on labour intensive sectors, and should clearly identify priority sectors and potential markets by leveraging Nigeria’s global network of diaspora and consulates.

4.2.4 Creating a conducive environment for attracting foreign investment. The rise in foreign investment outflows needs to be addressed by sending positive signals to foreign investors. The exchange rate needs to be market-determined. Also, security, banditry, kidnapping and insurgency need to be adequately tackled to send positive signals.

4.2.5 Providing incentives for export-oriented firms especially in the non-oil sectors. In order to leverage on the enormous market opportunities created by the African Continental Free Trade Area (AfCFTA) agreement, there should be a gradual reduction of import tariffs on intermediate products used by domestic firms that export or plan to do so. At the same time, the discretionary import duty waiver allocation system needs to be replaced with a clearly defined industry-wide incentive system that supports export-oriented firms.

Conclusion

The Nigerian economy has significant potential but faces several challenges. Nigeria is the largest economy in Africa, with a large and growing population, abundant natural resources, and a strategic location. However, the country has struggled with economic diversification and over-reliance on oil exports, which has made it vulnerable to external shocks. The country also grapples with some structural challenges, including poor infrastructure, limited access to credit, and weak institutions. These issues have hindered economic growth and made it difficult for businesses to thrive in the country. This note highlights some of the key challenges facing the Nigerian economy in the context of fiscal, monetary and exchange rate management, trade and investment policies. It also prescribes urgent actions on those three critical fronts.

*Professor Fowowe and Dr. Shuaibu teach Economics at the University of Ibadan and the University of Abuja respectively.

[1]https://agorapolicy.org/wp-content/uploads/2022/10/Updated-Digital-Version.pdf

[2] https://agorapolicy.org/wp-content/uploads/2022/10/Updated-Digital-Version.pdf

[4]http://compareyourcountry.org/trade-facilitation/en/0/default/all/default/2022

[5]https://www.worldbank.org/en/topic/trade-facilitation-and-logistics

[7]https://data.imf.org/?sk=A093DF7D-E0B8-4913-80E0-A07CF90B44DB

- Details

- Policy Memo

By Adebayo Ahmed | Jobs are one of the foundations for a stable society and key to improvements in quality of life. Unfortunately, unemployment is one of Nigeria’s major challenges today. Beyond the negative impact on human welfare, unemployment is gravely implicated in Nigeria’s other pressing challenges, especially low productivity, poverty and insecurity. It needs to be tackled aggressively and comprehensively, not in the current tokenistic and uncoordinated fashion.

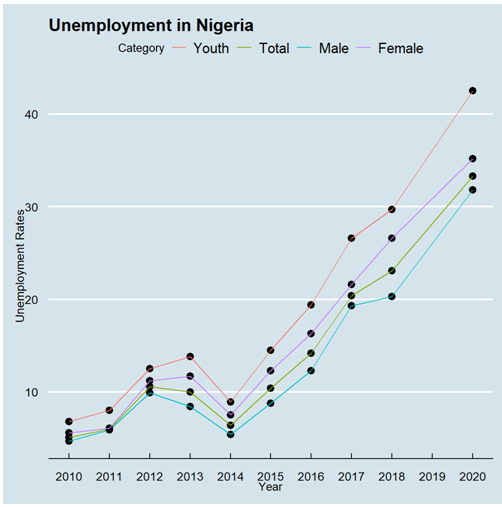

Fig 1: Unemployment Rates. Source: NBS

In the last decade Nigeria has struggled to create enough jobs to meet up with the constant flow of people entering working age. Since 2010 the unemployment rate has been on an upward trajectory rising from 5.1% in 2010 to the last pre-covid estimate of 23.1% in 2018, with the situation worse for women. Unemployment rate rose to 33.3% during COVID, combined with a much-reduced labour force participation rate. There has been little official information since. Although the National Bureau of Statistics (NBS) claims to be working on an improved methodology for measuring unemployment, all we can say at this point is that unemployment is likely still high and at an undesirable level. The situation has been particularly worse for young people who, as at 2020, faced an unemployment rate of over 40%. There is little doubt that this rising unemployment is linked to increasing restfulness and disenchantment among the youth.

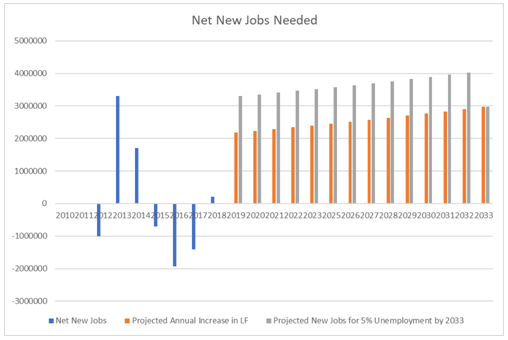

Fig 2: Net new jobs created and needed. Source: NBS, Author’s Calculations.

Given that the population, and hence the labour force, keeps growing, the challenge of reducing unemployment is therefore all about creating more new jobs than there are people entering the labour force. At the very least, to keep unemployment from rising, enough net new jobs need to be created to at least employ the majority of net new entrants to the labour market. What does this mean in the Nigerian context? Based on a labour force of about 90 million1 prior to COVID in 2018, about 2.5 million net new people enter the labour force every year. Which means the economy would have to create at least 2.5 million new jobs a year on average just to keep the number of the unemployed from rising. If we wanted to get the unemployment rate to a healthier five percent by 2033, and we assumed that the labour force grew at the same rate as population growth, then by our calculations, we would need to be creating at least 3.6 million net new jobs a year2. Given that between 2010 and 2018 we only created on average 21,757 net new full-time jobs a year then you can see clearly that we have a problem3. In fact, as shown in Figure 2, 2013 is the only year in the last decade when we actually produced over three million net new jobs.

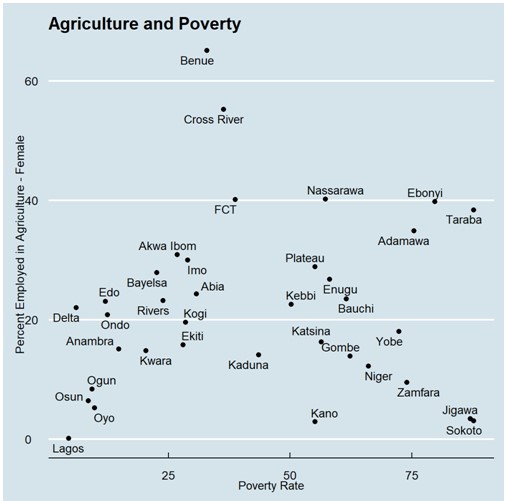

Fig 3: Employment in Agriculture vs Poverty Rates across states (Male and Female).

Source: NBS Living Standards Survey 2018.

If we add the caveat that the jobs created have to be good enough to allow people have a meaningful quality of life, then the challenge is even more difficult. One of the features of current employment, especially in subsistence agriculture, is that some of the jobs do not result in enough income to actually lift the employed persons out of poverty. As observed in Figure 3 above, some of the states with the largest employment in agriculture also happen to be the states with the highest poverty rates. Many of these people are employed but are still living in poverty despite their employment. For example, although Sokoto State had an unemployment rate of 14.3% in 20184, majority of the people were employed in (presumably) subsistence agriculture (51% of males and 3% of females). The implication being that over 87% of households were still living in poverty. In essence, it is not just jobs that are needed but decent jobs.

Limits of current approaches

The current approaches by government to tackling unemployment, while sometimes having merit, have failed to resolve the problem. This is largely because the majority of the approaches cannot reach the scale of what is required.

The first of the common approaches is direct government employment. This is particularly popular at the state and local government level, even if the Federal Government is not left out. Although it is easy to argue that the country needs more police personnel, more doctors, and more teachers, it is clear that government employment alone cannot solve the unemployment challenge. It is almost unfathomable to imagine the federal, state, and local governments combined being able to employ anywhere close to three million workers each year. This is even before you take into account their financial constraints. In fact, according to some reports, the entire Federal Government only employed about 720,000 people as at 20205. The ILO estimates that there were only about 2.12 million people employed in the public sector in Nigeria in 2020. Given the scale of the challenge, it is unsurprising that government employment has not worked in resolving the challenges.

Fig 4: Q3 2018 Unemployment by Educational Category. Source: NBS

A second common approach is the skills-acquisition driven approach. The summary of this approach is that if you teach people some skills, such as carpentry or tailoring, then that should automatically result in employment. For instance, a cursory look at the activities of the National Directorate of Employment (NDE) shows that most of its programmes are essentially skills acquisition programmes. However, unfortunately, in reality skills do not necessarily mean jobs. For instance, in 2018 the unemployment rate for people with post-secondary education at 29.8% was higher than for people with no education at 21.8%. Similarly, as is clear in Figure 4

above, people with only primary education had a lower unemployment rate than people with NCE/OND/Nursing certificates even though they presumably have more skills. Although there are issues such as skills mismatch and selectivity in employment, and there is still significant room for certification for specific skills, it does signify that more skills alone will not necessarily solve the unemployment challenge.

The third, and more recent approach is that of social investment or social transfers as signified by the expansion of programmes such as trader-moni or other direct cash support schemes popular at state and local government level. As with the case with direct government employment, the scale of the challenge means that this is unlikely to be a sustainable approach. According to the NBS6, only between 10,000 and 20,000 thousand were enrolled in the governments N-Power programme in each state as at 2018. The FG stated that it planned to raise the total number of beneficiaries to one million in 2020. The GEEP programmes have similar statistics. Although you can argue about the merits or demerits of such programmes, what is clear is they are not creating, and probably cannot create, the 3.6 million net new jobs a year to tackle Nigeria’s unemployment challenge.

Prescriptions / Recommendations

In thinking of a coherent strategy to tackle the unemployment challenge, we need to take a step back and understand what exactly jobs are. Jobs are essentially the contribution of individuals to economic activity. Which means if you want to see faster job growth then you must have faster economic growth. However, as we learned during the growth episodes in Nigeria in the early 2000s, growth alone does not imply jobs. There can be jobless growth and job-led growth. Specifically, what we need is growth in labour-intensive sectors.