By Ayobami Ayorinde and Uchechukwu Eze | The July 2024 inflation data released yesterday by the National Bureau of Statistics (NBS) showed that Nigeria’s key inflation figures fell for the first time in 19 months.

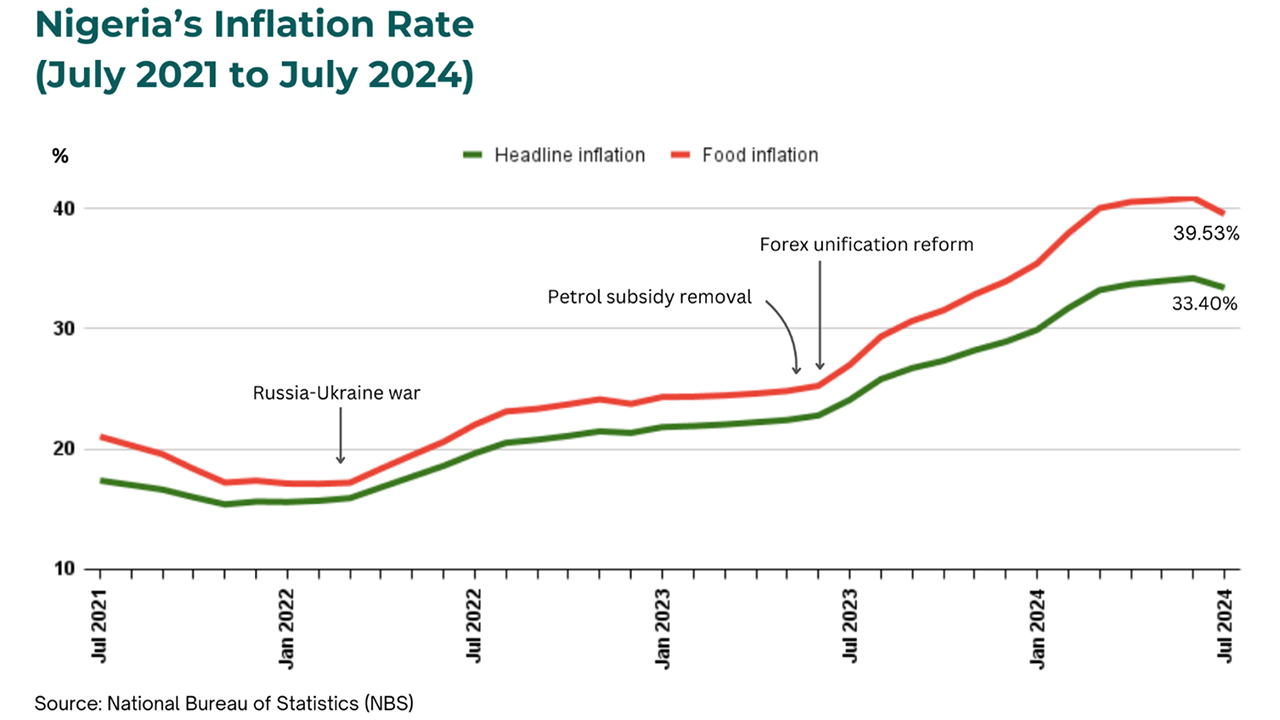

Headline inflation dropped to 33.40% in July from 34.20% in June, while food inflation declined to 39.53% in July from 40.87% the previous month. This is a positive development, given the negative impact of high prices on households and businesses and the general restiveness about the ongoing cost-of-living crisis. But the NBS report also raises many questions. These questions include: What does the change in inflation rates mean for the average person? What explains the slight decline? Has high inflation peaked in Nigeria? Is this decline a blip or sustainable trend? It is difficult to answer some of these questions with the limited data available. However, below are our three key observations from the July 2024 inflation data.

Prices Are Still Rising, But More Slowly

Let’s start with the obvious: contrary to the belief in some quarters, lower inflation rate does not mean that the prices of goods and services have started falling. Many of the people who are skeptical about the latest inflation figures wrongly assume that lower inflation rate means lower prices. People who hold such assumptions are likely to doubt the credibility of the data because it may appear at variance with what they experience when they make purchases. It is important to state that inflation data looks at the rate at which prices of a representative basket of goods and services have changed from year-to-year and from month-to-month.

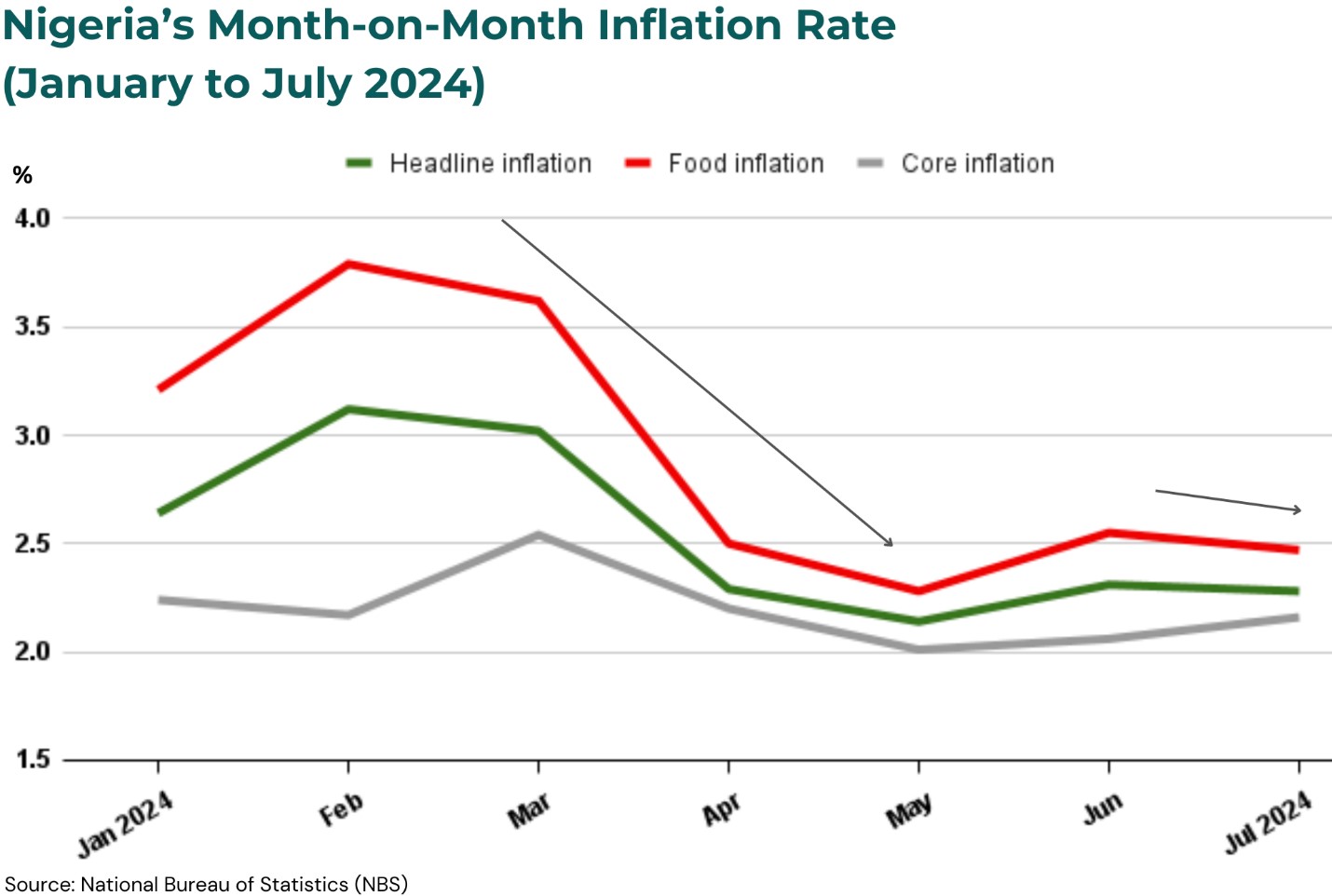

So, what the data shows is that year-on-year, the rate of change in prices decelerated from 34.20% in June to 33.40% in July for headline inflation and from 40.87% to 39.53% for food inflation. On a month-to-month basis, the rate of increase for headline inflation fell from 2.31% in June to 2.28% in July and from 2.55% to 2.47% for food inflation. Generally, prices of goods and services rose, rather than fell, in July. But the rate at which prices rose in July was lower than the rate in June.

In any event, year-on-year inflation at 39.53% for food and 33.40% for headline is still very high.

There is no doubt that the decline in the rate of prices go up is definitely a piece of good news. It is a needed relief. But it is important to clarify that the data does not say that prices fell or are falling. Hopefully, the fall in inflation rates will continue, and prices will start falling too.

The Impact of Base Effects

In response to persistently high inflation, the Central Bank of Nigeria (CBN), under the leadership of Governor Yemi Cardoso, has implemented a series of aggressive monetary policy measures. These included raising interest rates from 18.5% to 26.75% and increasing the Cash Reserve Ratio (CRR) from 32.5% to 45%. It is possible that the monetary tightening by the CBN and the interventions by others contributed to the slowdown in inflation figures in July 2024, but it is too early to know the extent of the contributions.

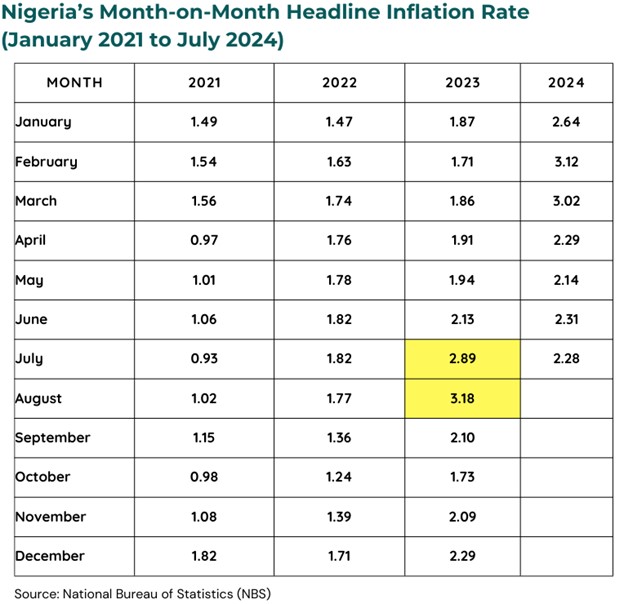

However, the impact of base effect for now is clearer. Inflation data are comparative figures. They compare one period to another (either corresponding months of two years or two consecutive months). The first of the periods serve as the base. When prices are exceptionally high or low during the base period, it can have impact on changes in the current period. For example, headline inflation rose from 2.13% in June 2023 to 2.89% in July 2023, representing a significant increase of 0.76% within one month alone. This contrasts with the more modest month-on-month increases of 2.31% in June 2024 and 2.28% in July 2024, which only show a 0.03% rise. Similarly, food inflation rose from 2.40% in June 2023 to 3.45% in July 2023, showing an increase of 1.05% compared to the month-on-month increases of 2.55% in June 2024 and 2.47% in July 2024.

The point is that inflation rates were already high in July 2023, which serves as the base for July 2024. This is largely because of the impact of the removal of petrol subsidy and floating of the Naira had fully kicked in by then. Because July 2023 was a higher base than June 2023, the rate of price increase in July 2024 was thus likely to be lower that of June 2024. This phenomenon is referred to as the statistical base effect. With month-on-month headline rate at 3.18% in August 2023, it is possible that the August 2024 CPI report might feature another decline, possibly steeper. It should be noted that monthly inflation rate for headline inflation was below 2% until June 2023, which is indicative of the inflationary impact of the two reforms of the current administration.

5t

5t

On a general note, Nigeria’s inflation rate has been elevated for some time. The last time the country recorded single-digit inflation figures is close to a decade ago: in May 2015, food inflation was 9.78% and in January 2016, headline inflation was 9.62%. Double-digit inflation has been the norm for the past eight to nine years. Apart from the shocks from subsidy removal/Naira depreciation, another development that has kept inflation rates high in Nigeria was the invasion of Ukraine by Russia. The lingering effects of the war significantly affected global commodity prices for food and energy which disrupted existing supply chain, causing inflationary pressures to rise across the world. As a country heavily reliant on imports for its food and fuel needs, Nigeria has been particularly affected by these global disruptions. In January 2022, before the Ukraine-Russia war, headline inflation and food inflation were reported at 15.60% and 17.13% respectively. By the third quarter of 2022, both headline and food inflation figures had risen above 20% (food inflation hit 20.60% in June and headline inflation got to 20.52% in August). They have stayed above 20% since, possibly due to the impact of the expansion of money supply through ways and means and other shocks. The reforms of mid-2023 eventually sent the both rates above 30%.

Effect of Seasonality is Noticeable

Food inflation is the major contributor to the current pattern of high inflation in the country. Food and non-alcoholic beverages accounted for more than half of the inflation rates (17.30% out of 33.40% for year-on-year headline inflation for July 2024; and 1.18% out of the 2.28% for month-on-month headline inflation). In Nigeria, the dominant driver of food inflation is domestic farm produce and prices here tend to follow seasonal trends with elevated patterns over the lean season and subdued trends during harvest months. Food inflation declined from 40.87% in June 2024 to 39.53% in July, which is the beginning of the harvest season for farm produce like yam, maize, tomatoes and others. This effect is expected to continue in August and September which form the peak of the harvest season assuming no major upward adjustments to fuel prices.

Addressing Nigeria’s food inflation will be crucial for achieving a sustainable decline in inflation rate in the long-term. This will take more than seasonality or emergency interventions or even monetary policy. While monetary policies are essential for controlling demand-side inflationary pressures and stabilising the exchange rate, they do not directly address supply-side issues like food production, storage and distribution. Therefore, it will be necessary to focus on tackling the structural issues in the agricultural sector, including insecurity, to address food inflation.

On the whole, it would appear that the ongoing inflationary spiral seems to have peaked. With monetary interventions eventually kicking in and barring another round of shocks in terms of significant hike in petrol prices or major depreciation of the value of the Naira, Nigeria’s inflation looks set to decelerate further in the coming months.

*Charts and table by Maryam Ibrahim