By Babajide Fowowe | Nigeria is currently struggling with a severe crunch in the supply of foreign exchange (forex), which negatively impacts the value of the Naira, its national currency. Both the official and the unofficial forex markets are afflicted by what is basically a liquidity and flow challenge. A number of initiatives and ideas have been mooted which largely relate to borrowing or finding ways to incentivise portfolio flows. Despite supportive oil prices, there is limited discussion around boosting organic forex flows from Nigeria’s oil exports.

Beyond improving security in the Niger Delta to curtail oil theft and re-engaging with capable partners to raise investments in oil production in the country, a short-term and sustainable fix for oil revenue and ultimately for increased forex flows will be for the Nigerian government to immediately cancel the policy of earmarking for domestic consumption a portion (and increasingly all) of its own share of oil output.

Of all the options being implemented or considered for boosting forex inflow into Nigeria, cancelling what is termed Domestic Crude Allocation (DCA) is Nigeria’s surest bet. This will yield immediate result and provide a steady (not one-off) flow of foreign exchange—and thereby address the cashflow challenge in the official segment of the forex markets. Additionally, it will end the dodgy deductions and accounting associated with the domestic crude allocation policy that has been aptly described as an active crime scene.

The DCA has acquired an outsized profile of recent. Any serious attempt at understanding and reforming how Nigeria’s share of oil is accounted and paid for must, for a number of reasons, zero in on the management of and the recent prominence of the DCA.

With the drastic reduction in oil production in Nigeria and the shift in production arrangements away from Joint Ventures (JVs) to Production Sharing Contracts (PSCs), most of the Federation’s share of crude oil produced in Nigeria is channelled to DCA, which has dramatically risen from below 10% of Federation’s share of oil in the early 2000s to almost 100% by 2023. This is not just a suboptimal allocation issue. In relation to forex flows, it is a key challenge because the revenue from DCA sales is received in Naira, meaning that the Central Bank of Nigeria (CBN) is starved of steady and healthy flow of foreign exchange from what used to be its dominant source: crude oil sales. As at 2010, flows from oil and gas accounted for 94% of forex to the CBN but plummeted to 24% by June 2022, and is conceivably much lower now (CBN, like NNPCL, has stopped disclosing some critical data).

Crude oil exports still account for over 70% of Nigeria’s total exports but since 2016 an increasingly disproportionate percentage of the country’s share of crude oil exports is earmarked for domestic consumption. The earmarked barrels of crude oil return first as petrol, then, in terms of monetary flow, as Naira, not dollars. This is because the resultant petrol from DCA is paid for in Naira, not dollars. It is worth highlighting that there is no guarantee that the Naira payment from DCA would translate to commensurate, or even any, revenue to the Federation Account. This is because the national oil company has always been in the habit of making upfront deductions for sundry reasons from revenue accruing from the DCA. The DCA is the site where NNPC performs its dark magic.

Crucially, the DCA policy not only provides an insight into why the national oil company failed to make remittances to the Federation Account for a long spell but also explains why forex inflows from sales of Federation’s crude oil dwindled and the country’s external reserves stagnated at a period of historically high oil prices.

Countries with low forex supply against demand can adopt a number of measures to increase foreign exchange inflows. Such measures include external loans, deposits by deep-pocket investors and countries, foreign direct investment (FDI) and foreign portfolio investment (FPI) and increasing other sources of exports (non-oil exports in Nigeria’s case). However, loans are likely to be one-off and have to be repaid and with interests (even if concessional). Investors are known to take their time and they can be fickle. Unlocking other sources of exports requires time too.

While the country needs to pursue all these options as both stop-gap and long-term measures, it should urgently embrace the one option that is largely under its control and can ensure a steady and sustainable flow of foreign exchange: earning dollars from the sale of its crude oil wherever it is sold. For this to be possible, the DCA policy needs to go immediately. Cancelling the DCA is the easiest and most predictable way to boost forex flows into Nigeria and the most realistic way to reduce pressure on and provide relief for the Naira.

DCA as the Missing Part of the Forex Puzzle

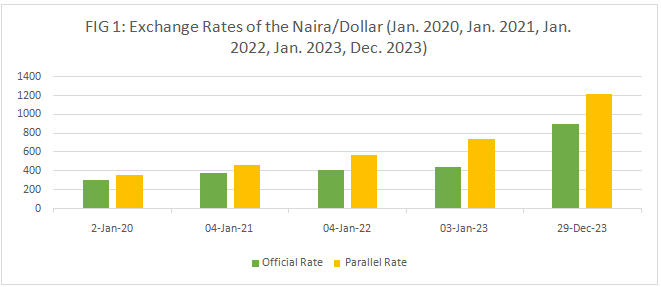

On23 September 2023, the exchange rate of the Naira to the U.S. dollar on the parallel market reached N1,004/$1, thus crossing the N1000/$ psychological mark1. This marked a significant milestone in the foreign exchange markets in Nigeria. The exchange rate of the Naira has been under pressure for some years, andit has been particularly unstable in the past three years. On 2 January 2020, the Naira exchanged for the dollar at N306.5/$ and N360.5/$at the official and parallel markets respectively (Figure 1).On 29 December 2023, the exchange rates of the Naira to the dollar jumped toN899.9/$ (official) and N1,215/$ (parallel) (Figure 1). Compared to the 2 January 2020 rates, this represents a depreciation of 66% for the official rate and 70% for the parallel rate.

Sources: Central Bank of Nigeria; Analysts Data Services and Resources

While many analysts and commentators have provided different explanations (including conspiracy theories) about factors responsible for the depreciation of the Naira, the primary cause is the simple economics law of demand and supply: the supply of foreign exchange in the country has not been sufficient to meet the demand. The country has a backlog of foreign exchange obligations estimated at between $4 billion and $7 billion by the new Governor of the Central Bank of Nigeria (CBN)during his Senate confirmation screening2,3. The backlog has been occasioned because there was simply not enough foreign currency in the country to meet demand. While the restrictive policies of the CBN had been able to suppress the effects of the pent-up demand on the exchange rate, the recent liberalisation has shown the full extent of the excess demand.

Following the removal of foreign exchange controls on 14 June 20234, the Naira was effectively floated, and the workings of market forces saw an immediate depreciation of 29% at the Investors and Exporters (I & E) window, with the exchange rate moving from N471.67/$1 to N664.04/$1. Further liberalisation came on 12 October 2023 with the removal of foreign exchange restrictions on imports of 43 items5.While the removal of these foreign currency restrictions has on one hand limited subsidisation in the foreign exchange markets, on the other hand, it has resulted in increased prices for imported goods (including petrol), and higher costs for foreign transactions (such as school fees and medical costs). This, coupled with seemingly constantly rising prices, has meant that the exchange rate of the Naira has been a dominant topic of discussion in the polity for the past six months.

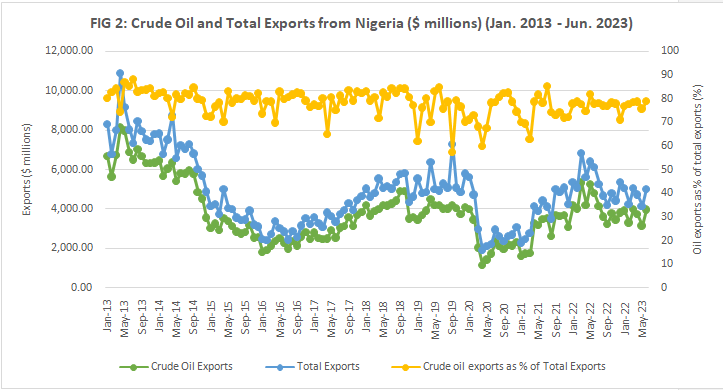

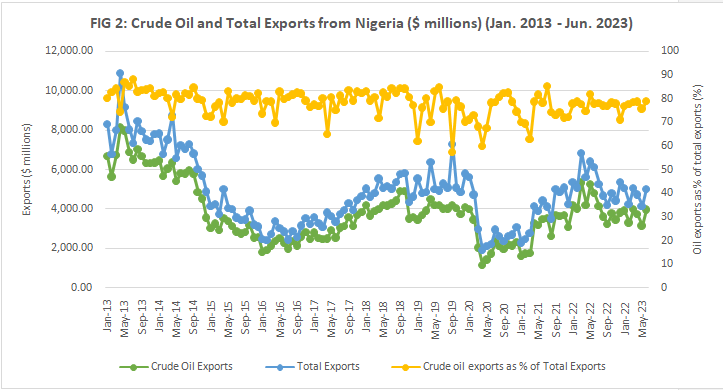

Despite the reforms, a lingering issue for Nigeria and the value of the Naira is that the supply of forex continues to track below demand. At the heart of the reduced supply of foreign exchange is the decline in USD inflows into Nigeria’s external reserves arising from lower oil receipts. A key explanation for this is the drastic reduction in oil production, and consequently oil exports. Oil exports have typically accounted for over 70% of total exports (Figure 2), and have, since the commencement of commercial oil exploration, provided the bulk of foreign exchange earnings for the country. However, oil production started falling drastically in the second half of 2020, and remained largely below 1.4 million barrels per day (Figure 3). Production dropped further in 2022 and was below one million barrels per day in August and September. Although it subsequently increased, production has not risen above 1.4 million barrels per day since then. The country has not been able to meet up with OPEC production allocations since July 2020 (Figure 3). Between March 2022 and August 2023, the shortfalls were so acute that they were above 450,000 barrels per day.

Source: Central Bank of Nigeria Quarterly Statistical Bulletin, 2023 Q2

Notes: 1. Crude oil exports as % of Total Exports are measured in percentages on the right-hand vertical axis

2. Crude oil exports and Total Exports are measured in millions of dollars on left-hand vertical axis

Sources: Nigerian Upstream Petroleum Regulatory Commission and OPEC Statistical Bulletin

Though a lot of attention has rightly focused on declining oil production with government officials and the media putting the blame on oil theft, this is only a part of the story as oil prices after declining over the 2014-16 period and during the COVID-19 pandemic have been broadly supportive of oil export receipts. Ordinarily, the decline in oil production should have been compensated for by significant rise in oil prices following the war in Ukraine. However, there has been a secular decline in the ratio of oil inflows into Nigeria’s external reserves and oil export receipts. We posit in this paper that the reduced forex flows reflect increased allocation of Federation’s crude to DCA at the expense of direct Federation oil exports which normally translated to dollar flows.

DCA involves ‘domestic’6 sales of crude oil, thereby bringing revenues in Naira, the domestic currency. Depending on the terms of the different production arrangements, crude oil produced in Nigeria is shared between the oil companies and the Federation. NNPC is responsible for selling the Federation’s share of the total oil produced. NNPC in turn allocates the Federation share either for exports or for domestic utilisation7. It is the component for domestic utilisation that is referred to as domestic crude allocation (DCA). The critical point to note is that the different allocations are paid for in different currencies: revenue from Federation exports is received in dollars and revenue from DCA is received in Naira.

With the dwindling oil production, a larger proportion of the Federation’s quota has increasingly been channelled to DCA. This has led to the situation where most of the oil revenue inflows have been in Naira, as opposed to dollars. It is our considered position that switching crude oil allocations from the DCA to exports will provide steady revenue in foreign exchange, and thus boost foreign exchange supply in Nigeria. Ultimately, an increased and steady supply of foreign exchange will ease demand pressures and help to stabilise the Naira.

Good Intention Gone Sour

The current outsized role of the DCA started around 2005 with the arrangement that about 445,000 barrels of crude oil per day (the nameplate capacity of the Nigeria’s four government-owned refineries) be set aside from Federation’s share of oil, and be channelled for domestic refining through sales to the then Pipelines and Product Marketing Company Ltd. (PPMC).The allocation would be paid for in Naira and PPMC would recoup proceeds via distribution and sale of the resulting refined products within Nigeria. The rationale was that such exclusive domestic allocation of crude oil would guarantee energy security, de-link refined petroleum product prices from volatility in exchange rates and international crude oil prices, and ensure adequate supplies of refined petroleum products in the country.

On the surface, the DCA seemed to be a reasonable idea, and a number of benefits of such an arrangement can be easily gleaned. It would help to insulate the country from price volatilities in the global oil markets. Such volatilities would be manifested in higher or unstable prices of petroleum products, scarcity of petroleum products, and uncertainty or unstable supply of petroleum products. Effectively, domestic crude allocation would ensure that Nigerians reap considerable benefits from being citizens of a major oil-producing

country. However, the policy had one notable weakness: a flawed pricing framework. On the one hand, the crude from the DCA was sold to the PPMC at an implied discount in dollar terms, when adjusted for the exchange rate, in comparison to the international market. On the other hand, the Naira sales price for refined products was delinked from Naira cost price to PPMC implying a subsidy whose bill was to be covered in annual budgetary allocations. In essence, the DCA created two layers of potential losses: first to the Federation in terms of potential export revenues and second to external reserves in the form of forex inflows. In addition, in de-linking domestic petrol prices from the underlying cost drives of refined petroleum products, the DCA pretty much created an incentive for the expansion of Nigeria’s petrol subsidy programme. The failure to incorporate the opportunity cost concept in economics would have dire implications further down the line for fiscal revenues and dollar proceeds while creating perverse incentives for malfeasance.

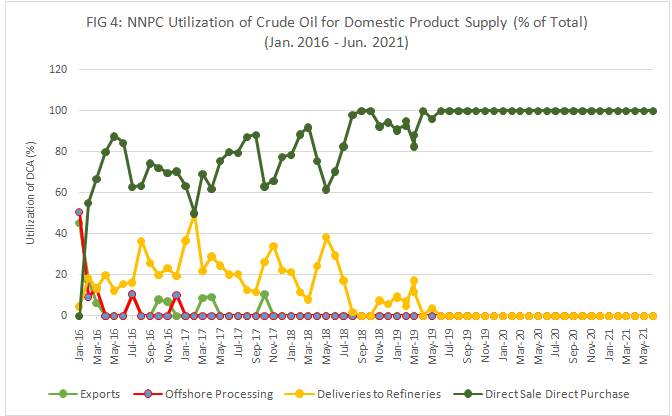

In what follows, we highlight some of the critical problems of the DCA8.Firstly, the losses borne by the PPMC provided little legroom to make the required investments in Nigeria’s domestic refineries which gradually fell into disrepair. Nigeria’s domestic refining capacity fell to low digits with zero allocation to the refineries from the DCA in 2020. While the loss in domestic refining capacity should have resulted in a termination of the DCA policy, successive Nigerian governments, desirous of ensuring low domestic fuel prices, responded by using the DCA barrels to enter into different arrangements (such as swap, offshore processing arrangements and direct sale and direct purchase) with international refineries and commodity traders to basically barter crude for refined petroleum products.

For much of the earlier period, the actual DCA arrangements amounted to sacrificing an insignificant share of Nigeria’s oil production for refined petroleum products. Given relatively tepid international oil prices for the much of the 1990s and early 2000s, the arrangement was not burdensome from a fiscal and FX perspective. Importantly, DCA usage was below 10% of the total Federation share of oil. However, by 2005, the decision to allocate about 445,000 barrels per day to DCA bumped up significantly the share of the Federation oil allocated for domestic consumption.

In 2004, for instance, only 39 million barrels or 8.57% of the 455 million barrels of the Federation share was allocated to domestic consumption, with the remaining 91.43% allocated to Federation exports. Following the policy mentioned earlier, the picture changed dramatically in 2005, with 160.9 million barrels or 35.25% of Federation’s share of 456 million barrels set aside for domestic consumption. The percentage devoted to DCA has steadily increased since then. In the early stages, NNPC refined some of the allocation locally, swapped some for refined products abroad, and exported the rest, which it paid for in dollars. Before long, things went downhill. The refineries basically collapsed, the crude for domestic consumption was all refined abroad or bartered, upfront deductions by NNPC from DCA increased, and the petrol subsidy programme soared.

Since 2016, DCA crude has been increasingly sold through the Direct-Sale Direct-Purchase (DSDP) arrangement (Figure 4). While the refineries no longer receive crude oil, the DSDP arrangement ensures that crude oil receipts are still in Naira, as opposed to dollars.

Sources: NNPC Monthly Financial and Operations Reports

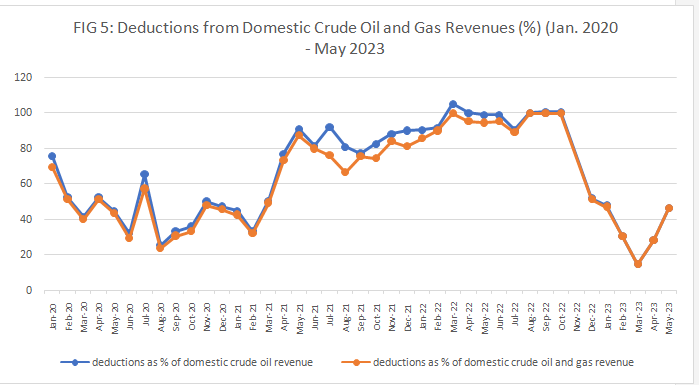

Second, the larger proportion of revenuefrom DCA was largely retained by the NNPC, meaning that the Federation progressively received less and less. Revenue from the DCA has been used by the NNPC for many years to finance its operations. Payments for subsidies, pipeline repairs and maintenance, product losses and lately JV cost recoveryare financed with DCA receipts. In January 2020, total deductions as a percentage of domestic crude oil revenue were 75% (Figure 5). This fell and reached 24% in August 2020. However, it started rising and reached 100% in March 2022. With the exception of July 2022 when it fell to 89%, it remained at 100% until October 2022.

This implies that all revenues from DCA were retained until October 2022, which also coincided with when NNPCL stopped making remittances to the Federation Account. The implementation of the Petroleum Industry Act (PIA) resulted in changes to the composition of deductions, leading to its percentage as a share of domestic crude oil and gas revenue falling to 15% in March 2023, before rising to 46% in May 2023 (see Box 1 for a more detailed description of deductions). Reporting of deductions ended in June 2023. The implementation of the PIA, coupled with removal of petrol subsidies, likely reduced the burden of deductions.

Sources: NNPC Presentations to the Federation Account Allocation Committee (FAAC) Meeting

Notes: 1. Between January 2020 and October 2022, total deductions consisted of JV Cost Recovery + Total Pipeline Repairs and Management Cost + Total Under-Recovery + Crude Oil & Products Losses + Value shortfall

2.The author was unable to obtain data for November 2022

3. Between December 2022 and May 2023, official deductions consisted of JV Cost Recovery + PSC(FEF) + PSC (Mgt Fee).

4, From June 2023, NNPC stopped reporting deductions as previously constituted.

5. See Box 1

| Box 1: Composition of Total deductions from DCA (January 2020 to November 2023 |

|---|

|

1) Between January 2020 and July 2022, total deductions consisted of three components: a. JV Cost Recovery (T1/T2)

b. Total Pipeline Repairs and Management Cost

i. strategic holding cost ii. pipeline management cost [January to April 2020, June 2020] iii. pipeline operations, repairs and management cost c. Total Under-Recovery + Crude Oil & Products Losses + Value shortfall

i. crude oil & product losses [reversal of product loss in May 2022 ii. PMS Under-recovery (Current + arrears) [January 2020 to April 2020] iii. Value loss due to deregulation [July 2020] iv. NNPC value shortfall (recovery on the importation of PMS/ arising from the difference between the landing cost and ex-coastal price of PMS) [March 2021 to October 2022] 2. For some months, the only deductions were for JV cost recovery [October 2020, January 2021, February 2021] 3. For August 2022, the only deductions were for NNPC value shortfall 4. From September 2022, there were changes in NNPC’s deductions, attributed to the PIA: a. Dollar deductions for NNPC value shortfall: 40% of PSC profit due to Federation (in addition to naira deductions: 100% of DCA revenue); b. No deductions for JV cost recovery and total pipeline repairs and management cost. Deductions for JV cost recovery resumed in December 2022; 5. From December 2022 (unclear if this change happened in November or December, as we were unable to obtain data for November), the composition of deductions changed and consisted of: a. JV cost recovery (naira and dollars) b. PSC Frontier Exploration Funds (FEF) (dollars, naira deductions started in February 2023) c. PSC (Management Fee) (dollars, naira deductions started in February 2023) 6 From December 2022, statutory payments to NUPRC (royalty) and FIRS (taxes) which had stopped in July 2021, commenced again (payments were made in September 2022) 7. From December 2022, payments started for NUIMS for profits 8. From February 2023, Payments for Federation PSC Profit Share in naira started (in addition to payments in dollars which started in December 2022) [40% of gross oil and gas revenue] 9. From December 2022 to May 2023, the addition of the official deductions (JV + PSC(FEF) + PSC (Mgt Fee), statutory payments (NUPRC + FIRS), NUIMS profits, and PSC profit share (from Feb 2023) are equal to DCA revenue. 10. From June 2023, NNPC stopped reporting deductions on the template. Rather, there was a section called Transfers, comprising 2 components: a. Transfer from PSC profits, comprising: i. PSC (FEF) ii. PSC (Mgt Fee) iii. Federation PSC profit share b. NNPC Ltd. calendarized Interim dividend to Federation Account c. The addition of the components under Transfer from PSC Profits was equal to total revenue from domestic crude oil and gas sales |

In recent years, Nigeria’s oil production (including condensates) has declined from the standard 2m barrels per day (mbpd) to a low of 1.1mbpd though this has recently stabilised around 1.4-1.6mbpd. As a result,crude oil production has not been able to meet budgetary targets or OPEC production allocation quotas as shown in charts above. This failure has been attributed to reflect a mixture of theft, outages from downtime during repairs and declines in underlying production as Nigerian oil fields mature in the face of reduced investments.

Since the 2010s, international oil majors have scaled back investment in Nigeria in the face of regulatory uncertainty following the delayed passage of the Petroleum Industry Bill, rising operating costs due to increased security and environmental clean-up, and growing pressures from climate change activists to cut emissions from oil projects with high greenhouse gas emissions. These factors have pushed oil majors to shift investments away from the high-cost onshore fields with less attractive fiscal terms to deep offshore projects with more favourable fiscal terms and greater stability. The preference for offshore assets has seen a wave of asset disposals of onshore fields to domestic producers who have struggled to increase production given their weaker access to global capital markets to raise financing for exploration and production.

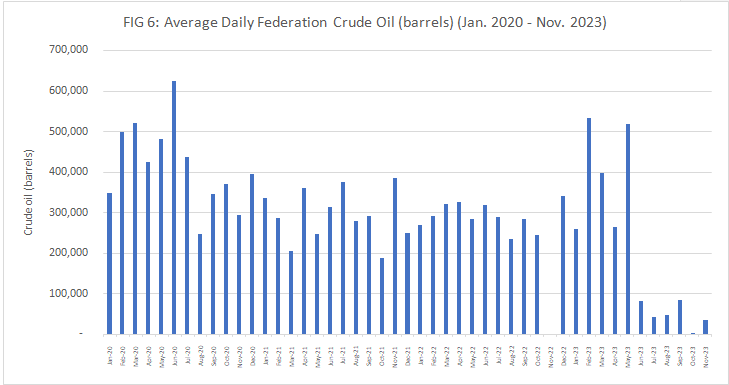

The derivative of the reduced oil production is that the Federation’s share of oil production has fallen dramatically. The daily average of the Federation’s share of crude oil was 414,463 barrels in 2020, 292,198 barrels in 2021, 290,649 barrels in 2022, and 205,184 barrels in 2023 (Figure 6). These are far below the daily average of one million barrels per day that accrued to the Federation between 2004 and 20149.Another important dynamic of import is that Nigeria’s oil production is now largely concentrated in Production Sharing Contracts (PSCs), where, by their design, oil companies get a larger share of production.

Sources: NNPC Presentations to the Federation Account Allocation Committee (FAAC) Meeting

Notes: 1. The author was unable to obtain data for November 2022

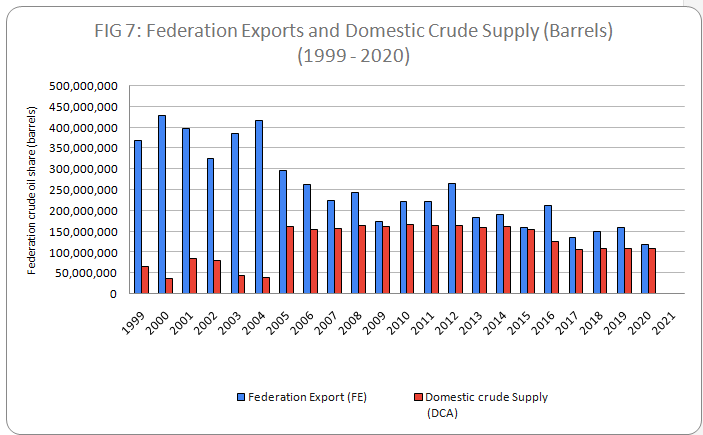

The net effect of the lower Federation share of crude oil is that domestic crude has assumed a larger portion of the Federation’s share of crude oil (Figure 7). As total Federation crude has fallen continuously in the past four years, an increasingly larger share has been allocated for domestic sales (Figure 8). Domestic crude allocation reached 99% of total Federation allocation in May 2021. Since then, it has not fallen below 95% (exceptions were in June 2021, March 2022, February - March 2023, June – August 2023, October 2023).

The dominance of domestic crude allocation has important implications for the foreign exchange market. Because sales of domestic crude are received in Naira, the fact that virtually all Federation sales of crude oil since May 2021 have been of domestic crude means that the bulk of crude oil revenue has been received (when it is received) in Naira, rather than in dollars. The fact that crude oil revenue is no longer being received in dollars has important negative implications for the supply of dollars in the economy, and the nation’s external reserves.

Sources: NEITI Oil and Gas Audit Reports

Sources: NNPC Presentations to the Federation Account Allocation Committee (FAAC) Meeting

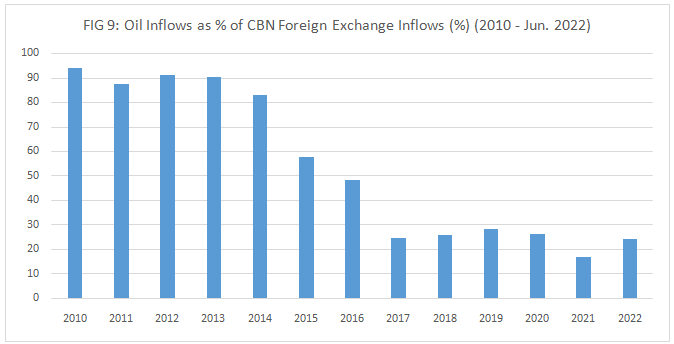

Notes: 1. The author was unable to obtain data for November 2022

The oil and gas sector has traditionally accounted for the largest part of foreign exchange inflows to the Central Bank of Nigeria (CBN) (Figure 9). In 2010, foreign exchange inflows through the oil sector accounted for 94% of total inflows through the CBN. However, this started falling and had dropped to 24% in June 2022 (January to June).Foreign exchange inflows through the oil sector which were above 80% between 2010 and 2014, fell and remained below30% from 2017 to 2022 (Figure 9).

Source: CBN Quarterly Statistical Bulletin, volume 11, no. 2, June 2022

Notes: 1. The data ends in June 2022, because the CBN no longer provides disaggregated data on foreign exchange inflows

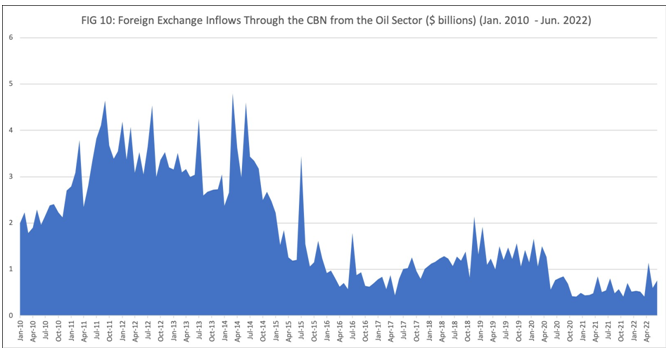

In January 2010, the oil sector brought in $1.99 billion through the CBN. This increased and reached $4.79 billion in March 2014 (Figure 10). Following this, it started falling and dropped to $922 million in January 2016. It rose and remained largely above $1 billion between July 2017 and April 2020. Then, it started falling and remained below $1 billion until June 2022 (with the exception of April 2022). Optically, the secular downtrend in oil inflows coincided with the start of the DSDP programme which used DCA crude allocation at a period of low oil prices. Following the recovery in prices over 2017 and in the 2021-2022 period, oil inflows have failed to recover mainly because most of Federation’s share of oil is being allocated for domestic consumption which does not translate to forex earnings. At an average price of $100/bbl and $84/bbl over 2022 and 2023, the nameplate DCA crude of 445kbpd would have translated into monthly inflows of $1billion to external reserves. However, as these sums were likely received in Naira, the opportunity cost is the reduced supply of FX by the CBN and the resulting demand pressures on the Naira.

Source: CBN Quarterly Statistical Bulletin, volume 11, no. 2, June 2022

Notes: 1. The data ends in June 2022, because the CBN no longer provides disaggregated data on foreign exchange inflows

While quick fixes cannot be implemented for returning steady foreign exchange inflows from oil to the levels experienced 10 years ago, ending the DCA and exporting the Federation’s share of crude oil can provide a steady supply of foreign exchange inflows. This would boost oil sector foreign exchange inflows through the CBN above the average of 24.2% experienced between 2017 and 2022. Assuming an average oil price of $70/bbl, the cessation of DCA could, before deductions, net $900million monthly which should bolster USD liquidity flows within the FX market. Critically, this will not be a temporary measure, but will be a steady supply of foreign exchange as long as crude oil is sold. Such steady supply will help in bringing some stability to the foreign exchange markets.

Fundamentally, with the removal of petrol subsidiesand the implementation of the PIA, there are virtually no more reasons for continuing with the DCA. Furthermore, the onset of the Dangote Refinery with a nameplate capacity of 650kbpd alongside recent announcements regarding a mechanical completion of repair work at the Port Harcourt Refinery (150-210kbpd) would imply a DCA that will further dim the prospects of forex from Federation’s share of oil if receipts are in Naira. Beyond legal realities, the DCA is impractical given the evolving dramatic changes in domestic refining capacity.

A caveat about the removal of petrol subsidies and implementation of the PIA is needed.

First, on subsidies, there have been reports that petrol subsidies are back in some form. The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN) has stated that the government has restored subsidies10. The World Bank indicated the reemergence of an implicit petrol subsidy11.The Independent Petroleum Marketers Association of Nigeria (IPMAN) has also said subsidies have only been reduced, but not removed12. Careful consideration and strategic planning are needed on the issue of subsidies. The oft-touted palliative measures to alleviate the increase in cost of living of the hike in petrol prices have yet to fully materialise. This, perhaps, has been responsible for the reluctance of the government to allow the prices of petrol to fully reflect market prices. There needs to be a well-thought out and clear policy direction on the issue of petrol subsidies and the need to pursue full deregulation and extricate the country from the awkward and perverse incentives-ridden situation where NNPCL becomes the sole importer of petrol.

Second, on the PIA, recent guidelines by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) have addressed the argument that local refineries need to be supplied with crude oil13. However, it is hoped that the new guidelines will stipulate that such domestic sales of Federation crude, if applicable, will be quoted in international prices and the payment will be made and received in foreign exchange. Failure to do this and properly manage and administer these new guidelines could present DCA version 2.0. Also, strict payment schedules must be stipulated and adhered to, so that there will be no backlog of payments. If properly administered, this new policy should not adversely affect foreign exchange inflows.

Conclusion

We have conducted an analysis of the rapid depreciation of the Naira in recent years. The central theme is that the supply of foreign exchange has not been able to meet up with its demand, leading to a backlog of foreign exchange obligations estimated at between $4 billion and $7 billion. With oil exports acting as a major enabler of foreign exchange inflows, the nation’s dwindling oil production was identified as an important contributor to lower supply of foreign exchange.

With lower oil production, higher proportions of the Federation’s share of crude oil have been allocated to domestic crude sales. Revenue from domestic sales is received in Naira, as opposed to dollars, thereby heightening scarcity of foreign exchange. We submit that the DCA has outlived its usefulness, and its continued use has proved costly to the country, especially for inflows of foreign exchange, thereby hurting the Naira. We recommend ending the DCA and selling Federation’s crude oil for exports, or if sold domestically to private refineries, to be sold in dollars. If this is done, steady inflows of foreign exchange will boost supply of foreign exchange, provide some quick wins to address foreign exchange scarcity, and help to maintain some level of stability for the Naira.

In October, the Federal Government announced plans for the injection of $10 billion of foreign exchange inflows14. These are expected to materialise from a variety of sources. Two executive orders were signed by the president in October: the first one will enable dollar-denominated instruments to be issued for purchase within the country; while the second is for issuance of dollar-denominated bonds for purchase by investors outside Nigeria15. Also, foreign exchange inflows are expected to receive a boost from the NNPCL through increased production, transactions such as forward sales, and investments from sovereign wealth funds16. In addition, NNPCL in August announced a $3 billion emergency crude oil repayment loan from the African Export Import Bank (Afrexim bank) “to support the Naira and stabilise the foreign exchange market”17.

Our central argument in this intervention is that while these measures can offer some succour and ease the pressure on the Naira, they do little to ensure a steady inflow of foreign exchange. They only provide emergency and temporary relief for foreign exchange stability.

In some instances, these measures have costs that, when fully considered, seem to outweigh the benefits. For example, the arrangement between NNPCL and Afrexim bank is a ‘pre-export finance facility’ (PxF) where the country has pledged 90,000 barrels per day for five years (2024 – 2028)18. This facility attracts an interest rate of 11.85%, which does not compare favourably with lower interest rates charged by international institutions for a longer period19. It is difficult to contextualise how the net effect of this facility will be of benefit, rather than loss to the country. It is more productive for NNPCL to concentrate on its core mandate and for the government to focus on how Nigeria can start earning foreign exchange again from the sale of the Federation’s share of oil. The DCA needs to go immediately.

*Professor Fowowe is an energy economist.

** Wale Thompson and Ifetayo Idowu contributed to this paper.

Footnotes

[1]The rate rose to N1,099.05/$1 on 8 December 2023 at the I & E window, but dropped back below N1,000/$1

[2] https://punchng.com/cardoso-to-clear-dollar-debts-suspend-intervention-loans/

[3] https://www.reuters.com/business/finance/nigerias-central-bank-governor-cardoso-pledges-clear-7-billion-forex-backlog-2023-09-26/

[4] https://www.cbn.gov.ng/Out/2023/CCD/CBN%20Press%20Release%20%20FX%20Market%20121023.pdf

[5]In reality, for many years, the crude oil has neither been utilized nor sold domestically, hence, the term ‘domestic’ has become a contradiction.

[6]NEITI 2021 Oil and Gas Audit Report

[7] Sayne, A., Gillies, A. and Katsouris, C. (2015) Inside NNPC Oil Sales: A Case for Reform in Nigeria, Natural Resource Governance Institute.

[8]https://www.premiumtimesng.com/news/top-news/631482-nigerian-govt-still-pays-subsidy-on-petrol-pengassan.html

[9]https://documents1.worldbank.org/curated/en/099121223114542074/pdf/P5029890fb199e0180a1730ee81c4687c3d.pdf

[10]https://punchng.com/nnpcl-marketers-clash-over-subsidy-operators-peg-petrol-at-n1200-litre/

[11]https://www.nuprc.gov.ng/wp-content/uploads/2023/12/DOMESTIC-CRUDE-SUPPLY-OBLIGATIONS.pdf

[12]https://www.premiumtimesng.com/news/top-news/636428-nigeria-expects-10-billion-forex-inflows-in-weeks-minister.html

[13]https://www.bnnbloomberg.ca/nigeria-plans-new-fx-rules-in-hopes-of-naira-reaching-fair-price-by-end-of-2023-1.1991306#:~:text=Nigeria%20expects%20to%20receive%20%2410,summit%20in%20Abuja%20last%20week.

[14https://www.premiumtimesng.com/news/top-news/636428-nigeria-expects-10-billion-forex-inflows-in-weeks-minister.html

[15]https://www.thecable.ng/report-afreximbank-approaches-oil-traders-to-finance-3bn-loan-to-nnpc

[16]https://www.thecable.ng/exclusive-nigeria-to-pay-11-85-interest-on-3-3bn-afriexim-nnpc-loan-pledges-164m-barrels-as-security#google_vignette

[17]Ibid.