By Samuel Ajayi and Maryam Ibrahim | In the last 12 months, there have been some significant shifts in the size and structure of the revenues shared to the three tiers of government and other statutory recipients by the Federation Accounts Allocation Committee (FAAC).

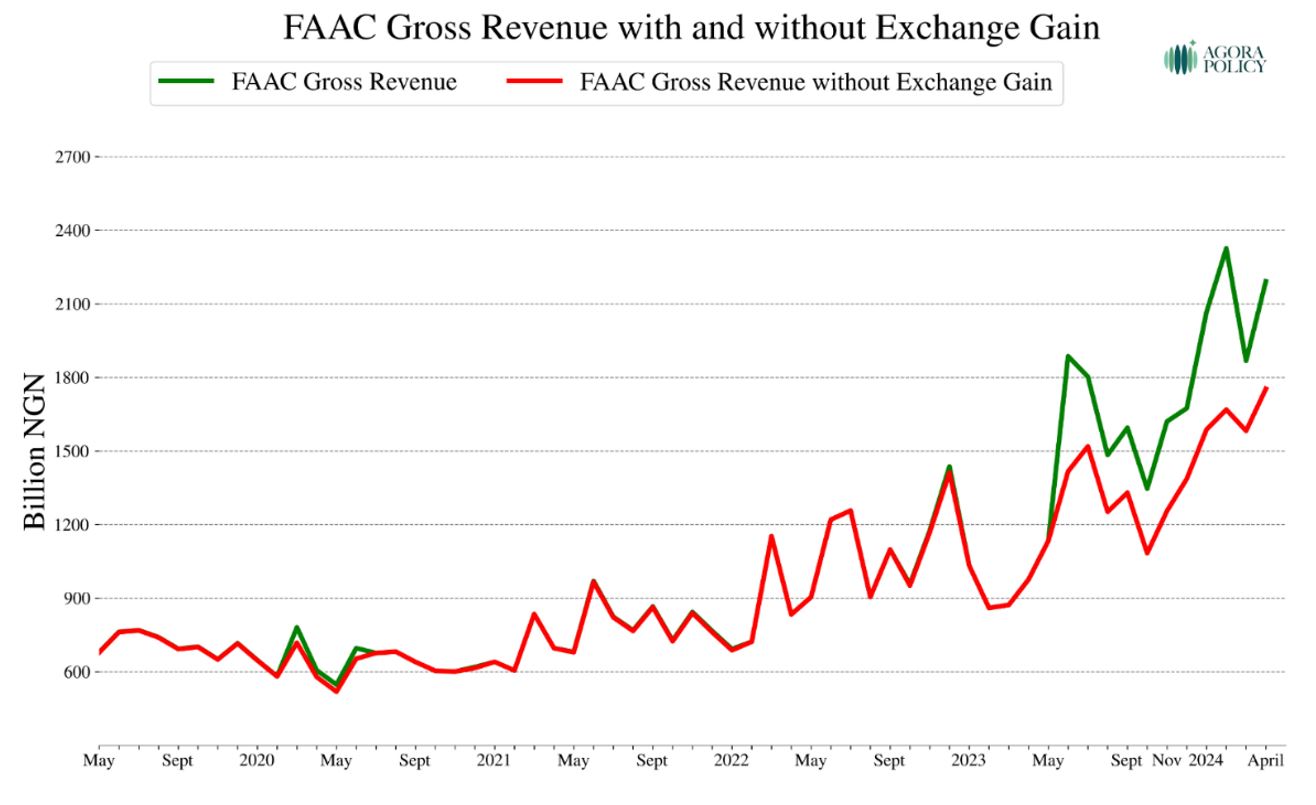

A major highlight is the sudden prominence of exchange gain as a component of FAAC revenues.

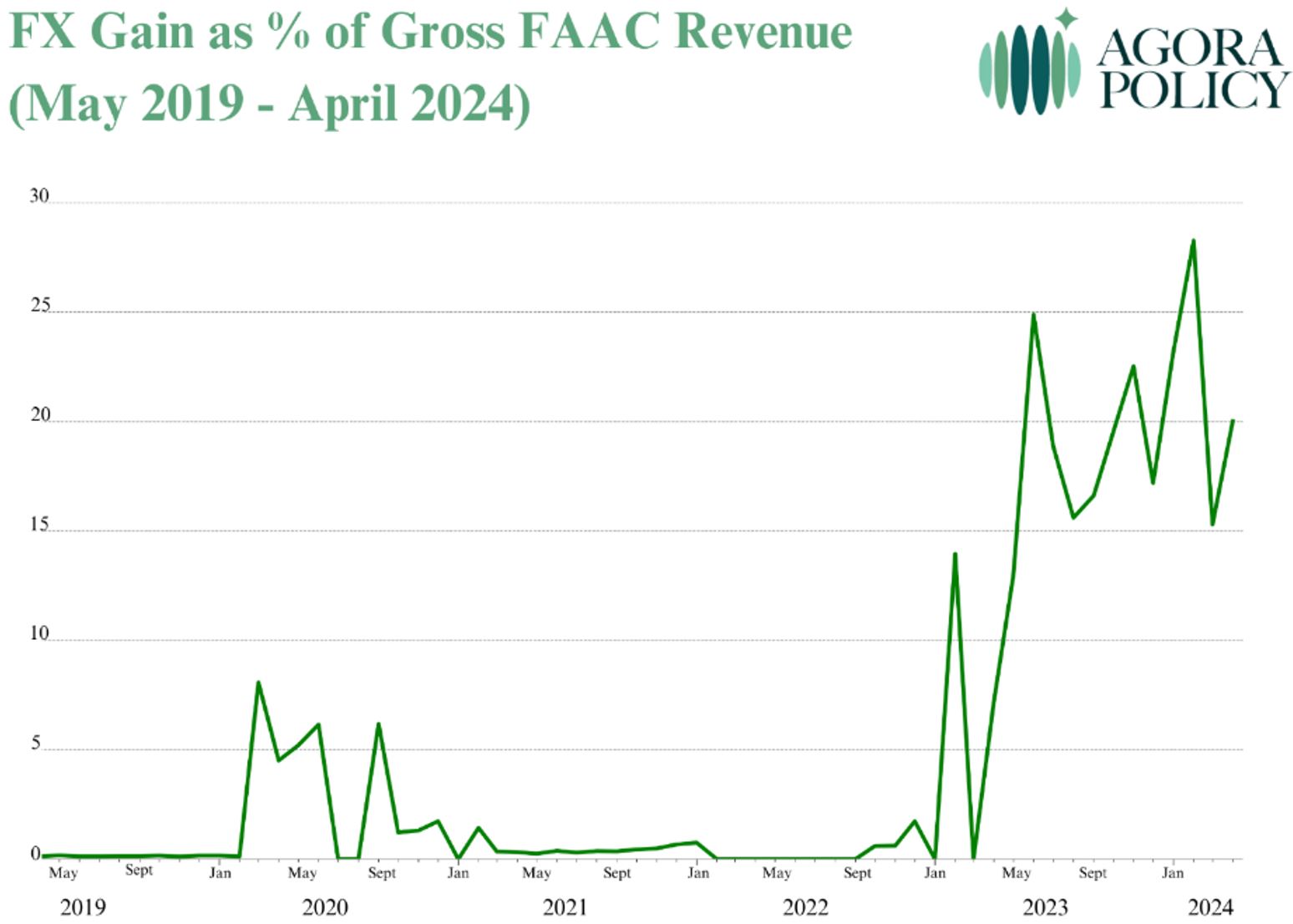

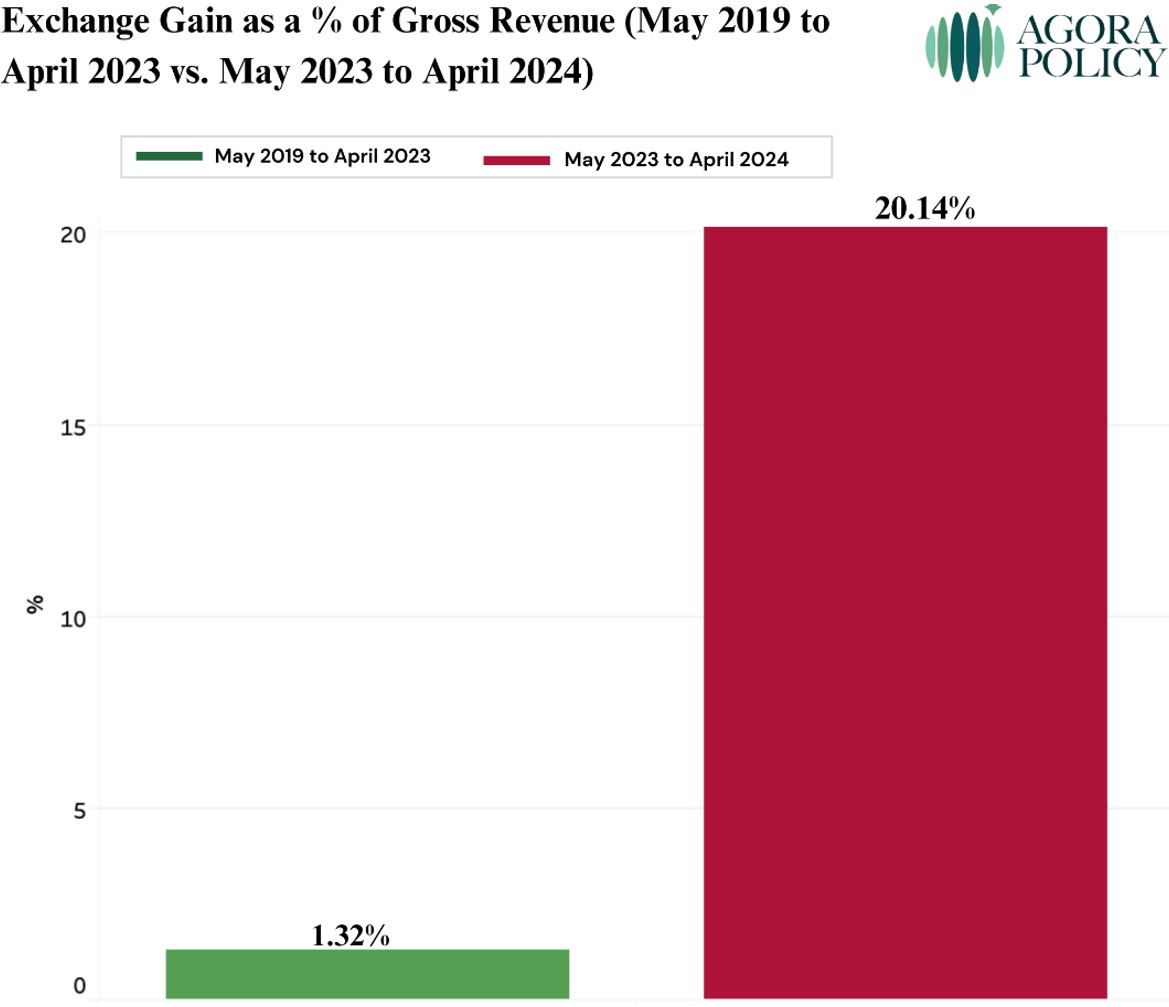

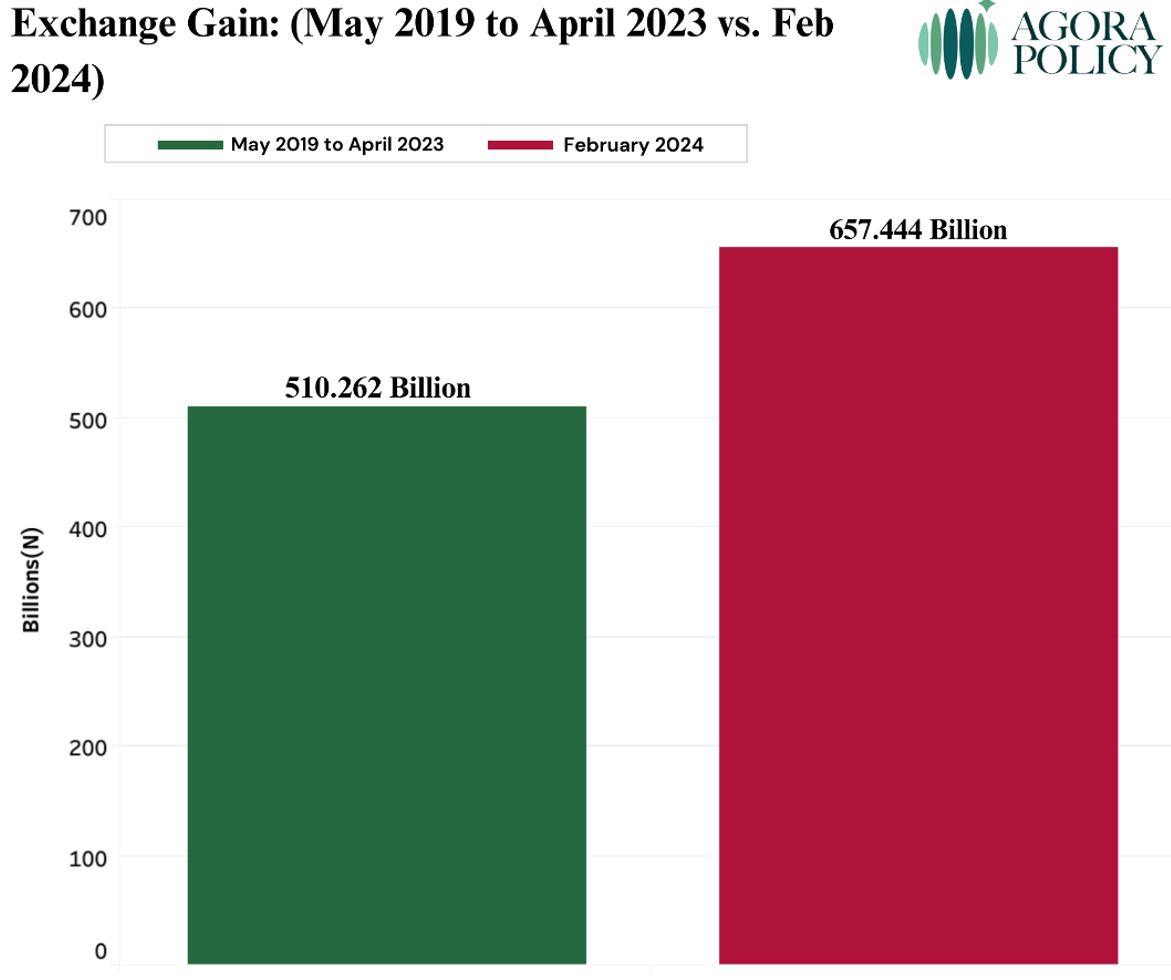

From May 2023 to April 2024, a total of N4.23trillion was shared as exchange gain by FAAC, representing 20.14% of N20.99 trillion, which was the gross FAAC revenue for the 12-month period. It is noteworthy that in February 2024, exchange gain recorded its best performance to date: it brought in N657.44 billion, or 28.26% of the gross FAAC revenue for the month.

Exchange gain represents the difference between the exchange rate projected in the budget and the actual rate at which applicable revenue streams are converted at FAAC. While exchange gain has been a feature of FAAC overtime, it was not prominent as there were only minor deviations between the budget’s exchange rate and the actual official exchange rate. Such deviations mostly occurred when there were devaluations or a slightly higher exchange rate was used to convert oil revenue at FAAC. However, the picture changed following the foreign exchange reforms that commenced on 14th June 2023 with resultant effect of large spreads between the budget rate and the actual official rate.

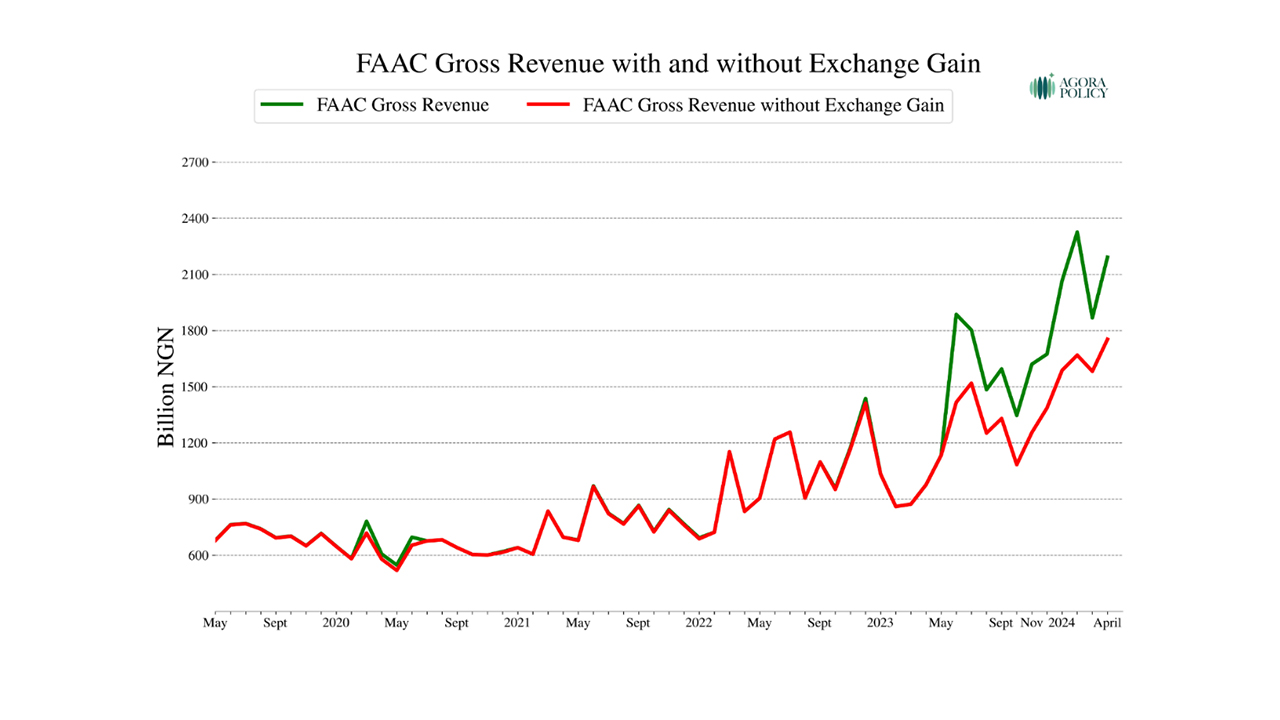

Figure 1: Prominence of Exchange Gain Since May 2023

Source: National Bureau of Statistics; FAAC Communique

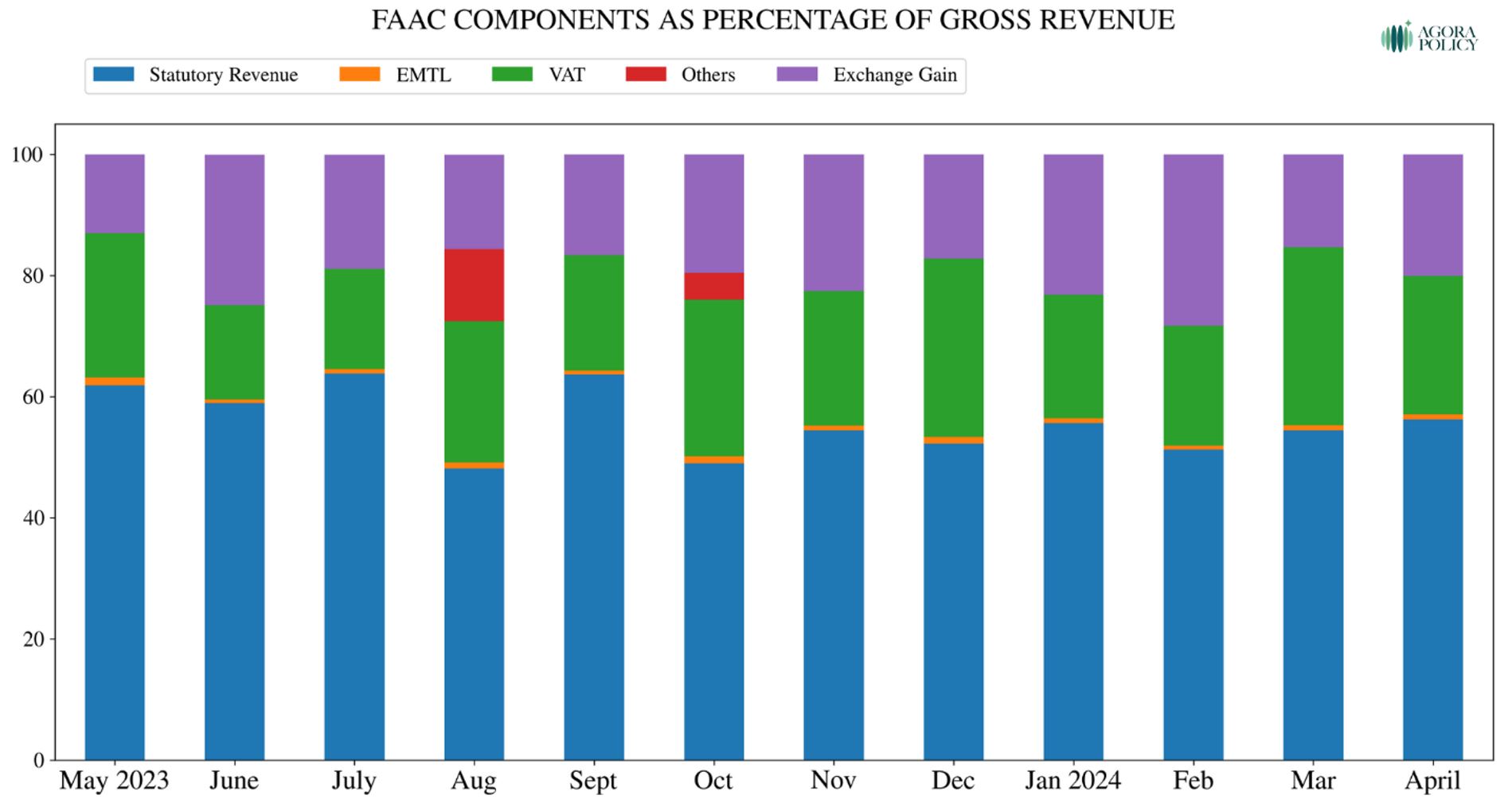

Figure 2: Sudden Ascendance of Exchange Gain from May 2023

Source: National Bureau of Statistics; FAAC Communique

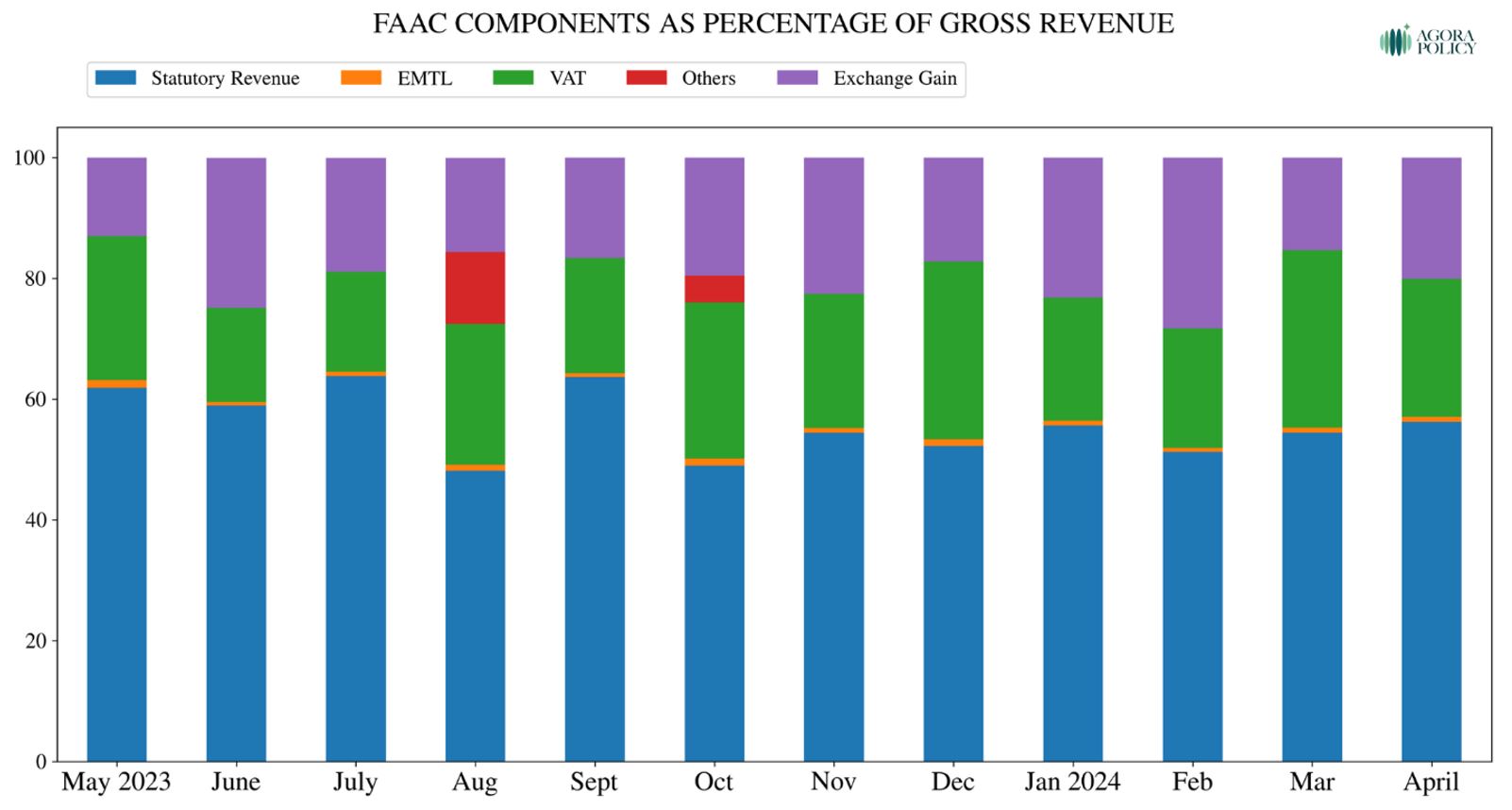

While the exact composition of the FAAC revenue pool has changed over time, it has largely comprised two main streams: Value Added Tax (VAT) and Statutory Revenue (subdivided into mineral revenue and non-mineral revenue). Other sources of revenue which have changed in magnitude and presence over time include: exchange gain, excess PPT savings, FOREX equalisation, excess bank charges, NNPC refund, and Electronic Money Transfer Levy (EMTL). While the other sources have been small, exchange gain has massively increased in the past year, even surpassing VAT’s contribution to FAAC in two months: June 2023 and February 2024. (See Figures 1& 2.)

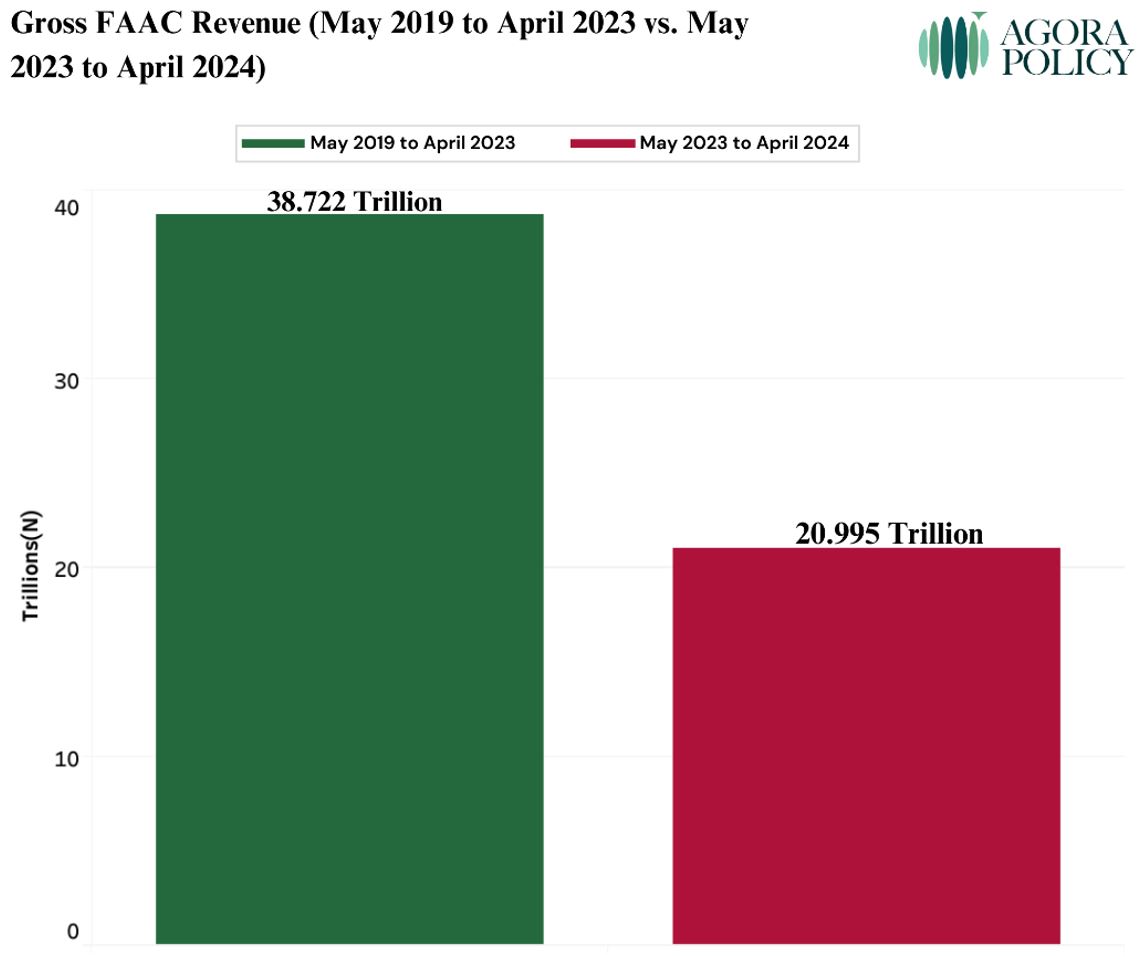

To fully understand what is going on and put things in broader perspective, we examined FAAC data for a five-year period, spanning May 2019 to April 2024. Gross revenue, rather than net revenue, is used so as not to exaggerate the contribution of exchange gain to FAAC revenue.

Figure 3: Exchange Rate over Five Years

Source: National Bureau of Statistics; FAAC Communique

Figure 4: Gross FAAC Revenue Compared

Source: National Bureau of Statistics; FAAC Communique

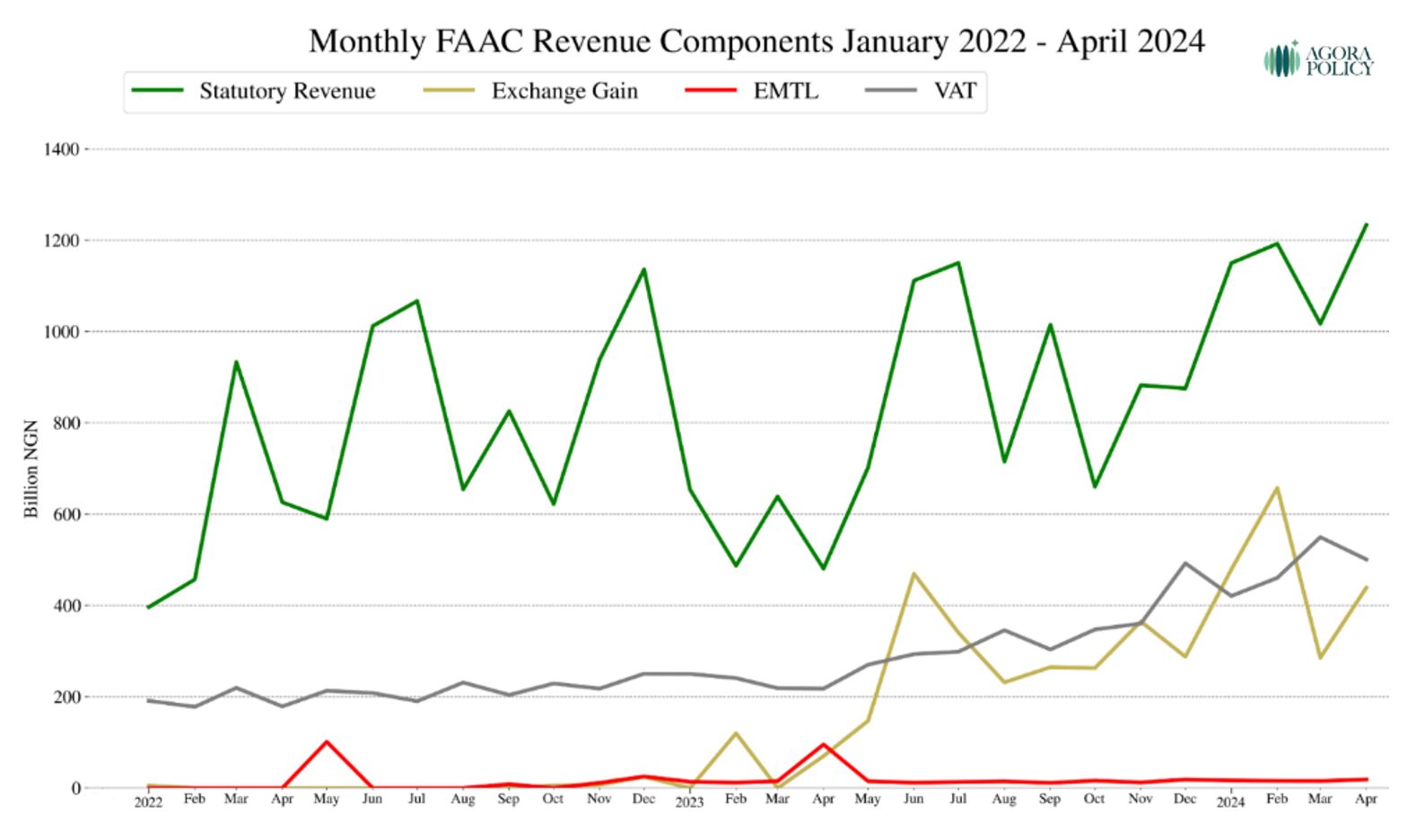

In the four years prior to May 2023, gross FAAC revenue was N38.72 trillion while the different forms of exchange gain shared amounted to just N510.26 billion, or a mere 1.32% of the gross FAAC revenue shared for the 48-month period. This contrasts sharply with the May 2023 to April 2024 era when only exchange gain accounted for a princely 20.14% of gross revenue. Significantly, the gross FAAC revenue for one year (N20.99 trillion) was more than half, or was 54.21%, of the total gross FAAC revenue for four years (N38.72 trillion), which underscores the outsized impact of exchange gain on gross revenue in the last 12 months at FAAC. (See Figures 3 and 4). Below are some of our other observations/findings:

- 12 Months Accounted for about 90% of the Total Exchange Gain in Five Years

The total exchange gain recorded from May 2019 to April 2024 amounted to N4.74 trillion. Out of this, only N510.26 billion was recorded as exchange gain for the four-year period from May 2019 to April 2023. However, the exchange gain for May 2023 to April 2024 was N4.23 trillion (see Figures 5 and 6). This means that one year accounted for 89.23% of the exchange gain in five years; while the prior four years contributed only 10.77% of the exchange gain in the five-year period. Put another way, 80% of the period under consideration produced only about 11% of the exchange gain while 20% of the period resulted in almost 90% of the exchange gain. The reason for this is not difficult to fathom: exchange gain swelled into prominence after the floating of the Naira by mid-June 2023.

Figure 5: Exchange Gain Values Compared

Source: National Bureau of Statistics; FAAC Communique

Figure 6: Proportion of Exchange Gain Compared

Source: National Bureau of Statistics; FAAC Communique - From the Margins, Exchange Gain Moved into the Mainstream from May 2023

For most of the five-year period, exchange gain hardly appeared as a significant item on FAAC records. During the 60 months under review, exchange gain recorded less than 1% of gross FAAC revenue for 37 months, ranging from zero percent in 10 months to 0.75% in January 2022. For 11 months, exchange gain recorded between a low of 1.22% in October 2020 and a high of 13.95% in February 2023. However, the fortune of exchange gain got transformed in the last one year when it became a major source of FAAC revenue with contribution ranging from a minimum of 12.97% in May 2023 to a peak of 28.26% in February 2024. The increasing eminence of exchange gain rubbed off positively on its beneficiaries because they have had more money to share (or would have had much less to share without it). The beneficiaries of exchange gain are: the states that earn 13% derivation, and the Federal Government, all the 36 states and the 774 local government areas that respectively take 52.68%, 26.72%, and 20.60% share of the exchange gain less 13% derivation. In FAAC disbursement for January 2024, a sum of N200b was saved in non-oil excess account from exchange gain.

Figure 7: Proportion of FAAC Gross Revenue Handles in One Year

Source: National Bureau of Statistics; FAAC Communique - Exchange Gain in February 2024 was 128% of the Total for 48 Months

February 2024 was a special month for exchange gain at FAAC. It contributed N657.44 billion or 28.26% of gross FAAC revenue of N2.33 trillion. That is highest exchange gain haul so far both in terms of absolute number and percentage contribution. Interestingly, the exchange gain of 657.44 billion for February 2024 amounts to 128.84% of the total exchange gain of N510.26 billion for the 48 months or four years from May 2019 to April 2023 (See Figures 7 and 8). Cue: the average official exchange rate for February 2024 was N1509.83/$, as against the 2024 budget rate of N800/$.

Figure 8: One Month’s Exchange Gain Vs 48 Months’

Source: National Bureau of Statistics; FAAC Communique - Lifted by FX Gain, Gross FAAC Revenue Has Seen a Surge

The monthly average of gross FAAC revenue for the period May 2019 to April 2023 was N806.71 billion. For this period, the lowest gross FAAC revenue was N547.31 billion in May 2020 and the highest was N1.44 trillion in December 2022. However, the monthly average from May 2023 to April 2024 was N1.75 trillion, an increase of 116.88% on the monthly average for the May 2019 to April 2023 period. In the last 12 months, gross FAAC revenue has crossed the N2 trillion mark thrice (January, February and March 2024). The lowest gross revenue for the period was N1.13 trillion in May 2023 while the highest was N2.33 trillion in February 2024.

A major reason for the consistent rise in gross revenue is the consistency of exchange gain. The monthly average for exchange gain for May 2023 to April 2024 was N352.45 billion compared to the monthly average of N10.63 billion for the May 2019 to May 2023 period. The lowest exchange gain in the last one year was N147.07 billion for May 2023 while the highest was N657.44 billion for February 2024.

It is noteworthy that gross FAAC revenue has been increasing despite the consistent shortfall between projected and actual revenues. For example, the April 2024 pro-rated budget for Statutory Revenue and VAT was N2.61 trillion while the actual revenue (inclusive of exchange gain) was N2.17 trillion or a revenue under-performance of 17%. Without the exchange gain of N438.88 billion for the month, the revenue shortfall would have been 33%. This underscores three salient points: Nigeria’s budget projections remain largely unrealistic; the oil sector is still a major drag on revenue (as mineral revenue experienced a 61% underperformance); and exchange gain has been bailing out and boosting federation revenue. See Figure 9).

Figure 9: Exchange Gain as a Booster

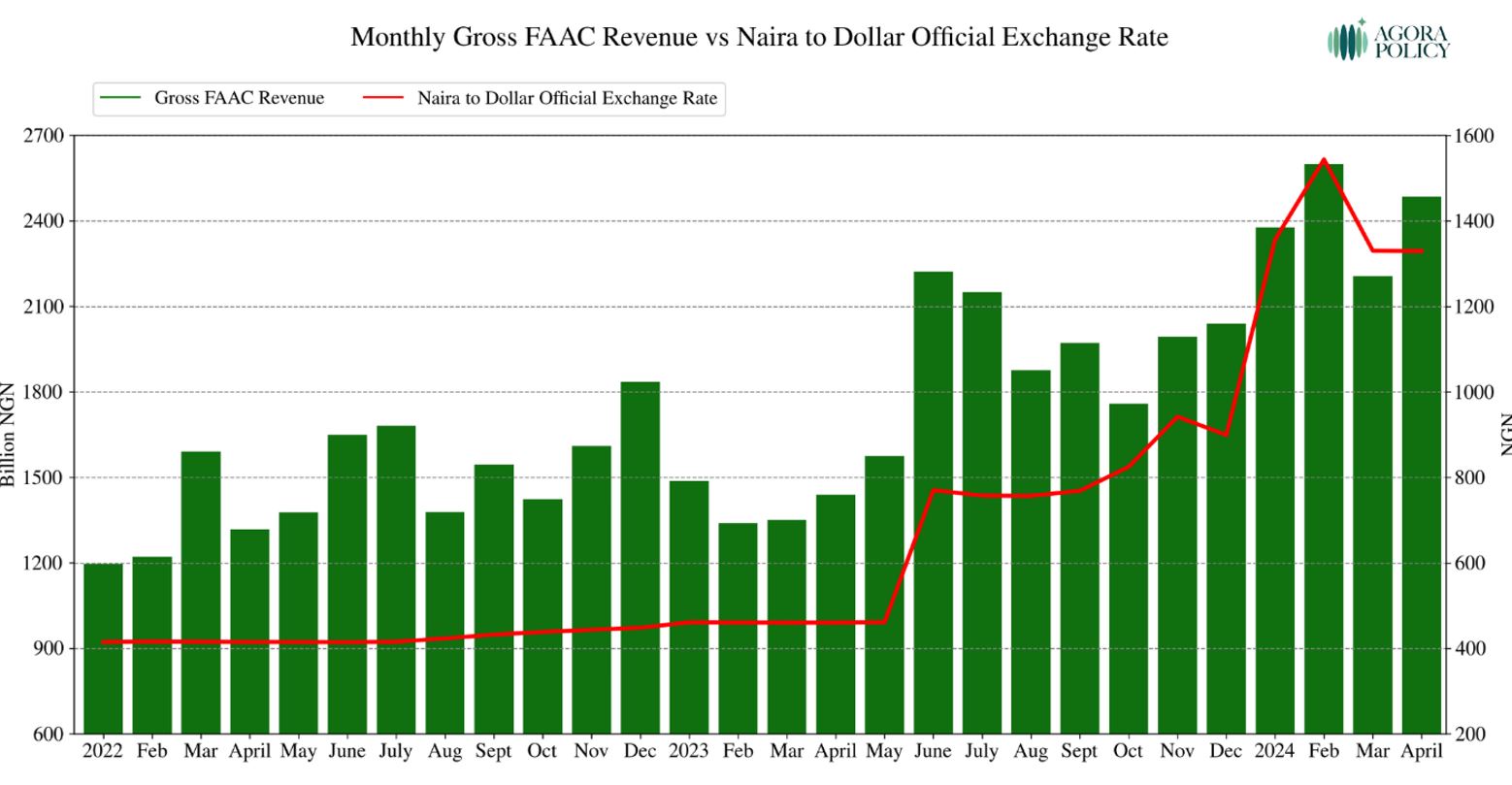

Source: National Bureau of Statistics; FAAC Communique - Rise in Gross FAAC Revenue Mirrors Rise in Exchange Rates

As stated above, the monthly average gross FAAC revenue for May 2023 to April 2024 was N1.75 trillion compared to the monthly average gross FAAC revenue of N806.71 billion for the May 2019 to April 2023 period. A major reason for the rise in revenue in the last one year is the sudden prominence of exchange gain, which itself can be traced to the spread between budget’s exchange rate and the actual official exchange rate. As shown in Figure 10, the official exchange rate was stable for a long time. But it swung upward from June 2023 and has stayed sky-bound since. Between May last year and now, the Naira has depreciated against the US dollar by about 70%.

Figure 10: FAAC Revenue and Forex Rate

Source: National Bureau of Statistics; FAAC Communique

Figure 11: Gross FAAC Revenue and Inflation Rate

Source: National Bureau of Statistics; FAAC Communique

A line can be drawn between this depreciation and increase in government revenue on one hand and from the depreciation to the rise in prices of goods and services on the other (as shown in Figure 11). As at April 2024, headline inflation was 33.69% while food inflation was 40.53%. This is not to say that there is a direct correlation between FAAC revenue and inflation. More study will be needed to understand the relationship between the two.

Link to download the policy insight:

https://agorapolicy.org/files/How Exchange Gain Became a Major Source of Federation Revenue.pdf

*Munir Salihu and Uchechukwu Eze contributed to this analysis.