By Ayobami Ayorinde and Oluchi Nkeonye | Nigeria is set to rebase its Gross Domestic Product (GDP) and Consumer Price Index (CPI) a decade after it undertook a similar exercise.

In October 2024, the Statistician General of the Federation said this was necessary to account for structural changes in the economy and to ensure that economic data accurately reflect current realities. Rightly said, as many changes have occurred over the time. The way people spend money, the types of goods and services they buy, and the sectors driving the economy have changed in the last decade.

When the 2014 rebasing was done, sectors like the film and video industries, telecoms, as well as information technology had to be included to show the true size of the economy, which saw an 89% increase in GDP size to $509.9 billion up from $285.56 billion. This made Nigeria Africa's largest economy. Currently, Nigeria ranks 4th on the continent in the dollar size of GDP according to IMF, largely on account of sharp fall in the value of the Naira.

The National Bureau of Statistics (NBS) in collaboration with the Nigerian Economic Summit Group (NESG), recently held a sensitisation workshop on the plan to rebase the country’s GDP and CPI. The announcement has ignited some controversies and thrown up some issues. This explainer focuses on what rebasing means and attempts to address some of the related issues.

What Does Rebasing Mean?

Rebasing is the process of revising the base year or reference point used to calculate various key economic indicators. For GDP, it involves updating the base year used to calculate the value of economic output to reflect changes in the structure and composition of the economy, while CPI rebasing revises the basket of goods and services, their weights, and the base year to better represent current consumer spending patterns and price levels. For example, Nigeria’s current GDP base year of 2010 may not account for the growth of sectors like the digital economy that have become significant in the last decade. Rebasing simply updates this information and offers a more accurate picture of the economy’s current size and structure. IMF advises conducting a rebasing exercise every five years to capture changes in economic activities accurately.

Changes in GDP and CPI Methodology

With the rebasing set to happen, enhanced data collection will be used in new areas to be covered in Nigeria’s GDP including- digital economic activities, quarrying and other mining activities, Nigerian Social Insurance Trust Fund (NSITF), pension funds administrators, domestic households as employers of labour, the National Health Insurance Scheme (NHIS), modular refineries, and surprisingly, illegal and hidden activities that might not contribute much to the size of the economy. Illegal and hidden activities like smuggling, are classified as part of the underground economy. As a result, they are usually excluded from GDP calculations by many countries due to the challenges in accurately estimating their contribution within the standard components of GDP: consumption, investment, savings, and net exports.

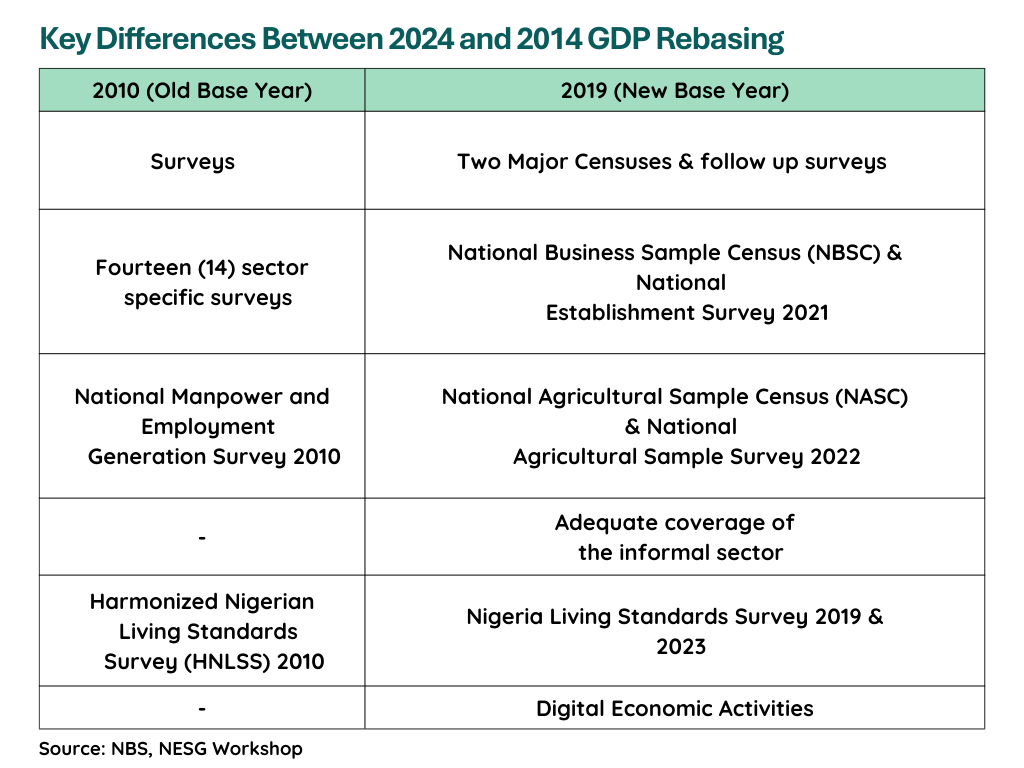

Compared to the previous rebasing which used the Harmonised Nigerian Living Standards Survey and the National Manpower and Employment Generation Survey of 2010, this new one seeks to utilise the more recent National Living Standards Survey of 2019 and 2023, the National Agricultural Sample Census Survey of 2022, the National Business Sample Census and National Establishment Survey of 2021. NBS has disclosed that the real estate sector is set to emerge as Nigeria's third-largest subsector, surpassing crude petroleum and natural gas, owing to its significance in the economy today.

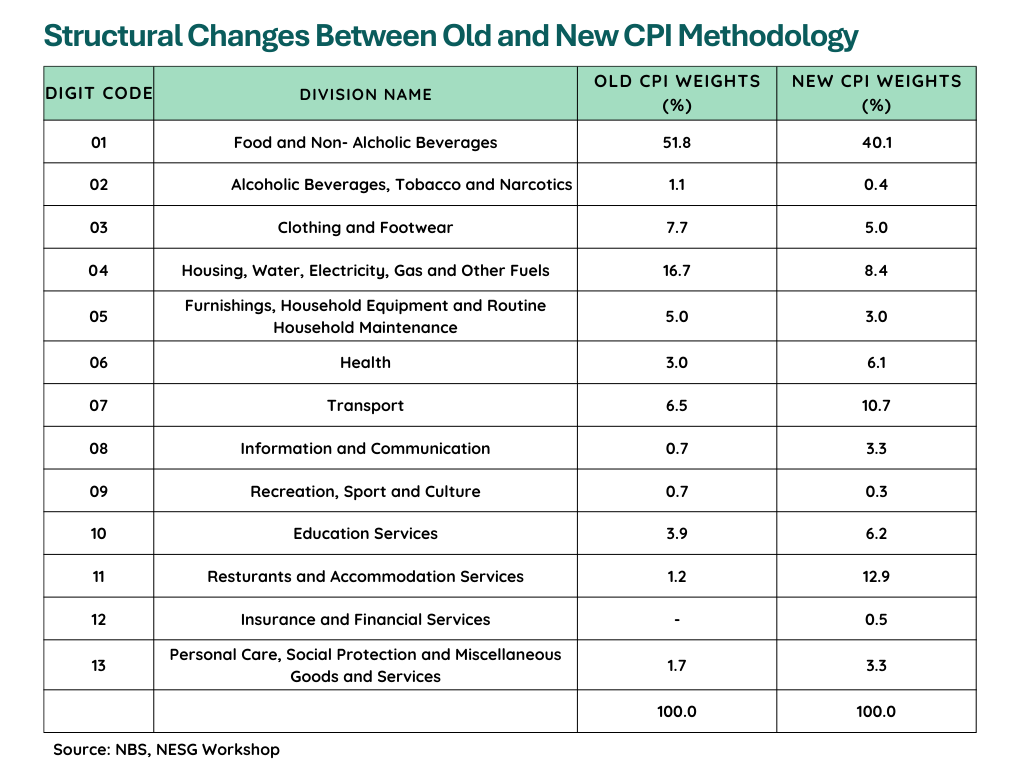

Several structural changes have been made to the methodology for computing CPI. Due to changing consumption patterns, the number of items in the CPI basket has now increased from 740 to 960. Additionally, a new division, "Insurance and Financial Services," has been added, raising the number of divisions in the classification from 12 to 13. Beyond the regular indexes computed by the National Bureau of Statistics (NBS), the rebased CPI will also include additional indexes at national and state levels, such as the services index, energy index, farm produce index, and goods index. The CPI weights have also been restructured. The share of food and non-alcoholic beverages has decreased from 51.8% to 40.1%, while the category of restaurants and accommodation services experienced the largest increase, rising from 1.2% to 12.9%. This reduction in the weight of food items may probably lower food inflation and reduce its volatility, as rising food prices have been a key driver of rising inflation.

Base Year Selection

When rebasing occurs, a year characterised by relative economic stability is usually selected as the base year to ensure that the data used for recalibrating economic indicators like GDP and CPI reflects a period with minimal disruptions. 2019 was chosen as the new base year for GDP calculations because it represents a relatively stable economic period (before COVID19 and other external and internal economic upheavals). However, the CPI used 2024 as the price reference period (the year for comparing prices) and 2023 as the weight reference period (the year for determining the spending patterns used in weighing the items in the CPI basket). According to the NBS, the purpose of updating the base year for CPI to 2024 is to account for economic shifts, including the removal of petrol subsidies, and ensure that inflation rates accurately reflect market conditions. However, the drawback is that the influence of unusual variations can cause inflation trends calculated from it to be exaggerated or understated.

Conclusion

GDP rebasing is likely to affect key metrics such as the debt-to-GDP ratio and the tax-to-GDP ratio. If GDP expands significantly, these ratios may decrease, but it should not be mistaken for actual changes to the country’s debt or tax challenges. While the official figures after rebasing remain uncertain until published by the NBS, GDP usually appears larger thereafter because it incorporates economic activities that were previously excluded, with the probable increase this time around reflecting more in Naira than in dollar terms (because of the significant depreciation of the national currency). It is important to note however that even an increase in Naira terms does not mean that the Nigerian economy has suddenly grown overnight or that everyone is better off—it is simply a more accurate representation of the current size and structure of the economy. Overall, the rebasing is useful and can improve fiscal and monetary policy formulation if objectively calculated, analysed and utilised.