By Ayobami Ayorinde and Uchechukwu Eze | Earlier this week, the National Bureau of Statistics (NBS) published the latest data on Internally Generated Revenue (IGR) for the 36 states and the Federal Capital Territory (FCT). The data covered the period from 2019 to 2023. In this report, we highlight a few key points from the data and what it indicates about the fiscal health of the states.

Total IGR Grew by 48 % in Five Years

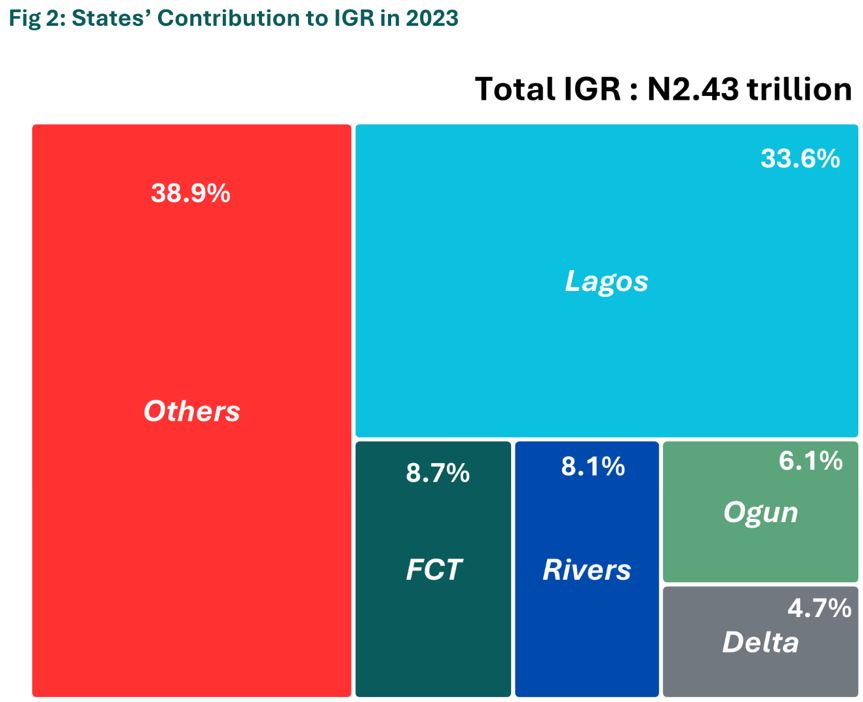

The total IGR for the states and FCT grew from ₦1.64 trillion in 2019 to ₦2.43 trillion in 2023, an increase of 48.17%. The highest year-on-year growth in this five-year period occurred between 2022 and 2023 from ₦1.93 trillion in 2022 to ₦2.43 trillion in 2023 representing a 26% increase. This increase is mainly attributable to two sources, which accounted for 71% of the total IGR for 2023: taxes from Pay As You Earn (PAYE) and revenue from Ministries, Departments, and Agencies (MDAs). The 2023 growth can also be possibly linked to increase in economic activities, improvement in tax collection by the states and increase in the prices of taxable goods and services due to the combined effect of rising inflation and weakening of the national currency. However, the highest yearly decline in IGR was recorded between 2019 and 2020, a decline of 4.6% from ₦1.64 trillion in 2019 to ₦1.56 trillion in 2020, likely due to COVID-19 disruptions. In 2023, Lagos State recorded the highest IGR of N815.9 billion while Taraba State recorded the least IGR of N10.87 billion. This represents a difference of 7,405% between the highest (Lagos) and the lowest (Taraba). IGR accounts for between 8% and 72% of the total revenues of states and is a good indicator of the financial health of the second tier of government. Other key sources for funding state budgets are: allocations from the Federation Account Allocation Committee (FAAC), grants, external aid and debt.

Lagos Remains the Undisputed IGR Champion

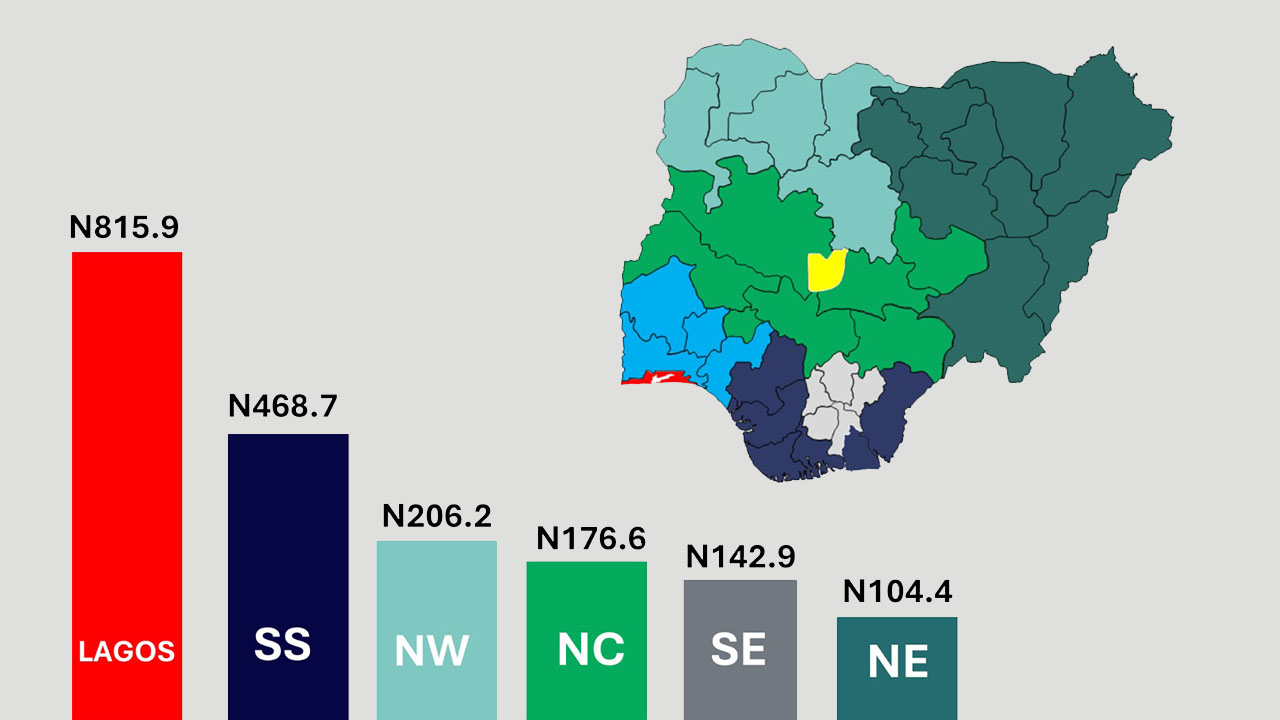

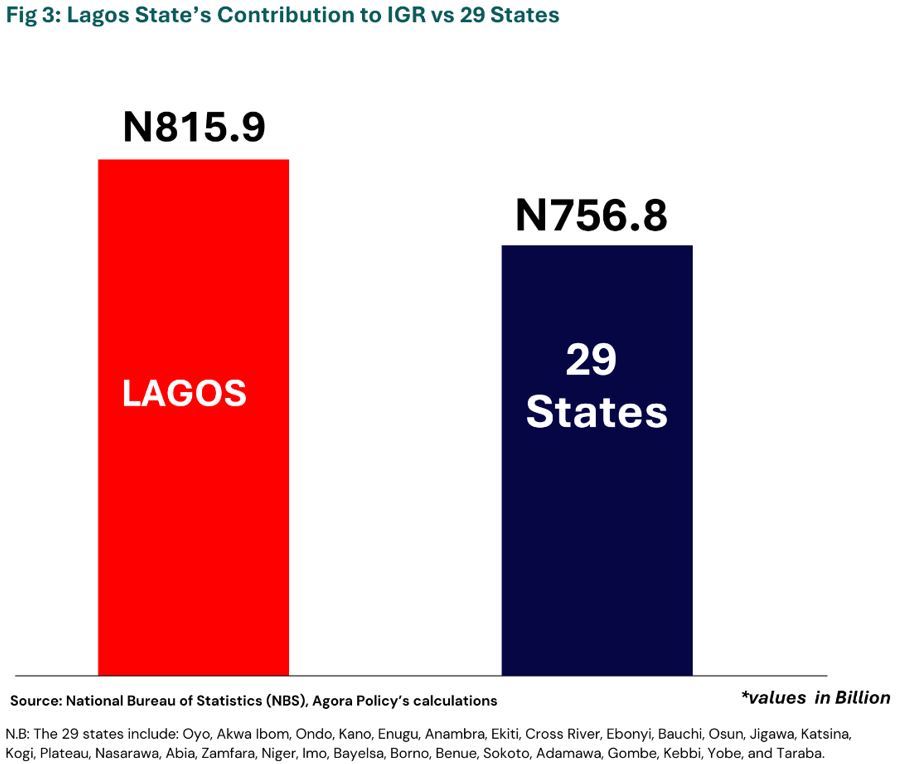

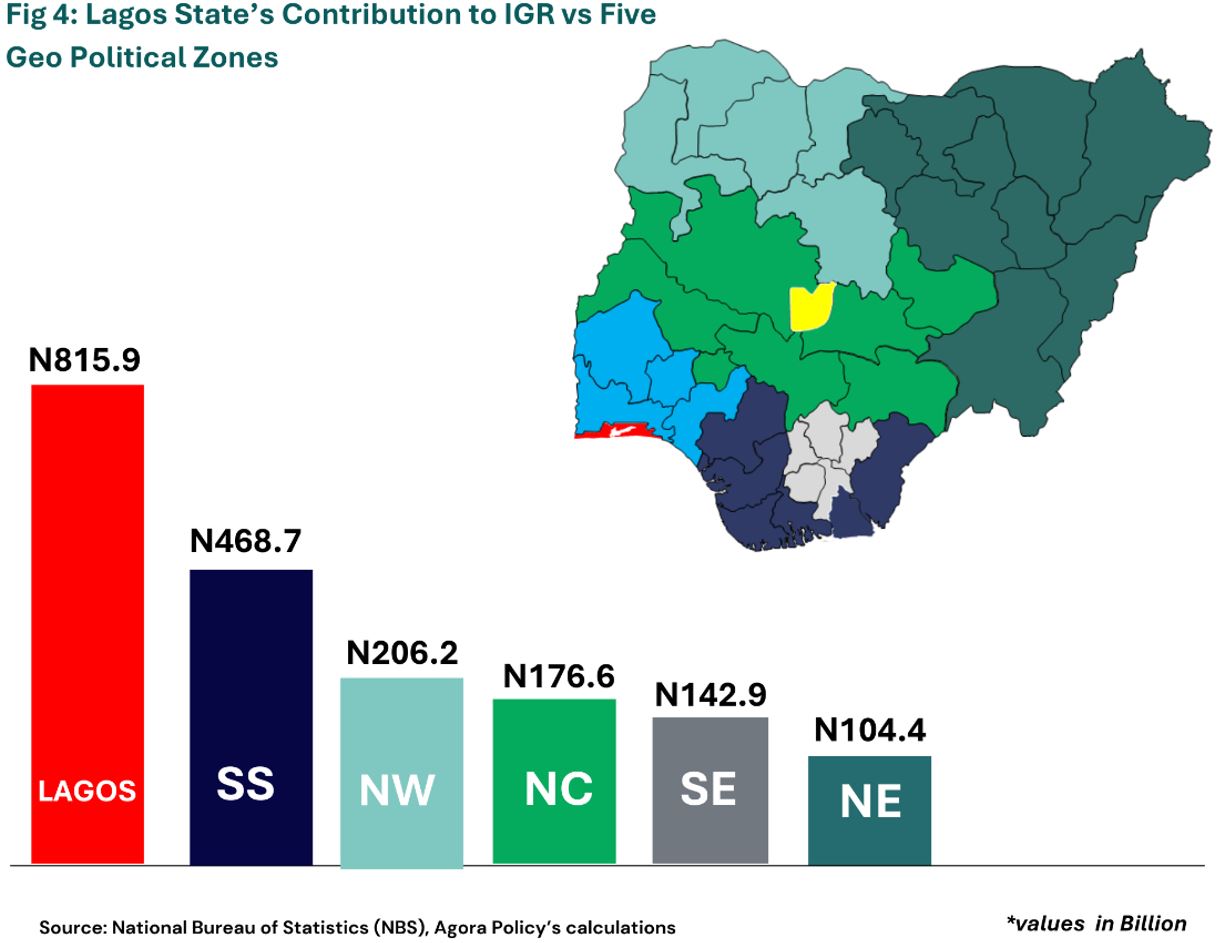

Lagos State stays miles ahead of the others in the IGR space, contributing 33.6% to the total IGR generated by the 36 states and FCT in 2023, an affirmation of the state’s towering status as Nigeria’s dominant commercial powerhouse. Between 2019 and 2023, the IGR of Lagos increased from ₦646 billion to ₦815 billion, an addition of N169 billion in five years. In 2023, the IGR of Lagos State (₦815.9 billion) exceeded the combined IGR for 29 states (₦756.8 billion). Lagos alone generated more IGR than each of the following geopolitical zones: South South (₦486.7 billion), North West (₦206.2 billion), North Central (₦176.6 billion), South East (₦142.9 billion), and the North East (₦104.4 billion). Also, the IGR of Lagos surpassed the combined IGR of North-Central, North-East, North-West, and South-East zones (₦630 billion). In addition, Lagos’s IGR was 7,405% higher than that of Taraba State, the state with the lowest IGR in the country.

In 2023, the trio of Lagos State, the Federal Capital Territory (FCT), and Rivers State accounted for half of total IGR generated by the 36 states and the FCT. The concentration of revenue generation within these few states poorly reflects on the revenue-generating capacity of the other states and geo-political zones and points at the need for improvement.

The impact of the contribution of Lagos is also evident when the six zones are compared. In 2023, the South West recorded the highest IGR of ₦1.12 trillion while North East recorded the least at ₦104.4 billion. However, the picture changes slightly when Lagos is taken out of the South West. The South West zone without Lagos (N301 billion) comes second behind the South South (N468 billion).

Overall, this imbalance shows that there is a need to increase the revenue-generating capacity of many states and zones in the country

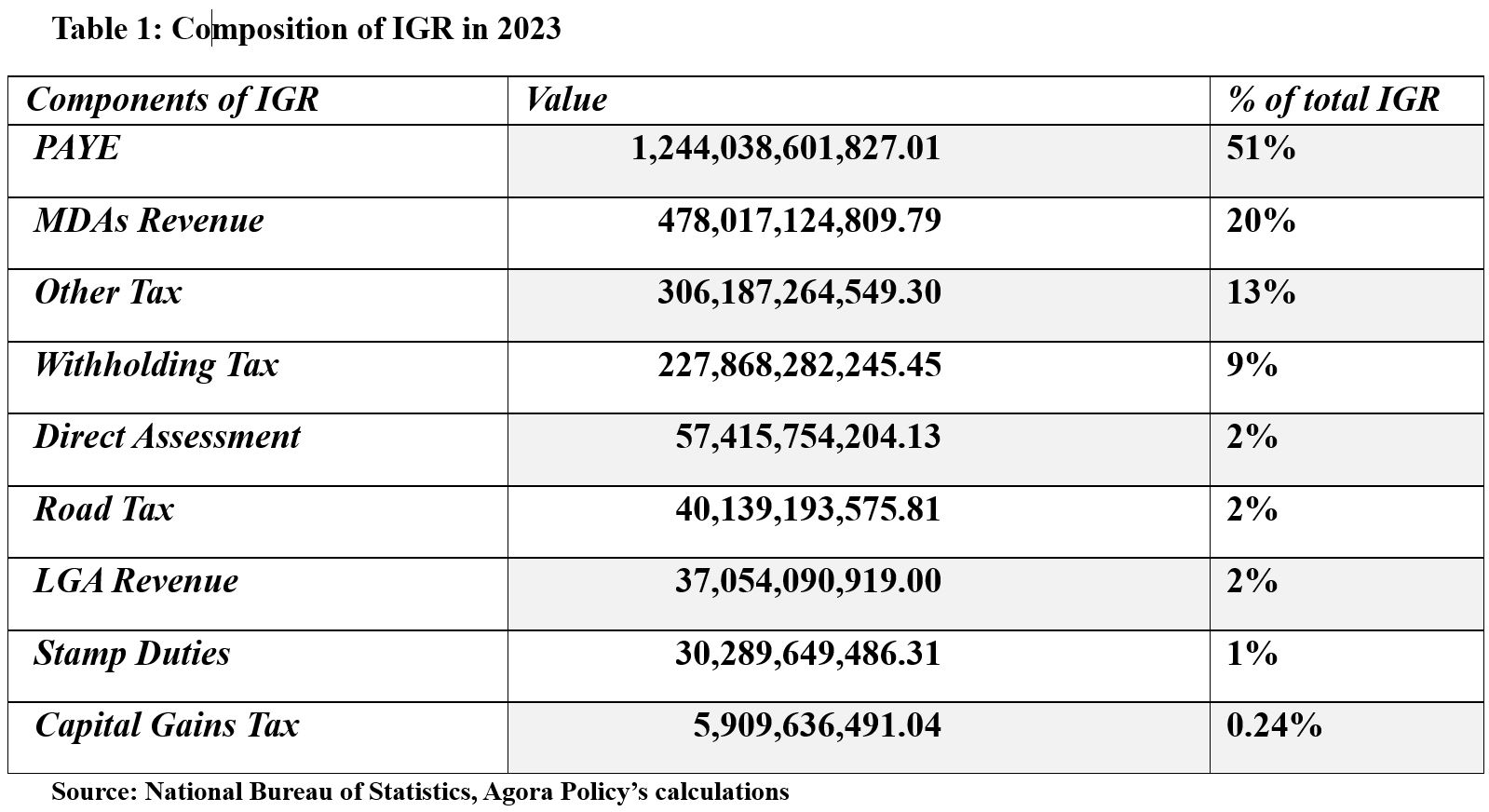

PAYE is the Major Driver of IGR

IGR by states and FCT is made up of PAYE, revenue from MDAs, Direct Assessment, Road Tax, Stamp Duties, Capital Gain Tax, Withholding Tax, Other taxes, and Local Government Revenue. However, PAYE remains the primary source of IGR, accounting for 51% of total IGR in 2023. It was followed by revenue from the MDAs, which contributed approximately 20%.

PAYE increased by 25% in 2023 compared to 2022, rising from ₦994 billion to ₦1.2 trillion. Other key IGR components also showed substantial growth in 2023 with revenue from "Other Taxes" surging by 70%, from ₦180 billion to ₦306 billion, while withholding tax revenues grew by 62%, increasing from ₦140 billion to ₦228 billion.

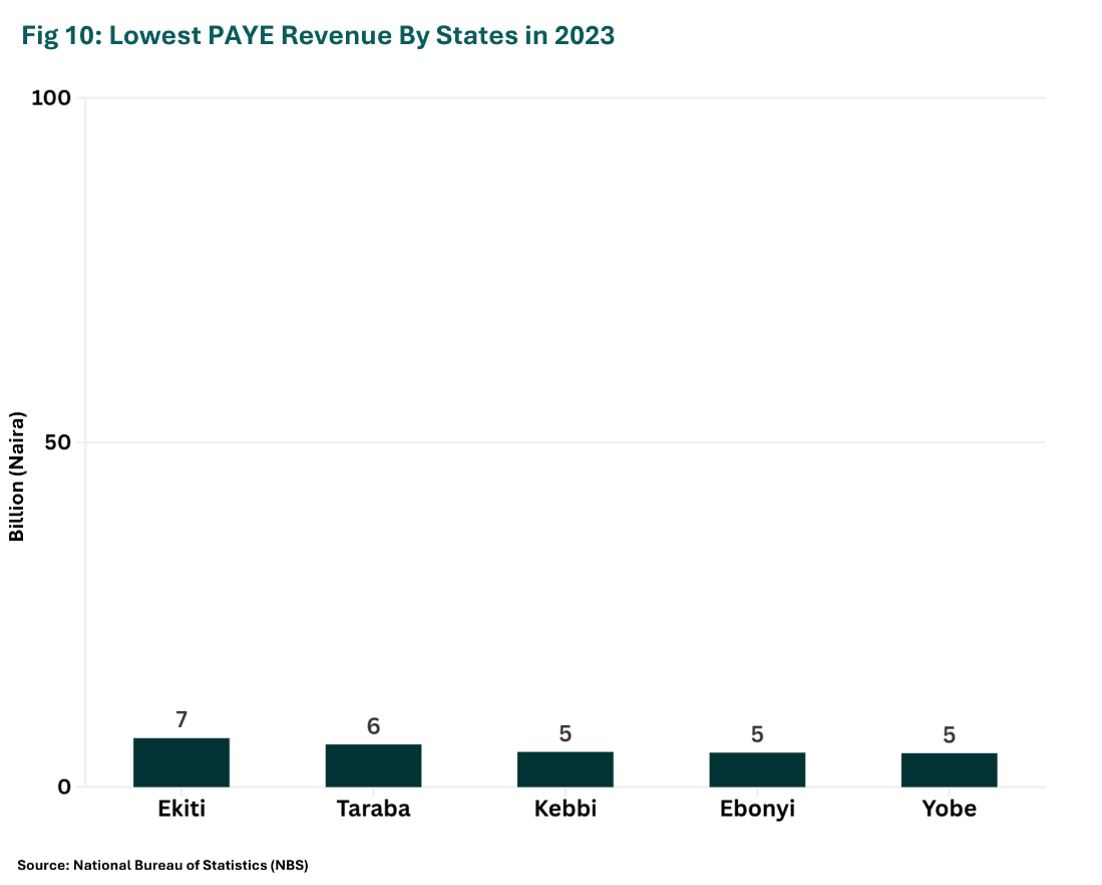

Among the states, Lagos unsurprisingly led in PAYE collections, generating ₦444.7 billion followed by Rivers State and the Federal Capital Territory (FCT), which reported PAYE revenues of ₦143 billion and ₦130 billion, respectively. On the other hand, states like Kebbi, Ebonyi, and Yobe recorded the lowest PAYE revenues, collecting ₦5.1 billion, ₦4.96 billion, and ₦4.91 billion, respectively.

This significantly low revenues from (PAYE) may signal limited employment within the formal sector of the affected states since PAYE is primarily collected from salaried employees in government and private sector jobs, and it may also reflect the inability of the state revenue services to adequately track and collect payroll taxes.

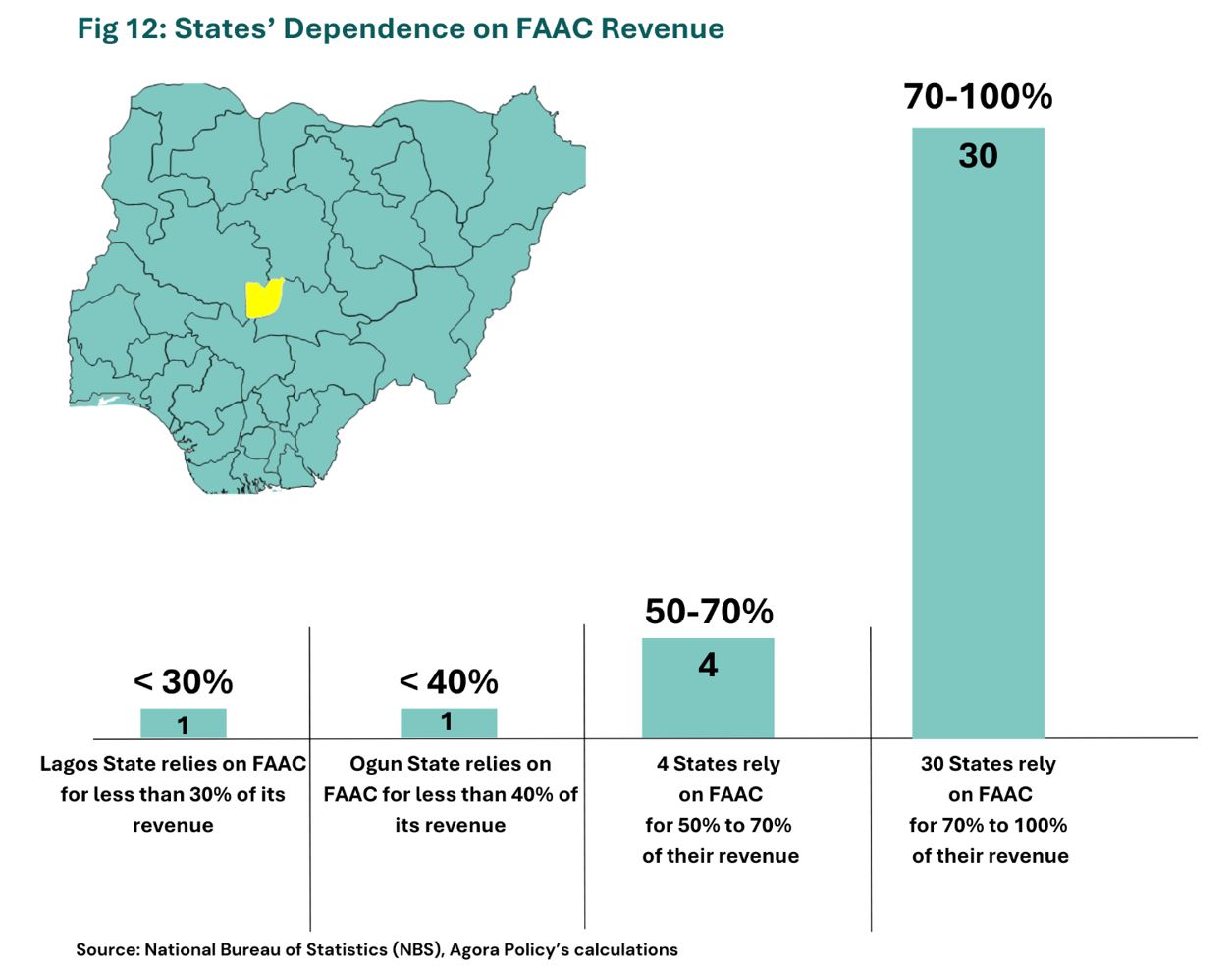

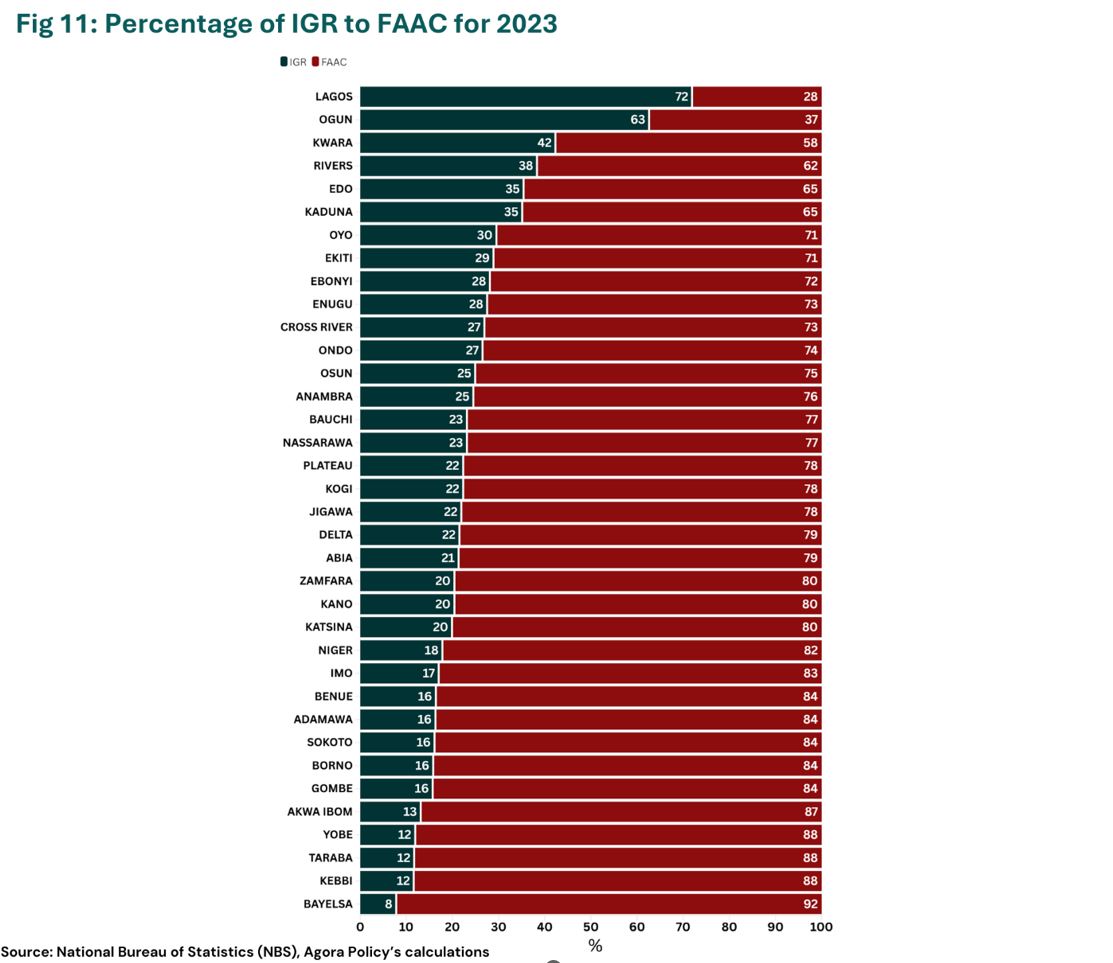

Only Two States Rely on FAAC for less than 40% of Revenues

From the IGR and FAAC data, Lagos and Ogun states rely less on FAAC with IGR comprising 71.9% and 62.6% of their revenues respectively. Only 28.1% of Lagos State's budget is funded through FAAC, compared to 37.4% for Ogun State. This data underscores a crucial point: both Lagos and Ogun States are less dependent on FAAC to sustain their budgets. However, the same cannot be said for the other 34 states. Four states (Kwara, Rivers, Edo, Kaduna) depend on FAAC for between 50% to 70% of their revenue, while 30 states rely on FAAC for between 71% to 92% of their revenue.