![]() By Wale Thompson | By the time President Bola Tinubu took over the reins of power almost a year ago, Nigeria’s economy was in some crisis. The economic crisis was characterised by soaring inflation, high unemployment, sluggish growth, and a weakened currency.

By Wale Thompson | By the time President Bola Tinubu took over the reins of power almost a year ago, Nigeria’s economy was in some crisis. The economic crisis was characterised by soaring inflation, high unemployment, sluggish growth, and a weakened currency.

Most concerning was the perception that economic policies under Tinubu’s predecessor, President Muhammadu Buhari, did not directly address the root causes of the crisis but rather sought to maintain the status quo and leave the underlying structural issues for the next president to resolve. Tinubu's economic campaign revolved around directly confronting these issues, with announced plans to remove longstanding fuel subsidies and liberalise the exchange rate. This Policy Note offers a review of one key area of the economy in the last one year: monetary policy.

Background: Nigerian Economy and the Conduct of Monetary Policy

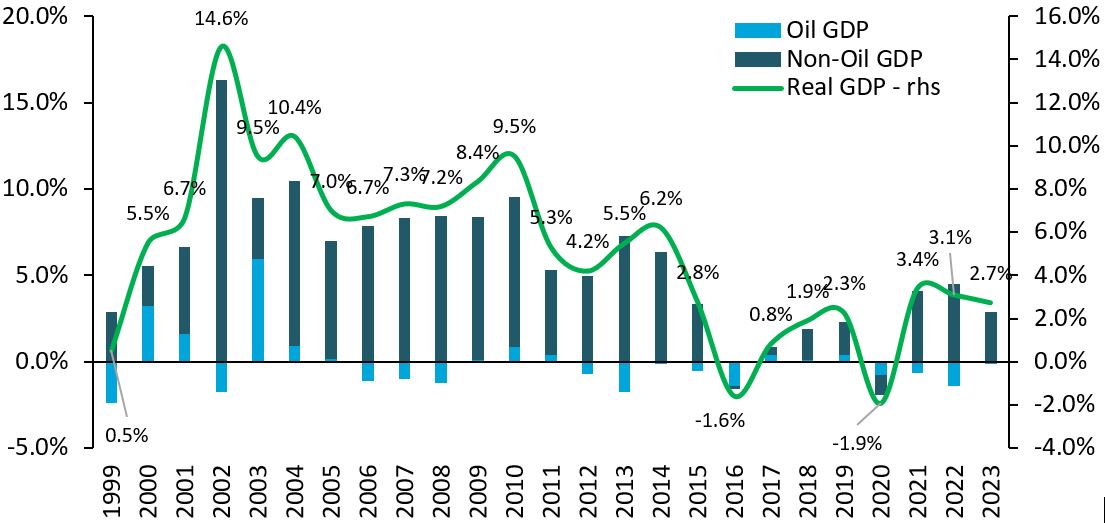

The macroeconomic backdrop at the entry of the Tinubu administration on 29th May 2023 was one of a structurally degraded growth profile. Real GDP growth had decelerated from the 7 percent norm in the pre-2015 period to a 2 percent steady state level. With annual population growth running in the 2.5 percent region, this new normal in economic growth implied lower per capita income growth and a pick-up in Nigeria’s poverty headcount. The downtrend in economic growth was characterised by negative trends in oil production and anaemic patterns in the non-oil sector. Oil production had slowed to 1.5mbpd from the prior 2mbpd trend, on account of heightened production outages linked to theft and insecurity issues in the Niger Delta as well as alarming levels of under-investment in exploration and production by the international oil companies, largely on account of lack of clarity over the Nigeria’s oil fiscal terms. Growth in Nigeria’s non-oil sector had also cratered on account of a foreign exchange illiquidity crisis which hampered access to imports of raw materials necessary for manufacturing operations and service imports.

Figure 1: Nigeria’s Annual Real GDP Growth and Its Components (1999-2023)

Source: NBS

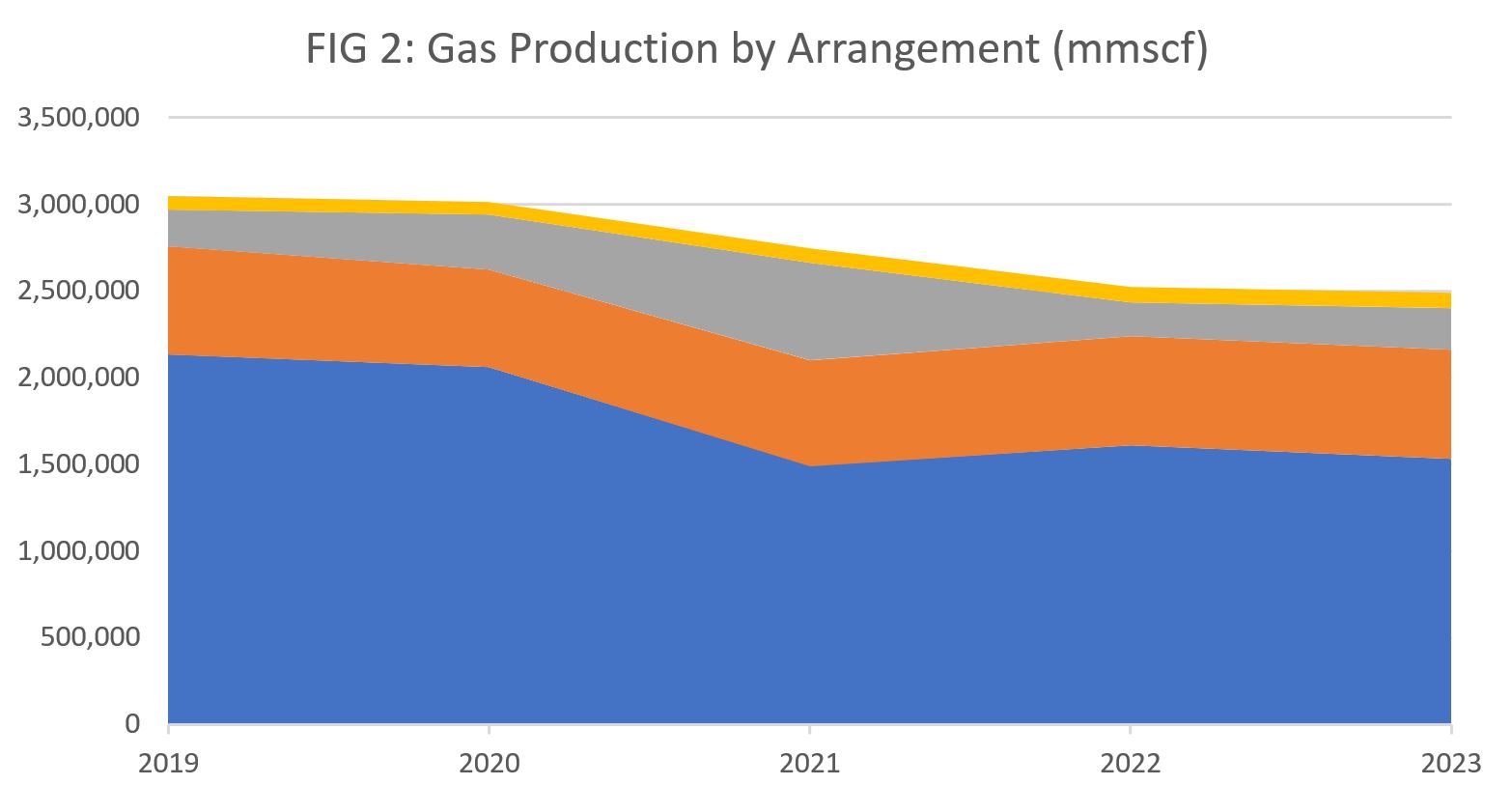

The decline in dollar supply began during the 2014-16 period following the dramatic collapse in oil prices and was exacerbated by the COVID-19 pandemic in 2020. The forex illiquidity crisis worsened due to the adoption of an unorthodox approach to economic policy management, which created significant encumbrances on oil exports (via an opaque crude-for-refined-petrol barter scheme) and external reserves (via cross-currency swaps). Given the central role of currency in the ongoing economic crisis, particularly during the President Buhari administration, it is important to contextualise the issue properly.

Starting in October 2014, oil markets buckled under the weight of rising US shale oil supply, disrupting long-standing OPEC arrangements and causing international crude prices to plummet from a steady $100/bbl to under $50/bbl. This development led to a balance of payments crisis across the economies of leading oil exporters. Nigeria was particularly affected due to the large share of oil receipts in its fiscal and external accounts. For context, in the lead-up to the crisis, Nigeria earned an average of $80 billion per annum from oil exports during the 2008-2014 period. This figure fell to $42 billion in 2015 and averaged $46 billion between 2015 and 2023. Despite the collapse in petrodollar receipts and its adverse implications for fiscal and external account balances, and consequently the ability of policymakers to manage key prices such as the exchange rate, Nigeria’s economic managers refused to make significant adjustments to this new reality.

This stance sharply contrasts with other large oil exporters which used a combination of petrol price increases, currency depreciations, tax hikes, and, in many cases (particularly in Africa), approached the International Monetary Fund for external financial assistance to manage the resulting balance of payments crisis.

Figure 2: Nigeria’s Balance of Payments (2005 to 2022)

Source: CBN

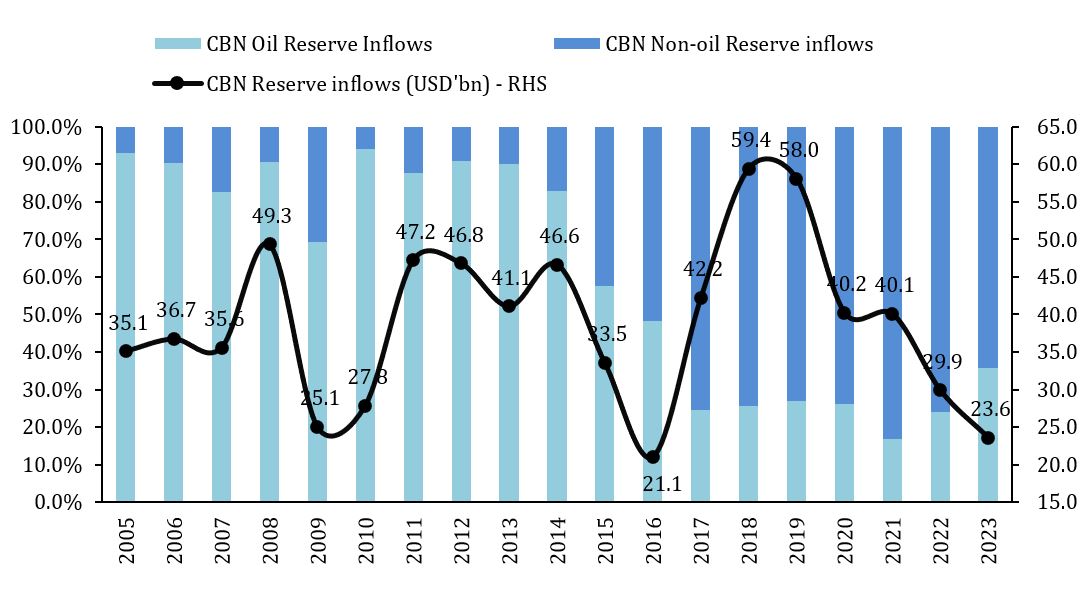

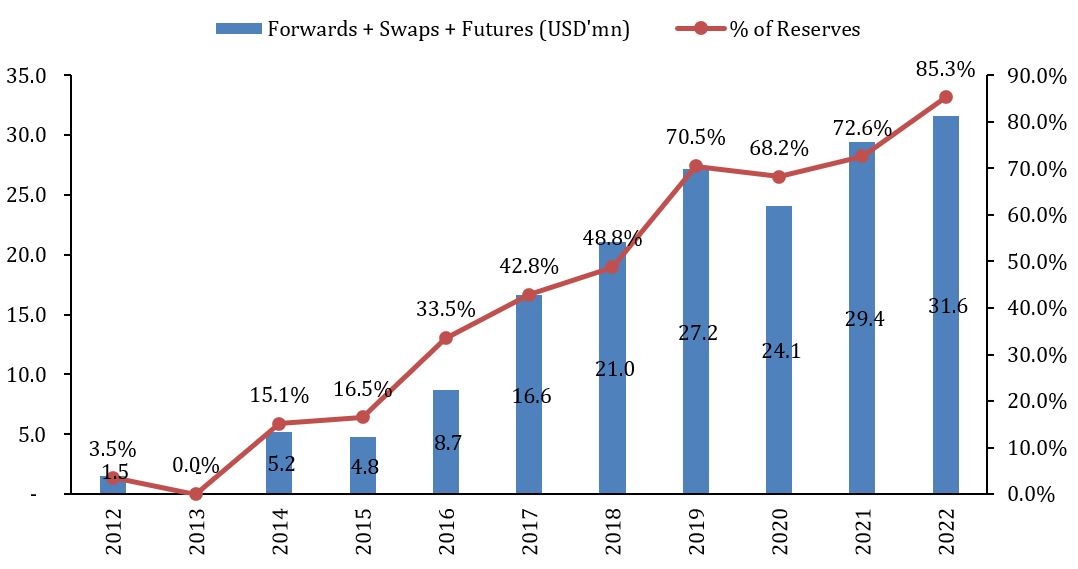

On the contrary, Nigeria’s response to the oil crisis evolved from an initially inflexible policy position on key prices to the removal of market forces, replacing them with ‘ad hoc’ fiat arrangements in pricing and allocation. Predictably, within the currency market, this development led to the emergence of multiple forex rate windows and increased the importance of the parallel market rate in driving sentiment regarding Naira pricing. To support the system, the Central Bank of Nigeria (CBN) resorted to currency swaps with Nigerian banks to boost its external reserve positions. This significantly altered the composition of reserve inflows, shifting from organic oil-based flows to inorganic derivative-based non-oil inflows. It is against this backdrop that the Tinubu presidency began life with the official exchange rate at N466/$ with the parallel market rate at N780/$.

Figure 3: Inflows into Nigeria’s External Reserves (2005-2023)

Source: CBN

In terms of monetary policy, the operational framework was codified in the CBN Act of 2007, which established a largely orthodox central bank with clear guardrails around fiscal deficit financing under the so-called Ways and Means threshold. This threshold capped CBN financing of fiscal deficits at 5 percent of realised fiscal revenues from the preceding year. The enabling laws created a conventional central bank focused on inflation control, exchange rate management, and broader macroeconomic objectives, as well as banking sector supervision. In the post-1999 period, Nigerian central bank governors generally adhered to this traditional script, maintaining a tight interest rate stance during periods of high inflation and lower interest rates during periods of low inflation. On the exchange rate, while management favoured nominal stability, the CBN tolerated Naira depreciations in 2008 and 2011.

However, the entry of Mr. Godwin Emefiele in 2014 marked a departure from the post-1999 norm towards a new regime characterised by heterodox monetary policy. Following the oil price shock of 2014-16, the CBN imposed a hard peg on the US dollar/Naira exchange rate within the official sector at N200/$, with curbs on Naira trading within the interbank FX market. Faced with declining flows, the CBN created multiple exchange rate tiers and USD exclusion lists to manage dollar allocation across the economy. This non-market, arbitrary approach to exchange rate management led to a surge in parallel market premiums to levels unseen in the post-1999 period, reminiscent of the military interregnum of Sani Abacha, when a similar hard peg was imposed on the official exchange rate.

It is important to highlight that the inflexibility of the Buhari administration to adjust fiscal spending and petrol prices effectively set the stage for the descent of monetary policy into heterodoxy. In response to the collapse of oil prices, the NNPC entered into numerous agreements to barter Nigeria’s crude oil for refined petrol which delivered implicit subsidies on petrol prices. This had direct implications for external reserves and government revenues, requiring the CBN to initially focus on cultivating portfolio inflows (2017-2019) to support the FX market before engaging in large swap transactions with Nigerian banks (2020-2023). Consequently, the Tinubu administration inherited a government with severely curtailed abilities to manage the exchange rate.

Figure 4: Outstanding Derivatives and CBN External Reserves

Source: CBN

Unorthodoxy would extend to interest rates in the form of a bifurcation in interest rates in 2019 in which the CBN proscribed access for non-bank domestic investors from its Open Market Operation (OMO) bills. This created a dual system for rates on risk-free securities as the OMO bills, which were now reserved for foreign investors and banks, were offered at a premium to the Nigerian Treasury Bills for domestic investors. This policy measure would force interest rates faced by Nigerian investors into single digit levels and amounts to what economists refer to as financial repression. Another layer of the shift to unorthodox settings was in the form of increased central bank financing of fiscal deficits which climbed through the gears from around N200billion (0.22% of GDP) in May 2014 to N26.9trillion (12% of GDP) over the 2014-2023 Buhari government era. These CBN loans, the so-called Ways & Means (W&M), exceeded statutory limits and were financed by an increase in money supply over the period.

The development is consistent with the shift to a low interest rate regime by the CBN. Beyond monetary policy, the wider economic policy framework had melded into the realm of heterodoxy in particular with respect to the management of fuel subsidies where the NNPC entered into numerous agreements to barter Nigeria’s crude oil for refined petrol. (See Figure 3). These swaps had profound implications for Nigeria’s external reserves as the export-to-reserve inflow ratios declined strongly and despite a recovery in oil prices following Russia’s invasion of Ukraine in 2022, Nigeria did not see a pick-up in external reserves.

In summary, at the dawn of the Tinubu administration, Nigeria’s economy grappled with a fundamental economic policy misalignment occasioned by the shocks in the external environment and complicated by an unorthodox economic policy posture which sought to deny the existence of these realities. Rather than helping to stabilise and rectify the cause of the macroeconomic imbalances, monetary policy had devolved into an arcane and byzantine realm which had inspired zero confidence from households, businesses, and the international community.

Tinubu’s Ambitious and Conflicting Monetary Policy Goals

To properly situate our assessment, it is important to highlight the apriori positions and objectives of President Tinubu on monetary policy as perceived through publicly expressed statements on monetary policy and campaign documents. A good starting point is the campaign manifesto published in November 2022, (Renewed Hope 2023: An Action Plan for Better Nigeria) which provides a more philosophical underpinning for the thinking of President Tinubu (or that his inner cabinet) about monetary policy. The document states that the ability of monetary policy in driving the attainment of broad economic objectives was limited as its transmission mechanism in Nigeria revolved around banking and financial ecosystem which had few linkages with the wider economy.

Against this backdrop, the overarching idea was that monetary policy should thus be subservient to fiscal policy with a focus on a tripod of objectives: exchange rates, interest rates and price stability. These views are not entirely new and are consistent with past statements and writings by President Tinubu about the primacy of fiscal dominance over monetary policy (See Tinubu and Browne, 2013 and Tinubu, 2006). However, the campaign document was light in specifics and so should be viewed more broadly as reflective of principles on the operations of monetary policy. Another point to note is that the campaign document specifically notes that exchange rates “… cannot be left to the vagaries of an unrestrained market”. This would suggest the preference of some degree of control over the currency and is a useful canvas to view CBN’s actions on the exchange rate.

Following President Tinubu’s victory at the 2023 elections, greater clarity emerged on specific monetary policy objectives suggested in the Policy Advisory Council (PAC) report published in May 2023. The PAC report recommended that the Tinubu administration should seek to deliver the following goals on monetary policy: a 13% inflation rate, a unified exchange rate system with the Naira within a target region of N550-600/$ and single digit interest rates. These are medium term objectives. So, they presumably should be viewed within a much longer time horizon as against the one-year scope of our review. As such an objective assessment should be to measure the probability of convergence between the current trajectory of these identified variables and the explicit targets set out. In terms of execution, the administration would look to undertake the following initiatives within a 12 to 18-month period:

- Cease the practice of multiple exchange rate tiers and unify the FX market under a willing buyer, willing seller arrangement. This preference for a free-market currency regime is one key divergence between the PAC and the president. The position likely reflects a more pragmatic assessment of the FX situation at the time relative to the president’s (at least his inner team) long-held intellectual disposition about unrestrained exchange rate markets.

- Drive accretion to external reserves with a target of $50-60 billion through certain initiatives aimed at improving export flows, attracting diaspora remittances and accessing funding at concessionary terms from development finance institutions (DFIs). While there is mention of re-engaging international investors, no mention was made of cultivating portfolio flows. This distinction is important as we shall see.

- Reform CBN’s operating model with a focus on reducing its cost of operations by ending the quasi-fiscal activities and the large development finance operations. Interestingly, the PAC document included an explicit mention of carving out the banking supervisory duties of the CBN and transferring these to a separate regulatory authority. In addition, the proposal on the reform of CBN appeared ambitious in scope with mention of audits of the forex reserves and proposals to rationalise CBN’s operations to core monetary policy.

- On monetary policy, the goal was to anchor market rates on the Monetary Policy Rate (MPR) and normalise the Cash Reserve Requirement (CRR) regime.

- End cash shortage problems associated with the controversial Naira re-design policy.

Three key points from the PAC document were mentioned in President Tinubu’s inauguration day speech: Forex rate unification, lower interest rates and solving the cash liquidity issues associated with the Naira re-design policy. In summary, the Tinubu administration sought to deliver lower inflation (a medium-term target of 13%), a stable exchange rate (N500-600/$) and lower interest rates. It would look to achieve these ambitious targets by returning the CBN to the path of orthodox monetary policy settings and engaging the external sector to improve forex liquidity.

Policy in Practice: Return to Conventional Setting with a Hawkish Posture

Within the first week of his inauguration, President Tinubu moved to replace the erstwhile CBN Governor, Mr. Godwin Emefiele, who was first suspended and then subsequently arrested to face a litany of allegations ranging from terrorism to corruption. The development drew curtains on the nine-year reign of Emefiele. Under Emefiele, the CBN embraced an unorthodox approach to monetary policy characterised by direct quasi-fiscal interventions across economic sectors, curbs on currency trading with multiple FX windows, the use of non-market approaches to managing interest rates and unapproved lending to support fiscal operations. Emefiele would be temporarily replaced with one of his erstwhile deputies (Mr. Shola Shonubi) who held the fort until the appointment of Mr. Olayemi Cardoso as substantive CBN governor in September 2023. Cardoso, a longstanding associate of President Tinubu with a background steeped in banking and public finance, would enter the CBN with a fresh slate of CBN deputy governors. His period at the helm over the last seven months has been broadly defined as returning the CBN to the path of monetary orthodoxy while attempting to stabilise key macroeconomic variables that have moved wildly. But first we will outline the key monetary policy developments over the last twelve months.

- The shift to a more flexible exchange rate regime: Following Emefiele’s ouster, Acting CBN Governor Shonubi, immediately moved to lift the longstanding restrictions of currency trading with the introduction of a “willing buyer, willing seller” arrangement. This shift to a more flexible exchange rate arrangement was hastily announced within the first week of his appointment and would see the Naira within the official window fall from N460/$ to N778/$ at the end of June 2023. It is important to state that after nearly eight years during which the Naira exchange rate was hand-held by the CBN, the move to jettison the practice without any appropriate policy qualifiers or administrative guidance contrasts sharply with the views expressed in the president’s manifesto about unrestrained financial markets. Furthermore, as the adjustment occurred within the context of low CBN and non-CBN USD liquidity within the now liberated FX market, the scale of suppressed foreign exchange demand within the non-official segments rushing into the official window resulted in the Naira losing around 48 percent of its value to close 2023 at N899/$ within the NAFEM window. However, this was only the beginning, as in 2024, the Naira would test new lows with a precipitous drop in February to N1662/$ within the official window. The unexpected announcement of the adoption of a less rigid exchange rate framework with limited restrictions on pricing without a line of sight on potential dollar flows would prove to be the undoing of the shift to a liberal foreign exchange regime. Indeed, a semblance of stability, albeit fleeting, only began to appear after the CBN directly moved to cultivate foreign portfolio inflows via a surge in interest rates alongside a flurry of circulars to re-direct domestic dollar flows towards the FX markets.

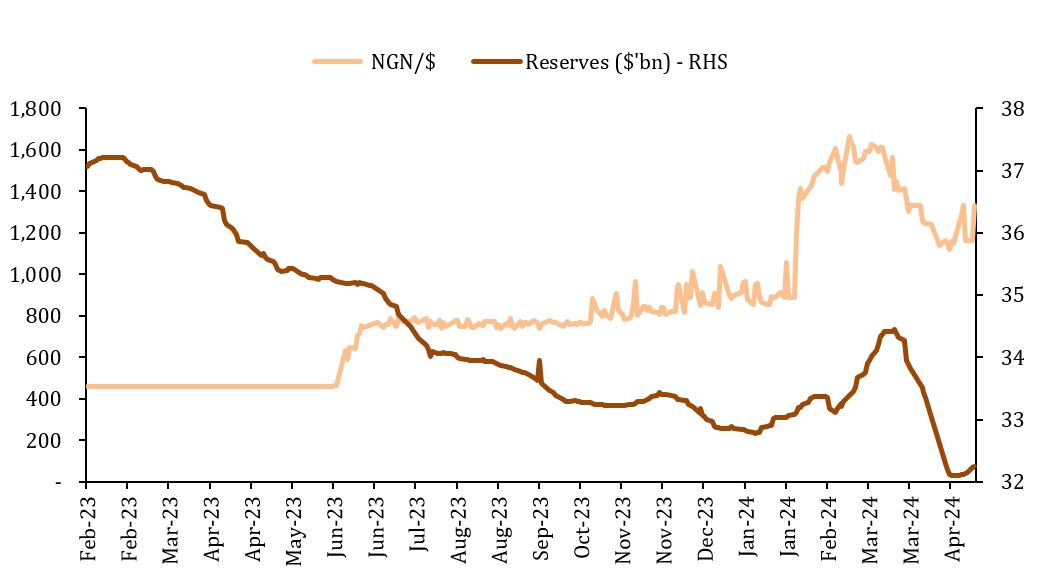

Figure 5: Naira Exchange Rate and USD Reserves (Feb 2023 to Apr 2024

Source: CBN - Monetary policy tightening to cultivate foreign portfolio flows: On the interest rate front, the change in CBN leadership precipitated a shift to a tight monetary policy stance from the ultra-accommodative monetary policy posture of the Emefiele years. Though the CBN had on paper embarked on the start of a rate tightening cycle in May 2022, when it raised its key monetary policy rate from 11.5 percent to 13 percent and subsequently to 18.5 percent at the end of the Buhari administration in May 2023, actual market rates were lower with average treasury bill rates moving from 3.8 to 6.8 percent while bond yields climbed from 10 to 13 percent levels. In essence, the CBN rate hikes were demonstrative with the actual conduct of policy at variance with the declared intentions. In keeping with the norm, at its first MPC meeting, the Shonubi CBN delivered another limp 25 basis points rate hike in July, bringing the MPR to 18.75 percent and with the predictable limited impact on market rates. Following Cardoso’s entry in September, the CBN would not hold an MPC meeting until February 2024 ostensibly to allow the new leadership time to strategize on its course of action and to allow for the appointment of other members of the Monetary Policy Committee (MPC). At its debut meeting, Cardoso delivered a seismic 400 basis point hike in policy rates to a record 22.75 percent accompanied by another 200-basis point increment in March bringing the MPR to 24.75 percent. Unlike his predecessors, Cardoso moved to improve the broken monetary policy transmission cycle by restoring the efficacy of the discount window operations by removing the prior restrictions on deposit facilities. This created a surge in market interest rates with average T-bill and bond yields rising to 21% and 20% respectively, ending the legacy of repressive financial policies of the Emefiele era.

Figure 6: Policy and Market Interest RatesSource: CBN

- Cessation of Ways and Means Financing: Another point of departure between the Tinubu administration and Buhari government is in the elevated use of Ways and Means financing to fund fiscal deficits. From around N200 billion (0.22% of GDP) in May 2014, the Ways and Means loans surged to N26.9 trillion (12% of GDP) at the end of May 2023 as the Emefiele central bank extended loans to the Buhari government in clear violation of the CBN Act. At the twilight of its tenure, the Buhari government commenced the process of clearing out the outstanding W&M loans via a securitisation process which consolidated these facilities into the FGN debt. Legislative assent was received in May 2023 for the conversion of around N22.7 trillion leaving N4.3 trillion which closed December 2023 at N8.3 trillion likely reflecting accrued interest costs (MPR + 300bps). The Tinubu administration moved to extinguish the remaining component with another securitisation in late December.

- Banking recapitalization: After dropping firm hints at a December 2023 gala for Nigerian banks, the Cardoso CBN in late March 2024 announced a new recapitalisation programme for Nigerian banks which raised the minimum capital requirements for commercial banks from N25 billion to N50 billion for regional and merchant banks, N200 billion for national banks, and N500 billion for banks with international authorisation. The programme set a two-year timeframe for compliance, and had the stated goal of strengthening the Nigerian banking sector by boosting banks' capacity to withstand internal and external shocks. It would appear that concerns over the impact of the large Naira depreciation ultimately pushed the CBN into mandating raised capital levels to improve confidence in the health of Nigerian banks.

However, the announcement had a minor accounting kink: banks would be required to capitalise with only paid-in equity capital which no allowance for historical retained earnings. This development is controversial, as the CBN circular appears to imply that historical retained earnings within the banking system is ‘unreal’ which is a dangerous precedent for a variety of reasons. Firstly, it would imply that the annual ritual of the CBN approving banks’ financial statements is irrelevant as either the CBN banking supervision lacks the technical capacity to credibly certify these statements as clean or worse the CBN had been deliberately approving the financial statements even though it harboured doubts about the quality of the earnings. Secondly, the CBN historically pushed for banks to retain capital as against paying out profits as dividends to shareholders. In electing to reject access to historical retained earnings and anoint only paid-in capital as the real equity, the apex bank now lacks the basis for its prior position. Thirdly, in insisting on only cash equity as the only valid form of capital, the CBN is showing itself as being extremely narrow-minded in thinking about finance where the norm internationally is shifting away from nominal numbers as the basis of capital adequacy. Though the CBN would declare the banks should still comply with existing capital adequacy ratio requirements, the use of this nominal cash position suggests that the apex bank either has no faith in these metrics or lacks the technical capacity to properly ascertain them.

Overall, the actual execution of monetary policy under President Tinubu can be characterized as a return to conventional settings with a hawkish posture by the CBN as the antidote to elevated inflation and Naira weakness. Unlike in the past, when the CBN focused on highly symbolic gestures, policy delivery has actual ‘bite’ with market rates adjusting upwards. On the exchange rate, the apex bank has adopted an exchange rate system with greater flexibility though with option of interventions.

Naira Stability as the Achilles Heel of Monetary Policy

As Milton Friedman once noted, policymakers should be judged by the results not their intentions. In assessing the efficacy of monetary policy over the last twelve months, we must consider the time lags between policy adjustments and impact on target macroeconomic variables. This makes a definitive assessment of monetary policy under Cardoso a bit challenging due to the short duration of his tenure. That said, we can draw inferences about how policy adjustments are impacting the future time path of key economic variables.

The first key area to observe policy effects is with respect to the exchange rate where despite several interventions in the form of policy adjustments (fixed to floating), large interest rate hikes (+600bps) to cultivate USD inflows, a step-up in the frequency of circulars and numerous rounds of FX market interventions, Naira stability remains elusive. Indeed, the Naira appears to be in a realm of constant downside pressures with renewed weakness in May 2024 towards fresh lows of NGN1500-1600/$ despite the adoption of supposedly liberal FX policies that should have supported an appreciation. This development reflects the absence of any direct efforts at securing a large source of forex liquidity amid lingering issues with oil export related flows where an implicit fuel subsidy and large legacy liabilities linked with the refined petrol for crude swaps continues to curtail organic dollar flows. Thus, it would appear that CBN’s monetary policy actions are merely cosmetic without direct attempts at raising dollar liquidity to stabilise the supply picture. That said, it is important to note one area the CBN achieved a pass-mark: the unification of the official and parallel market exchange rates which was one of the key deliverables on monetary policy in President Tinubu’s inauguration address of 29th May 2023.

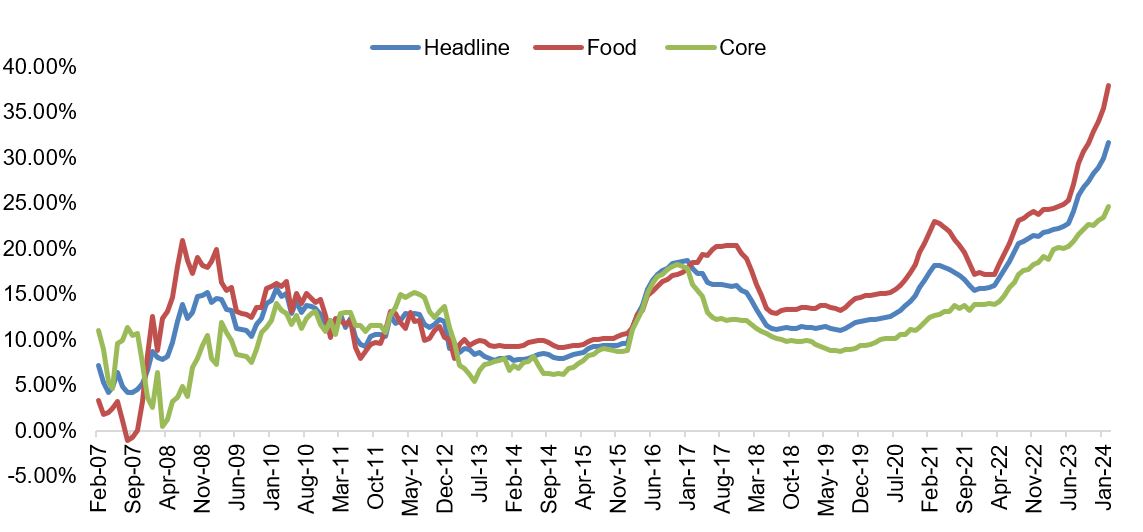

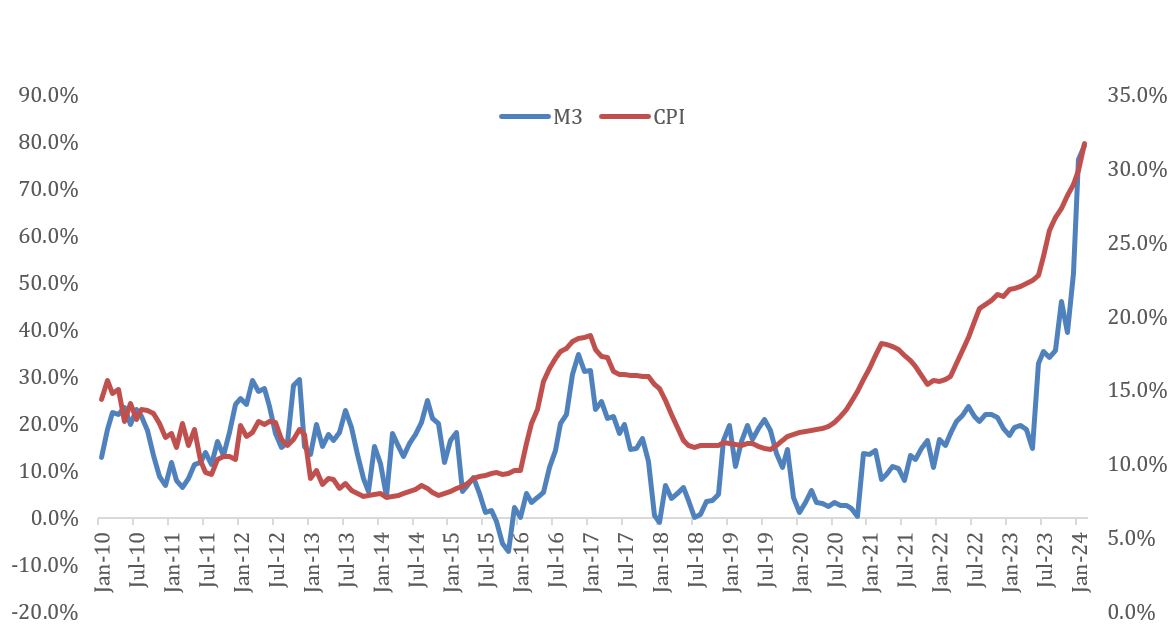

Given the centrality of the Naira depreciation in driving inflationary pressures, a low score on the currency translates to a poor score in terms of price stability. Over the last twelve months, consumer prices accelerated following the FX adjustments, rising to 33.69% in April 2024, from 22.4% at the start of the Tinubu administration. The Naira depreciation induced a surge in the energy costs (petrol, diesel, kerosene and cooking gas) with adverse knock-on effects on key consumer prices. Despite the rate hikes in early 2024, the lingering Naira weakness appears to be driving heightened inflationary expectations leading to price hikes across board. Granted these are supply-side shocks with limited recourse to traditional monetary variables, the core CPI data which adjusts for these shocks remains elevated and is suggestive of excessive money supply growth fuelling price increases. The historical record would suggest some linkages and the recent surge in monetary aggregates over the Buhari administration hints at some connections (See Figure 8).

Figure 7: Nigeria’s Inflation Rate (Feb 2007 to Jan 2024

Source: NBS

Figure 8: Money Supply and Inflation (Jan 2010 to Jan 2024)

Source: CBN, NBS

On interest rates, relative to President Tinubu’s preference for lower interest rates, the CBN was unable to meet this objective given the need to bolster the returns to cultivate foreign portfolio investors. On the Naira redesign, after some teething issues, the CBN has largely solved the shortage issues faced during the cash swap policy.

Recommendations and Conclusion

Despite strong action on the monetary policy front, which has garnered widespread praise from domestic and international observers, Nigeria’s key macroeconomic variables have yet to respond favourably for the populace. At the heart of this ongoing divergence is the lack of a concerted effort by policymakers to address the forex liquidity problem that underlies the exchange rate turmoil. Specifically, the absence of a tractable source of USD liquidity to fill the shortfall from oil flows, which remain largely encumbered, continues to hinder CBN’s efforts to manage the foreign exchange situation. Without tangible progress on this front, the persistent weakness of the Naira will continue to drive higher inflation, necessitating even higher interest rates and leaving a precarious outlook for non-oil sector growth.

Nigeria’s external sector gap, looking at the shortfall between the current account (9M 2023 surplus: $2.7 billion) and the financial account (9M 2023 deficit: $7.7 billion), stood at $5 billion as of October 2023, according to CBN data. This shortfall is largely driven by negative trends in foreign net flows and ongoing domestic financial outflows, reflecting the negative impact of the Emefiele-era policy of negative real interest rates. To bridge that 2023 gap, Nigeria would have needed total flows of $7-10 billion to prevent significant external reserve drawdowns. Though a return to orthodox policies has partially addressed this issue, a complete restoration to historical trend levels will take time. In short, Nigeria needs a temporary dollar liquidity bridge to allow reforms to take effect.

Beyond the rhetoric of orthodox reforms, Nigeria’s economic managers need to directly address the forex illiquidity problem by exploring optimal solutions. These options include a possible Eurobond sale in the $5-10 billion range, though this might be challenging to execute without commercially punitive terms (e.g., double-digit dollar interest rates). Asset sales have been suggested as a way to raise dollar flows, including the sale of certain strategic public corporations. However, outside the oil sector, Nigeria lacks assets of sufficient strategic value to raise large sums quickly.

Another option is the possibility of sovereign placements, similar to Egypt’s receipt of large foreign dollar deposits from the UAE, alongside support from the EU, UK, and western donors. However, such flows depend on international diplomacy, and Nigeria lacks a strong history of focused international relations to unlock capital flows. Alternatively, engaging multilateral agencies like the IMF for financing options within the context of a reform programme is a viable route. Given the difficult reforms undertaken over the last twelve months (hikes in fuel and electricity prices and a shift to a flexible exchange rate system), Nigeria is in a position to negotiate a favourable financing package. While these are fiscal decisions, not within the monetary policy remit, they are crucial for the CBN to stabilise the Naira exchange rate. Success in this area would stabilise exchange rate trends associated with portfolio flows and build confidence to unlock private and foreign USD flows.

Over the medium term, Nigeria must focus on restoring organic dollar flows from oil exports by clearing the backlog of encumbrances. Transparency regarding the nature and size of these liabilities will improve confidence about potential timelines for reserve recovery.

Beyond the immediate forex liquidity problem, there is a pressing need for a credible basis for conducting monetary policy over the medium term. While various Nigerian central bank governors have considered inflation targeting, these have largely been declarative positions without the empirical groundwork for setting achievable inflation targets and the policy leeway to attain these goals. The crisis of the last twelve months has underscored the importance of the exchange rate in anchoring inflationary expectations. In a small open economy like Nigeria, monetary policy must balance exchange rate stability, crucial for near-term inflation, with non-mineral export competitiveness. This boils down to achieving a Naira Real Effective Exchange Rate (REER) level that anchors inflationary expectations sustainably.

Additionally, there is a need to clarify monetary policy implementation in light of Nigeria’s regime of fiscal liquidity dominance. Nigeria’s fiscal petrodollar-to-Naira monetisation generates surplus Naira liquidity, complicating the execution of monetary policy. Unlike other oil-exporting countries that use fiscal rules to determine the rate of export USD monetisation, Nigeria injects transformed export dollars to Naira at a fiat exchange rate, leading to excess financial system liquidity. The significant costs associated with curbing the impact of this excess Naira liquidity on inflation and USD demand drive actual monetary policy. Recalibrating Nigeria’s monetary policy implementation toolkit to address monthly government liquidity transformations is central to improving monetary policy transmission. Ideally, this would require a fiscal rule, which is outside the scope of this paper and requires political capital to reform. If the status quo persists, the default monetary policy posture will be to constantly curtail financial system liquidity to manage the fallout of excess liquidity on USD demand.

This Policy Note has examined the execution of monetary policy over the first one-year of the President Tinubu administration. Faced with a difficult economic backdrop, the signature changes in monetary policy are the restoration to more credible orthodox settings. This adjustment is significant as it lays the basis for some hope that in the medium term, with progress in unlocking external USD liquidity, the Naira troubles which are at the heart of the current economic malaise can start to moderate. Exchange rate stability should help anchor inflationary expectations towards the trend levels observed before the 2014 oil price collapse and support business activity going forward.

Link to Download File:

https://agorapolicy.org/files/Monetary_Policy.pdf