By Wale Thompson

Last week, the Federal Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed announced the receipt of presidential approvals to ‘securitize’ Ways and Means (W&M) loans totaling NGN20trillion which the Federal Government (FG) owes to the Central Bank of Nigeria (CBN). In economics, Ways & Means is the unrestrained central bank financing of fiscal deficits or more simply excessive government borrowing from the central bank to plug financing holes in annual budgets. In her briefing, the minister noted that the securitization would take the form of the issuance of FGN debt instruments of a 40-year tenor and at an interest rate of 9 percent to the CBN in lieu of the amounts owed. Upon completion, the transaction would represent the single largest addition to Nigeria’s federal government debt which would rise to N55.7trillion from the N35.7trillion reported in June 20221.

So, what is this all about?

Securitization is a finance term which refers to the process in which certain assets (usually obligations to receive money e.g. loans) are pooled in a manner that they can be repackaged into interest-bearing securities that can be sold in the capital market. The interest and principal payments from the assets are passed through to the purchasers of the securities.

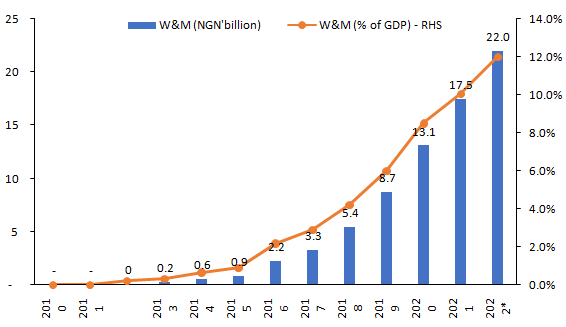

Since 2015, Nigeria’s Federal Government has extensively relied on advances from the CBN to finance fiscal deficits in excess of approved budget amounts. Cumulatively, these advances sum up to N22.1trillion at the end of August 2022 (12 percent of GDP) and were essentially financed by the CBN expanding the monetary base (or simply put: printing money). For context, total FGN domestic debt rose from N8.8trillion in 2015 to N20trillion at the end of June 2022, while the W&M figure went from under NGN1trillion in 2015 to N20trillion in the space of six years, faster than the rate of legislated borrowing plans. Beyond the scale of the increase, the W&M advances present legal problems as these amounts are in breach of provisions within the CBN 2007 Act which not only set a ceiling on W&M borrowings at no more than 5 percent of prior year revenues but also stipulated that new advances cannot be granted without repayment of prior year advances. In addition, the position runs contrary to ECOWAS convergence criteria which sets a 10 percent of prior year revenues as the ceiling for central bank finances to the government within the sub-region.

Figure 1: Cumulative Ways and Means Balances

Source: CBN, NBS

In seeking to convert these W&M advances to FGN debt, the Buhari administration is perhaps signaling a desire to draw the line on the practice as its tenure winds down.

A short history of Ways & Means

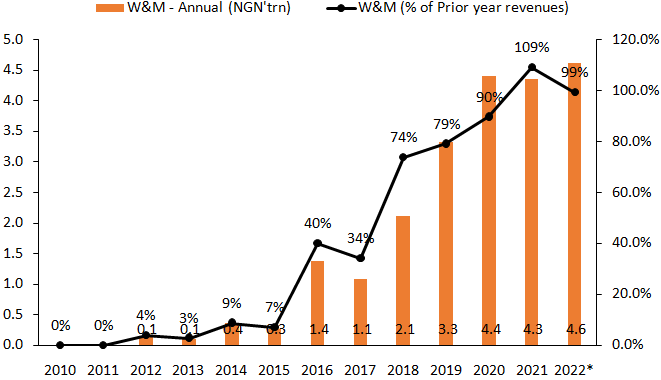

Historically, W&M or to use the proper economics term, unrestrained central bank deficit financing has been observed in two major episodes of Nigeria’s history looking at CBN data going back to independence in 1960. The first episode was during the 1993-2000 era when CBN advances to the FGN in excess of budgeted amounts went from zero to a peak of N34billion in 1996. As a share of fiscal revenues, the amount peaked at 5.4 percent in 1996 and generally stayed within range. In 2007, as part of the CBN 2007 Act, the Obasanjo administration which wound down the Abacha era W&M facilities reduced the limit to 5 percent.

However, the 2015-2022 era is unprecedented in Nigerian history as W&M as a ratio of prior-year revenues hit 109% in 2021. Essentially the CBN generated more money than the FGN in the prior year though 2020 revenues were undoubtedly hurt by the COVID-19 pandemic.

Figure 2: Annual Ways & Means borrowings

Source: CBN, Budget Office.

So, what happened in the last six years?

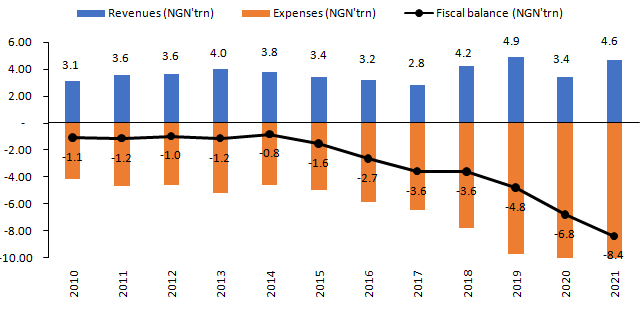

The concurrent collapse in oil prices and Nigeria’s oil production in 2016 cascaded into a drop in FGN receipts. Following the dip in oil prices, Nigeria’s oil exports dropped from an average of USD85billion in 2010-2014 period to USD42billion in 2015 and USD32billion in 2016. In the face of the collapse, the FGN responded by maintaining expenditure levels in a bid to shift the economy out of recession. This bold gamble required financial assistance from the CBN which printed over N1.4trillion in 2016 to sort out the FGN. Rather than being a one-off, the practice soon became embedded as the finance ministry saw a solution to ramping up expenditure levels despite the exit from recession in 2017 and accessible Eurobond financing over the period.

Figure 3: Nigeria Fiscal Accounts.

Source: CBN

When governments run fiscal deficits, they usually borrow to cover the revenue shortfalls to their spending plans. These borrowings have to be approved by the National Assembly as part of the appropriation bill and can be either domestic (via FGN bonds and treasury bills) or foreign via Eurobonds or concessionary loans from bilateral(such as from China, France, India etc.) and multilateral agencies (such as the World Bank, IMF). Once the budget is passed, borrowings have a hard ceiling and when the actual deficit exceeds the projected deficit, the is no legal recourse for the Debt Management Office (DMO) to borrow in excess of the budgeted borrowing amount. To address this, the CBN as the banker to the FG can provide over-draft facilities to meet temporary differences between budget and actual revenues arising from timing differences. For instance, corporate taxes tend to be paid over the third quarter but the government has running costs which need some financing. As such the CBN provides over-draft facilities on these budget accounts. The real problem with W&M is when the actual deficit exceeds the budget deficit by a sizable difference. Given the testy process and haste required in financing these hitherto over-budgeted deficits, the Buhari government found it expedient to simply tap the CBN to extend short-term financing to cover its shortfalls.

So, what is the big deal about Ways & Means?

Unrestrained central bank financing of budget deficits is generally problematic given that it essentially amounts to printing money which raises the money supply. When this exceeds the absorptive capacity of an economy i.e. relative to the amount of goods and services available, economists posit that the excess money supply balances directly fuel inflation. This has its origins in the so-called quantity theory of money by Irving Fisher.

Indeed, over the last six years, the broadest monetary supply aggregate has risen more than double to N49.4trillion (27 percent of, GDP) from N21.6trillion (23 percent of GDP) in 2015. Core inflation, a measure of inflation which excludes food and petrol prices, which tend to be volatile, has averaged 11.8 percent, up from single digit average of 9.5 percent in the preceding eight years. Though not causal, these directional movements suggest links between the expansion in money supply and inflation.

Perhaps one area where the expansion in money supply is likely to pose greater problems is in currency management. Excess money supply balances above an economy’s absorptive capacity are likely to flow outwards towards the purchase of external goods. Given the external account pressures over the last six to seven years, occasioned by the collapse in crude oil prices, the resilience in dollar demand in the face of fairly large currency devaluations hints at an outsized role of the CBN ways and means operation.

What are the implications of this securitization on Nigeria’s economy?

Firstly, Nigeria’s debt metrics are about to change, as the securitization raises debt-GDP ratio to 35 percent of GDP from 23.7 percent at the end of June. While this remains below the recently raised parliamentary ceiling of 40 percent, this development robs Nigeria of the low debt narrative that has appealed to international investors in recent years

Secondly, in terms of debt service costs, the 9% rate (which favourably compares with the current 13.3% weighted average cost of debt on Nigeria’s NGN20.9trillion domestic debt) implies incremental debt service costs of N1.8trillion. For context in the FGN debt service costs in the 2022 budget are set at N3.9trillion. Assuming fiscal revenues continue to tail the N5-6trillion level observed in the last five years, the increase pushes debt-service revenue ratio higher (Jan-July 2022: 84 percent) which presents challenges for future governments.

Thirdly, from a principal repayment perspective, the securitization will potentially add around N500billion in principal repayments (assuming no repayment moratorium and equal amortization) as the FGN is unlikely to fathom having a bullet principal repayment N20trillion in the year 2062. More likely the repayments will be spread over the course of 40years.

From a structural perspective, the action creates some breathing space for the CBN to adopt a more reasonable Naira liquidity management operation. Presently, while printing huge sums of money to plug fiscal deficits, the CBN engages in countercyclical contractionary monetary policy to limit the inflationary blowback of excessive growth in money supply. Unlike in conventional monetary policy when the CBN would sell securities at an interest rate that incentivizes banks to purchase these securities, the CBN engages in a low-cost, mopping-up operation via the use of cash reserve ratio (CRR) debits which costs nothing and more recently the issuance of Special Bills (SPEBs) which are at a yield of 0.5%. Assuming the Buhari government calls time on Ways &Means borrowings, the CBN no longer needs to restrict activity within the banking system as it now has an asset which pays interest and at decent level. Essentially, monetary policy can return to a more conventional path.

How do we prevent another episode of Ways & Means explosion in the future?

Unfinanced fiscal deficits are a function of either poor fiscal budget forecasting, if one assumes that the deviations are naïve mistakes or deliberate fiscal indiscipline. Given the persistently rising pattern of Ways &Means advances under the Buhari administration, one cannot rule out the latter. Combined with the annual ritual of announcing new tax levers to unlock mythical revenue numbers, it is not uncontroversial to say that the finance czars adopted a kamikaze approach to fiscal affairs.

To prevent future abuses, parliamentary oversight must include explicit provisions that prevent the passage of new appropriations bills without explicit borrowing provisions to pay down outstanding unfinanced fiscal deficits. To improve coverage, the finance minister should be made to prepare supplementary appropriation bills in the event of the existence of Ways & Means balances in excess of the statutory 5 per cent limit. Lastly, CBN governors must be made to sign annual declarations that they have not breached Ways & Means. And there should clear and serious consequences, including criminal prosecution and jail sentences, when it is proven that these declarations are false.

*Thompson is an economist with specialization in monetary policy

[1]Source: DMO. Total FGN debt is split across domestic debt (NGN20.9trillion) and external debt (USD40.1billion or NGN14.7trillion).