By Babajide Fowowe and Muhammed Shuaibu

As Nigeria prepares to usher in a new administration, the state of the economy remains a key point of interest. This owes largely to the myriad of economic challenges the country faces, as highlighted in the Agora Policy Report on the economy1. A critical issue that the incoming administration has to grapple with is how to revamp the economy, and quickly.

The key macroeconomic statistics do not paint a rosy picture. The inflation rate rose to 22.04% in March2023. Real GDP growth rate fell from 3.40% in 2021 to 3.1% in 2022. The latest statistics show that 40.1% of Nigerians are poor, while unemployment is 33.28%.Despite favourable global oil market conditions, domestic oil production shocks have dampened oil revenue inflows and have drastically increased the cost of the petrol subsidy, thereby widening Federal Government’s fiscal deficit. This has led to crowding-out of critical spending on social services and infrastructure.

While there are numerous development challenges and actions required at all levels of government, this memo focuses on three key policy actions at the Federal level: fiscal, monetary and trade policies. It is our considered opinion that the incoming administration needs to undertake fast, coordinated macroeconomic policy reforms on these three fronts. These policy actions or economic reforms must be predicated on inclusion, transparency and accountability.

2 Fiscal Policy

2.1 State of Affairs

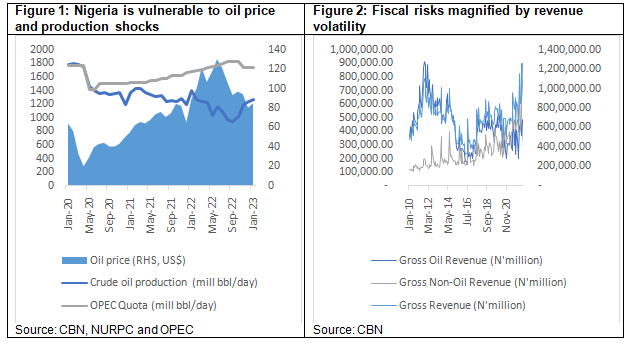

Since the 1970s, Nigeria’s fiscal profile has been tied to the oil sector. Despite the high oil prices in the aftermath of the COVID-19 pandemic, Nigeria’s oil production has been very low. Oil production started falling from 1.799 million barrels per day (bpd) in January 2020 and reached a trough of 937,766 bpd in September 2022 (Figure 1). Since April 2020, the country’s oil production has consistently been below its OPEC quota, and the production shortfall reached a peak of 892,234 bpd in September 2022 (Figure 1). These drastic falls in oil production have come amid a surge in oil prices, with oil prices reaching an all-time high of $130 per barrel in June 2022 (Figure 1). The overall performance of federally-collected revenue has been quite poor, exhibiting heightened volatility in line with global crude oil price movements. FG’s gross oil revenue inflows were N329.984 million in January 2022 but fell to N199.082 million in February 2022. It then started rising and reached a peak of N485.068 million in August 2022 (Figure 2).

The performance of federally-collected gross non-oil revenue exhibited relatively larger swings in 2022. It dropped from N485.645 million in January to N393.012million in March but rose to N805.854 million in July before declining to N616.420 million in September 2022. While the modest improvement could be a reflection of improvements in tax collection, the non-oil revenue generating capacity remains far below its potential especially given the country’s significant spending needs. As pointed out in the Agora Policy report on the economy, many revenue-generating agencies either fail to remit any revenue, or remit a very small fraction to the government. This is a serious problem that needs to be addressed because it deprives the FG of the much-needed revenue. Moreover, the action of such agencies is in violation of the Fiscal Responsibility Act which mandates revenue-generating agencies to remit 80% of their operating surpluses to the Consolidated Revenue Fund and retain 20% in their reserve fund.

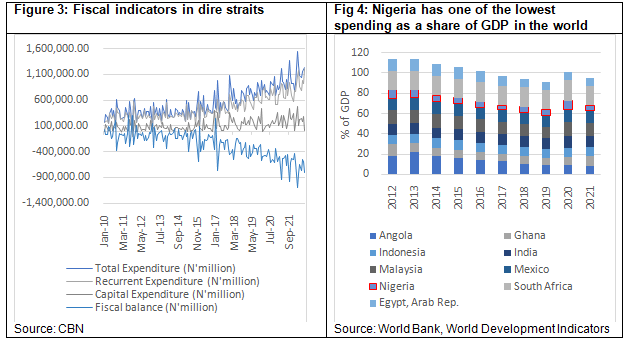

Nigeria’s spending needs have maintained an upward trend since 2010 (Figure 3). However, when compared to other countries, the quantity and quality of spending is low (Figure 4). Figure 3 shows that total FGN spending is largely dominated by recurrent spending with a limited share going to capital expenditure. The average share of monthly recurrent spending in 2021 was about 79% compared with 21% for capital expenditure. Between January and September 2022, average recurrent expenditure was about 84% while capital expenditure was 16%.

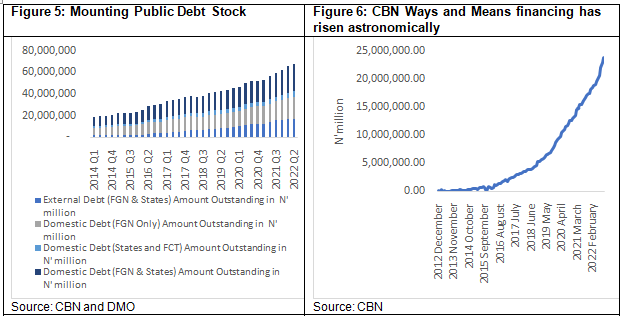

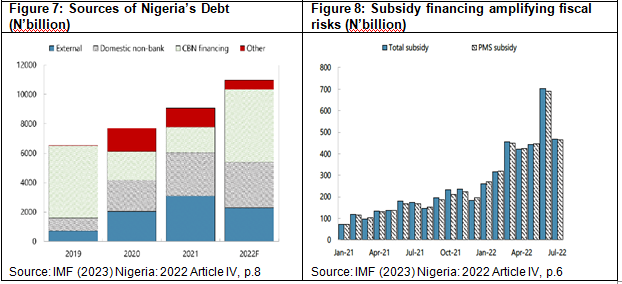

The FG has consistently run a fiscal deficit over the last decade but this has worsened in recent times due to a combination of lower revenue inflows and high fuel subsidy payments (Figure 8). The high fiscal deficit financing need has led to a steady increase in FG’s total public debt stock. FG’s domestic debt doubled from N7.18 trillion in Q1 2014 to N14.534 trillion in Q1 2020. Domestic debt further increased to N20.14 trillion in Q1 2022. It is important to note that the official domestic debt statistics does not include ways and means borrowing from the CBN. The Agora policy report on the economy2 highlighted the fact that the FGN’s ways and means borrowing from the CBN had reached N18.8 trillion in March 2022. If this is added to the official domestic debt figures, then total domestic debt would be N38.94 trillion in Q1 2022. The Central Bank of Nigeria’s (CBN) ways and means financing has overshot the statutory limit. Since 2005, FG has increased borrowing through the ways and means financing from CBN (Figure 6). This has been further increased in recent times due to external elevated borrowing costs in the Eurobond market (Figure 7).3

On the external side, the combined outstanding debts of the FG and state governments increased from N8.3 trillion in Q2 2019 to N11.3 trillion in Q2 2020. By Q2 2021, the outstanding external debt stock increased further to N13.7 trillion and rose further to an all-time high of N16.6 trillion in Q2 2022 (Figure 5).

2.2 Immediate Fiscal Reforms

2.2.1 Boosting oil revenue: The drastic fall in oil revenue has been as a result of the double whammy of lower oil production and petrol subsidy. The government needs to take decisive action to address these two critical issues.

Ending oil theft: Addressing the drastic fall in oil production requires urgent action to end oil theft in the oil producing areas. This would require strong determination from the government and crucially, cooperation from host communities and the security agencies. The government needs to review the security architecture in the oil producing areas and give clear instructions about ending oil theft. In addition, both the Nigeria Upstream Petroleum Regulatory Commission (NUPRC) and Nigeria National Petroleum Corporation (NNPC)Limited should be given clear oil production and exporting targets, and be held accountable when these are not met.

Removal of the petrol subsidy: The use of a strategic communication team to engage the public and other critical stakeholders on the benefits and costs of removing the subsidy would be required for the public to buy into this policy measure. At the same time, detailed plans of how funds are saved from subsidy removal need to be extensively discussed and disseminated to the general public to increase trust as a social capital. The savings from the fuel subsidy could be used to scale up short-term direct cash transfers to the poorest and most vulnerable groups in the country. Prices of petroleum products should be market-determined rather that regulated by the government.

2.2.2 Boosting non-oil revenue: There is a need to address the nation’s dismal tax revenue to GDP ratio. The FIRS has done well in recent times by increasing revenue generated from N6.4 trillion in 2021 to N10.1 trillion in 2022, thereby crossing N10 trillion in revenue for the first time. However, for the size of the economy, government revenue and expenditure are grossly inadequate to effectively drive policy, enhance economic growth, lower poverty, and achieve the Sustainable Development Goals (SDGs). This would require two critical actions on boosting non-oil revenue:

Tax reforms and domestic revenue mobilisation: There is an urgent need to broaden the tax net to capture the formal and informal sectors not in the existing tax net. For the formal sector, a first step would be to properly capture and tax high net worth individuals and large corporations. Also, FIRS needs to work closely with the NBS to identify small and medium scale enterprises (SMEs) and ensure they pay taxes appropriately. Some simple incentives and an amnesty period, following which appropriate sanctions will be meted out, can be given to ensure quick compliance. It would be crucial to continuously communicate the issue of tax reforms to the citizens to gain public confidence in the system. In addition, leakages from taxes collected by non-state actors need to be eliminated.

Full compliance with the Fiscal Responsibility Act: The Fiscal Responsibility Act mandates revenue generating agencies to remit 80% of their operating surpluses to the Consolidated Revenue Fund and retain 20% in their reserve fund. There are many revenue-generating agencies that either fail to remit any revenue or remit a very small fraction to the government. The Fiscal Responsibility Act should be amended to set strict penalties for agencies that fail to remit their stipulated operating surpluses. Also, there is the need to stop funding revenue-generating agencies from the federal budget.

2.2.3 Improving the budget implementation framework. This entails strengthening the zero-based budgeting framework by ensuring that budget preparation starts on time. There is an urgent need to end “drip-feeding” which has inhibited the completion of critical capital projects and perpetuated the “ongoing project” syndrome. This comes at zero cost to the key agencies such as the Federal Ministry of Finance, Budget and National Planning and the Budget Office of the Federation. Increased budgetary provisions should be given to capital expenditure. There is also the need to increase the percentage of the budget that goes to capital expenditure and the necessity of trimming recurrent expenditure.

3 Monetary Policy

3.1 Monetary Policy Developments

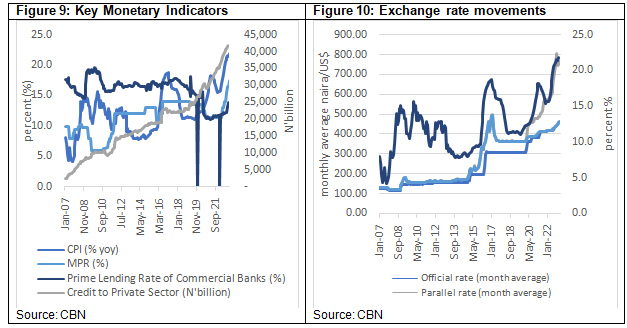

Similar to other central banks around the world, the Central Bank of Nigeria (CBN) has tightened its monetary policy stance to tame rising inflation. The CBN raised the monetary policy rate by a cumulative 5% in 2022 and also increased the cash reserve ratio from 27.5% to 32.5%. Despite these tightening measures, the monetisation of the fiscal deficit and other quasi-fiscal activities such as the intervention programmes have expanded the growth of credit and thus contributed to inflationary pressures. The year-on-year composite price index (CPI) increased from 15.6% in January to 18.6% in June and to 20.8% in September 2022. It moderated marginally to 21.3% in December 2022 before rising again to 21.91% in February 2023. The obvious disconnect between fiscal and monetary policy has heightened macroeconomic risks and vulnerabilities. The weak transmission mechanism of monetary policy is a combination of poor policy coordination and focus of the CBN on economic growth rather than on inflation(Figure 9).

Exchange rate management has remained at the front burner of policy discussions. This is due to the complete exchange rate pass-through to domestic prices in Nigeria. Nigeria currently operates several exchange rate windows, often at varying rates (Figure 10). This has created arbitrage opportunities for speculators in the foreign exchange market. The official exchange rate was N416/$ in March 2022 and had increased to N461/$ in February 2023 (Figure 10). The parallel market exchange rate has continued to diverge from the official rate. In January 2022, the parallel market exchange rate was about N570/$ and had increased to about N761/$ in February 2023. The CBN also created an Investors and Exporters Foreign Exchange (IEFX) window to give genuine importers and exporters access to foreign exchange. This IEFX rate closely mirrors the official exchange rate but is still below the market-based parallel exchange rate. The average IEFX rate in 2022 was about N428/$ and it had increased to N461/$ in January 2023.

- Immediate Monetary Reforms

- Enhance the coordination of fiscal and monetary policy to reduce frictions and counteractive policy goals. The government should strengthen the Fiscal-Monetary Coordination Committee to ensure that the monetary authority (CBN) and the fiscal authority (Federal Ministry of Finance, Budget and National Planning) optimally coordinate policies to ensure the gains from fiscal and monetary reforms are maximized.

- Restore monetary policy focus back to its price stability mandate, taming inflationary pressure and strengthening the monetary transmission. The CBN should focus on its core mandate of maintaining price stability. The CBN should set clear and realistic targets for inflation, and a timeline for achieving these targets. Addressing supply-side bottlenecks such as trade restrictions on critical intermediates that increase the cost of doing business. The CBN will have to restore the credibility of the MPR such that bond yields and lending rates are reflective of the monetary policy rate (MPR).

3.2.3 The removal of the current multiple exchange rate windows being operated by the CBN. This would make the exchange rate market-determined and mitigate speculative pressures that fuel arbitrage conditions in the market. This would further inspire confidence from domestic and foreign investors.

3.2.4 Putting an end to ways and means financing of FGN expenditure. This would curtail the growth of the money supply and thus curtail inflationary pressure. Part of this will involve the CBN helping the FG to properly forecast its revenue as well as helping the FG, on a technical level, identify potential sources of revenue. A strategy will also need to be developed to manage the current stock of FG’s debt at the CBN.

4 Trade and Investment

4.1 State of Trade and Investment

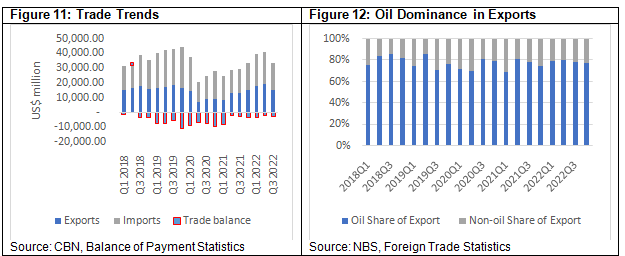

Nigeria has one of the largest economies in Africa, with a significant trade volume. However, the country’s trade profile has historically been dominated by oil exports, which account for a large share of the country’s foreign exchange earnings (Figure 12). The low level of trade diversity and the need to reduce over-reliance on oil exports in Nigeria has remained a major concern for governments over time. Figure 11 indicates that since Q1 2020, with the exception of Q2 2021, Q2 2022 and Q4 2022, imports have exceeded exports, resulting in trade deficits for most of the period.

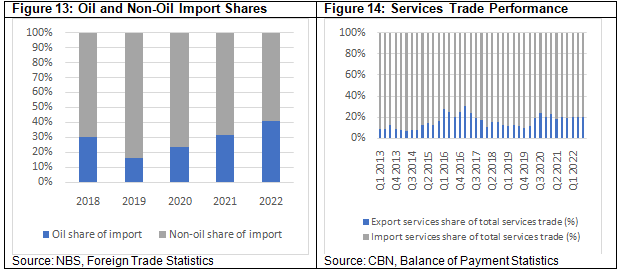

While Nigeria’s export shave largely been dominated by oil exports, the trend of imports depicts a different picture. Non-oil commodities dominate Nigeria’s total imports as they increased from 70% in 2018 to 84% in 2019 and 77% in 2020, before falling to 69% in 2021 to 59% in 2022 (Figure 13).In terms of trade in services, Nigeria’s performance is quite limited as services import dwarfs services export (Figure 14). The average services import in 2018 was about 87% and increased to 89% in 2019 then dropped to 81% in 2020. By 2021, it dropped marginally to 80% and remained at the same average level in the first three quarters of 2022.

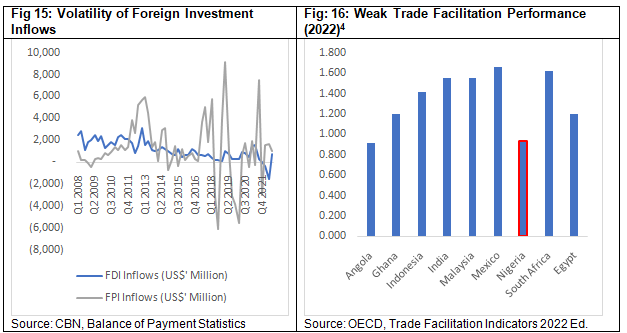

The volatility of capital inflows has persisted over the last decade. FPI inflows in the fourth quarter of 2018 was US$3,935 million but dropped significantly, translating to an outflow of US$3,788 million in the fourth quarter of 2019. By the fourth quarter of 2020, FPI outflow slowed down to US$477 million and even recorded significant improvements with inflows of US$1,926 million recorded in Q1 2021, before dropping to outflows of US$3,012 million in 2021Q4. FPI remained positive in the first three quarters of 2022 recording a drop from US1,542 million in 2022Q1 to US$1,001 million in 2022Q3. In terms of FDI inflows, the fluctuations have been relatively lower than FPI as it rose from US$59 million in 2018Q4 to US$248 million in 2019Q4and US$439 million in 2020Q4. This positive trend reversed by the fourth quarter of 2021 as FDI inflows dropped significantly to US$42 million and for the first time in over a decade recorded an outflow in 2022Q1 (US$323 million) and 2022Q2 (US$1,537 million) before a positive rebound of US$726 in the third quarter of 2022.

One of the major issues that have impeded trade performance and thus diversification in Nigeria is the weak trade-related infrastructure. Having in efficient or inadequate systems of transportation, logistics, and trade-related infrastructure can severely impede a country’s ability to compete on a global scale.5 Based on the 2022 OECD trade facilitation performance indicator, Nigeria performs poorly (0.930) relative to regional peers such as Ghana (1.200), South Africa (1.625), and Egypt (1.200). The trade facilitation performance indicator is composed of a set of variables measuring the extent to which countries have introduced and implemented trade facilitation measures in absolute terms, but also their performance relative to others. The indicator takes values from 0 to 2, where 2 indicates the best performance that can be achieved.6

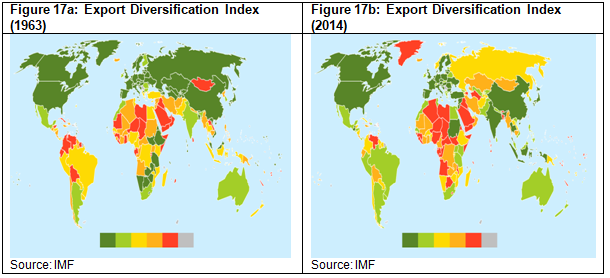

The lopsided structure of Nigeria’s trade performance over time is linked to low trade diversity. Although this has remained at the forefront of various development policy plans, weak implementation and poorly coordinated macroeconomic policy and structural reforms have constrained trade diversification. For example, Nigeria has used several trade restrictions mainly to protect domestic industries and spur domestic productivity. However, this has not achieved the planned objectives as domestic firms remain largely uncompetitive due to structural rigidities tied to the inadequate soft and hard infrastructure. Comparatively, as shown in Figures 17a and 17b, Nigeria’s export diversification has worsened over the last five decades. At 3.74 in 1963, it increased to 4.65 in 1970 and 6.15 in 1980. By 1990 it had reduced marginally to 5.99 before rising to 6.04 in 2000 and then dropping again to 5.54 in 2010. In 2014 Nigeria’s export diversification index was 5.62 which was far below the performance of other countries like South Africa (2.59), Egypt (2.65), India (2.16), Indonesia (2.21) and Mexico (2.43).7It is important to note that higher values correspond to lower export diversification while lower values correspond to high export diversity.

4.2 Immediate Trade and Investment Reforms

4.2.1 Replacement of import bans with import duties. The use of tariffs rather than the existing import bans would spur the domestic productivity of firms, especially those that rely on the import of intermediates that are affected by the import prohibition. This has to be done in a coordinated manner between the Ministry of Industry, Trade and Investment, Ministry of Finance, Budget and National Planning, and the Nigeria Customs Service.

4.2.2 Development of regional industrial hubs and transport infrastructure through PPP arrangements. FGN should prioritise the development of industrial hubs and export processing zones as well as the delivery on critical infrastructure which support international trade, such as ports, roads, and telecommunications networks. In view of obvious budgetary constraints and current revenue shortfalls, the government should seek partnership with the private sector. This could help enhance efficient service delivery and reduce trade costs, thereby making it easy for domestic firms to integrate in domestic and regional value chains.

4.2.3 Reopening all closed borders and removing all food trade restrictions. These have hurt prices and have not led to the expected increase in domestic productivity. The government needs to prioritise the development of a goods and services export strategy in collaboration with the subnational governments. Such a strategy should focus on labour intensive sectors, and should clearly identify priority sectors and potential markets by leveraging Nigeria’s global network of diaspora and consulates.

4.2.4 Creating a conducive environment for attracting foreign investment. The rise in foreign investment outflows needs to be addressed by sending positive signals to foreign investors. The exchange rate needs to be market-determined. Also, security, banditry, kidnapping and insurgency need to be adequately tackled to send positive signals.

4.2.5 Providing incentives for export-oriented firms especially in the non-oil sectors. In order to leverage on the enormous market opportunities created by the African Continental Free Trade Area (AfCFTA) agreement, there should be a gradual reduction of import tariffs on intermediate products used by domestic firms that export or plan to do so. At the same time, the discretionary import duty waiver allocation system needs to be replaced with a clearly defined industry-wide incentive system that supports export-oriented firms.

Conclusion

The Nigerian economy has significant potential but faces several challenges. Nigeria is the largest economy in Africa, with a large and growing population, abundant natural resources, and a strategic location. However, the country has struggled with economic diversification and over-reliance on oil exports, which has made it vulnerable to external shocks. The country also grapples with some structural challenges, including poor infrastructure, limited access to credit, and weak institutions. These issues have hindered economic growth and made it difficult for businesses to thrive in the country. This note highlights some of the key challenges facing the Nigerian economy in the context of fiscal, monetary and exchange rate management, trade and investment policies. It also prescribes urgent actions on those three critical fronts.

*Professor Fowowe and Dr. Shuaibu teach Economics at the University of Ibadan and the University of Abuja respectively.

[1]https://agorapolicy.org/wp-content/uploads/2022/10/Updated-Digital-Version.pdf

[2] https://agorapolicy.org/wp-content/uploads/2022/10/Updated-Digital-Version.pdf

[4]http://compareyourcountry.org/trade-facilitation/en/0/default/all/default/2022

[5]https://www.worldbank.org/en/topic/trade-facilitation-and-logistics

[7]https://data.imf.org/?sk=A093DF7D-E0B8-4913-80E0-A07CF90B44DB