By Wale Thompson

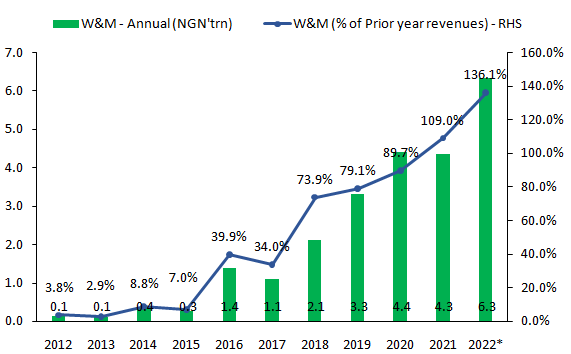

Last week, both chambers of Nigeria’s parliament approved President Muhammadu Buhari’s December request to convert longstanding overdraft facilities obtained from the Central Bank of Nigeria (CBN) – amounting to N23.7 trillion – into government bonds, the so-called “securitization.” This move draws a line on a longstanding issue that had raised concerns about the management of Nigeria’s fiscal policy and economy over the past eight years, and the approval will now go for ratification by President Buhari, with less than a month to the end of his tenure. For the sake of context, it should be noted that the so-called ‘Ways and Means’ (W&M) provisions allow the CBN to provide short-term financing to the Federal Government of Nigeria (FGN), with an annual ceiling set at no more than 5% of the prior year’s fiscal revenues, on the condition that these loans are repaid before new advances are extended by the CBN to the FGN. However, over the last eight years, the outstanding W&M advances skyrocketed from N790 billion in May 2015 to N23.7 trillion by the end of October 2022. The cumulative figure for W&M advances over the last eight years is equivalent to 77% of the trailing fiscal revenues between 2014 and 2021. Moreover, the ratio of annual W&M drawdowns to prior year revenues averaged 71% during this period, indicating that both the CBN and the Finance Ministry breached the 5% limit prescribed by the law.

Figure 1: Ways and Means

Source: CBN, Budget Office; * January to October

How does this securitization impact Nigeria’s debt metrics?

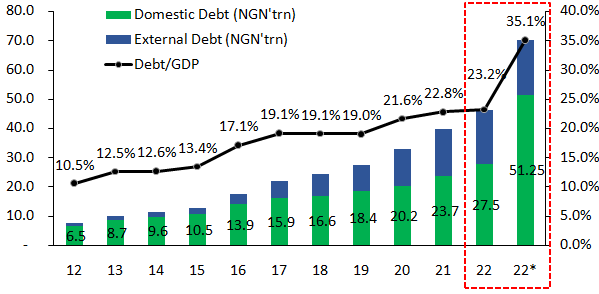

Firstly, the incorporation of the securitized W&M advances into Nigeria’s official debt data implies a jump in aggregate public debt (inclusive of state government loans of N7.3trillion) from N46.3trillion in December 2022 to N70trillion. This means that Nigeria’s total public debt is now around 35% of GDP, up from the 23% of GDP at the end of 2022 and just under the 40% limit per the medium-term debt strategy approved by the National Assembly in 2021. While this level implies that Nigeria can no longer be classified as low-debt country, Nigeria’s debt-GDP metric remains below the 50-55% average observed across emerging and developing countries. To put this in context, Ghana’s debt-GDP ratio was running at 93.5%. Indeed, in its 2022 Nigeria Article IV report published in February this year, the IMF, which incorporated W&M loans in its definition of Nigeria’s debt obligations for its Debt Sustainability Analysis (DSA), classifies Nigeria as having a “moderate” overall risk of sovereign stress. In justifying this position, the IMF which estimated Nigeria’s debt-GDP ratio at 37%, noted that external debt burdens remained low (9% of GDP) plus a large share (over 85%) of domestic and external debt is of medium to long term maturities. On this note, the Ways and Means (W&M) securitization does not radically alter these features as the new debt is of long-term nature (40-years) and in local currency.

Figure 2: Debt/GDP Data – Nigeria

Source: DMO; *January to October

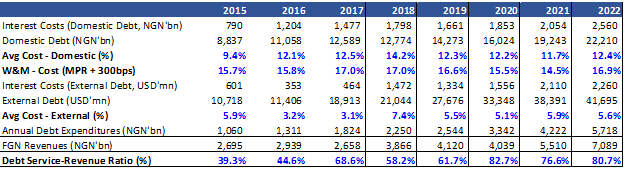

While the securitization of W&M loans suggests limited damage to Nigeria’s overall debt capacity, the focus is often on debt service, as highlighted by the president of the African Development Bank, Mr. Akinwunmi Adesina, who famously stated that “we cannot eat GDP.” On this front, the securitized W&M loans will arrive on the public debt balance sheet at a single-digit rate of 9%, which is lower than the expensive cost of the Ways and Means (W&M) financing, currently set at the Monetary Policy Rate (MPR) plus 300 basis points. The current MPR rate is 18%, which implies that the cost of W&M financing is at an interest rate of 21%, making it more expensive than the cost of regular Naira debt issuances. Therefore, it is clear that there will be significant cost savings from the securitization of W&M loans, which will have knock-on effects on debt service costs. At 9%, the annual costs of the outstanding W&M loans will drop by more than half to N2.1 trillion, compared to N4.9 trillion if we use the current cost of 21%.

Table 1: Debt Service Costs

Source: CBN, DMO, Budget Office, Author’s computation

How does the W&M impact the conduct of monetary policy now?

It is important to note that the W&M loans in Nigeria were largely financed through an expansion in money supply, or more simply, printing money. The broadest measure of money supply in Nigeria, M3, was N21.8 trillion in May 2015 but surged to N52.1 trillion at the end of 2022, driven by significant growth in lending to the government from N2 trillion to N27 trillion among other factors. Historically, there was a bias against central bank financing of budget deficits, but economists now believe that some level of central bank financing is acceptable within reasonable limits. The key is to ensure that these loans are consistent with the growth rate of money supply in tandem with economic activity. There has been a trend towards the use of legislative limits, such as the 5% of prior year revenues ceiling for FGN borrowings from the CBN as stipulated in the CBN Act 2007. This trend has accelerated globally since the 2008 financial crisis and, more recently, the COVID-19 pandemic, as advanced economies responded to weak economies with large asset purchase programmes financed through a broad-based expansion in money supply. However, in Nigeria, the rapid expansion in money supply over the last eight years, which is unprecedented in recent years, is tied to the CBN financing of FGN deficits. Not surprisingly, Nigeria’s core inflation, which excludes volatile food and fuel prices, has jumped from single digit levels in 2013-2015 to 19% in March 2022.

Naturally, some might ask will this securitization lead to increased inflation over the near to medium term. Given that the securitization seeks to legalise what has already happened (i.e. CBN to FGN loans) then discussions about inflation are moot as the deed has already been done. Essentially, the W&M securitization is not a fresh request for CBN to lend money to the FGN, rather it’s the FGN providing legal form to monies that have already been borrowed from the CBN and disbursed into the economy over the last eight years. Whatever inflation arising from the expansion in money supply is already reflected in the ‘system’. That said, the securitization now leaves room for the CBN to return to the business of conventional monetary policy as it no longer has to grapple with the implications of increasing money supply via lending to the FGN on the one hand and sterilizing the increased liquidity via ad-hoc cash reserve ratio debits on the other. With these loans out of the way, CBN is expected to return to orthodox liquidity management via credible market operations and move away from the current crude quantitative zero-cost approach to liquidity management.

How can Nigeria prevent future breaches of the W&M provisions in the CBN Act?

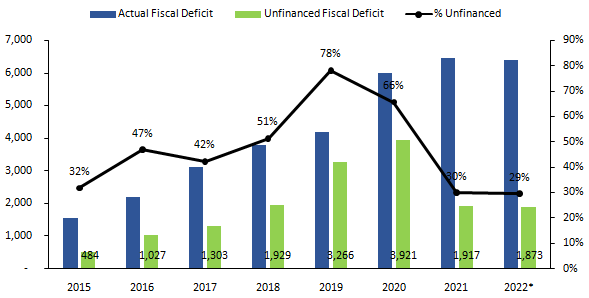

To answer this question, it must first be acknowledged that the root driver of CBN to FGN loans is the existence of large unfinanced fiscal deficits—that is a budget deficit to which there was no provision in the approved annual budget. Let’s assume that the Nigerian government planned to spend N15trillion but projected to raise revenues of N10trillion resulting in a N5trillion deficit. Usually, the annual budget would include a borrowing or financing provision for the N5trillion shortfall. Now assume that annual revenues came in at N7trillion relative to the N10trillion target and actual spending was at N15 trillion in line with the target, the actual deficit is now N8trillion comprising a budgeted deficit of N5trillion and an unbudgeted deficit of N3trillion. Who funds the shortfall deficit? Ideally, the Executive via the Finance Ministry should prepare a supplementary budget to cover the N3trillion-gap, but owing to timing issues and likely apprehension over the potential fallout from debating a new debt-ridden supplementary budget may mean that the need to approach the National Assembly for new borrowings is often swept under the carpet. As the FGN’s banker and with the instrumentality of the Treasury Single Account (TSA) the CBN has an implicit obligation to provide a short-term facility to cover unfinanced deficits. The real issue clearly is the failure of the executive to approach the legislature with a supplementary budget. A related issue to this is how realistic the annual budgets are. There is a strong argument that the Nigerian budgets are deliberately crafted to ensure easy acceptance by the populace at the expense of a more realistic assessment of revenue profiles. In essence, the unfinanced deficit appearance is not some naïve error of forecasting but one that was set in stone the moment the budget was prepared without any sense of realism.

This is the story of Nigeria over the 2015-2022 period when following the collapse in oil prices in the 2014-17 period and the COVID-19 pandemic in 2020, fiscal revenues cratered, which should have resulted in either downward adjustments in spending or increased borrowings. As governments are often reluctant to respond to dramatic negative changes in fiscal revenues given political considerations, borrowings are an easier decision to make to finance revenue shortfalls. This is more so in developing economies where the risk of social disorder is high. Add the operationalisation of the TSA which created an easy avenue for requests of overdraft facilities by the FGN to the CBN.

Figure 3: Financed and Unfinanced Fiscal Deficits

Source: Budget Office, Authors Computation *January-November

Fixing this requires inclusion of legal provisions which open the possibility of criminal prosecution with jail terms for finance ministers and CBN governors who violate these provisions. As a line of oversight, the National Assembly can impose an annual requirement for the heads of Nigeria’s fiscal and monetary policy teams to declare the existence or otherwise of W&M loans in excess of statutory limit with criminal prosecutions where infractions are observed. This does two things. Firstly, it imposes an obligation on finance ministers to prepare more realistic budgets or where dramatic changes occur to budget estimates, to submit supplementary budgets to clear out any unfinanced fiscal deficit. Secondly, this also curtails the appetite of future CBN governors to ingratiate themselves to the FGN via the provision of unrestrained financing in breach of the CBN Act. Lastly, parliament can introduce a provision wherein the existence of above target fiscal deficits beyond a certain threshold in two consecutive years should be grounds for the dismissal of the Head of the Budget Office. The Budget Office is a specialised sub-unit of the Finance Ministry which should be staffed with technical experts in fiscal projections. Unfinanced fiscal deficits are by and large a symptom of poor budgeting processes and fixing these issues at the source can greatly reduce the probability of future breaches in W&M legal provisions.

Conclusion

It is very important for Nigeria to draw a line on the entire episode as unrestrained CBN financing of fiscal deficits can create moral hazard problems in that future Nigerian governments, rather than embark on structural reform to increase fiscal revenues will merely engage in excessive spending and borrowings. This perception of an endless pool of domestic financing more often than not makes governments more financially reckless with little regard for fiscal discipline and such reckless disposition will ultimately lead to inflationary pressures and long-term macroeconomic instability. Moreso as we have seen in the Nigerian experience, it limits the ability of the central bank to carry out credible monetary policy as its core stabilisation and market-signalling tools lose efficacy in the eyes of financial markets.

*Thompson is an economist with specialisation in monetary policy.